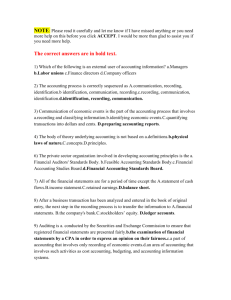

FINANCIAL ACCOUNTING APPLICATIONS WEEK 2 – RECORDING PROCESS\ Analyse effect of accounting transactions and events on the basic accounting equation. Exxplain what an account is and how it helps in recording process. Define debits and credits and explain how they are used to record accounting transactions. Identify basic steps in recording process. Explain what a journal is and how it helps in recording process. Explain what a general ledger is and how it helps in recording process. Explain what posting is and how it helps in recording process. Explain purpose of a trial balance. THE RECORDING PROCESS Most companies today use computerized accounting systems which help handle all the steps of recording, from initial data entry to preparation of financial statements. With the growth of expanding technology, businesses need to stay on top by constantly improving their systems. The need for Bluetooth eliminates need for cables and wires. This chapter is on manual accounting system as the principles are still the same. ACCOUNTING TRANSACTI ONS AND EVENTS – LO1 Not all transactions and events are recorded as some events may exchange nothing (E.g. hiring a new employee would not be recorded (event), but purchasing equipment would be (transaction)). Anything that has an effect on assets, liabilities or equities needs to be recorded. o Such as purchasing a computer, payment of rent and selling an ad space. Transaction analysis should make sure the accounting equation always balances. o Each transaction has a double sided effect o If an asset increases, there must be a V decrease in another asset, an ^ increase in a liability or ^ increase in equity. (1) Issuing shares for cash (2) Borrows from bank – Borrow $5k from ANZ Bank (3) Purchase inventory for cash – Buys office equipment for $5000 cash. (4) Receipt of cash advance from customer – Receives 1200 cash advance from client for advertising services expected to be done by 2 months as they have to prepay. (5) Render services for cash – Receives $10k cash for advertising services performed. Sometimes business provide services on account (provide goods and services and be paid on a later date). o This is called an accounts receivable (right to be payed at a later date) o When you receive the cash from the customer, accounts receivable decreases by 10,000 and cash increases (6) Payment of rent in cash – Pay office rent for October in cash, expenses decrease equity (7) Payment of insurance in cash – Pay $600 for 1 year insurance policy that will expire next year. o As insurance extends more then a month, this is identified as a prepaid expense. (8) Purchase of supplies on credit – purchase 3 month supply of advertising materials on account for $2500. o Assets are increased as supplies will be used to provide services to customers, liabilities increased. (9) Hiring of new employers – Hire four new employers to work in the next 6 days, weekly salary of $500 for 5 days every fortnight. o No transaction has occurred, there is only an agreement that they will start work and be paid in 3 weeks. (10) payment of dividends – Pay $500 dividends which are distribution of profit and not an expense. (11) Payment of cash for salaries – Employees have worked 2 weeks and earned $4k and paid on 26th October. Each transaction is analysed in terms of its effect on A, L or OE. Two sides must always be equal (Assets = liabilities + owners equity) Cause of each change must be indicated . THE ACCOUNT An account is an individual account record of increases and decreases in specific items (A, L or OE) Account has three parts: o Name of the account o A left (debit side) o Right (credit side). o Resembles letter T so its called a T account. DEBITS AND CREDITS Every positive is a receipt of cash, and every negative is a payment of cash. In account forms increase in cash are debits and decreases of cash are credits. DEBIT AND CREDIT PRO CEDURES For each transaction, debits = credits. This is the basis of the double-entry system o Provides logical method for recording transactions. o Offers a means of ensuring accuracy of the amounts. o This method is much more easier then the plus/minus method used earlier. Debit/Credit procedures for assets and liabilities Asset accounts show debit balances – debits to a asset account should exceed credits to that account. Debit and credit procedures for equity o Subdivisions include share capital, retained earnings. Dividends revenues & expense. Share capital is in exchange for owners investment, share capital account is increased by credit and decreased by debits. (E.g. cash is invested in the business, cash is debited and share capital is credited). Retained earnings – is profit that is retained in business, represents portion of equity that has been gained through profiterable operation of the business. R/Earnings account is increased by credits (profit) and decreased by debits (losses). Dividends – distribution by company to its shareholders in proportion to each investors % ownership. o Most common is cash dividend and result in reduction of shareholder claim on retained earnings. o Dividends reduce equity so dividends account is increased with debit and decreased debit. Revenues and expenses – when revenue is made, equity is increased, revenue accounts increased by credits and decreased by debits o Expenses decrease equity – expense account recorded as increased by debits and decreased by debits. o Credits (increases) to revenue accounts normally exceed debits (decreases) and debits to expense should exceed credits o EQUITY RELATIONSHIPS Share capital, dividends and retained earnings are reported in the equity section of the balance sheet. Revenues and expenses are reported on the income statement. Dividends, revenues and expenses are then transferred to retained earnings at the end of the period. To calculate ending balance of retained earnings account : o Beginning balance in retained earnings + profit or – loss and then – dividends. EXPANSION OF THE BAS IC ACCOUNT EQUATION. Assets = liabilities + Share capital + Beginning retained earnings – dividends + revenues – expenses STEPS IN RECORDING PROCESS 1. 2. 3. Analyse each transaction in terms of its effect on accounts Enter transaction info in journal Transfer the journal information to appropriate accounts in a ledger. To have evidence of a transaction you need a source document (evidence of goods purchased from supplier, tax invoice, purchase order etc). THE JOURNAL Transactions are first recorded in chronological order in a journal before they are transferred to accounts. Each transaction shows the debit and credit effects on each account. General journal contributes: o Providing a chronological record of all transactions o Discloses in one place the complete effect of transaction. Prevents errors. Entering transaction data is known as journalizing. END OF CHAPTER REVISION 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. B B C D D A C D A c QUESTIONS 3) 6) 7) (a) Service Rev ^ – Cash ^ Cr. (b) Equipment ^ Dr. Cash ^ Cr. (c) Cash ^ Dr. Share capital ^ Cr. (d) Account payable ^ Dr. Cash ^ Cr. (a) Assets ^ Dr. (b) liability ^ Cr. (c) Share capital ^ Cr. (d) Revenue ^ Cr. Expense ^ Dr. Dividend ^ Dr. (a) debit balance (b) debit balance (c) debit balance (d) credit balance (e) credit balance (f) debit balance (g) credit balance 8) 9) A ledger is the entire group of accounts maintaed by a business is referred to as a ledger. It keeps all the information in one place as well as all the changes that happens in the balances. A trial balance is used to keep a running total of all the accounts maintained at a point in time and see if they balance, they also help to uncover errors and usefil in financial statement prep