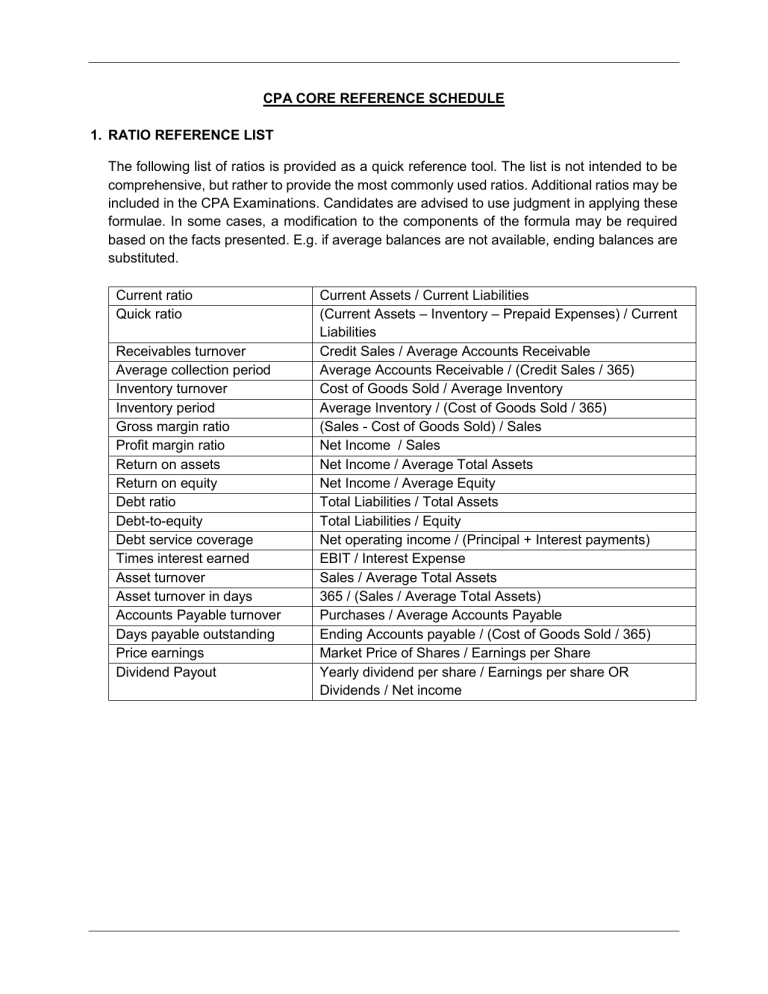

CPA CORE REFERENCE SCHEDULE 1. RATIO REFERENCE LIST The following list of ratios is provided as a quick reference tool. The list is not intended to be comprehensive, but rather to provide the most commonly used ratios. Additional ratios may be included in the CPA Examinations. Candidates are advised to use judgment in applying these formulae. In some cases, a modification to the components of the formula may be required based on the facts presented. E.g. if average balances are not available, ending balances are substituted. Current ratio Quick ratio Receivables turnover Average collection period Inventory turnover Inventory period Gross margin ratio Profit margin ratio Return on assets Return on equity Debt ratio Debt-to-equity Debt service coverage Times interest earned Asset turnover Asset turnover in days Accounts Payable turnover Days payable outstanding Price earnings Dividend Payout Current Assets / Current Liabilities (Current Assets – Inventory – Prepaid Expenses) / Current Liabilities Credit Sales / Average Accounts Receivable Average Accounts Receivable / (Credit Sales / 365) Cost of Goods Sold / Average Inventory Average Inventory / (Cost of Goods Sold / 365) (Sales - Cost of Goods Sold) / Sales Net Income / Sales Net Income / Average Total Assets Net Income / Average Equity Total Liabilities / Total Assets Total Liabilities / Equity Net operating income / (Principal + Interest payments) EBIT / Interest Expense Sales / Average Total Assets 365 / (Sales / Average Total Assets) Purchases / Average Accounts Payable Ending Accounts payable / (Cost of Goods Sold / 365) Market Price of Shares / Earnings per Share Yearly dividend per share / Earnings per share OR Dividends / Net income 2. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired before November 21, 2018 = 𝐶𝑇𝑑 2+𝑘 ( ) (𝑑+𝑘) 2(1+𝑘) 𝐶𝑑𝑇 = (𝑑+𝑘) ( 1+0.5𝑘 1+𝑘 ) Present value of total tax shield from CCA for a new asset acquired after November 20, 2018 = 𝐶𝑑𝑇 1+1.5𝑘 ( ) (𝑑+𝑘) 1+𝑘 Notation for above formula: C = net initial investment T = corporate tax rate k = discount rate or time value of money d = maximum rate of capital cost allowance 3. SELECTED PRESCRIBED AUTOMOBILE AMOUNTS Maximum depreciable cost — Class 10.1 Maximum monthly deductible lease cost Maximum monthly deductible interest cost Operating cost benefit — employee Non-taxable automobile allowance rates — first 5,000 kilometres — balance 2018 $30,000 + sales tax $800 + sales tax $300 26¢ per km of personal use 2019 $30,000 + sales tax $800 + sales tax $300 28¢ per km of personal use 55¢ per km 49¢ per km 58¢ per km 52¢ per km 4. INDIVIDUAL FEDERAL INCOME TAX RATES For 2018 If taxable income is between $0 and $46,605 $46,606 and $93,208 $93,209 and $144,489 $144,490 and $205,842 $205,843 and any amount Tax on base amount $0 $6,991 $16,544 $29,877 $47,670 Tax on excess 15% 20.5% 26% 29% 33% If taxable income is between $0 and $47,630 $47,631 and $95,259 $95,260 and $147,667 $147,668 and $210,371 $210,372 and any amount Tax on base amount $0 $7,145 $16,908 $30,534 $48,718 Tax on excess 15% 20.5% 26% 29% 33% For 2019 5. SELECTED INDEXED AMOUNTS FOR PURPOSES OF COMPUTING INCOME TAX Personal tax credits are a maximum of 15% of the following amounts: Basic personal amount Spouse, common-law partner, or eligible dependant amount Age amount if 65 or over in the year Net income threshold for age amount Canada employment amount Disability amount Canada caregiver amount for children under age 18 Canada caregiver amount for other infirm dependants age 18 or older (maximum amount) Net income threshold for Canada caregiver amount Adoption expense credit limit 2018 $11,809 11,809 7,333 36,976 1,195 8,235 2,182 6,986 2019 $12,069 12,069 7,494 37,790 1,222 8,416 2,230 7,140 16,405 15,905 16,766 16,255 2018 $2,302 5,500 26,230 848,252 2019 $2,352 6,000 26,500 866,912 Other indexed amounts are as follows: Medical expense tax credit — 3% of net income ceiling Annual TFSA dollar limit RRSP dollar limit Lifetime capital gains exemption on qualified small business corporation shares 6. PRESCRIBED INTEREST RATES (base rates) Year Jan. 1 – Mar. 31 Apr. 1 – June 30 July 1 – Sep. 30 Oct. 1 – Dec. 31 2019 2018 2017 2 1 1 2 1 2 1 2 1 This is the rate used for taxable benefits for employees and shareholders, low-interest loans, and other related-party transactions. The rate is 4 percentage points higher for late or deficient income tax payments and unremitted withholdings. The rate is 2 percentage points higher for tax refunds to taxpayers, with the exception of corporations, for which the base rate is used. 7. MAXIMUM CAPITAL COST ALLOWANCE RATES FOR SELECTED CLASSES Class 1………………………………. Class 1………………………………. Class 1………………………………. Class 8………………………………. Class 10…………………………….. Class 10.1…………………………... Class 12…………………………….. Class 13…………………………….. Class 14…………………………….. Class 14.1…………………………... Class 17…………………………….. Class 29…………………………….. Class 43…………………………….. Class 44…………………………….. Class 45…………………………….. Class 50…………………………….. Class 53…………………………….. 4% for all buildings except those below 6% for buildings acquired for first use after March 18, 2007 and ≥ 90% of the square footage is used for non-residential activities 10% for buildings acquired for first use after March 18, 2007 and ≥ 90% of the square footage is used for manufacturing and processing activities 20% 30% 30% 100% Original lease period plus one renewal period (minimum 5 years and maximum 40 years) Length of life of property 5% For property acquired after December 31, 2016 8% 50% Straight-line 30% 25% 45% 55% 50%