Chapter 6 - Business Markets and Business Buyer Behavior

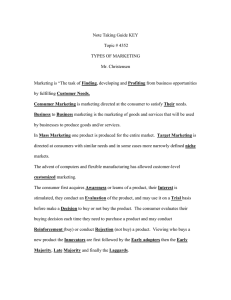

advertisement