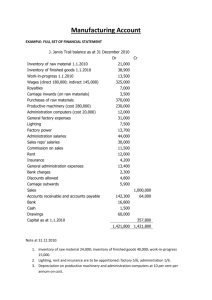

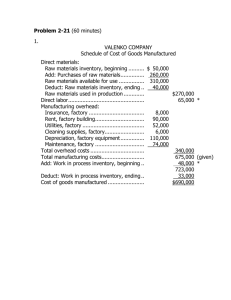

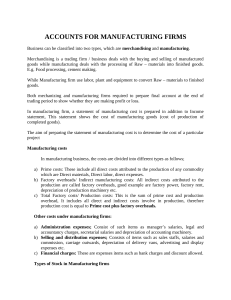

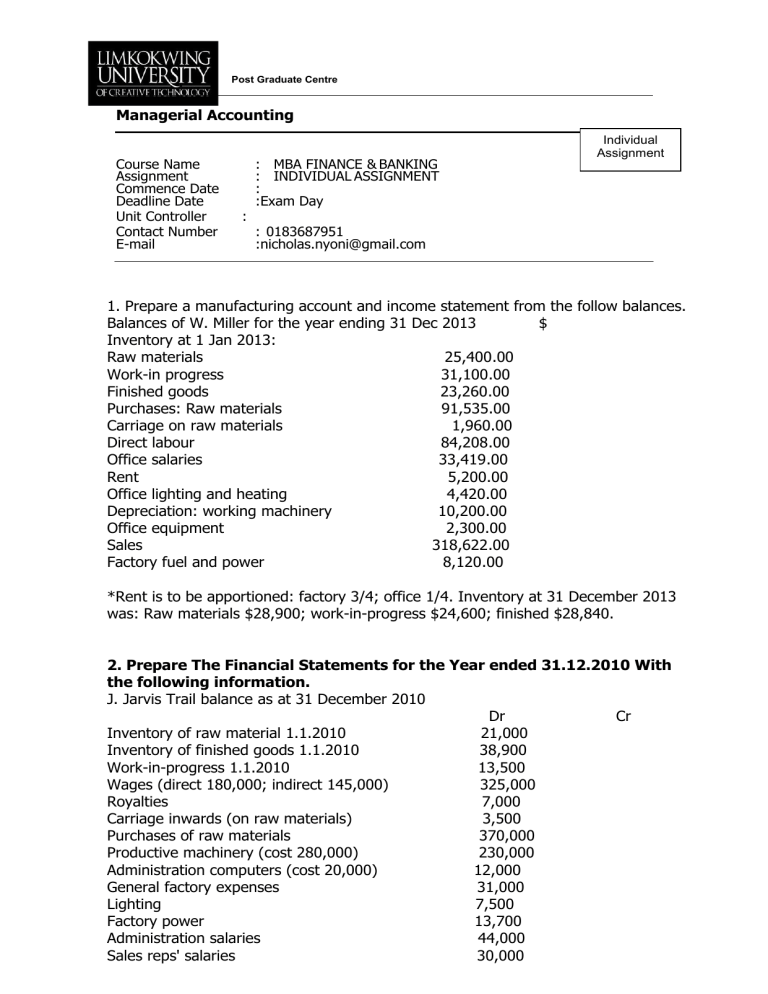

Post Graduate Centre Managerial Accounting Course Name Assignment Commence Date Deadline Date Unit Controller Contact Number E-mail : : MBA FINANCE & BANKING : INDIVIDUAL ASSIGNMENT : :Exam Day Individual Assignment : 0183687951 :nicholas.nyoni@gmail.com 1. Prepare a manufacturing account and income statement from the follow balances. Balances of W. Miller for the year ending 31 Dec 2013 $ Inventory at 1 Jan 2013: Raw materials 25,400.00 Work-in progress 31,100.00 Finished goods 23,260.00 Purchases: Raw materials 91,535.00 Carriage on raw materials 1,960.00 Direct labour 84,208.00 Office salaries 33,419.00 Rent 5,200.00 Office lighting and heating 4,420.00 Depreciation: working machinery 10,200.00 Office equipment 2,300.00 Sales 318,622.00 Factory fuel and power 8,120.00 *Rent is to be apportioned: factory 3/4; office 1/4. Inventory at 31 December 2013 was: Raw materials $28,900; work-in-progress $24,600; finished $28,840. 2. Prepare The Financial Statements for the Year ended 31.12.2010 With the following information. J. Jarvis Trail balance as at 31 December 2010 Dr Cr Inventory of raw material 1.1.2010 21,000 Inventory of finished goods 1.1.2010 38,900 Work-in-progress 1.1.2010 13,500 Wages (direct 180,000; indirect 145,000) 325,000 Royalties 7,000 Carriage inwards (on raw materials) 3,500 Purchases of raw materials 370,000 Productive machinery (cost 280,000) 230,000 Administration computers (cost 20,000) 12,000 General factory expenses 31,000 Lighting 7,500 Factory power 13,700 Administration salaries 44,000 Sales reps' salaries 30,000 Commission on sales Rent Insurance General administration expenses Bank charges Discounts allowed Carriage outwards Sales 1,000,000 Accounts receivable and accounts payable Bank Cash Drawings Capital as at 1.1.2010 12,000 4,200 13,400 2,300 4,800 5,900 142,300 16,800 1,500 11,500 64,000 60,000 357,800 1,421,800 1,421,800 Note at 31.12.2010: 1. Inventory of raw material 24,000; inventory of finished goods 40,000; work-inprogress 15,000. 2. Lighting, rent and insurance are to be apportioned: factory 5/6, administration 1/6. 3. Depreciation on productive machinery and administration computers at 10 per cent per annum on cost. 3. The financial position of ABC Ltd. on 1 January 2009 and 31 December 2009 was as follows: Assets 1-1-2009 31-12-2009 Cash Debtors Stock Land Building Machinery: Provision for Depreciation Liabilities Current Liabilities Loan from associate company Loan from Bank Capital and Reserves 8,000 7,200 70,000 76,800 50,000 44,000 40,000 60,000 1,00,000 1,10,000 2,14,000 2,44,000 (54,000) (72,000) 4,28,000 4,70,000 72,000 – 60,000 2,96,000 4,28,000 82,000 40,000 50,000 2,98,000 4,70,000 During the year $52,000 were paid as dividends. Prepare a cash flow statement. 5. The following information is available from the books of Exclusive Ltd. for the year ended 31st March, 2016: (a) Cash sales for the year were $10,00,000 and sales on account $12,00,000. (b) Payments on accounts payable for inventory totaled $7,80,000. (c) Collection against accounts receivable were $7,60,000. (d) Rent paid in cash $2,20,000, outstanding rent being $20,000. (e) 4, 00,000 Equity shares of $10 par value were issued for $48, 00,000. (f) Equipment was purchased for cash $16, 80,000. (g) Dividend amounting to $10, 00,000 was declared, but yet to be paid. (h) $4,00,000 of dividends declared in the previous year were paid. (i) An equipment having a book value of $1,60,000 was sold for $2,40,000. (j) The cash account was increased by $37,20,000. Prepare a cash flow statement using direct method. 6 Following information is available from the books of Standard Company Ltd.: Calculate cash flow from operations. OBJECTIVE The objective of this activity is to test your knowledge of the managerial accounting concepts. You are required to apply your relevant knowledge and understanding to solve the given problem. SPECIFIC INFORMATION This assignment will be an individual work. This assignment carry 20% of your total 100 marks This assignment should be submitted on the Date of exam. Late submissions will result in the loss of marks. RULES AND REGULATIONS Plagiarism will be dealt with sternly You must write the report based on real information. Page 2 of 2