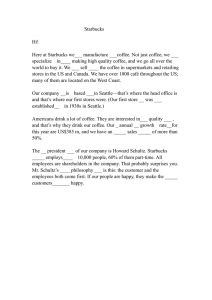

Top five new or emerging risks for an MNC and measures to address those risks Mayank Mistry – 133 Dhiren Patel – 115 Vinit Shah – 158 Varun Sayta – 155 Ashish Ramesh – 110 Chaitanya Joshi – 014 Assessing Political Risk • At the macro level, firms attempt to assess a host country’s political stability and attitude toward foreign investors. • At the micro level, firms analyze whether their firm-specific activities are likely to conflict with host-country goals as evidenced by existing regulations. Classification of Political Risks Firm-Specific Risks Country-Specific Risks Global-Specific Risks • Business risks • Terrorism & War • Foreign-exchange • Anti-globalization risks • Governance risks Cultural and Institutional Risk Transfer Risk movement • Environmental concerns • Poverty • Blocked funds • • • • • • Ownership structure • Cyberattacks Human resource norms Religious heritage Nepotism & corruption Intellectual property rights Protectionism Assessing Political Risk • Predicting country-specific risk (macro risk): • Political risk studies usually include an analysis of the historical stability of the country in question, evidence of present turmoil or dissatisfaction, indications of economic stability, and trends in cultural and religious activities • Analysis of trends in these metrics leads many to speculate that the future will resemble the past, which is often not the case • Despite this difficulty, the MNE must conduct adequate analysis in preparation for the unknown Assessing Political Risk • Predicting global-specific risk: • Global-specific risk is clearly quite difficult to predict (i.e. September 11th) • There are many groups interested in disrupting MNEs operations for the cause of religion, anti-globalization, environmental protection, and even anarchy • We can expect to see a number of new indices, similar to country-specific indices, but devoted to ranking different types of terrorist threats, their locations, and potential targets Management Strategies for Country-Specific Risks Cultural and Institutional Risk Transfer Risk Blocked Funds Ownership Structure Human Resource Norms • Preinvestment strategy to anticipate blocked funds • Fronting loans • Joint venture • Local management & staffing • Creating unrelated exports Religious Heritage • Understand and respect host country religious heritage • Obtaining special dispensation • Forced reinvestment Nepotism and Corruption • Disclose bribery policy to both employees and clients • Retain a local legal advisor Intellectual Property • Legal action in host country courts • Support worldwide treaty to protect intellectual property rights Protectionism • Support government actions to create regional markets Management Strategies for Global-Specific Risks Terrorism & War Anti-Globalization Environmental Concerns • Support government efforts to flight terrorism and war • Support government efforts to reduce trade barriers • Show sensitivity to environmental concerns • Crisis planning • Recognize that MNEs are the targets • Support government efforts to maintain a level playing field for pollution controls Poverty Cyber Attacks • Provide stable, relatively well-paying jobs • No effective strategy except internet security efforts • Establish the strictest of • Support government occupational safety standards anti-cyber attack efforts MNE movement towards multiple primary objectives: Profitability, Sustainable Development, Corporate Social Responsibility Illustration of Global-Specific Risks: The Case of Starbucks • Starbucks found itself an early target of the anti-globalist movement. • The company appeared to be yet another American cultural imperialist. • As global prices for coffee plummeted in the late 1990’s, companies like Starbucks were criticized as being unwilling to help improve the economic conditions of the coffee growers themselves Starbucks’ coffee buyers work with coffee wholesalers and directly with small farmers and farm cooperatives in procurement Infrastructure, including schools, clinics, and coffee processing facilities Supplemental funding for farm credit programs to support farm capital needs Contributions to CARE, the non-profit international relief organization Shade Grown Mexico Brand Fair Trade Certified Brand Partnership formed in 1998, encourages production of shade-grown coffee using ecologically sound growing practices to promote bio-diversity and to financially support farms employing these practices (with Conservation International, CI) Partnership in which Starbucks promises consumers that the farmers who produced the coffee beans were paid a guaranteed minimum price that helps support a better life for farm families (with TransFair USA) Corporate Governance Risk Corporate governance is the system of rules, practices and processes by which a firm is directed and controlled. Reasons for Risk • Tolerance or support of illegal activities. • Non-cooperation with auditors. • Improper selection of auditors. • Poorly structured board. Measures to minimize risk • Sarbanes – Oxley Act 2002. • Transparent set of rules and controls in which shareholders, directors and officers have aligned incentives. Currency Risk Currency risk, commonly referred to as exchange-rate risk, arises from the change in price of one currency in relation to another. e.g.: Airbus currency crisis Measures to minimize risk • Currency forwards. • Currency swaps. • Swaption. Accounting & Reporting Complexities • The two sets of rules use similar accounting terms, and a lot of the practices are identical but there are also some big differences • The layout of financial statements. • How you report inventory costs. • How you treat extraordinary items • When you recognize revenue you've earned. Accounting & Reporting Complexities • Different local regulations for every country • Consolidation of entities in a group - current-rate method - Temporal method • Transfer pricing and intercompany cost allocations • Differencial cost accounting for parent and subsidiary Resource Risk Reasons for risk: • Lack of skilled labor - Latin America faces an acute skills shortage. Around 50% of formal Latin American firms cannot find candidates with the skills they need, compared to 36% of firms in OECD countries • Natural Resources - In March of 2016, Coca-Cola shut down three of its bottling operations in India following a years-long community-led campaign blaming the company for exacerbating local water shortages • Physical infrastructure and inadequate technology – While 15 percent of the world's population lives in Africa, only about one percent of global manufacturing takes place there. That is largely due to poor transport, communications and energy infrastructures Measures to minimize resource risk • Global Human Resource team to identify, recruit and train suitable personnel in foreign countries • Uniform company policies to unite culturally diverse people in one community • Invest in additional technology and improvise when necessary to keep subsidiaries in loop • Training based on efficient utilization of natural resources • Offering incentives for effective management of resources • Make operations more flexible and change strategy accordingly to minimize overall reliance on physical resources