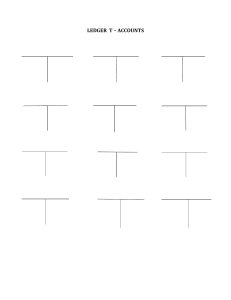

CH-2: The Recording Process The Account Steps in the recording process The Trial Balance Study Objectives 1. Explain what an account is and how it helps in the recording process. 2. Define debits and credits and explain their use in recording business transactions. 3. Identify the basic steps in the recording process. 4. Explain what a journal is and how it helps in the recording process. 5. Explain what a ledger is and how it helps in the recording process. 6. Explain what posting is and how it helps in the recording process. 7. Prepare a trial balance and explain its purposes. The Recording Process The Account Debits and credits Expansion of basic equation Steps in the Recording Process Journal Ledger The Recording Process Illustrated Summary illustration of journalizing and posting The Trial Balance Limitations of a trial balance Locating errors Use of dollar signs The Account An account is an accounting record of increase and decrease in a specific asset, liability, or owner’s equity item. Debit = “Left” Credit = “Right” An Account can be illustrated in a TAccount form. Account Name Debit (Dr.) Credit (Cr.) The Account Debit and Credit Procedures Double-entry system ► Each transaction must affect two or more accounts to keep the basic accounting equation in balance. ► Recording done by debiting at least one account and crediting another. ► DEBITS must equal CREDITS. Debits and Credits If Debits are greater than Credits, the account will have a debit balance. Account Name Debit / Dr. Credit / Cr. Transaction #1 $10,000 $3,000 Transaction #3 8,000 Balance $15,000 Transaction #2 Debits and Credits If Credits are greater than Debits, the account will have a credit balance. Account Name Transaction #1 Balance Debit / Dr. Credit / Cr. $10,000 $3,000 Transaction #2 8,000 Transaction #3 $1,000 The Account Assets Debit / Dr. Increase in Assets are recorded as Debit Increase in Liabilities are recorded as Credit. Normal balance is on the increase side. Credit / Cr. Normal Balance Chapter 3-23 Liabilities Debit / Dr. Credit / Cr. Normal Balance Chapter 3-24 The Account Owner’s Equity Debit / Dr. Increase in Owner’s Equity are recorded as Credit Remember: Credit / Cr. o Investment (Capital) and Revenue increases onwer’s equity o Drawings and Expenses decrease owner’s equity Normal Balance Chapter 3-25 The Account Owner’s Capital/Investment Debit / Dr. Owner’s Drawing Credit / Cr. Debit / Dr. Normal Balance Normal Balance Chapter 3-23 Chapter 3-25 Expense Revenue Debit / Dr. Chapter 3-26 Credit / Cr. Credit / Cr. Debit / Dr. Normal Balance Normal Balance Chapter 3-27 Credit / Cr. Debits and Credits Summary Liabilities Normal Balance Debit Assets Credit / Cr. Normal Balance Chapter 3-24 Owner’s Equity Credit / Cr. Debit / Dr. Debit / Dr. Normal Balance Credit Debit / Dr. Credit / Cr. Normal Balance Normal Balance Chapter 3-23 Expense Debit / Dr. Revenue Chapter 3-25 Credit / Cr. Debit / Dr. Normal Balance Chapter 3-27 Credit / Cr. Normal Balance Chapter 3-26 The Account Summary of Debit/Credit Rule Relationship among the assets, liabilities and owner’s equity of a business: Basic Equation Assets = Liabilities + Owner’s Equity Expanded Basic Equation The equation must be in balance after every transaction. For every Debit there must be a Credit. Debits and Credits Summary Balance Sheet Asset Debit Credit = Liability Income Statement + Equity Revenue - Expense Debits and Credits Summary Review Question Debits: a. increase both assets and liabilities. b. decrease both assets and liabilities. c. increase assets and decrease liabilities. d. decrease assets and increase liabilities. Debits and Credits Summary Review Question Accounts that normally have debit balances are: a. assets, expenses, and revenues. b. assets, expenses, and owner’s capital. c. assets, liabilities, and owner’s drawings. d. assets, owner’s drawings, and expenses. Steps in the recording process Analyze each transaction Enter transaction in a journal Transfer journal information to ledger accounts Source documents, such as a sales slip, a check, a bill, or a cash register tape, provide evidence of the transaction. ) Steps in the recording process The Journal Book of original entry. Transactions recorded in chronological order. Contributions to the recording process: 1. Discloses the complete effects of a transaction. 2. Provides a chronological record of transactions. 3. Helps to prevent or locate errors because the debit and credit amounts can be easily compared. Steps in the recording process Journalizing - Entering transaction data in the journal. Example: On September 1, Ray Neal invested $15,000 cash in the business, and Softbyte purchased computer equipment for $7,000 cash. General Journal Date Sept. 1 Account Title Cash Ref. Debit 15,000 Owner’s, Capital Equipment Cash Credit 15,000 7,000 7,000 Journalizing E2-4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Pete Hanshew begins business as a real estate agent with a cash investment of $15,000. Oct. 1 General Journal Date Oct. Account Title 1 Cash Hanshew, Capital (Owners investment) Ref. Debit Credit 15,000 15,000 Journalizing E2-4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 3 Purchases office furniture for $1,900, on account. General Journal Date Oct. 3 Account Title Office Furniture Accounts Payable (Purchase furniture) Ref. Debit Credit 1,900 1,900 Journalizing E2-4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 6 Sells a house and lot for B. Kidman; bills B. Kidman $3,200 for realty services provided. General Journal Date Account Title Oct. 6 Accounts Receivable Ref. Service Revenue (Realty services provided) Debit Credit 3,200 3,200 Journalizing E2-4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 27 Pays $700 on balance related to transaction of Oct. 3. General Journal Date Account Title Oct. 27 Accounts Payable Cash (Payment on account) Ref. Debit Credit 700 700 Journalizing E2-4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 30 Pays the administrative assistant $2,500 salary for Oct. General Journal Date Oct. 30 Account Title Ref. Salary Expense Cash (Payment for salaries) Debit Credit 2,500 2,500 Journalizing Simple Entry – Two accounts, one debit and one credit. Compound Entry – Three or more accounts. Example – On June 15, H. Burns, purchased equipment for $15,000 by paying cash of $10,000 and the balance on account (to be paid within 30 days). General Journal Date June 15 Account Title Equipment Cash Accounts Payable (Purchased equipment) Ref. Debit Credit 15,000 10,000 5,000 Steps in the recording process The Ledger General Ledger contains the entire group of accounts maintained by a company. The General Ledger includes all the asset, liability, owner’s equity, revenue and expense accounts. Steps in the recording process Example: Standard Form of Account Chart of Accounts Accounts and account numbers arranged in sequence in which they are presented in the financial statements. Hanshew Real Estate Agency Chart of Accounts Assets 101 112 126 130 150 158 Cash Accounts receivable Advertising supplies Prepaid insurance Office equipment Accumulated depreciation Owner's Equity 300 306 350 Revenues 400 Liabilities 200 201 209 212 230 Accounts payable Notes payable Unearned revenue Salaries payable Interest payable Hanshew, Capital Hanshew, Drawing Income summary Service revenue Expenses 631 711 722 726 729 905 Advertising supplies expense Depreciation expense Insurance expense Salaries expense Rent expense Interest expense Standard Form of Account T-account form used in accounting textbooks. In practice, the account forms used in ledgers are much more structured. Cash Date Oct. Explanation 1 27 30 Ref. No. 101 Debit Credit 15,000 700 2,500 Balance 15,000 14,300 11,800 Posting Posting – the process of transferring amounts from the journal to the ledger accounts. General Journal Date Oct. 1 Account Title Cash J1 Ref. Debit 101 15,000 Hanshew, Capital Credit 15,000 (Owner's investment in business) General Ledger Cash Date Oct. 1 Explanation Ref. Debit J1 15,000 Acct. No. 101 Credit Balance 15,000 Posting Review Question Posting: a. normally occurs before journalizing. b. transfers ledger transaction data to the journal. c. is an optional step in the recording process. d. transfers journal entries to ledger accounts. Steps in the recording process Posting – process of transferring amounts from the journal to the ledger accounts. The Recording Process Illustrated Illustration 2-19 Follow these steps: 1. Determine what type of account is involved. 2. Determine what items increased or decreased and by how much. 3. Translate the increases and decreases into debits and credits. The Trial Balance Example: A list of accounts and their balances at a given time. Purpose is to prove that debits equal credits. The Trial Balance Limitations of a Trial Balance The trial balance may balance even when 1. a transaction is not journalized, 2. a correct journal entry is not posted, 3. a journal entry is posted twice, 4. incorrect accounts are used in journalizing or posting, or 5. offsetting errors are made in recording the amount of a transaction. The Trial Balance Review Question A trial balance will not balance if: a. a correct journal entry is posted twice. b. the purchase of supplies on account is debited to Supplies and credited to Cash. c. a $100 cash drawing by the owner is debited to Owner’s Drawing for $1,000 and credited to Cash for $100. d. a $450 payment on account is debited to Accounts Payable for $45 and credited to Cash for $45.