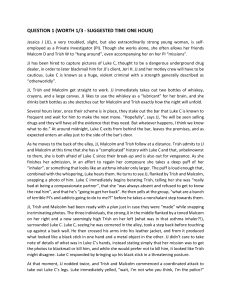

CIR vs. St. Luke's Medical Center, Inc. FACTS: St. Luke's is a non-stock non-profit hospital. The BIR assessed St. Luke's based on the argument that Section 27(B) of the Tax Code should apply to it and hence all of St. Luke's income should be subject to the 10% tax therein as it is a more specific provision and should prevail over Section 30 which is a general provision. St. Luke's countered by saying that its free services to patients was 65% of its operating income and that no part of its income inures to the benefit of any individual. ISSUE: Does Section 27(B) have the effect of taking proprietary non-profit hospitals out of the income tax exemption under Section 30 of the Tax Code and should instead be subject to a preferential rate of 10% on its entire income? RULING: No. The enactment of Section 27(B) does not remove the possible income tax exemption of proprietary non-profit hospitals. The only thing that Section 27(B) captures (at 10% tax) in the case of qualified hospitals is in the instance where the income realized by the hospital falls under the last paragraph of Section 30 such as when the entity conducts any activity for profit. The revenues derived by St. Luke's from pay patients are clearly income from activities conducted for profit.