Cost study guide

advertisement

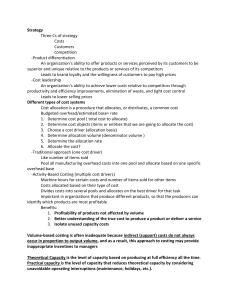

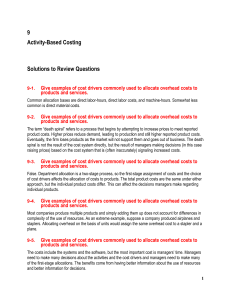

Strategy Three Cs of strategy Costs Customers competition -Product differentiation An organization’s ability to offer products or services perceived by its customers to be superior and unique relative to the products or services of its competitors Leads to brand loyalty and the willingness of customers to pay high prices -Cost leadership An organization’s ability to achieve lower costs relative to competitors through productivity and efficiency improvements, elimination of waste, and tight cost control Leads to lower selling prices Different types of cost systems Cost allocation is a procedure that allocates, or distributes, a common cost Budgeted overhead/estimated base= rate 1. Determine cost pool ( total cost to allocate) 2. Determine cost objects (items or entities that we are going to allocate the cost) 3. Choose a cost driver (allocation basis) 4. Determine allocation volume (denominator volume ) 5. Determine the allocation rate 6. Allocate the cost? -Traditional approach (one cost driver) Like number of items sold Pool all manufacturing overhead costs into one pool and allocate based on one specific overhead base -Activity-Based Costing (multiple cost drivers) Machine hours for certain costs and number of items sold for other items Costs allocated based on their type of cost Divides costs into several pools and allocates on the best driver for that task Important in organizations that produce different products, so that the producers can identify which products are most profitable Benefits: 1. Profitability of products not affected by volume 2. Better understanding of the true cost to produce a product or deliver a service 3. Isolate unused capacity costs Volume-based costing is often inadequate because indirect (support) costs do not always occur in proportion to output volume, and as a result, this approach to costing may provide inappropriate incentives to managers Theoretical Capacity is the level of capacity based on producing at full efficiency all the time. Practical capacity is the level of capacity that reduces theoretical capacity by considering unavoidable operating interruptions (maintenance, holidays, etc.). Two rules to remember about capacity 1. Charge the cost of unused capacity to those who demand it 2. Do not charge the cost of excess capacity to customers Budgeting Purpose Planning, evaluating performance & providing incentives, Facilitating communication and coordination, managing financial & operating performance, allocating resources - How to create a budget Bottom-Up (Zero Base) Approach – Managers and accountants plan the performance of the company, taking into account past performance and anticipated future changes Top-Down Approach - Senior managers distribute a set of goals against which actual results will be compared - Budgets used for planning (static budget) Prepared before the period begins and is only for the planned level of activity - Budgets used for evaluation (flexible budget) Estimate of what revenues and cost would have been based on actual activity for the period - Variances (how to calculate/how they are used) Variances provide managers with 1. Early warning of problems 2. A basis for performance evaluation 3. A basis for strategy evaluation Activity variance Differences simply due to differences in the activity level between the planned and actual activity levels Difference between static budget profit and flexible budget profit Revenue/spending variance Deviations in sales revenue ($) differences due to variance in selling prices – “revenue variance” – diff between actual rev and flex rev Deviations in costs ($) differences due to variance in costs “spending variance”diff between actual expenses and flex expenses Difference between flexible budget profit and actual budget profit - Human elements that can distort budgeting Individuals‘ incentives Budgetary slack, or padding the budget, is the practice of managers knowingly including a higher amount of expenditures or a lower amount of revenue in a budget Spending the budget managers often feel if they do not use all the resources they receive, next year’s budget may be cut Goal congruence is a term that refers to the degree of consistency between goals of the firm, its subunits, and its employees – Involving employees in the budgeting process fosters goal congruence