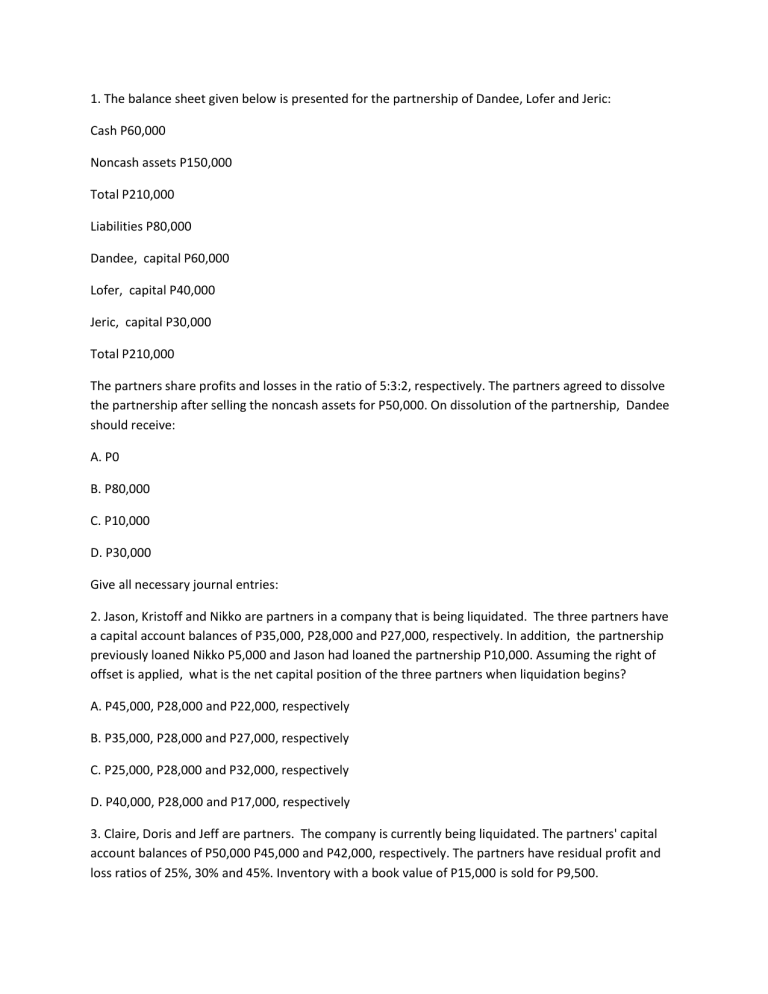

1. The balance sheet given below is presented for the partnership of Dandee, Lofer and Jeric: Cash P60,000 Noncash assets P150,000 Total P210,000 Liabilities P80,000 Dandee, capital P60,000 Lofer, capital P40,000 Jeric, capital P30,000 Total P210,000 The partners share profits and losses in the ratio of 5:3:2, respectively. The partners agreed to dissolve the partnership after selling the noncash assets for P50,000. On dissolution of the partnership, Dandee should receive: A. P0 B. P80,000 C. P10,000 D. P30,000 Give all necessary journal entries: 2. Jason, Kristoff and Nikko are partners in a company that is being liquidated. The three partners have a capital account balances of P35,000, P28,000 and P27,000, respectively. In addition, the partnership previously loaned Nikko P5,000 and Jason had loaned the partnership P10,000. Assuming the right of offset is applied, what is the net capital position of the three partners when liquidation begins? A. P45,000, P28,000 and P22,000, respectively B. P35,000, P28,000 and P27,000, respectively C. P25,000, P28,000 and P32,000, respectively D. P40,000, P28,000 and P17,000, respectively 3. Claire, Doris and Jeff are partners. The company is currently being liquidated. The partners' capital account balances of P50,000 P45,000 and P42,000, respectively. The partners have residual profit and loss ratios of 25%, 30% and 45%. Inventory with a book value of P15,000 is sold for P9,500. What is Claire's capital account balance after the transaction is completed? A. P47,625 B. P50,000 C. P46,250 D. P48,625 What is Doris'capital account balance after the transaction is completed? A. P40,500 B. P43,350 C. P45,000 D. P42,150 4. The following condensed balance sheet is presented for the partnership of D, E and F who share profits and losses in the ratio of 5:3:2, respectively: Cash P100,000 Other assets P150,000 Total P580,000 Liabilities P160,000 D, capital P200,000 E, capital P130,000 F, capital P90,000 Total P580,000 The partners agreed to liquidate the partnership after selling the other assets. If the other assets are sold for P280,000, how much should F receive A. P44,000 B. P50,000 C. P76,000 D. P90,000 If the other assets are sold for P80,000 and all partners are personally insolvent, how much should E receive upon liquidation? A. P0 B. P6,000 C. P10,000 D. P20,000 5. Oliver, Patrick and Quincy LLP, is beginning liquidation. It has no cash, total liabilities of 60,000 including a P10,000 loan payable to Patrick, and equal partners' capital account balances of P40,000. The income-sharing ratio is 5:1:4, respectively. If a portion of the noncash assets with a carrying amount of P140,000 realizes P120,000, the cash payment that Patrick receives: Give all necessary entries: 6. Keaton, Lewis and Meador partnership had the following balance sheet just before entering liquidation: Cash P10,000 Noncash assets P300,000 Total P310,000 Liabilities P130,000 Keaton, capital P60,000 Lewis, capital P40,000 Meador, capital P80,000 Total P310,000 Keaton, Lewis and Meador share profits and losses in a ratio of 2:4:4. Noncash assets were sold for P180,000. Liquidation expenses were 10,000. Assume that Lewis was personally insolvent and could not contribute any assets to the partnership, while Keaton and Meador were both solvent. What amount of cash would Keaton have received from the dostribution of partnership assets? 7. The abrams, Bartle and Creighton partnership began thr process of liquidation with the following balance sheet: Cash P16,000 Noncash assets P434,000 Total P450,000 Liabilities P150,000 Abrams, capital P80,000 Bartie, capital P90,000 Creighton, capital P130,000 Total P450,000 Abrams, Bartie and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be P12,000. After the liquidation expenses of P12,000 had been paid and the noncash assets are sold, Creighton had a deficit of P8,000. For what amount were noncash assets sold? 8. The balance sheet for the partnership Ella, Jaylee and Charish, whose shares of profits and losses are 40%, 50% and 10%, is as follows: Cash P50,000 Inventory P360,000 Total P410,000 Accounts payable P150,000 Ella, capital P160,000 Jaylee, capital P45,000 Charish, capital P55,000 Total P410,000 The partnership will be liquidated in installments. As cash becomes available, it will be distributed to the partners. If inventory costing P200,000 is sold for P140,000, how much cash should be distributed to each Ella at this time? What is the maximum possible loss? 9. On December 31, 2020, the Statement of Financial Position of UFC Partnership shows the following data with profit or loss sharing of 2:3:5: Cash P15M Noncash assets P40M Liabilities to others P20M U, capital P15M F, capital P12.5M C, capital P7.5M On january 1, 2021, the partners decided to wind up the partnership affairs. During the winding up, liquidation expenses amounted to P2M were paid. Noncash assets with book value of P30M were sold during January. 40% of total liabilities were also paid during January. P3M cash was withheld during January for future liquidation expenses. On January 31, 2021, partner U received P10M. What is the amount received by partner F on January 31, 2021? A. P2.5M B. P7.5M C. P5M D. P3M Using the same data above, what is the net proceeds from the sale of noncash assets during January 2021? A. P25M B. P20M C. P22M D. P23M