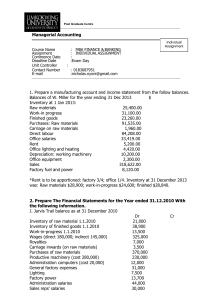

Topic ● Manufacturing accounts 37.13 Full set of financial statements A complete worked example is now given. Note that in the profit and loss account part the expenses have been separated so as to show whether they are administration expenses, selling and distribution expenses, or financial charges. The trial balance in Exhibit 37.5 has been extracted from the books of J. Jarvis, Toy Manufacturer, as at 31 December 2014. Exhibit 37.5 J. Jarvis Trial Balance as at 31 December 2014 Dr Inventory of raw materials 1.1.2014 Inventory of finished goods 1.1.2014 Work-in-progress 1.1.2014 Wages (direct £180,000; factory indirect £145,000) Royalties Carriage inwards (on raw materials) Purchases of raw materials Productive machinery (cost £280,000) Administration computers (cost £20,000) General factory expenses Lighting Factory power Administration salaries Sales reps’ salaries Commission on sales Rent Insurance General administration expenses Bank charges Discounts allowed Carriage outwards Sales Accounts receivable and accounts payable Bank Cash Drawings Capital as at 1.1.2014 506 £ 21,000 38,900 13,500 325,000 7,000 3,500 370,000 230,000 12,000 31,000 7,500 13,700 44,000 30,000 11,500 12,000 4,200 13,400 2,300 4,800 5,900 142,300 16,800 1,500 60,000 _________ 1,421,800 Cr £ 1,000,000 64,000 357,800 1,421,800 Chapter 37 ● Manufacturing accounts Notes at 31.12.2014: 1 Inventory of raw materials £24,000; inventory of finished goods £40,000; work-in-progress £15,000. 2 Lighting, rent and insurance are to be apportioned: factory 5/6, administration 1/6. 3 Depreciation on productive machinery and administration computers at 10 per cent per annum on cost. J. Jarvis Manufacturing Account and Statement of Profit or Loss for the year ending 31 December 2014 £ £ Inventory of raw materials 1.1.2014 Add Purchases Carriage inwards Less Inventory raw materials 31.12.2014 Cost of raw materials consumed Direct labour Royalties Prime cost Indirect manufacturing costs: General factory expenses Lighting 5/6 Power Rent 5/6 Insurance 5/6 Depreciation of productive machinery Indirect labour 31,000 6,250 13,700 10,000 3,500 28,000 145,000 237,450 794,950 13,500 808,450 (15,000) 793,450 Add Work-in-progress 1.1.2014 Less Work-in-progress 31.12.2014 Production cost of goods completed c/d Sales Less Cost of goods sold: Inventory of finished goods 1.1.2014 Add Production cost of goods completed b/d 1,000,000 38,900 793,450 832,350 (40,000) Less Inventory of finished goods 31.12.2014 Gross profit Administration expenses Administration salaries Rent 1/6 Insurance 1/6 General expenses Lighting 1/6 Depreciation of administration computers £ 21,000 370,000 3,500 394,500 (24,000) 370,500 180,000 7,000 557,500 (792,350) 207,650 44,000 2,000 700 13,400 1,250 2,000 63,350 Selling and distribution expenses Sales reps’ salaries Commission on sales Carriage outwards 30,000 11,500 5,900 47,400 Financial charges Bank charges Discounts allowed 2,300 4,800 7,100 Net profit (117,850) 89,800 507 ➔ Part 6 ● Special accounting procedures ➔ J. Jarvis Statement of Financial Position as at 31 December 2014 Non-current assets Productive machinery at cost Less Depreciation to date £ 280,000 (78,000) Administration computers at cost Less Depreciation to date 20,000 (10,000) £ 202,000 10,000 212,000 Current assets Inventory Raw materials Finished goods Work-in-progress Accounts receivable Bank Cash 24,000 40,000 15,000 142,300 16,800 1,500 239,600 451,600 Less Current liabilities Accounts payable Financed by Capital Balance as at 1.1.2014 Add Net profit Less Drawings 37.14 (64,000) 387,600 357,800 89,800 447,600 (60,000) 387,600 Market value of goods manufactured The financial statements of Jarvis, just illustrated, are subject to the limitation that the respective amounts of the gross profit which are attributable to the manufacturing side or to the selling side of the business are not known. A technique is sometimes used to bring out this additional information. This method uses the cost which would have been involved if the goods had been bought in their finished state instead of being manufactured by the business. This figure is credited to the manufacturing account and debited to the trading account so as to throw up two figures of gross profit instead of one. It should be pointed out that the net profit will remain unaffected. All that will have happened will be that the figure of £207,650 gross profit will be shown as two figures instead of one. When added together, they will total £207,650. Assume that the cost of buying the goods instead of manufacturing them had been £950,000. The relevant parts of the Manufacturing Account and Statement of Profit or Loss will then be: 508 Chapter 37 ● Manufacturing accounts Manufacturing Account and Statement of Profit or Loss extract for the year ending 31 December 2014 £ Market value of goods completed Less Production cost of goods completed (as before) Gross profit on manufacture c/d Sales Inventory of finished goods 1.1.2014 Add Market value of goods completed b/d £ 950,000 (793,450) 156,550 1,000,000 38,900 950,000 988,900 (40,000) Less Inventory of finished goods 31.12.2014 (948,900) 51,100 Gross profit on trading c/d Gross profit On manufacturing On trading 156,550 51,100 207,650 Learning outcomes You should now have learnt: 1 Why manufacturing accounts are used. 2 How to prepare a manufacturing account and statement of profit or loss. 3 That the trading account section of the statement of profit or loss is used for calculating the gross profit made by selling the goods manufactured. 4 That the profit and loss account section of the statement of profit or loss shows as net profit what is left of gross profit after all administration, selling and distribution and finance costs incurred have been deducted. 5 That work-in-progress, both at the start and the close of a period, must be adjusted so as to identify the production costs of goods completed in the period. Answers to activities 37.1 You may have included some of the following: (1) (2) (3) (4) (5) Direct costs raw materials machine operator’s wages packer’s wages machine set-up costs crane hire for building contract Indirect costs canteen wages business rates rent insurance storage of finished goods costs However, you can only really do a split like this if you have a specific job or product in mind. You must first identify the ‘cost object’, that is, the item you are making or providing. Taking the example of a construction company building a hotel (it is engaged in other similar projects at the same time). The direct and indirect costs may include: (1) (2) (3) (4) (5) Direct costs concrete forklift truck operator’s wages bricklayer’s wages steel girders windows Indirect costs site canteen wages company lawyer’s salary company architect’s salary company headquarters insurance company warehousing costs 509 Part 6 ● Special accounting procedures Now you should see that the indirect costs are not solely incurred in order to build the hotel. This is the key. Direct costs are those costs you can specifically link to a specific job. All the other costs of a job are indirect. 37.2 Direct materials (a) ( g) (i) Direct labour (b) Direct expenses (h) Indirect manufacturing costs (c) (d ) (f) (k) (o) Administration expenses ( j) Selling and distribution expenses (e) (m) Financial charges (l) (n) 37.3 Because only administration expenses, selling and distribution expenses, and financial charges appear in the profit and loss account part when a manufacturing account is being used. The rest all arose because manufacturing was taking place and can be directly or indirectly attributed to the products being produced, so they appear in the manufacturing account. Review questions 37.1 A business both buys loose tools and also makes some itself. The following data is available concerning the years ended 31 December 2014, 2015 and 2016. 2014 Jan 1 Dec 31 2015 Dec 31 2016 Dec 31 Inventory of loose tools During the year: Bought loose tools from suppliers Made own loose tools: the cost of wages of employees being £1,300 and the materials cost £900 Loose tools valued at During the year: Loose tools bought from suppliers Made own loose tools: the cost of wages of employees being £1,600 and the materials cost £1,200 Loose tools valued at During the year: Loose tools bought from suppliers Made own loose tools: the cost of wages of employees being £1,000 and the materials cost £1,340. Received refund from a supplier for faulty tools returned to him Loose tools valued at £ 6,000 8,000 12,000 4,000 12,800 7,200 320 14,600 You are to draw up the Loose Tools Account for the three years, showing the amount transferred as an expense in each year to the Manufacturing Account. 37.2 Using whichever of the following figures are required, prepare a manufacturing account and trading account for 2017. The manufacturing account should show clearly the prime cost of manufacture and the production cost of finished goods produced. 510 Chapter 37 ● Manufacturing accounts £ Inventory, 1 January 2017: Raw materials Partly finished goods Finished goods Inventory, 31 December 2017: Raw materials Partly finished goods Finished goods Purchases of raw materials Carriage on raw materials Salaries and wages: factory (including £44,500 for management and supervision) Salaries and wages: general office Rent and business rates (three-quarters works, one-quarter office) Lighting and heating (seven-eighths works, one-eighth office) Repairs to machinery Depreciation of machinery Factory direct expenses Insurance of plant and machinery Sales 24,600 20,200 18,600 31,300 23,400 29,200 165,400 9,100 151,400 28,400 3,000 5,600 3,400 5,600 730 860 406,120 Note:RCTVN[ƂPKUJGFIQQFUCTGXCNWGFCVVJGKTRTQFWEVKQPEQUV 37.3A From the following information, prepare a manufacturing account and statement of profit or loss for the year ending 31 December 2016 and a statement of financial position as at 31 December 2016 for J. Jones Limited. Purchase of raw materials Fuel and light Administration salaries Factory wages Carriage outwards Rent and business rates Sales Returns inward General office expenses Repairs to plant and machinery Inventory at 1 January 2016: Raw materials Work-in-progress Finished goods Sundry accounts payable Capital account Freehold premises Plant and machinery Accounts receivable Accumulated provision for depreciation on plant and machinery Cost in hand £ 258,000 21,000 17,000 59,000 4,000 21,000 £ 482,000 7,000 9,000 9,000 21,000 14,000 23,000 37,000 457,000 410,000 80,000 20,000 11,000 984,000 8,000 ________ 984,000 Make provision for the following: (i) Inventory in hand at 31 December 2016: Raw materials £25,000 Work-in-progress £11,000 Finished goods £26,000. ➔ 511 Part 6 ● Special accounting procedures ➔ (ii) Depreciation of 10% on plant and machinery using the straight line method. (iii) 80% of fuel and light and 75% of rent and rates to be charged to manufacturing. (iv) Allowance for doubtful debts: 5% of sundry accounts receivable. (v) £4,000 outstanding for fuel and light. (vi) Rent and business rates paid in advance: £5,000. (vii) Market value of finished goods: £382,000. 37.4 Prepare a manufacturing account and statement of profit or loss from the following balances of Z. Varga for the year ending 31 December 2017. £ Inventory at 1 January 2017: Raw materials 50,800 Work-in-progress 62,200 Finished goods 46,520 Purchases: Raw materials 183,070 Carriage on raw materials 3,920 Direct labour 168,416 Office salaries 66,838 Rent 10,400 Office lighting and heating 8,840 Depreciation: Works machinery 20,400 Office equipment 4,600 Sales 637,244 Factory fuel and power 16,240 Rent is to be apportioned: Factory 3/4; Office 1/4. Inventory at 31 December 2017 was: Raw materials £57,800; Work-in-progress £49,200; Finished goods £57,692. 37.5 From the following information, draw up a manufacturing account and the trading account section of the statement of profit or loss for the six months ending 30 September 2017. You should show clearly: (a) (b) (c) (d) Cost of raw materials consumed. Prime cost of production. Production cost of finished goods. Gross profit on sales. Inventory, 1 April 2017: Raw materials Work-in-progress Finished goods Inventory, 30 September 2017: Raw materials Work-in-progress Finished goods Purchases of raw materials Carriage on raw materials Direct wages Factory general expenses Office salaries Depreciation of office furniture Carriage outwards Advertising Bad debts Sales less returns Sales of scrap Discounts received Depreciation of factory equipment Rent and business rates (factory three-quarters, office one-quarter) 512 £ 2,990 3,900 15,300 4,200 3,600 17,700 15,630 126 48,648 7,048 22,200 420 191 1,472 200 112,410 1,317 188 4,200 2,800 Chapter 37 ● Manufacturing accounts 37.6A From the following figures prepare a manufacturing account and the trading account section of the statement of profit or loss so as to show: (a) (b) (c) (d) (e) Cost of raw materials used in production. Prime cost. Production cost of finished goods produced. Cost of goods sold. Gross profit. £ Inventory at 1 January 2017: Raw materials Goods in course of manufacture (at factory cost) Finished goods Inventory at 31 March 2017: Raw materials Goods in course of manufacture (at factory cost) Finished goods Expenditure during the quarter: Purchases of raw materials Factory wages: direct indirect Carriage on purchases of raw materials Rent and business rates of the factory Power Depreciation of machinery Repairs to factory buildings Sundry factory expenses Sales during the quarter 37.7 10,500 2,400 14,300 10,200 2,900 13,200 27,200 72,600 13,900 700 1,200 2,000 3,900 1,300 900 160,400 E. Wilson is a manufacturer. His trial balance at 31 December 2017 is as follows: Delivery van expenses Lighting and heating: Factory Office Manufacturing wages General expenses: Factory Office Sales reps: commission Purchase of raw materials Rent: Factory Office Machinery (cost £40,000) Office equipment (cost £9,000) Office salaries Accounts receivable Accounts payable Bank Sales Van (cost £6,800) Inventory at 31 December 2016: Raw materials Finished goods Drawings Capital £ 1,760 7,220 1,490 72,100 8,100 1,940 11,688 57,210 6,100 2,700 28,600 8,200 17,740 34,200 £ 9,400 16,142 194,800 6,200 13,260 41,300 24,200 ________ 360,150 155,950 360,150 ➔ 513 Part 6 ● Special accounting procedures ➔ Prepare the manufacturing account and statement of profit or loss for the year ending 31 December 2017 and a statement of financial position as at that date. Give effect to the following adjustments: 1 Inventory at 31 December 2017: raw materials £14,510; finished goods £44,490. There is no work-in-progress. 2 Depreciate machinery £3,000; office equipment £600; van £1,200. 3 Manufacturing wages due but unpaid at 31 December 2017 £550; office rent prepaid £140. 37.8 The financial year end of Mendip Limited is 30 June. At 30 June 2017, the following balances are available: Freehold land and buildings at cost Plant and machinery at cost Accumulated depreciation on plant and machinery Purchase of raw materials Sales Factory rates Factory heat and light Accounts receivable Accounts payable Wages (including £15,700 for supervision) Direct factory expenses Selling expenses Office salaries and general expenses Bank General reserve Retained profits Inventory 1 July 2016: Raw materials Finished goods Dividends paid: Preference shares Ordinary shares £ 143,000 105,000 23,000 130,100 317,500 3,000 6,500 37,200 30,900 63,000 9,100 11,000 43,000 24,500 30,000 18,000 20,000 38,000 840 20,000 (i) The inventory at 30 June 2017 was: raw materials £22,000; finished goods £35,600. (ii) Salaries include £6,700 for directors’ fees. (iii) Depreciation is to be charged at 10% on cost of plant and machinery. Required: Prepare a manufacturing account and statement of profit or loss for the year ending 30 June 2017. 514 Chapter 37 ● Manufacturing accounts 37.9A Jean Marsh owns a small business making and selling children’s toys. The following trial balance was extracted from her books on 31 December 2017. Dr £ Capital Drawings Sales Inventory at 1 January 2017: Raw materials Finished goods Purchases of raw materials Carriage inwards Factory wages Office salaries J. Marsh: salary and expenses General expenses: Factory Office Lighting Rent Insurance Advertising Bad debts Discount received Carriage outwards Plant and machinery, at cost less depreciation Car, at cost less depreciation Bank Cash in hand Accounts receivable and accounts payable Cr £ 15,000 2,000 90,000 3,400 6,100 18,000 800 18,500 16,900 10,400 1,200 750 2,500 3,750 950 1,400 650 1,600 375 9,100 4,200 3,600 325 7,700 112,600 6,000 112,600 You are given the following additional information. 1 Inventory at 31 December 2017 Raw materials Finished goods 2 There was no work-in-progress. Depreciation for the year is to be charged as follows: Plant and machinery Car 3 4 5 £2,900 £8,200 £1,500 £500 At 31 December 2017 insurance paid in advance was £150 and office general expenses unpaid were £75. Lighting and rent are to be apportioned: 4/5 Factory, 1/5 Office. Insurance is to be apportioned: 3/4 Factory, 1/4 Office. Jean is the business’s salesperson and her salary and expenses are to be treated as a selling expense. She has sole use of the business’s car. ➔ 515 Part 6 ● Special accounting procedures ➔ Questions: For the year ended 31 December 2017 prepare (a) the manufacturing account showing prime cost and factory cost of production. (b) the trading account section of the statement of profit or loss. (c) the profit and loss account section of the statement of profit or loss, distinguishing between administrative and selling costs. (d) a statement of financial position as at 31 December 2017.Author’s Note (Midland Examining Group: GCSE) Author’s Note: Part (d) of the question was not in the original examination question. It has been added to give you further practice. 37.10 The following list of balances as at 31 July 2016 has been extracted from the books of Jane Seymour who commenced business on 1 August 2015 as a designer and manufacturer of kitchen furniture: £ 60,000 30,000 9,000 170,000 43,000 39,000 5,000 8,000 1,600 12,000 11,600 31,000 9,000 13,000 122,000 16,500 11,200 8,500 6,000 Plant and machinery, at cost on 1 August 2015 Motor vehicles, at cost on 1 August 2015 Loose tools, at cost Sales Raw materials purchased Direct factory wages Light and power Indirect factory wages Machinery repairs Motor vehicle running expenses Rent and insurances Administrative staff salaries Administrative expenses Sales and distribution staff salaries Capital at 1 August 2015 Sundry accounts receivable Sundry accounts payable Balance at bank Drawings Additional information for the year ended 31 July 2016: (i) It is estimated that the plant and machinery will be used in the business for ten years and the motor vehicles used for four years: in both cases it is estimated that the residual value will be nil. The straight line method of providing for depreciation is to be used. (ii) Light and power charges accrued due at 31 July 2016 amounted to £1,000 and insurances prepaid at 31 July 2016 totalled £800. (iii) Inventory was valued at cost at 31 July 2016 as follows: Raw materials Finished goods £7,000 £10,000 (iv) The valuation of work-in-progress at 31 July 2016 included variable and fixed factory overheads and amounted to £12,300. (v) Two-thirds of the light and power and rent and insurances costs are to be allocated to the factory costs and one-third to general administration costs. (vi) Motor vehicle costs are to be allocated equally to factory costs and general administration costs. (vii) Goods manufactured during the year are to be transferred to the trading account at £95,000. (viii) Loose tools in hand on 31 July 2016 were valued at £5,000. 516