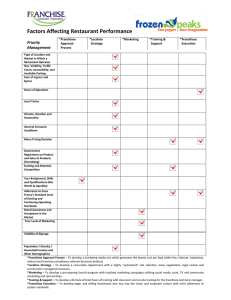

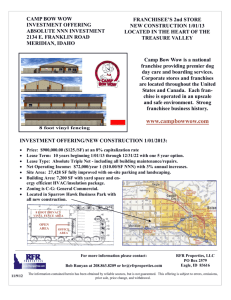

ADVANCED FINANCIAL ACCOUNTING AND REPORTING Number 26 On January 1, 2020, San Juan Builders Inc. accepted a long-term construction project to build a bridge. The outcome of the construction project can be estimated reliably and the contractor decided to employ cost to cost method. The following data are provided by the accountant and project manager concerning the contract price and contract costs for three years of construction: Year 12/31/2020 12/31/2021 12/31/2022 P 10,000,000 P 15,000,000 P 20,000,000 1,000,000 5,000,000 Estimated cost to complete at the end of the year 3,000,000 4,000,000 Contract price as of the end of the year Costs incurred during the year 8,000,000 2,000,000 What is San Juan Builder’s realized gross profit / (loss) for the year ended December 31, 2022? Number 27 On January 1, 2031, Dev’t Corp. accepted a long term construction project to build a condominium at a fixed contract price of P100M. The outcome of the construction project cannot be estimated reliably. The following data are provided by the accountant and project manager concerning the construction costs for the three years of construction. Year 12/31/2031 12/31/2032 Cumulative costs incurred as of the end of P P the year 40,000,000 50,000,000 Estimated cost to complete at the end of the year 90,000,000 60,000,000 12/31/2033 P 70,000,000 20,000,000 What is Dev’t Corp.’s realized gross profit / (loss) for the year ended December 31, 2033? Number 28 On January 1, 2011, Arki Inc. started the construction of a building with a fixed contract price of P 10,000,000. The outcome of the construction project can be estimated reliably and the contractor decided to employ cost to cost method. The following data are provided by the accountant and project manager concerning the construction costs for the three years of construction: Year Cost incurred during the year 12/31/201 1 ? Realized gross profit/loss during the year P 750,000 Percentage of completion as of the end of the year 37.5% 12/31/201 2 P 1,500,000 (P 250,000) 50% 12/31/2013 P 3,740,000 (P 800,000) 80% What is the balance of Construction in Progress on Arki Inc.’s Statement of Financial Position on December 31, 2013? Number 29 On January 1, 2041, ENGR Inc. accepted a long-term construction project to construct a building with an initial contract price of P 10,000,000. The outcome of the construction project can be estimated reliably and the contractor decided to employ cost to cost method. During 2043, the contract price increases due to the change in the project design. The following data are provided by the accountant and project manager concerning the construction costs for the three years of construction: Year 12/31/2041 12/31/204 2 ? Cumulative costs incurred as of the end of the year Realized gross profit/loss during the year P 1,000,000 ? P 350,000 Percentage of completion as of the end of the year 12.5% 60% 12/31/2043 P 10,800,000 (P 1,600,000) 90% What is ENGR Inc.’s Cost of Construction Revenue to be recognized in its Income Statement for the year ended December 31, 2043? Number 30 On July 1, 2020, Toki-Toki Inc., a franchisor entered into a contract with a franchisee for the establishment of a restaurant. The franchise agreement provides that the franchisee shall pay a non-refundable franchise fee in the amount of P 500,000 with P 200,000 payable at the signing of the contract and the balance payable in three equal annual installments starting June 30, 2021. The franchisee issued a non-interest bearing note with effective interest rate of 10%. The present value of the note receivable using the effective interest rate is P 248,685. The collection of the note is reasonably assured. Aside from that, the franchisee shall pay on-going royalties equivalent to 5% of franchisee’s revenue for the year. As of July 1, 2020, Toki-Toki has substantially performed the obligation under the initial franchise fee. The franchisee reported P 200,000 and P 300,000 sales revenue for the year 2020 and 2021, respectively. What is the amount of total revenue to be recognized Toki-Toki Inc. for the year ended December 31, 2021? Number 31 On January 1, 2030, Starbuko Inc., a franchisor entered into a contract with a franchisee for the establishment of a coffee shop. The franchise agreement provides that the franchisee shall pay a non-refundable upfront franchisee fee in the amount of P 8,000,000 payable at the date of signing of contract. The franchise agreement also provides for the payment of on-going royalties equivalent to 10% of franchisee’s revenue. The franchise agreement requires Starbuko to (1) to construct the coffee shop; (2) to allow the franchisee to use the Starbuko’s trademark for a period of 20 years from the signing of contract; and (3) to deliver 100,000 unit of raw beans for the franchisee’s operation. Based on the evaluation of the contract, it is determined that it is covered by IFRS 15: Revenue from Contract with Customers. It is determined that the franchisee’s three performance obligations under the franchise contract are separate and distinct from each other and need to be accounted for as separate performance obligations. Based on franchisor’s data, it is established that the stand-alone selling prices of: (1) Construction of coffee shop is P 5,000,000; (2) License to use Starbuko’s trademark is P 2,000,000; and (3) Delivery of raw beans is P 3,000,000. On January 1, 2030, the franchisee paid the initial franchise fee. As of December 31, 2030, Starbuko Inc. has completed 80% of the coffee shop which already allowed the franchisee to operate. During the said year, Starbuko Inc. has already delivered 30,000 units of raw beans to the franchisee. For the year ended December 31, 2030, Starbuko Inc. reported sales revenue amounting to P 500,000. What is the total revenue to be reported by Starbuko Inc. for the year ended December 31, 2030? Number 32 On July 1, 2022, Mcgreen Inc., a franchisor, entered into a contract with a franchisee for the operation of a restaurant. The franchise agreement provides that the franchisee shall pay a non-refundable upfront franchise fee amounting to P 2,500,000 with P 500,000 payable at the signing of contract and the balance payable in five equal semi-annual installments every December 31 and June 30. The franchisee issued a non-interest bearing note with effective interest rate of 10%. The present value of the note receivable is P 1,731,791. The collection of the note receivable is unlikely. The franchise agreement further provides for the payment of on-going royalties equivalent to 3% based on franchisee’s sales revenue. During 2020, Mcgreen Inc. has substantially performed the direct cost of services required by the franchise in the amount of P 1,785,433. In the same year, Mcgreen Inc. has also incurred indirect cost amounting to P 10,000. For the years 2020 and 2021, the franchisee has reported sales revenue amounting to P 400,000 and P 600,000, respectively. What is the net income to be reported by Mcgreen Inc. for the year ended December 31, 2021? Number 33 SM Appliances Inc. sells its inventories under instalment contract. The 2017 book of the company before necessary adjustment has provided the following data: Installment Receivable 1/1/2017 (2016 contract) Instalment Receivable 12/31/2017 (2016 contract) Installment Receivable 12/31/2017 (2017 contract) 2017 Instalment sales (exclusive of sales of repossessed inventory) Deferred gross profit 1/1/2017 (2016 contract) Deferred gross profit 12/31/2017 (2016 contract) Deferred gross profit 12/31/2017 (2017 contract) Debit 6,000,000 3,000,000 5,000,000 Credit 10,000,000 ? 1,200,000 3,200,000 The following additional data are provided for year 2017: On March 1, 2017, a 2016 instalment receivable is written off and bad debt expense of P 1,400,000 is recognized. On October 1, 2017, the company repossessed inventory from 2017 instalment contract. The fair value of the repossessed inventory is P 1,000,000 while the loss on repossession recognized is P 200,000. On December 1, 2017, the repossessed inventory on October 1, 2017 was resold at a selling price of P 1,500,000 after being reconditioned at a cost of P 200,000. For 2016 contracts the total collection made during 2017 amounted to P 1,000,000 while for 2017 contracts the total collection made during 2017 is P 3,000,000. What is the total realized gross profit to be recognized in the Income Statement for the year ended December 31, 2017? Number 34 On January 1, 2017, Honda Makati Inc. sold a car a price of P 3,400,000. The terms of the contract provides that P 400,000 cash is payable at contract signing and a used car will be received 3 days after as additional down payment from the buyer. The trade-in value allowed on the used car is P 1,000,000. On the same date, the buyer issued a 10% interest-bearing note for the balance of the price. The note is payable in 4 equal semiannual instalments every June 30 and December 31. The used car has estimated selling price of P 1,500,000 after reconditioning cost of P 100,000 with a normal profit of 20%. The production cost of the car is P 2,450,000. What is the realized gross profit for the year ended December 31, 2017? Number 35 On January 1, 2020, Abenson Inc. sold a TV set a price of P 100,000. The contract provides that 10% is payable on the date of contract and an old cellphone will be received as additional down payment within 10 days. The old cellphone has a trade-in value of P 30,000. On the same date, Abenson Inc. received a 1 year 10% interest bearing note payable in 4 equal quarterly instalment every March 31, June 30, September 30 and December 31 for the balance of the price. The interest will be based on the outstanding balance of the note. At the date of the contract, the old cellphone has an estimated selling price of P 60,000 after reconditioning cost of P 4,000 with normal profit of 10%. The production cost of TV set is P 84,000. Abenson was able to collect the instalment due and its corresponding interest on March 31 and June 30. However the buyer defaulted on the instalment due on September 30 but was able to pay the interest for that period. It resulted to the repossession of the TV set. The fair value of the TV on the date of repossession is P 15,000. On November 1, 2020, the repossessed TV set was resold at a selling price of P 19,000 after reconditioned at a cost P 3,375. What is the Abenson’s net income for the year ended December 31, 2020?