Sampling Strategy & Conjoint Study: Marketing Research

advertisement

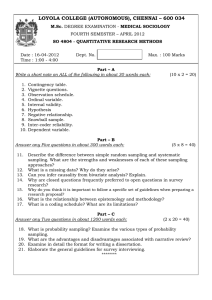

Session 7. Sampling Strategy and Conjoint Study MKTG 3010 MARKETING RESEARCH 1 Marketing Research Process Step 1: Defining the Problem Step 2: Developing an Approach to the Problem Step 3: Formulating a Research Design Step 4: Doing Field Work or Collecting Data Step 5: Preparing and Analyzing Data Step 6: Preparing and Presenting the Report 2 Define the Information Needed Design the Exploratory, Descriptive, and/or Causal Phases of the Research Specify the Measurement and Scaling Procedures Construct a Questionnaire Specify the Sampling Process and the Sample Size Develop a Plan of Data Analysis 3 Key Issues in Survey Design Structure of the survey Order of information Respondent-driven design Understanding the psychology of survey response • Question wording − 4 Are they answering what we’re asking? Review - Do you find anything wrong with the following questions? Why? 1. 2. 5 “How many cartons of orange juice did you buy in the last year?” “Do you think that patriotic Americans should buy imported automobiles when that would put American labor out of work? Context Effects: Compromise HD Space Preference for the middle option RAM 6 Judgment 7 8 The Importance of Alternatives: The Decoy Effect Add a decoy choice to the choice set, next to the choice you really want people to take. 9 Define the Information Needed Design the Exploratory, Descriptive, and/or Causal Phases of the Research Specify the Measurement and Scaling Procedures Construct a Questionnaire Specify the Sampling Process and the Sample Size Develop a Plan of Data Analysis 10 Large Sample Size vs. Probability Design Sampling 2 Mil+ 11 “Landon in a Landslide,” History Matters Sampling Strategy Define the Population Determine the Sampling Frame Select Sampling Technique(s) Determine the Sample Size Execute the Sampling Process I. Define the Target Population The target population is the collection of elements or objects that possess the information sought by the researcher and about which inferences are to be made. Who do you want to generalize to? The target population should be defined in terms of 13 Elements – the object that the information is desired Sampling units – element, or entity contains the element Extent - geographical boundaries Time – the time period of interest Example: Revlon want to sample women over 18 years of age Time Frame: Upcoming Summer Sampling Unit: Households with 18 year old females 14 Extent: Domestic United States Element: 18 year old females II. Determine the Sampling Frame A sampling frame is a representation of the elements of the target population. It consists of a list or set of directions for identifying the target population. How can you get access to them? e.g. 15 telephone book a mailing list purchased from a commercial organization Yellow page III. Select Sampling Techniques Sampling Techniques Nonprobability Sampling Techniques 16 Probability Sampling Techniques Probability Non-Probability Population elements are selected in a non-random manner Advantages of Probability Samples 17 Every element has a known, non-zero probability of inclusion in the sample Allows quantification of sampling error Generally more representative Probability Sampling Techniques Probability Sampling Techniques Simple Random Sampling 18 Systematic Sampling Stratified Sampling Cluster Sampling Nonprobability Sampling Nonprobability Sampling Techniques Convenience Sampling 19 Judgmental Sampling Quota Sampling Snowball Sampling Simple Random Sampling Each element of the population has the same known nonzero probability of inclusion Example: Random selection from voter database 20 Simple Random Sampling Mechanics Table of random numbers Computer generated random numbers Random digit dialing Advantages • Easy to implement • Does not always require a list (e.g. random-digit dialing) 21 Disadvantages • Less efficient than stratified sampling • May be more expensive than cluster sampling Is Random Sampling “Random Enough”? Can get outcomes that don’t “seem” random. 1 out of 16 chance OR 1 out of 16 chance →“Inefficient” 22 Systematic Sampling kth Every element from the list Systematically spreading the sample through the population list Sampling efficiency depends on the ordering of the list (e.g. sorted on key variable) 23 Example: Every 5th voter from registered voter list Leveraging Sample Structure: Stratified vs. Cluster Sampling Stratified Stratified Cluster Cluster Grouping: homogenous Strategy: randomly sample within randomly select clusters e.g. 5 voters at each precinct every voter at 5 precincts Tradeoff: more statistically efficient cheaper 24 heterogenous Matched Samples Identify matched pairs (e.g. on demographics) Controls for confounding variables in small samples 25 Is There Ever Such a Thing as a Random Sample? Often there is no “master list” Usually only a subset of the universe is relevant What is the universe being sampled from? “Likely voters” Non-response bias 26 20-30% response rates common (9%, Pew Center, 2012) Biases in contact, acceptance and completion Attempts to improve response rates can backfire Survey Bias, Slate, 5/17/2012 Case Study: 2008 California Democratic Primary Zogby Survey USA Feb 3-4 N=895 MOE = +/- 3.3% Obama 49% Clinton 36% Feb 3-4 N=872 MOE = +/- 3.4% Obama 42% Clinton 52% Why? Turnout assumptions… 27 Actual “It appears that we underestimated Hispanic turnout and overestimated the importance of younger Hispanic voters. We also overestimated turnout among African-American voters…” Zogby 43% 52% Coping With Non-Random Samples: Account For and Manage Bias Weights / Quotas Emphasize comparisons over absolute numbers When key characteristics of population are known Testing alternatives vs. marketing sizing Experiments Validate large (cheap) non-random sample by comparing with small (expensive) more random sample 28 IV. Determining Sample Size: Generalizing from Sample to Population Basis of statistics: Law of Large Numbers As the sample size increases, the sample measure converges to the population “true” measure Example: Proportion Choosing Coke Interview 1 Person 1.0 0.8 0.6 0.4 0.2 0.0 1 0 2 3 4 5 6 7 8 9 50% % preferring Coke 10 11 100% Either chooses Coke or Pepsi Example: Proportion Choosing Coke Interview 2 People 1.0 0.8 0.6 0.4 0.2 0.0 1 0 2 3 4 5 6 7 8 9 50% % preferring Coke 10 11 100% 3 outcomes; Split most likely Example: Proportion Choosing Coke Interview 4 People 1.0 0.8 0.6 0.4 0.2 0.0 1 0 2 3 4 5 6 7 8 9 50% % preferring Coke 10 11 100% 5 outcomes; Extremes less likely Example: Proportion Choosing Coke Interview 10 People 1.0 0.8 0.6 0.4 0.2 0.0 1 0 2 3 4 5 6 7 8 9 50% % preferring Coke 10 11 100% 10 outcomes; Extremes less likely Example: Proportion Choosing Coke Interview 100 People 1.0 0.8 0.6 Normal distribution 0.4 0.2 0.0 1 0 2 3 4 5 6 7 8 9 50% % preferring Coke 11 Extremes 100% 10 highly unlikely Most of the time, within 10% Confidence Interval (Margin of Error) Examples N MOE For proportion of 20%: N MOE 10 30 50 100 250 500 1000 +/-30% +/-18% +/-14% +/-10% +/-6% +/-4.4% +/-3% 10 30 50 100 250 500 1000 For proportion of 50%: +/-25% +/-14% +/-11% +/-8% +/-5% +/-3.5% +/-2.5% Benefit of adding more cases drops off… How Large Should the Sample Be? Work backwards from a margin of error table or confidence interval. Sample size determination - means 1. Specify the level of precision (D) 2. Specify the confidence level (95%) 3. Determine the z value associated with the CL(z=1.96) 4. Determine the standard deviation of the population (secondary source) (𝜎) 5. Determine the sample size using the formula for the standard error 𝜎 2𝑧2 𝑛= 2 𝐷 Sample size determination - proportions 1. Specify the level of precision (D) 2. Specify the confidence level (95%) 3. Determine the z value associated with the CL (z=1.96) 4. Estimate the population proportion(secondary source) (π) 5. Determine the sample size using the formula for the standard error of the proportion 𝜋(1 − 𝜋)𝑧 2 𝑛= 𝐷2 A sample size of 400 is enough to represent China’s more than 1.3 billion people or the more than 300 million American people. The sample size is independent of the population size for large populations. 4-39 Conjoint Study 40 Getting to know your classmate Find out what smartphone the person sitting next to you most prefers. Find out what feature he/she considers most important. 41 Color Screen Size 4.7 inch, 5.2 inch, 5.7 inch, Capacity White, Black, Gold 32 GB, 128 GB, 256 GB Price 42 HKD 4688, HKD 6588, HKD 8288 Conjoint Analysis Conjoint analysis is a popular marketing research technique that marketers use to determine what features a new product should have and how it should be priced. Conjoint analysis became popular because it was a far less expensive and more flexible way to address these issues than concept testing. What is Conjoint Analysis? Research technique developed in early 70s Measures how buyers value components of a product/service bundle Dictionary definition-- “Conjoint: Joined together, combined.” Marketer’s catch-phrase-- “Features CONsidered JOINTly” Main Idea – Suppose we want to produce a new golf ball We know from experience and from talking with golfers that there are three important product features: Average driving distance Average ball life Price A range of feasible alternatives for each of these features “ideal” for the consumer “ideal” for the company What is the most viable product? Now consider the same two features taken conjointly Using some statistic method Next, let’s figure out a set of values for driving distance (eg. 100, 60,0) and a second set for ball life (eg. 50,25,0) So that when we add the value together, they can reproduce buyer 1’s rank orders. Next, do the same thing to price and ball life A complete set of values that capture Buyer1’s trade-offs (Part-worth) Use the values to predict choice What’s So Good about Conjoint? More realistic questions: Would you prefer . . . Nice attendants Often late or Cold attendant Never late Logic: If choose left, you prefer service. If choose right, you prefer punctuality Rather than ask directly whether you prefer service over punctuality, we present realistic tradeoff scenarios and infer preferences from your product choices When respondents are forced to make difficult tradeoffs, we learn what they truly value Ask directly? Ask direct questions about importance How important is it that you get the <<brand, interest rate, annual fee, credit limit>> that you want? What is the problem with this? Stated Importances Importance Ratings often have low discrimination with most responses falling in most important categories: Average Importance Ratings 6.7 Brand 7.2 Interest Rate 8.1 Annual Fee 7.5 Credit Limit 0 5 10 How to Learn What Customers Want for Each Component? Ask direct questions about preference: What brand do you prefer? What processor do you prefer? How much RAM do you prefer? How much hard disk space do you prefer? What type of monitor do you prefer? What price do you prefer? What is the problem with this? Problems with Direct Questioning Answers are often trivial and unenlightening “I prefer more processor speed to less” “I prefer more RAM to less” “I prefer more hard disk space to less” “I prefer a lower price to a higher price” Conjoint Study Process Step 1 —Designing the conjoint study: Step 1.1: Select attributes relevant to the product or service category, Step 1.2: Select levels for each attribute, and Step 1.3: Develop the product bundles to be evaluated. Step 2 —Obtaining data from a sample of respondents: Step 2.1: Design a data-collection procedure, and Step 2.2: Select a computation method for obtaining part-worth functions. Step 3 —Evaluating product design options: Step 3.1: Part-worth functions Step 3.2: Attribute importance Step 3.3: Design market simulations Step 2 Obtaining Data from respondents Profile cards Rank order data Rating data Step 3 Conjoint Analysis Output Part-worth functions. The part-worth functions, or utility functions, describe the utility consumers attach to the levels of each attribute. Relative importance weights. The relative importance weights are estimated and indicate which attributes are important in influencing consumer choice. Market simulations I. Conjoint Utilities (Part-Worths) Numeric values that reflect how desirable different features are for each individual: Color Level black white gold Utility 4.67 6.33 4.00 Screen Size 4.7 inch 5.2 inch 5.5 inch 3.33 6.00 5.67 32 GB 128 GB 256 GB 2.67 6.33 6.00 $4,688 $6,588 $8,288 5.33 3.33 6.33 Capacity Price The higher the utility, the better 60 What is the most desirable offering? II. Conjoint Importance Measure of how much difference each attribute could make in the total utility of a product. Best minus worst level of each attribute, take percentage: White - Gold 5.2 in- 4.7 in 128 GB –32 GB $8288 - $2588 What is the most important factor? (6.33 – 4.00) = 2.33 (6.00 – 3.33) = 2.67 (6.33 – 2.67) = 3.66 (6.33 - 3.33) = 3.00 -----Totals: 11.66 20% 23% 31% 26% -------100.0% Importances are directly affected by the range of levels 61you choose for each attribute III. Market Simulations Make competitive market scenarios and predict which products respondents would choose Accumulate (aggregate) respondent predictions to make “Shares of Preference” (some refer to them as “market shares”) 62 III. Market Simulation Example Consider the following two products: 1. White, 5.2 in, 256 GB, $6588 2. Gold, 5.7 in, 128 GB, $8288 Which one does he/she prefer? For example 1. 6.33 + 6.0 + 6.0 + 3.33 = 21.66 2. 4.00 + 5.67 + 6.33 + 6.33 = 22.33 What is the share in the class? 63 Try it yourself – designing a new smart phone Color Screen Size 4.7 inch, 5.2 inch, 5.7 inch, Capacity White, Black, Gold 32 GB, 128 GB, 256 GB Price 64 HKD 4688, HKD 6588, HKD 8288 Guest Talk Venue: YIA LT3 Size: 249 Time: 18:30 - 20:30 Date: October, 29th No class on Tue 65