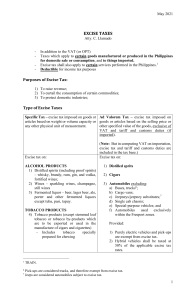

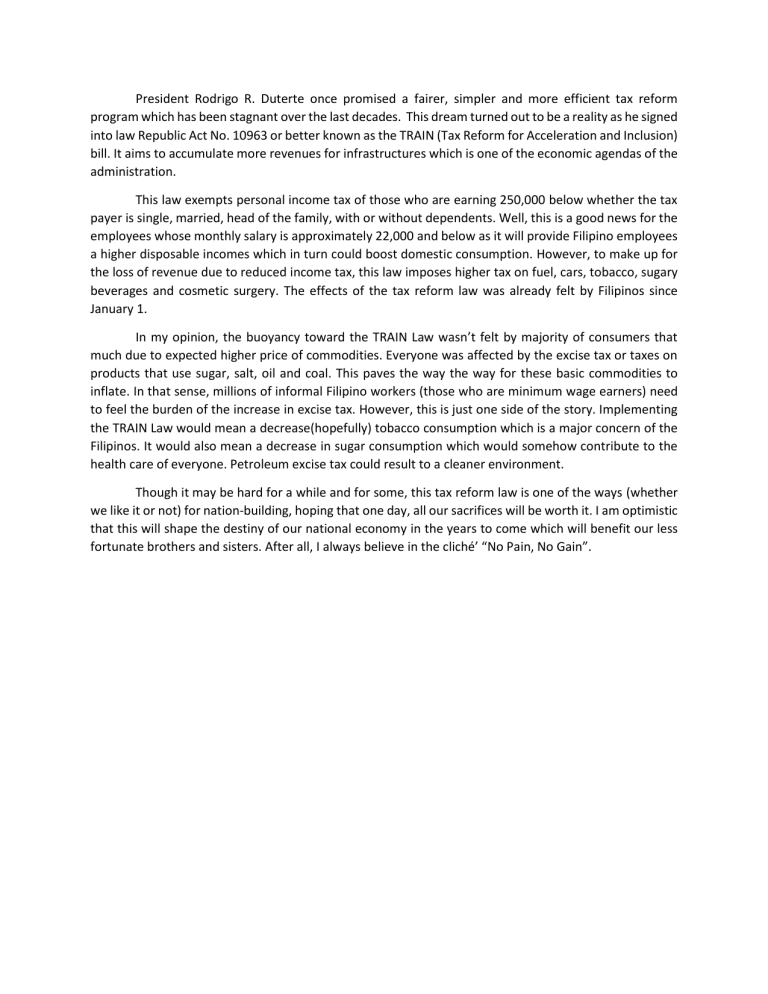

President Rodrigo R. Duterte once promised a fairer, simpler and more efficient tax reform program which has been stagnant over the last decades. This dream turned out to be a reality as he signed into law Republic Act No. 10963 or better known as the TRAIN (Tax Reform for Acceleration and Inclusion) bill. It aims to accumulate more revenues for infrastructures which is one of the economic agendas of the administration. This law exempts personal income tax of those who are earning 250,000 below whether the tax payer is single, married, head of the family, with or without dependents. Well, this is a good news for the employees whose monthly salary is approximately 22,000 and below as it will provide Filipino employees a higher disposable incomes which in turn could boost domestic consumption. However, to make up for the loss of revenue due to reduced income tax, this law imposes higher tax on fuel, cars, tobacco, sugary beverages and cosmetic surgery. The effects of the tax reform law was already felt by Filipinos since January 1. In my opinion, the buoyancy toward the TRAIN Law wasn’t felt by majority of consumers that much due to expected higher price of commodities. Everyone was affected by the excise tax or taxes on products that use sugar, salt, oil and coal. This paves the way the way for these basic commodities to inflate. In that sense, millions of informal Filipino workers (those who are minimum wage earners) need to feel the burden of the increase in excise tax. However, this is just one side of the story. Implementing the TRAIN Law would mean a decrease(hopefully) tobacco consumption which is a major concern of the Filipinos. It would also mean a decrease in sugar consumption which would somehow contribute to the health care of everyone. Petroleum excise tax could result to a cleaner environment. Though it may be hard for a while and for some, this tax reform law is one of the ways (whether we like it or not) for nation-building, hoping that one day, all our sacrifices will be worth it. I am optimistic that this will shape the destiny of our national economy in the years to come which will benefit our less fortunate brothers and sisters. After all, I always believe in the cliché’ “No Pain, No Gain”.

![-----Original Message----- From: D'Ann Grimmett [ ]](http://s2.studylib.net/store/data/015587774_1-b8b0167afe0c6fb42038c4518a661b2a-300x300.png)