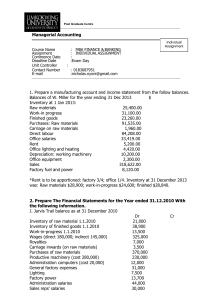

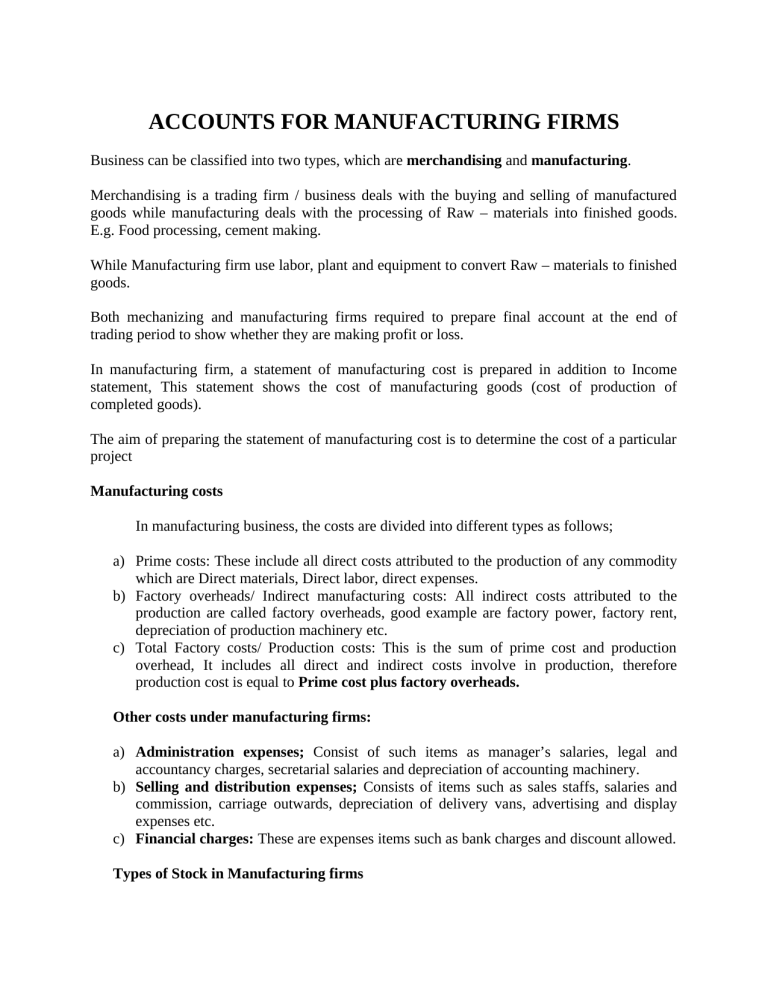

ACCOUNTS FOR MANUFACTURING FIRMS Business can be classified into two types, which are merchandising and manufacturing. Merchandising is a trading firm / business deals with the buying and selling of manufactured goods while manufacturing deals with the processing of Raw – materials into finished goods. E.g. Food processing, cement making. While Manufacturing firm use labor, plant and equipment to convert Raw – materials to finished goods. Both mechanizing and manufacturing firms required to prepare final account at the end of trading period to show whether they are making profit or loss. In manufacturing firm, a statement of manufacturing cost is prepared in addition to Income statement, This statement shows the cost of manufacturing goods (cost of production of completed goods). The aim of preparing the statement of manufacturing cost is to determine the cost of a particular project Manufacturing costs In manufacturing business, the costs are divided into different types as follows; a) Prime costs: These include all direct costs attributed to the production of any commodity which are Direct materials, Direct labor, direct expenses. b) Factory overheads/ Indirect manufacturing costs: All indirect costs attributed to the production are called factory overheads, good example are factory power, factory rent, depreciation of production machinery etc. c) Total Factory costs/ Production costs: This is the sum of prime cost and production overhead, It includes all direct and indirect costs involve in production, therefore production cost is equal to Prime cost plus factory overheads. Other costs under manufacturing firms: a) Administration expenses; Consist of such items as manager’s salaries, legal and accountancy charges, secretarial salaries and depreciation of accounting machinery. b) Selling and distribution expenses; Consists of items such as sales staffs, salaries and commission, carriage outwards, depreciation of delivery vans, advertising and display expenses etc. c) Financial charges: These are expenses items such as bank charges and discount allowed. Types of Stock in Manufacturing firms There are three types of stocks involved in manufacturing firms: i) ii) iii) Stock of Raw materials: These are unprocessed materials in the production process such as cotton, coffee, tea etc. Work in Progress: There are partly finished goods, are the goods which are not yet completely produced, they are at the time of annual stock taking, neither in form of raw materials nor in finished product state. Stock of finished goods: These are goods which are ready for use, like motor car, Shirt, Mobile phones etc. There is no any further processing of such goods. Statement of Manufacturing Costs: As explained earlier, the main purpose of preparing the statement of manufacturing costs is to determine the production cost of goods completed, this figure is then transferred to the income statement where it will replace the entry for purchases. THE FORMAT OF THE STATEMENT OF MANUFACTUING COSTS Inventory of Raw materials at start…………………………………………….. xxxx Add: Purchases of Raw materials ……………………………………………... xxxx Add: Carriage inwards for raw materials……………………………………… xxxx Less: Return outwards of raw materials ………………………………………. xxxx Cost of Raw materials Available for Use …………………………………… xxxx Less: Inventory of Raw material at close…………………………………..… (xxxx) Cost of Raw materials consumed………………………………………….... xxxx Add: Direct wages………………………………………….. xxx Other direct expenses ………………………………… xxx Prime Costs xxxx xxxx Add: Indirect Manufacturing Costs: Fuel and power xxx Indirect wages xxx Rent of factory xxx General factory expenses xxx Insurance of factory building xxx Depreciation of plant and machinery xxx xxxx xxxx Add: Opening Inventory of work in progress xxxx Less: Closing Inventory of work in progress xxxx Production cost of goods completed c/d xxxx Example 1: From the following information prepare the statement of manufacturing cost for the year ended 31 Dec 2008. 1st Jan; stock of Raw materials…………………………………………......8,000/= 31st Dec: Stock of Raw – material………………………………………...10,500/= Jan; Work in progress…………………………………………………… 3,500/= Dec:. Work in Progress………………………………………………….. ..4,200/= During the year: Wages: Direct………………………………………………………….... 39,600/= Indirect………………………………………………………….. 35,500/= Purchases of Raw - material………………………………………….. .. 87,000/= Direct expenses………………………………………………………….... 1,400/= Lubricants……………………………………………………………….... 3,000/= Rent of factory…………………………………………………………..... 7,200/= Fuel and power………………………………………………………........ 9,900/= Depreciation of factory plant and machine…………………………......... 4,200/= Internal transport expenses………………………………………….......... 1,800/= Insurance of a factory building and plant…………………………….......… 1,500/= General factory expenses…………………………………………........ 3,300/= Solution: STATEMENT OF MANUFACTURING COST FOR THE YEAR ENDED 31ST DECEMBER 2008 Opening Inventory of Raw materials 8,000 Add: Purchases of Raw materials 87,000 Cost of Raw materials available of use 95,000 Less: Closing inventory of Raw materials 10,500 Cost of Raw materials used 84,500 Add: Direct wages 39,600 Direct expenses 1,400 41,000 Prime costs 125,500 Add: Indirect manufacturing costs Indirect wages 35,500 Lubricants 3,000 Rent of factory 7,200 Fuel and power 9,900 Depreciation of factory plant and machine 4,200 Internal transport expenses 1,800 Insurance of a factory building and plant 1,500 63,100 188,600 Add: Opening Inventory of Work in progress 3,500 192,100 Less: Closing Inventory of Work in progress Production cost of goods completed c/d 4,200 187,900 FINANCIAL STATEMENTS OF MANUFACTURING FIRMS 1. Income Statement; This is prepared at the end of accounting period, the same way as it is prepared under other merchandising firms, it includes the following items i) Production cost of completed goods as brought forward from the statement of manufacturing costs ii) Opening and closing inventories for the finished goods iii) Sales of finished goods. iv) Gross profit/Loss v) All administration expenses vi) Selling and distribution expenses vii) All financial charges When completed, the Income Statement will show the Net profit or Net Loss earned by the manufacturing firm. Example: Prepare the statement of manufacturing cost and income statement from the following balances of W Miller for the year ended 31 December 2013. Stocks at 1 January 2013: Raw materials 25,400 Work in progress 31,100 Finished goods 23,260 Purchases: Raw materials 91,535 Carriage on raw materials 1,960 Direct labour 84,208 Office salaries 33,419 Rent 5,200 Office lighting and heating 4,420 Depreciation: Works machinery 10,200 Office equipment 2,300 Sales 318,622 Factory fuel and power 8,120 Rent is to be apportioned: Factory 3/4; Office 1/4. Stocks at 31 December 2013 were: Raw materials Tzs. 28,900; Work in progress Tzs. 24,600; Finished goods Tzs. 28,840. SOLUTION STATEMENT OF MANUFACTURING COST FOR THE YEAR ENDED 31ST DECEMBER 2013 Opening inventory for Raw materials 25,400 Add: Purchases of raw materials 91,535 Add: Carriage of raw materials 1,960 Cost of raw materials available for use 93495 118,895 Less: Closing Inventory for Raw materials 28,900 89,995 Direct labour 84,208 174,203 Add: Factory overheads Factory fuel and power Depreciation on work machinery Factory rent (5200 X ¾) 8,120 10,200 3,900 22,220 196,323 Add: Opening Inventory of Work in progress 31,100 227,523 Less: Closing Inventory of Work in Progress 24,600 Production cost of goods completed c/d 202,923 INCOME STATEMENT FOR THE YEAR ENDED 31ST DECEMBER 2013 Sales 318,622 Less: Cost of goods Sold Opening inventory of Finished goods Add: Production costs of goods completed b/d 23,260 202,923 226,183 Less: Closing inventory of Finished goods 28,840 Gross profit 197,343 121,279 Less: Expenses: Office salaries 33,419 Lighting and Heating 4,420 Depreciation on Office equipment 2,300 Office rent (5200 X ¼) 1,300 Net Profit 41,439 79,840 MARKET VALUE OF GOODS MANUFACTURED Sometime manufacturing form would like to know the gross profit it would get to the goods has been brought in their finished state, The market price of goods produced by a firm is called market value If the market value is grate than the cost of production then the firm will get manufacturing profit and if the market value is less than production cost then the firm will incur the manufacturing loss. The manufacturing profit of loss should be transferred to income statement as an income or expenses respectively. Example: Prepare the Statement of Manufacturing cost and Income statement from the given information provided from the books of John & Sons Manufacturing Company. DR Stock of Raw – material 1/1/2007 21,000/= Stock of Finished goods 1/1/2007 38,900/= Work in progress 1/1/ 2007 13,500/= Wages (Direct 180,000 factory indirect 145,000) 325,000/= Royalties 3,500/= Carriage in wards of (R.M) 3,500/= Purchases of Raw – material 370,000/= Productive machinery (cost 280,000) 230,000/= Accounting Machinery (cost 20,000) 12,000/= General factory expenses 31,000/= Lighting 7,500/= Factor power 13,700/= Administrative salaries 44,000/= Sales men salaries 30,000/= Commission on Sales 11,500/= Rent 12,000/= Insurance 4,200/= CR General administration exp. 13,400/= Bank charges 2,300/= Discount Allowed 4,800/= Carriage out wards 5,900/= Sales 1,000,000/= Account receivables and payables 125,000/= 142,300/= Bank 56,800/= Cash 1,500/= Drawings 20,000/= Capital as at 1st Jan 2007 296,800/= NOTE: at 31/12/2007 1. 2. Stocks: Raw material 24,000/= Finished good 40,000/= Work in progress 15,000/= Lighting, Rent and Insurance are to be appointed: Factory 5/6, administration 1/6 3. Depreciation on productive and accounting machinery at 10% p.a on cost. 4. Market value of finished goods Tzs. 950,000/= SOLUTION JOHN & SONS STATEMENT OF MANUFACTURING COST FOR THE YEAR ENDED 31ST DECEMBER 2007 Stock of raw materials 1.1.2007 Add: Purchases Carriage inwards 21,000 370,000 3,500 373,500 394,500 Less: Stock raw materials 31.12.2007 ( 24,000) Cost of raw materials consumed 370,500 Direct labour Royalties 180,000 7,000 Prime cost 187,000 557,500 Indirect manufacturing costs: General factory expenses Lighting (7,500 x 5/6) 31,000 6,250 Power 13,700 Rent (12,000 x 5/6) 10,000 Insurance ( 4,200 x 5/6) 3,500 Depreciation of productive machinery 28,000 Indirect labour 145,000 237,450 794,950 Add: Work in progress 1.1.2007 13,500 808,450 Less: Work in progress 31.12.2007 ( 15,000) Production cost of goods completed c/d 793,450 Market value of goods completed 950,000 c/d Gross profit on Manufacturing 156,550 JOHN & SONS INCOME STATEMENT FOR THE YEAR ENDED 31ST DECEMBER 2007 Sales 1,000,000 Less Cost of goods sold: Stock of finished goods 1.1.2007 Add: Market value of goods completed b/d 38,900 950,000 988,900 Less Stock of finished goods 31.12.2007 ( 40,000) Gross profit on trading 51,100 Add: Gross profit on Manufacturing b/d 156,550 Overall gross profit 207,650 Less: Administration expenses Administration salaries Rent (12,000 x 1/6) Insurance (4,200 x 1/6) General expenses 948,900 44,000 2,000 700 13,400 Lighting (7,500 x 1/6) 1,250 Depreciation of administration computers 2,000 63,350 Selling and distribution expenses: Sales reps’ salaries 30,000 Commission on sales 11,500 Carriage outwards 5,900 47,400 Financial charges: Bank charges 2,300 Discounts allowed 4,800 7,100 (117,850) Net profit 89,800 2. Statement of Financial position: Any entity has to prepare the statement of financial position at the end of financial year or at a certain particular date, the same applied to the manufacturing firms, Example: From the previous example you are required to prepare the Statement of Financial position of John & Sons Manufacturing Company as at 31st December 2007 Solution: JOHN & SONS MANUFACTURING COMPANY STATEMENT OF FINANCIAL POSITION AS AT 31ST DECEMBER 2007 Non current assets: Tzs. Tzs. Productive machinery at cost 280,000 Less Depreciation to date Administration computers at cost ( 78,000) 20,000 202,000 Less Depreciation to date ( 10,000) 10,000 212,000 Current assets: Stock: Raw materials 24,000 Finished goods 40,000 Work in progress 15,000 Debtors 142,300 Bank 16,800 Cash 1,500 239,600 Less: Current liabilities Creditors Net current assets ( 64,000) 175,600 387,600 Financed by: Capital Balance as at 1.1.2007 Add: Net profit 357,800 89,800 447,600 Less: Drawings ( 60,000) 387,600 Review Questions: Question 1. From the following information provided, you are required to prepare the Statement of Manufacturing cost and the Income statement for the year ended 31st December 2012 Stocks at 1 January 2012 Raw materials 10,500 Goods in course of manufacture (at factory cost) 2,400 Finished goods 14,300 Stocks at 31 December 2012 Raw materials 10,200 Goods in course of manufacture (at factory cost) 2,900 Finished goods 13,200 Expenditure during the year: Purchases of raw materials 27,200 Factory wages: direct 72,600 indirect 13,900 Carriage on purchases of raw materials 700 Rent and business rates of the factory 1,200 Power 2,000 Depreciation of machinery 3,900 Repairs to factory buildings 1,300 Sundry factory expenses 900 Sales during the year 160,400 Question 2: The following list of balances as at 31 July 2016 has been extracted from the books of Jane Seymour who commenced business on 1 August 2015 as a designer and manufacturer of kitchen furniture: TZS. Plant and machinery, at cost on 1 August 2015 60,000 Motor vehicles, at cost on 1 August 2015 Loose tools, at cost Sales 30,000 9,000 170,000 Raw materials purchased 43,000 Direct factory wages 39,000 Light and power 5,000 Indirect factory wages 8,000 Machinery repairs 1,600 Motor vehicle running expenses 12,000 Rent and insurances 11,600 Administrative staff salaries 31,000 Administrative expenses Sales and distribution staff salaries Capital at 1 August 2015 9,000 13,000 122,000 Sundry debtors 16,500 Sundry creditors 11,200 Balance at bank 8,500 Drawings 6,000 Additional information for the year ended 31 July 2016: (i) (ii) It is estimated that the plant and machinery will be used in the business for 10 years and the motor vehicles used for 4 years: in both cases it is estimated that the residual value will be nil. The straight line method of providing for depreciation is to be used. Light and power charges accrued due at 31 July 2016 amounted to Tzs.1,000 and insurances prepaid at 31 July 2016 totaled Tzs. 800. (iii) Stocks were valued at cost at 31 July 2016 as follows: Raw materials Tzs. 7,000 , Finished goods Tzs. 10,000 (iv) The valuation of work in progress at 31 July 2016 included variable and fixed factory overheads and amounted to Tzs. 12,300. (v) Two-thirds of the light and power and rent and insurances costs are to be allocated to the factory costs and one-third to general administration costs. (vi) Motor vehicle costs are to be allocated equally to factory costs and general administration costs. (vii) Goods manufactured during the year are to be transferred to the trading account at Tzs. 95,000. (viii)Loose tools in hand on 31 July 2016 were valued at Tzs. 5,000. Required: (a) Prepare a manufacturing, trading and profit and loss account for the year ended 31 July 2016 of Jane Seymour. Question 3. From the following information, prepare the Statement of manufacturing costs, Income statement for the year ending 31 December 2016 and the Statement of Financial position as at 31 December 2016 for the firm of J Jones Limited. Tzs. Purchase of raw materials Fuel and light Administration salaries Factory wages Carriage outwards Rent and business rates Sales Returns inward General office expenses Repairs to plant and machinery Stock at 1 January 2016: Raw materials Work in progress Finished goods Sundry creditors Capital account Freehold premises Plant and machinery Debtors Tzs. 258,000 21,000 17,000 59,000 4,000 21,000 482,000 7,000 9,000 9,000 21,000 14,000 23,000 37,000 457,000 410,000 80,000 20,000 Accumulated provision for depreciation on plant and machinery Cost in hand 8,000 11,000 984,000 984,000 Make provision for the following: (i) (ii) (iii) Stock in hand at 31 December 2016: Raw materials Tzs. 25,000 Work in progress Tzs. 11,000 Finished goods Tzs. 26,000. Depreciation of 10% on plant and machinery using the straight line method. 80% of fuel and light and 75% of rent and rates to be charged to manufacturing. (iv) Doubtful debts provision: 5% of sundry debtors. (iv) Tzs. 4,000 outstanding for fuel and light. (v) Rent and business rates paid in advance: Tzs. 5,000. (vii) Market value of finished goods: Tzs. 382,000.