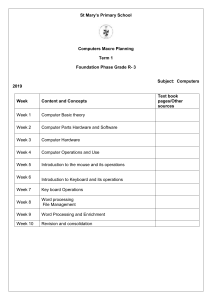

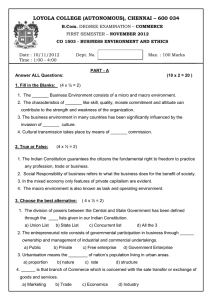

Indian stock market is unique By Harshit Agrawal Using quarterly data for the last 18 years, and doing regression analysis to understand the impact of three macro variables: year-on year change in exchange rates, GDP growth, and interest rates on stock prices. Bloomberg quint showed that 60 percent of the variability in stock prices in India is driven by these macro factors. In contrast, in the two biggest stock markets in the world – the United States and Japan – the corresponding figures are 34 percent and 35 percent respectively, implying that in these markets, company-specific factors are responsible for two-thirds of shareholder returns. The only emerging market which is comparable to India is Brazil where 53 percent of the variability in share prices is driven by macro factors. Major contribution of macroeconomic factors on different stock markets Reasons why this happens are: 1. Though we are called democratic society, we still have traits of communism and capitalism, which makes it a feudal society. As a result, most sectors are still heavily regulated by the centre, the state and by local government. For example, to start a hotel in Mumbai one needs almost 60 clearances from various layers of government. 2. Factors of production are much more expensive in India as compared to other large economies. For almost the entire period under consideration (2001-18), the cost of borrowing for small and medium enterprises in India has been well in excess of 11 percent. In contrast, in economies like China, Japan and the U.S., SMEs borrow at rates well below 5 percent. 3. If we could segment the Indian stock market in south versus north terms, it is highly likely that in the south we would see company-specific factors being more important than the north. Per capita income there is less than half that of the south. Female labour force participation there is lower than in Pakistan and Afghanistan. On human development indicators, north India is on par only with war-torn African countries. If you exclude the megapolis around Delhi, in north India it does not make sense to even talk about company-specific factors. Investment Implications If you can’t understand where the cost of funding or the exchange rate will go in India, you will have a tough time managing an Indian equities portfolio no matter how good your stock selection skills are. Secondly, because the macro is tough in India, very few companies can outperform over extended periods of time. Companies who survive the vicissitudes of India’s macros are world-class and you profit from backing these stocks. Thirdly, if life does get incrementally easier for SMEs going forward (India’s upward movement in World Bank’s ‘Ease of Doing Business’ is encouraging on this front), and if the cost of funding does fall for SMEs going forward, then the investment paradigm will change in India. 2019 outlook Rate forecast of unemployment, inflation, GDP growth and manufacturing for 2019 and 2020 (source:- Federal reserve) Chart above does not show us the good story for 2019 and hence macroeconomic conditions in the world, particularly USA, will tremendously effect India. As of today, 21 December, 2019, Sensex plunged around 700 points due to weak global cues and because fed hiked the rates. Be on the lookout for a bubble in the stock market in 2019 That signals the peak of the business cycle. Another recession is probably two to three years out. If you've invested in the stock market, be calm during any pull-back. Plummeting commodity prices, including gold, silver, and oil, will return to the mean. All in all, time to reduce debt, build up your savings, and increase your wealth.