Zamboanga City Tourism Strategic Development Plan

advertisement

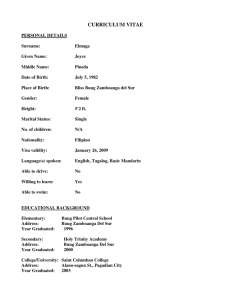

Zamboanga City Strategic Development Plan By: Agabao, Joyce, Delos Ama, M., Labaupa, M. A project in Tour 281 | Tourism Strategies | University of the Philippines Asian Institute of Tourism | Graduate Diploma in Tourism Development and Management May 27, 2019 monika labaupa [Date] [Course title] TABLE OF CONTENTS ...................................................................................................................................................................... 0 INTRODUCTION ............................................................................................................................................. 2 A. BACKGROUND AND OBJECTIVE OF THE STUDY ................................................................................ 2 B. ABOUT THE DESTINATION ................................................................................................................ 2 C. ORGANIZATION OF THE REPORT ...................................................................................................... 6 SITUATIONAL ASSESSMENT .......................................................................................................................... 7 A. GLOBAL AND INTERNATIONAL TRENDS ............................................................................................ 7 A. NATIONAL TRENDS.......................................................................................................................... 10 B. CURRENT TOURISM SITUATION IN THE REGION ............................................................................ 12 A. TOURISM ATTRACITON SITES.......................................................................................................... 15 B. TOURISM ACTIVITIES....................................................................................................................... 15 C. OTHER TOURISM ENTERPRISES....................................................................................................... 16 D. TOURISM INSTITUTIONS ................................................................................................................. 17 E. TOURiSM DEMAND ......................................................................................................................... 17 ANALYSIS ..................................................................................................................................................... 22 A. TOURISM CIRCUIT MAPPING .......................................................................................................... 22 B. MARKET ANALYSIS .......................................................................................................................... 26 C. KEY ISSUES AND CONSTRAINTS....................................................................................................... 27 TOURISM STRATEGY ................................................................................................................................... 29 A. zamboanga city tourism GOALS AND OBJECTIVES.......................................................................... 29 B. STRATEGIC TOURISM DEVELOPMENT FRAMEWORK...................................................................... 29 C. TOURISM DEVELOPMENT STRATEGIES ........................................................................................... 31 References .................................................................................................................................................. 33 Agabao, J., Delos Ama, M. and Labaupa, M. 2019 1 INTRODUCTION A. BACKGROUND AND OBJEC TIVE OF THE STUDY This study evaluates the current situation of the tourism in Zamboanga City which leads to the construction of tourism strategies of the city. The objective of this study is to develop a strategic tourism development framework for Zamboanga City. Also, this is only a class requirement and the aforementioned strategic framework is an unofficial strategy for the City of Zamboanga. The strategic tourism development framework created in this paper will not be used officially by the Local Government Unit of Zamboanga City, it will only be used for academic purposes. The proponents used secondary data with no direct inputs or communication with the LGU of Zamboanga City. B. ABOUT THE DESTINATION Basic Info Figure 1 Official Seal of Zamboanga City Zamboanga City, also known as Ciudad de Zamboanga, is a 1st class highly urbanized city in Zamboanga Peninsula Region. It is the commercial, industrial, financial, and educational center of the region. Its current Mayor is Ma. Isabelle G. Climaco. The city is known as the “The City of Flowers” and “Sardines Capital of the Philippines”. Moreover, the Port of Zamboanga and the Zamboanga International Airport served as the main gateway of the region to many destinations in the Philippines and Southeast Asia. Zamboanga City is also known as the melting pot of culture and cuisine because of its geographic location. The Santa Cruz Pink Sand Beach along with the famous Eleven Islands is the most well-known attractions of the city. Because of its diverse culture and enchanting tourist attractions “Zoom in Zamboanga” or “Asia’s Latin City” became the tourism brand of the city. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 2 The city is divided in to two congressional districts with a total of 98 barangays. The two districts are delineated by Veterans Avenue. District 1 is composed of 36 barangays on the west coast while District 2 is composed of 61 barangays on the east coast. The 98 barangays are further classified into urban (30) and rural (68) barangays. Zamboanga City is an independent, chartered city but is grouped with the province of Zamboanga del Sur for statistical purposes. Figure 2 Map of Zamboanga Peninsula Figure 3 Map of the Philippines Agabao, J., Delos Ama, M. and Labaupa, M. 2019 3 Zamboanga City is the commercial and industrial center of the Zamboanga Peninsula Region which lies between the Moro Gulf (part of the Celebes Sea) and the Sulu Sea in the South of the Philippines. Zamboanga City is accessible thru: By air: There are daily flights to from Manila to Zambaonga City International Airport by Philippine Airlines and Cebu Pacific. There are also regular flights to Zamboanga City via Cagayan de Oro and Davao City by Cebu Pacific. By sea: 2GO ferries have one ferry a week sailing to/from Manila to Zamboanga City via Dipolog and Dumaguete. Aleson Shipping lines has a ferry going to and from Sandakan, Malaysia. Also, the Port of Zamboanga is an international port of entry. It has a scheduled passenger ferry going to and from Sandakan, Malaysia. Several shipping lines also offer regular trips from and to Jolo (Sulu), Bongao (Tawi-Tawi) and Isabela City (Basilan). Figure 5 Manila to Zamboanga City by air transportation. Figure 4 Manila to Zamboanga City by land and sea transportation Agabao, J., Delos Ama, M. and Labaupa, M. 2019 4 Physical Features It is the 3rd largest city by land area in the Philippines with a total land area of 148,338.49 hectares. The territorial jurisdiction of the city includes the islands of big and small Sta. Cruz, Tictabon, Sacol, Manalipa, Tumalutap, Vitali, as well as other numerous islands. The total land area of city is combined of 142,099.99 hectares or 1,420.99 square kilometers land area of the city with the area of about 25 other islands within the territorial jurisdiction of the city — which have an aggregate area of 6,248.5 hectares as verified by the Office of the City Engineer. Climate. Zamboanga City features a tropical wet and dry climate under the Köppen climate classification (Aw). Zamboanga City enjoys a location that is free from the typhoon belt area. March to May is hot and dry, with temperature at 22 degrees Celsius. June to October is rainy. November to February is cool, with temperatures ranging from 22 degrees Celsius to 28 degrees Celsius. Average humidity year-round is 77%. Socio-Economic Profile Zamboanga City is the 6th most populous in the Philippines and the 2nd most populous in Mindanao after Davao City. According to the 2015 census, it has a population of 861,799 people. Roman Catholicism remains the predominant religion in the city which comprises the 60% of the city's population. Zamboanga City was the first to establish its own Catholic diocese in Mindanao (now the Roman Catholic Archdiocese of Zamboanga). Muslims have also been an integral part of Zamboanga, comprising 35% of the city's population. The ancestors of the present inhabitants of the city are said to also have migrated to other areas in the Southwestern Mindanao. Due to migration, several other ethnicities have a visible presence in the city such as the Samal, Yakan, Tausug and Badjao peoples. Chavacano, a Spanish-based creole language, is the native language of inhabitants living around the city and the nearby island of Basilan. Aside from Chavacano, English is also understood. Tausug and Cebuano are also spoken, mostly by migrants to the city. Subanon is mainly spoken by Subanons living in the city. Zamboanga is noted as the Sardines Capital of the Philippines because 8 out of 11 sardines companies in the country are operating in the city. The canning factories are converged in the west coast of Zamboanga. Sardine fishing and processing account for about 70 percent of the city’s economy. Situated at the western tip of the Mindanao mainland, Zamboanga is a natural docking point for vessels traversing the rich fishing grounds of the Zamboanga peninsula and the Sulu archipelago. Zamboanga’s principal exports also include processed fruit, coconut-based products, shell and rubber manufactures, and wooden furniture. The city is also a center for Moro brass ware and bronze ware and a collecting point for shells, which, if not exported, are used mainly for local button manufacture. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 5 Brief History Zamboanga City was founded in the late 12th or early 13th century as a settlement by the Subanen people. Zamboanga Peninsula was also the homelands of the ancestors of the Yakan, the Balanguingui, and other closely related Sama-Bajau peoples. The area was inhabited by the Subanen people and was the site of trade among the Chinese, Malays and different native ethnic groups around the area. The city used to be known as Samboangan in historical records. Samboangan is a Sinama term for "mooring place", from the root word samboang ("mooring pole"). The name was later Hispanicized and named as Zamboanga. The Philippine Commonwealth Act No. 39 of 1936 signed by President Manuel L. Quezon on October 12, 1936 in Malacañang Palace created and established Zamboanga as a chartered city. It has been known variously as "El Orgullo de Mindanao" (The Pride of Mindanao), nicknamed the "City of Flowers," and affectionately called by Zamboangueños as "Zamboanga Hermosa" Chavacano/Spanish for "Beautiful Zamboanga." Zamboanga City was formerly a part of the Commonwealth Era Moro Province of Mindanao. Its ancient inhabitants were vassals of the Sultanate of Sulu and North Borneo. Zamboanga City brings its best foot forward during the popular Fiesta Pilar, celebrated in honor of the city's patron saint, La Nuestra Senora del Pilar de Zaragoza Our Lady of the Pillar of Zaragoza, Spain. A statue honoring the saint is prominently embossed above the façade on the eastern wall of the meter-thick walled fort called El Real Fuerza de Nuestra Señora del Pilar de Zaragoza. This Spanish military fort was built on June 23, 1635, by the Spanish Jesuit priest Fr. Melchor de Vera in defense against pirates and slave raiders. Zamboanga City is one of the oldest cities in the country and is the most Hispanized. Moreover, Día de Zamboanga (Day of Zamboanga) is celebrated every February 26 it was the day when Zamboanga was declared as a chartered city under the Commonwealth Government. C. ORGANIZATION OF THE REPORT This paper is organized into five chapters. After this introductory chapter, Chapter Two provides the situation assessment of the tourism of Zamboanga City; this includes the global and international trends, national trends, and the current situation of tourism in the city. Analysis of the issues and problems that the tourism of the City of Zamboanga is facing is discussed in the Chapter Three. Lastly, the suggested tourism strategies will be presented in Chapter Four. This study is delimited by the online resources about Zamboanga City and Zamboanga Peninsula Region. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 6 SITUATIONAL ASSESSMENT A. GLOBAL AND INTERNATI ONAL TRENDS World @ A Glance (Emmer, 2018) Economist are predicting softening of the US Economy According to the Conference Board the global economy will grow 3.1% in 2019 and GNP growth will slow in key markets such as Europe (1.9%) and Japan (0.9%). U.S. companies will not only struggle with exports to China but in mature economies around the world. US – China relations will remain shaky The Technology of the future will be 5G, be ready to go virtual reality Bots will revolutionize customer service E Commerce grows at a torrid pace Business will continue to feel the pain of the fill employment and higher labor costs World Tourism @ A Glance (Kutschera, 2018) Last minute bookings are increasing – 39% of the sample group booked 1 to 3 hours before arrival but advance booking is preferred over multi day tour. Tourists are visiting more new destinations and requesting new experiences. Ecological and educational tours are in demand and so are SKIP THE LINE tours. Travellers are enjoying local experiences with history and culture; demand for adventure remains high Asian Tourism @ A Glance (Alampay, 2019) 82% of Asian international trips are holiday trips • 23% of holiday trips to sun-and-beach destinations • Holiday trips to city-destinations grew by 9% • Multi-destination tours declined slightly Changing profile of the Chinese outbound market • Millennials now comprise 60% of market • More than 50% are independent travelers • Gradual increase in international travelers from 2nd- and 3rd-tier cities (mostly package tourists) More About Asian Travel Tourism Market (Check-in Asia, 2017) China’s tourism juggernaut is transforming the travel sector from top to bottom and not because of the 145M outbound travelers and 4.8 billion domestic trips this year. Emerging India. The UNWTO predicted that by 2020, Indian travelers will total 50M. In SEA, Malaysia, Thailand and Indonesia local tourists take advantage of competitive LCC sectors to enjoy long weekends and holidays. South Korea increased domestic travel from 35-38M between 2011 and 2015. Airbnb went into partnership with All Nippon Airways and Peach Aviation to promote domestic travel in Japan Diversity of Destinations, there is opportunity in the shifting demographics. China, India and SEA are obvious choice for destination marketers. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 7 Global Tourism in Numbers International tourist arrivals have grown from 25 million globally in 1950 to 669 million in 2000 and reached 1 billion in 2012. In 2017, international tourist arrivals grew by a remarkable 7 percent, recording a total of 1.3 billion. 2018 is expected to post an ave. growth of 4 to 5% which is higher than the 3.8% growth projected by UNWTO (Horwarth HTL, 2018). Global trends show that the future of tourism is shifting to Asia with the future BIG markets coming from this region. With the Experiential Trend this part of the country can offer more (UNWTO, 2018). Data below is saying 55% of tourists travels to for recreation. Asia came second in arrivals generating 25% of the total world traveler’s arrival next to Europe only. South-East Asia enjoyed the highest growth of all Asian subregions, with an additional nine million international tourists in 2017 (UNWTO, 2018). Current trend of travelers that are expected to grow in the coming years are solo travel, eco travel, bleisure that is becoming millennial in nature and local experience tours. These market segments open opportunities for SEA destinations (Revfine, ND). The large majority of international travel takes place within travellers’ own regions (intraregional tourism). It was posted that 4 out of 5 tourists travel within their region (UNWTO, 2018). Figure 6 Source: World Tourism Organization Agabao, J., Delos Ama, M. and Labaupa, M. 2019 8 Figure 7 Source: World Tourism Organization The trend is going towards Asia, The Chinese and the Indian Market present huge growth potential in terms of tourist receipts, Asia needs to be market ready. Technology has bridged the gap between continents, so distance is simply relative to time that people have or to their disposable income. Global Tourism is robust, and travel is no longer a status quo for the rich and famous, it has become accessible and everyone have equal opportunity for all tourism products because of that the industry has become highly competitive. There is a need for niche targeting for service providers to ensure quality of service and product. Lastly, don’t forget to look inwards, local market contributes highly to the tourism industry. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 9 A. NATIONAL TRENDS Philippines Political, Economic, Social and/or Technological Drivers of Change Strong economic growth continues in the Philippines. Strong performer over the years. Sound policies and a favorable global economic environment have delivered robust growth, low inflation, and a sustainable debt path (IMF, 2018). In 2017, the Philippines was among the top three growth performers in the East Asia region. Only Vietnam and China performed better. The Philippines growth performance slightly weakened in 2017 to 6.7 percent year-on-year from 6.9 percent in 2016 (The World Bank, 2018). Philippine Foreign Policy for security prospects in the country, Defense Secretary Delfin N. Lorenzana said President Rodrigo R. Duterte pursues an independent foreign policy that will allow the Philippines continue to deepen its security ties with the United States, but at the same time forge closer relations with China, and other regional powers like India and Russia. “Engaging more partners does not mean we are letting go of old friends,” he said (Aguinaldo, 2018). PEACE AND ORDER. It’s better to think of "safe” in relative terms. There is an active travel warning for the Philippines, but only for some regions. Most other parts of the nation are generally considered as safe as other places in Southeast Asia. Having said that The Global Peace Index, compiled by the Institute for Economics and Peace, is a measure of the relative peacefulness of 162 nations worldwide (representing more than 99% of the world’s population). The Index measures peace based on 22 qualitative and quantitative indicators including ongoing domestic and international conflict; societal safety and security (including crime rates); and militarization. For the 2018 study, the Philippines ranked 137 out of 163 countries (Folger, 2018). Agabao, J., Delos Ama, M. and Labaupa, M. 2019 10 Philippine Tourism Outlook There is a 7.9% increase in tourist arrivals for Q1 of 2019. South Korea remains the top source market with 519,584 tourist arrivals compared to last year’s 477,087. Chinese market ranking second with 463,804 tourists, 24.87 percent higher than the previous year’s tally of 371,429. 3rd is United States, registering 293,780 visitors, up by 3.10 percent from last year. Completing the top 12 markets for the three-month period are: Japan, 177,769; Taiwan, 77,908; Australia, 73,147; Canada, 72,352; United Kingdom, 53,402; Singapore, 39,484; Malaysia, 37,651; India, 36,275; and Germany, 33,725 ( (Rocamora, PH tourist arrivals up by 7.59% in Q1 2019, 2019) Taiwanese with the highest posted increase while Indian market (one of the big markets to watch out for) posted a growth of 1.52%. currently in the 13TH spot. DOT Sec. Puyat said the DOT remains committed with its objective to establish the Philippines as a "quality destination" in the region, To ensure that we get these done, the DOT is implementing a convergence approach where the Department works in partnership with other national government agencies (Rocamora, PH tourist arrivals up by 7.59% in Q1 2019, 2019). The govt is also encouraging tourism stakeholders to embrace gender responsive industry. There is also a focus on manpower development, DOT Sec. Puyat in another article was quoted to say “DOT will continue to empower Filipino tourism workers in partnership with the Technical Education and Skills Development Authority (TESDA) and the Tourism Industry Board Foundation Inc. (TIBFI) (Rocamora, PHs Sustainable Tourism Invests in Destinations, People: DOT, 2019). Philippines Tourism Trends DYI is still popular with the internet access the is available now, small groups prefer to plan and arrange for their own trips. Rehab is becoming a new buzzword in the local tourism industry after the Boracay closure, local travelers believes that sustainable is the way to go. Camping and glamping is slowly generating followers. Farm Tourism is a thing. Is Pilgrimage a possibility of the Phil. Tourism? The verdict is still out for this at this time. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 11 B. CURRENT TOURISM SITUATION IN THE REGION Overview Of the physical and geographical characteristics of the province Region 9, also known as the Zamboanga Peninsula Region lies at the Southernmost portion of the Philippine archipelago. Located at the western tip of the island of Mindanao, Zamboanga Peninsula is strategically situated in close proximity to Sabah, Malaysia, Brunei Darussalam and Indonesia. Known as Philippines’ gateway to the Brunei-Indonesia-Malaysia-Philippines East ASEAN Growth Area or BIMP-EAGA (Dept. Trade and Industry, ND). The region's topography is relatively rugged. About 51% are hilly; some having steeped slopes and within the elevation range of 100 to more than 1,000 meters above sea level. In terms of land classification, about 51 per cent is considered alienable and disposable and the remaining 49 per cent is classified as forest land. Almost 60,000 hectares of land that can be developed for planting crops still remain idle, while around 310,000 hectares of coconut land can be utilized for multi-cropping and pasture purposes (Dept. Trade and Industry, ND). Nature also endowed it with so much natural attractions such as white sand beaches, spectacular waterfalls, dive spots, caves for spelunking, marine sanctuaries and awesome coral formations, among others (Dept. Trade and Industry, ND). Overview of the regional and provincial economy The gross regional domestic product (GRDP) grew 6.3 percent, amounting to approximately Php197.4-billion in 2018. The economic growth in 2017 has been noted to be only 2.4 percent. This growth represents figures in 1) agriculture, hunting, forestry and fishing, 2) industry, and 3) services. The bulk coming from service sector and service sector comprises of transportation, storage and communication, trade and repair of motor vehicles, motorcycles, personal and household goods, financial intermediation, real estate, renting and business activities, public administration and defense, compulsory social security and other services (Sanchez, 2019). Employment rates also posted positive growth for the city, some indicators of a healthy economy. Regional tourism performance In the last five years before the dip in 2017 due to insurgency issues in Zamboanga that required the government to declare Martial Law tourist arrival in Region 9 has been slowly but positively Agabao, J., Delos Ama, M. and Labaupa, M. 2019 12 REGION 9 Arrivals 1 096 952 561 086 608 812 increased. What should be note though is that 76% of the arrivals are in Zamboanga City, Dipolog and Dapitan. 653 812 370 860 330056 228405 49228 32903 2012 7837 6835 2013 12 051 7 785 2014 12 859 9 080 2015 Philippine Residents 13 11 267 046 2016 4 3 812 612 2017 Non Residents 16 400 830 15 2018 OFWs The Current Environment for Tourism in the City Overview of the city economy Zamboanga City is also dubbed as the Sardines Capital of the Philippines, for 9 out of 12 sardine companies in the country are produced here it exports an estimated 16M worth of Sardines. Located on the tip portion of Zamboanga Peninsula, it has become the docking port of sea vessels. Zamboanga City together with Cebu and Southern Luzon produces seaweeds. Further, Zamboanga was also one of three Special Economic Zones outside of Luzon. The Department of Tourism has selected Zamboanga City as a flagship tourism destination in Zamboanga Peninsula. Access to the destination How to get to Zamboanga City Zamboanga City is pretty much accessible from major cities in the Philippines. Daily flights to and from Manila, Cebu and Davao are available. Ferry services from Manila, Cebu and even Sandakan, Malaysia are available on a weekly basis. Zamboanga City can also be reached by land travel. Buses from Cagayan de Oro City, Dipolog, Pagadian and Ozamis have multiple daily trips. The most common transportation out of Zamboanga Airport is by jeepney or tricycle. If you know where you are going, just get out of the main gate and take a jeepney from there and if you prefer to take a tricycle, drivers normally ask for a fixed / contracted rate. The most common modes of transportation within the city are jeepneys and tricycles. You can also rent a van if you are in a group so you can easily move in and out of the city. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 13 Ceres and Rural Transit operate from Zamboanga City Bus Terminal to other parts of Mindanao and even in the Visayas. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 14 A. TOURISM ATTRACITON SITES Zamboanga City B. Sta. Cruz Island Fort Pilar Shrine and Museum Paseo del Mar Zamboanga City Hall Rizal Park Metropolitan Cathedral of the Immaculate Conception Pasonanca Natural Park Plaza Pershing Merloquet Falls Pandilusan Island Rio Hondo Village Limpapa Bridge Victoria Pader Cave Dulian Falls Dulian View Deck Caragasan Beach El Museo de Zamboanga Climaco Freedom Park Parola de Labuan Pitas Island Nancy Falls Yakan Weaving Village La Vista del Mar Tetuan Church Taluksangay Mosque and Village TOURISM ACTIVITIES Zamboanga City Tourism may be considered in its infant stages, most of its clusters are available for day tours only and no formal infrastructure are in place but all them have been listed and are currently part of different Tourism Products being offered by Tourism Operators in Zamboanga Peninsula as a whole. There is huge growth potential for these sites for intraregional tourism. Cluster 1 = Sun and Beach Tourism – the island is well known to be the only island in the Philippines with Pink Sand. One of the major attractions of the Peninsula. There is no formal lodging available at the island and currently offered only as a day tour destination. Cluster 2 = Cultural Tourism – the sites in this cluster offers a peek in the rich historical and cultural experiences of the both the Malay and Spanish influences in Zamboanga City. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 15 Cluster 3 = Cultural / Educational / Leisure and Entertainment Tourism. Highlight of cluster is the Yakan Village, Yakan are the indigenous people of nearby Basilan Island, and their woven designs are characterized by bright colours and geometric designs. Cluster 4 = Cultural / Natural Tourism – the sites in this cluster offers a wide variety of activities for the nature lovers. Cluster 5 & 6 = Sun and Beach Tourism. Pitas Island Beach for adventure-seekers. Within the area are 11 islands other with equally crystal-clear waters. Motorized boats are available for island hopping. Enjoy snorkeling or just swimming in its clear waters. Cluster 7 and 8 = Nature Tourism. Enjoy a road trip and see the rustic scenery that abounds Zamboanga. C. OTHER TOURISM ENTERP RISES There are 6 travel agencies and 1 tourist transport operator which was accredited by DOT in Zamboanga City namely: - Air Savings Travel and Tours - Emerald Travel and Tours - Four Bro's and I Events and Travel - Happy Campers Tour and Leisure - iTravel Tourist Lane - Terrene Tours and Travel - Asia's Latin City Transport Services Corp. There are also available community guides, local guides, and eco guides in Pasay Drive, San Roque and Rosa Village, Pasonanca in Zamboanga City. Hotels and Resorts have been a place for events and conventions in Zamboanga City, however the most well-known and DOT accredited MICE establishment in the city is the Marcian Business Center and Palacio Del Sur. Moreover, there are a lot of restaurants available in the city but only 14 are DOT accredited. Such restaurants offer local and international cuisines. Likewise, the famous local cuisines in the city are: knickerbocker, satti, lokot-lokot, pianono from tsokolate, chicalang, sulu/tausug native cuisines, and curacha in alavar sauce. The Sulu/Tusug Native Cuisines or collectively called “Bangbang Sug” is available in Dennis Coffee Garden and Bay Tal Mal, while the Curacha in Alavar Sauce is available in Alavar Seafood Restaurant. Local cuisines are more famous than international cuisines, nevertheless Harley’s Food + Craft Beer is one of the well-known restaurants that serves Asian Halal food with a pub serving an array of local craft beer from Mindanao. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 16 Shopping centers are also available in the city such as malls like SM MindPro and KCC Mall de Zamboanga, and souvenir and specialty shops like the Canelar Barter Trade Center, Angie's Yakan Handloom Weaving, Dela Cruz Pearls and Fine Jewelries Corp., and Mang Isto Chili Garlic Sauce. D. TOURISM INSTITUTIONS Tourism Offices Zamboanga City Tourism Office Department of Tourism Information Center and Regional Office (Zamboanga City) Regional Director, Myra Paz Valderrosa-Abubakar Tourism-Related Associations Hotel and Restaurant Association of Zamboanga City (HRAZC) Asosacion de Guia Turistico del Zamboanga (Tour Guides Association of Zamboanga) Academic Institutions Pillar College and Universidad de Zamboanga offers tourism courses in the city. Moreover, tourism and hospitality courses are offered in some of the senior high school in Zamboanga City as well as TESDA training institutions. - Last 2017, a 10-day Tourism Industry Skills Program jointly undertaken by the tourism stakeholders and the Department of Tourism (DOT) was conducted. E. TOURISM DEMAND Trends in Visitor Arrivals Visitor arrivals increase in Zamboanga City because of the Sta. Cruz Pink Island along with the Eleven Islands. Also, Zamboanga City is one of the major hosts of seminars, conventions and events in Zamboanga Peninsula and Mindanao, that is why one of the tourism trends in the city is MICE. Market Profile and Segmentation According to the 2018 Annual Report of the Department of Tourism – Zamboanga Peninsula, the greatest number of visitor arrivals are Filipinos with a number of 489,739. Moreover, next to Filipinos are Asian tourists mostly from East Asia and Southeast Asia. There are less than 2,000 Tourists from America, Europe, and Australia and the Pacific. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 17 Table 1 Visitor Arrivals for 2018 Source: DOT Zamboanga Peninsula Annual Report (2018) Country of Residence No. of Arrivals Country of Residence No. of Arrivals Philippines 489,739 Canada 275 Indonesia 1,118 USA 766 Malaysia 1,535 Belgium 11 Singapore 136 France 54 Thailand 131 Germany 68 Vietnam 63 Luxembourg 5 China 1,419 Netherlands 2 Hong Kong 131 Switzerland 16 Japan 329 United Kingdom 82 Korea 1,260 Italy 8 Taiwan 55 Australia 280 India 341 New Zealand 58 Saudi Arabia 743 Total of Guest Arrivals 513,995 Table 2 Occupancy Rate and Length of Stay for 2018 Source: DOT Zamboanga Peninsula Annual Report (2018) NO. OF ROOMS OCCUPIED 105,892 NO. OF ROOMS AVAILABLE 11,736 TOTAL GUEST NIGHTS 233,672 AVERAGE OCCUPANCY RATE 30% AVERAGE LENGTH OF STAY 2.2 Most tourists go to Zamboanga City because of the leisure activities and MICE. The city being the industrial center and economic zone of the region, most of the seminars and other events are held here, which it attracts visitors who are attending this kind of events. Likewise, leisure tourists come to Zamboanga City because the famous Sta. Cruz Pink Sand Beach and the other enchanting islands with its crystal clear water, island hopping, and other water activities. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 18 Destination marketing activities of the city Figure 8 Zamboanga City Tourism Ad Campaign 1 Source: Blog Folio of Ced Zabala Zamboanga City launches its new advertising campaign at the 24th Philippine Travel Mart at the SMX Convention Center in Pasay City last September 2013. This ad campaign was used to invite visitors and locals alike to zoom in again and take a closer look at the many reasons why people love Zamboanga and why many calls it their home. This new campaign helps Zamboangueños to share a piece of Zamboanga that they truly love. This ad campaign also tells the visitors to Zoom In to its diversity. Also, using the hashtag #ZoomInZamboanga in their Instagram photos, Facebook status and tweets, and that tells them what makes Zamboanga be their next destination. The Zamboanga City Tourism Office promotes the tourism of the city in various ways. For one, they use social media such as their Facebook page ‘Zoom In: Zamboanga City’ as a platform to advertise the events and attractions in the city. They also created a Vlog competition for locals as well as tourists to promote the tourism of the city. The city tourism office also joins the Philippine Travel Mart (PTM) and other travel conventions to let people know more about Zamboanga City and make it their next destination. Other promotional activities include video ad campaign thru YouTube, posters, blogs, brochures and other promotional materials. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 19 Figure 9 Zamboanga City Tourism Facebook Page Figure 10 Vlog Competition Poster Agabao, J., Delos Ama, M. and Labaupa, M. 2019 20 Figure 11 City Tourism Brochure Agabao, J., Delos Ama, M. and Labaupa, M. 2019 21 ANALYSIS A. TOURISM CIRCUIT MAPPING Figure 12 Proposed Zamboanga City Tourism Clusters There are seven (7) proposed tourism clusters for Zamboanga City Cluster 1 is the Grande Santa Crus Island Cluster; Cluster 2 or the Zamboanga Poblacion; Cluster 3 or the Yakan Area Cluster; Cluster 4 or the Ecotourism Cluster; Cluster 5 or the Dulian Cluster; Cluster 6 of the Pitas Island Cluster and; Cluster 7 or the Limpapa Bridge or the Parola de Labuan Cluster. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 22 Figure 13 Cluster 1 Grande Santa Cruz Island Cluster 1 is the Grande Santa Crus Island Cluster is four kilometers away from the mainland and 6 kilometers away from the Airport. It is also about 16 kilometers away from the Island of Basilan. It is composed of two attractions, the Grande Santa Cruz Island and the Little Sant Cruz Island or islet. Figure 14 Cluster 2 or the Zamboanga Poblacion Cluster. Cluster 2 or the Zamboanga Poblacion Cluster, is also the city’s tourism center. This is where the main gateway of the city and one of the major gateways of the Zamboanga Peninsula is situated, the Zamboanga International Airport. Another gateway which the Port of Zamboanga is is also located within this cluster. This is also were most of the tourist attractions in Zamboanga City is concentrated such as the Fort Pilar Shrine, Paseo Del Mark, Plaza Pershing, National Museum and Rio Hondo. The city’s tourism office as well as the DOT regional office is located here. There are about 6 accommodation establishments located in this cluster. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 23 Figure 15 Cluster 3 or the Yakan Area Cluster Cluster 3 or the Yakan Area Cluster seats along the southern coastal road of the city. The highlight of this cluster is the Yakan Village, the Caragsan Beach and some modest beach front resorts. Figure 5 Cluster 4 or the Ecotourism Cluster. This cluster comprises most of the city’s ecotourism sites such as the Pasonanca Park, AbongAbong Park, Mt. Pulong Bato, Muruk Bike and Joggers Haven and the Dulian View Deck. This is also were one of the biggest and high-end hotel and convention is location the Astoria Hotel and Convention Center. This cluster is approximately 4 to 6 kilometers away from gateway and the town center. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 24 Figure 16 Cluster 5 or Pitas Island Cluster is one of the city’s less developed areas. It comprises one potential attraction, which is the Pitas Island and one accommodation establishment. It is approximately 30 kilometers away from gateway and town center. North of this circuit are a few more less known white sand beached island such as the Bisaya – Bisaya beach and the Baong Island Beach. Figure 17 Cluster 6 or the Dulian Falls Circuit is comprised of two ecotourism sites, the Dulian Falls and the Merloquet Falls. There are no accommodation establishment in this area, and it is approximately 30 and 50 kilometers away from the town center. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 25 Figure 18 Cluster 7 is comprised of 2 more potential attractions, the Parola de Labuan and the Limpapa Bridge. It is approximately 30 to 35 kilometers away from the town center and gateway. B. MARKET ANALYSIS Market segmentation and targeting Foreign and future visitor arrivals. Key Market Source are the Top Foreign Markets Koreans, Chinese and Europeans. OFWs and Domestic Tourists. Agabao, J., Delos Ama, M. and Labaupa, M. 2019 26 C. KEY ISSUES AND CONSTRAINTS I. COMPARATIVE & COMPETITIVE STRENGTHS AND OPPORTUNITIES OF ZAMBOANGA CITY AS A TOURIST DESTINATION The Strengths Zamboanga is a city of rich Hispanic culture. Tourism is one of the contributor’s economic growth in the city and region Zamboanga International Airport as sole international point of entry in the region Improved road quality Attractions has seen the increased share of the tourism pie Inadequate local transportation system The Opportunities Government gearing up the region to become the country’s Southern Gateway for Muslim Countries in Asia and Middle East, New Zealand and Australian Bloc Vigorous public spending and stronger partnerships with private sector are being forged to promote and develop existing and potential tourist destinations and cultural events Implementation of more road projects leading to tourism destinations and industries through DOT-DPWH TRIPC The Government is pushing modernization, rehabilitation and improvement of airport and seaport II. KEY ISSUES AND CONSTRAINTS AFFECTIVE TOURISM IN ZAMBOANGA CITY The major key issue for tourism in Zamboanga City is the relatively low tourism activity, compared to other provinces in the Zamboanga Peninsula despite the abundance of its tourist attractions and presence of an international airport due to the following factors: Minimal tourism investments Unfavorable business climate Lack of skilled workers. There is a mismatch between supply and demand of needed tourism industry worker. Resources with potential for tourism are given less priority for tourism development. Lack of modern equipment and facilities in airports and seaports Inadequate local transportation system Lack of marketing projects to promote positive news features about Zamboanga City Volatile peace order situation in the region/neighboring areas; Agabao, J., Delos Ama, M. and Labaupa, M. 2019 27 Overuse of natural resources as sources of livelihood (i.e kaingin, illegal settlements in watersheds, destructive fishing methods and mining activities) The mining activities is considered as a threat to the tourism resources and the natural resources in general of Zamboanga City; Agabao, J., Delos Ama, M. and Labaupa, M. 2019 28 TOURISM STRATEGY A. ZAMBOANGA CITY TOURI SM GOALS AND OBJECTIVES Increase the Tourism Activity in Zamboanga City To increase Tourism Investments, encouraging small and medium scale enterprises to diversify economic activities To improve overall business environment and provide investment incentives To Provide training and livelihood assistance for displaced and underemplo yed workers To Strengthen peace building and conflict transformation capabilities of actors and institutions To give high priority on tourism development and look at it as a strong and sustainable economic driver for the city To upgrade the airport and seaport facilities to meet internationa l standards To implement more road projects and upgrade seaports and seaport facilities for safe and efficient transport of goods and services Pursue a city or regional marketing program to promote the area as a source of quality and competitive tourism products and services to enhance the area’s positive international image Promote ecotourism in the area B. STRATEGIC TOURISM DEVELOPMENT FRAMEWORK OBJECTIVE SUCCESS INDICATORS STRATEGIES TIMELINE GOAL 1: To increase Tourism Investments, encouraging small and medium scale enterprises to diversify economic activities number of new tourism enterprises in the city Promote Small and Medium Scale Industries to diversify economic activities in the rural areas Year 3 Objective 1. To improve overall business environment and provide investment incentives New investment policy Simplify and rationalize the system to improve the business environment Year 1 Objective 2. To Provide training and livelihood assistance for Agabao, J., Delos Ama, M. and Labaupa, M. 2019 Number of trained employees in Create a holistic investment package for tourism investors Conduct skills training for tourism workers and unemployed Year 1 29 displaced and underemployed workers tourism sector and trained Number of employed in tourism induries Conduct of livelihood Assistance Projects/ Trainings for various sectoral groups Objective 3. To Strengthen peace building and conflict transformation capabilities of actors and institutions new policies/program on tourism safety and security Implement a vigilant program especially among tourism workers and host communities through training and incentive programs and incentive programs that should deter unscrupulous activities that can threaten safety and security Year 2 Goal 2. To give high priority on tourism development and look at it as a strong and sustainable economic driver for the city Number of tour packages and promotion activities Sustain a more focused and aggressive promotion campaign to expand existing and emerging market Year 2 Objective 4. To upgrade the airport and seaport facilities to meet international standards Improved facilities Seek public and private partnership to improve local transportation, airport and seaport facilities, manpower training, and product development Year 5 Objective 5. To implement more road projects and upgrade seaports and seaport facilities for safe and efficient transport of goods and services and Develop roll on-roll-off (RoRo) Improved access to tourism sites Implementation of road projects leading to leading to tourism attractions and industries Year 4 Objective 6. Pursue a city or regional marketing program to promote the area as a source of quality and competitive tourism products and services to enhance the area’s positive international image Number of visitor arrivals There shall also be continuous promotion of products to culturebased markets, i.e. halal. Year 2 Objective 7. To Promote ecotourism in the area Number of tour packages incorporating ecotourism Agabao, J., Delos Ama, M. and Labaupa, M. 2019 Identify and develop new tourism products conduct of Market Opportunity Mapping, Inbound Business Matching, and Offshore Business Matching activities. Maximize tourism potentials and responding to critical infrastructure and environmental concerns to reduce degradation i.e ecotourism products Year 3 30 No physical damage or alteration to particular biodiversity C. TOURISM DEVELOPMENT STRATEGIES ACTION PLAN OBJECTIVE TIMEFRAME FOR DEVELOPMENT PROGRAMS AND PROJECTS RESOURCE NEEDED RESPONSIBLE AGENCY Objective 1. To improve overall business environment and provide investment incentives Year 3 to 5 Formulation of Tourism Investment Code for Zamboanga City Fund for research, committee meetings, and writeshops Sangguniang Panglungsod, Planning Division, Tourism Office, stakeholders Objective 2. To Provide training and livelihood assistance for displaced and underemployed workers Year 1 Tourism Skills Training for tourism workers, OSY, unemployed, etc. Fund for training provider and resource speakers, various training needs DOT, DTI, MSWDO, LGU, stakeholders Fund for training provider and resource speakers, various training needs PNP, DOT, LGU, Stakeholders Fund for Site visits, workshops, familiarization tours, various promotional and marketing activities LGU, DOT, private tour operators and attraction operators, media outlets Livelihood Assistance Project Livelihood trainings Objective 3. To Strengthen peace building and conflict transformation capabilities of actors and institutions Year 2 Goal 2. To give high priority on tourism development and look at it as a strong and sustainable economic driver for the city Year 2 Objective 4. To upgrade the airport and seaport Year 5 Formulation of Tourism Safety and Security Plan Conduct of capacity buildings for tourism workers Development of tour packages Tourism promotion and marketing campaign Agabao, J., Delos Ama, M. and Labaupa, M. 2019 Lobby for the improvement and Sangguniang Panlungsod, 31 facilities to meet international standards development of airport, seaport, etc. LGU, DOT, DOTC, etc. Sangguniang Panlungsod, LGU, DOT, DOTC, etc. Objective 5. To implement more road projects and upgrade seaports and seaport facilities for safe and efficient transport of goods and services and Develop roll on-roll-off (RoRo) Year 4 Lobby for the funding of road projects and seaport facilities Objective 6. Pursue a city or regional marketing program to promote the area as a source of quality and competitive tourism products and services to enhance the area’s positive international image Year 2 Tourism mapping Objective 7. To Promote ecotourism in the area Year 3 Product development workshops with operators Marketing and promotional campaign Ecotourism sites mapping Ecotourism product development workshops with operators Fund for Site visits, workshops, familiarization tours, various promotional and marketing activities LGU, DOT, private tour operators and attraction operators, media outlets Fund for Site visits, workshops, familiarization tours, various promotional and marketing activities LGU, DOT, DENR, private tour operators and attraction operators, media outlets Marketing and promotional campaign Agabao, J., Delos Ama, M. and Labaupa, M. 2019 32 REFERENCES Aguinaldo, C. (2018, December 7). Stratbase forum charts PHL outlook on economy, politics, international relations. Retrieved from Businessworld: https://www.bworldonline.com/stratbase-forum-charts-phl-outlook-on-economy-politicsinternational-relations/ Alampay, R. (2019). Global & National Tourism Trends. Quezon City, Philippines. Check-in Asia. (2017, October). 10 Key Trends in Asian Travel and Tourism. Retrieved from Check-in Asia: https://www.check-in.asia/10-trending-takeaways-asian-tourism/ Dept. Trade and Industry. (ND). Profile of Region 9. Retrieved from Dept. Trade and Industry: https://www.dti.gov.ph/regions/region9/r9-profile-of-region Emmer, M. (2018, December 14). 19 Trends That Will Shape The World In 2019. Retrieved from Forbes: https://www.forbes.com/sites/forbeslacouncil/2018/12/14/19-trends-that-will-shape-theworld-in-2019/#507774813b45 Folger, J. (2018, October 14). How Safe Is Traveling in the Philippines? Retrieved from Investopedia: https://www.investopedia.com/articles/personal-finance/041015/how-safe-travelingphilippines.asp Horwarth HTL. (2018, May). Market Report Asia Pacific: Regional Tourism Trends. Retrieved from Horwarth HTL: https://corporate.cms-horwathhtl.com/wpcontent/uploads/sites/2/2018/05/MR_AP_REGIONAL-TOURISM-TRENDS.pdf IMF. (2018, September 28). The Philippines' Economic Outlook in Six Charts. Retrieved from International Monetary Fund: https://www.imf.org/en/News/Articles/2018/09/27/na092718-the-philippineseconomic-outlook-in-six-charts Kutschera, S. (2018, December 4). 9 Travel Trends that Will Drive Travel in 2019. Retrieved from Trekk Blog: https://www.trekksoft.com/en/blog/9-travel-trends-that-will-drive-the-tourism-industryin-2019 Revfine. (ND). Tourism Trends : 13 Opportunities for The Tourism Industry. Retrieved from REVFINE: https://www.revfine.com/tourism-trends/ Rocamora, J. A. (2019, May 9). PH tourist arrivals up by 7.59% in Q1 2019. Retrieved from Gov Ph: https://www.pna.gov.ph/articles/1069334 Rocamora, J. A. (2019, May 2). PHs Sustainable Tourism Invests in Destinations, People: DOT. Retrieved from Philippine News Agency: https://www.pna.gov.ph/articles/1068787 Sanchez, D. (2019, April 29). Zambo Peninsula’s economy more improved - PSA. Retrieved from Phil. Information Agency: https://pia.gov.ph/news/articles/1021402 Agabao, J., Delos Ama, M. and Labaupa, M. 2019 33 The World Bank. (2018, April). PHILIPPINES ECONOMIC UPDATE: Investing in the Future. Retrieved from Philippines Economic Update April 2018: http://pubdocs.worldbank.org/en/280741523838376587/Philippines-Economic-Update-April15-2018-final.pdf UNWTO. (2018). UNWTO Tourism HIghlights 2018 Edition. Retrieved from E-UNWTO: https://www.eunwto.org/doi/pdf/10.18111/9789284419876 Agabao, J., Delos Ama, M. and Labaupa, M. 2019 34