1/2/2019

Behind Lumber’s Collapse: A Perfect Storm of Housing and Trade - WSJ

DOW JONES, A NEWS CORP COMPANY

DJIA Futures 22930 -1.45% ▼

S&P 500 F 2467.50 -1.51% ▼

Stoxx 600 334.62 -0.90% ▼

U.S. 10 Yr 9 32 Yield 2.652% ▲

Crude Oil 44.62 -1.74% ▼

This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or customers visit

https://www.djreprints.com.

https://www.wsj.com/articles/behind-lumbers-collapse-a-perfect-storm-of-housing-and-trade-11546437601

COMMODITIES

Behind Lumber’s Collapse: A Perfect Storm

of Housing and Trade

Con luence of market pressures brought about an epic collapse after the commodity hit a record last

May

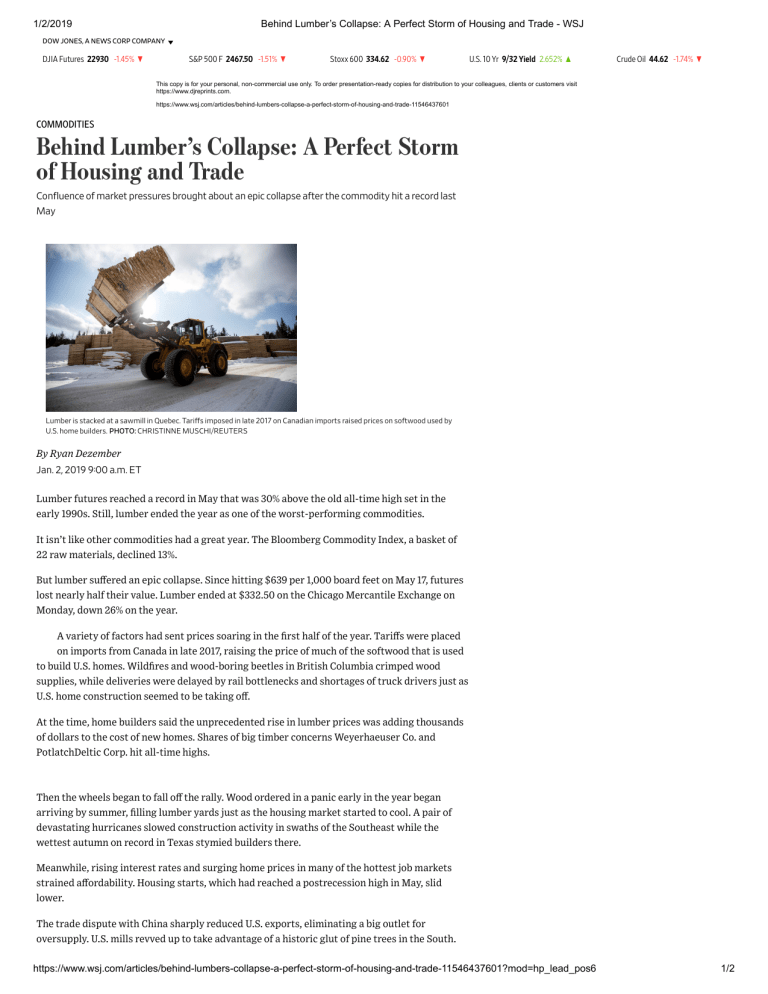

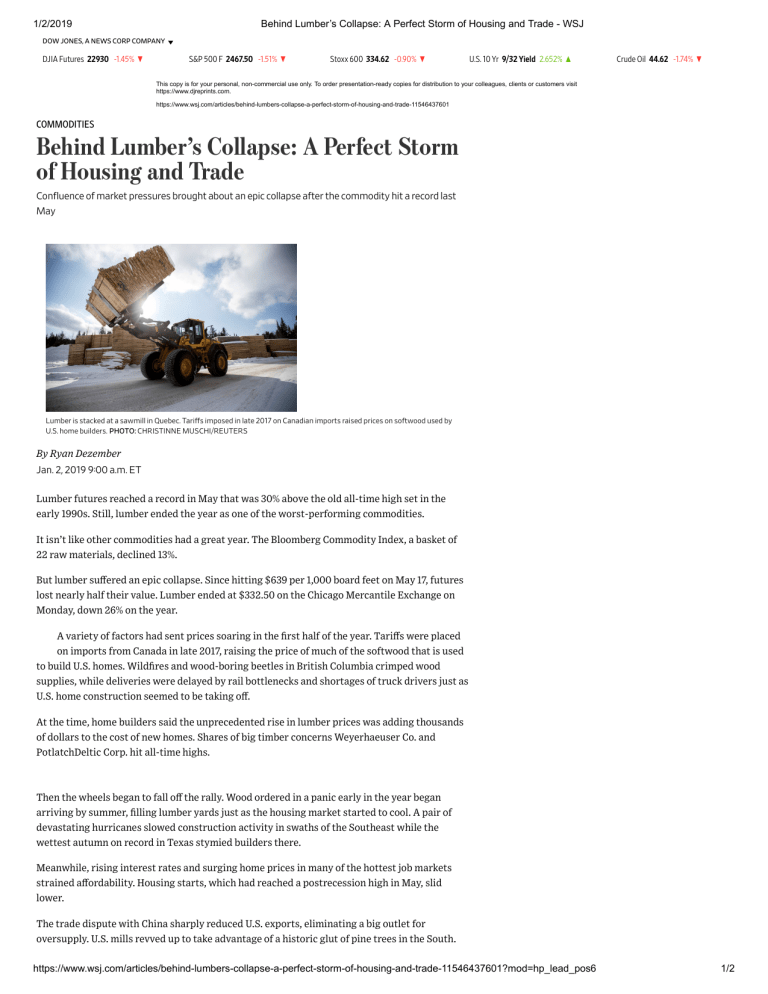

Lumber is stacked at a sawmill in Quebec. Tari s imposed in late 2017 on Canadian imports raised prices on softwood used by

U.S. home builders. PHOTO: CHRISTINNE MUSCHI REUTERS

By Ryan Dezember

Jan. 2, 2019 9 00 a.m. ET

Lumber futures reached a record in May that was 30% above the old all-time high set in the

early 1990s. Still, lumber ended the year as one of the worst-performing commodities.

It isn’t like other commodities had a great year. The Bloomberg Commodity Index, a basket of

22 raw materials, declined 13%.

But lumber suffered an epic collapse. Since hitting $639 per 1,000 board feet on May 17, futures

lost nearly half their value. Lumber ended at $332.50 on the Chicago Mercantile Exchange on

Monday, down 26% on the year.

A variety of factors had sent prices soaring in the first half of the year. Tariffs were placed

on imports from Canada in late 2017, raising the price of much of the softwood that is used

to build U.S. homes. Wildfires and wood-boring beetles in British Columbia crimped wood

supplies, while deliveries were delayed by rail bottlenecks and shortages of truck drivers just as

U.S. home construction seemed to be taking off.

At the time, home builders said the unprecedented rise in lumber prices was adding thousands

of dollars to the cost of new homes. Shares of big timber concerns Weyerhaeuser Co. and

PotlatchDeltic Corp. hit all-time highs.

Then the wheels began to fall off the rally. Wood ordered in a panic early in the year began

arriving by summer, filling lumber yards just as the housing market started to cool. A pair of

devastating hurricanes slowed construction activity in swaths of the Southeast while the

wettest autumn on record in Texas stymied builders there.

Meanwhile, rising interest rates and surging home prices in many of the hottest job markets

strained affordability. Housing starts, which had reached a postrecession high in May, slid

lower.

The trade dispute with China sharply reduced U.S. exports, eliminating a big outlet for

oversupply. U.S. mills revved up to take advantage of a historic glut of pine trees in the South.

https://www.wsj.com/articles/behind-lumbers-collapse-a-perfect-storm-of-housing-and-trade-11546437601?mod=hp_lead_pos6

1/2

1/2/2019

Behind Lumber’s Collapse: A Perfect Storm of Housing and Trade - WSJ

Lumber dealers now find themselves trying to sell

Newsletter Sign-up

wood that they piled up at high prices earlier in

the year, which is preventing many from stocking

for the spring building season with lower-cost

wood, said Stinson Dean, managing partner of

Markets

Kansas City lumber broker Deacon Lumber Co.

A pre-markets primer packed with news,

trends and ideas. Plus, up-to-the-minute

market data.

SIGN UP

PREVIEW →

“We’ve got a lot of lumber we have to chew

through before we can think about higher prices,”

Mr. Dean said. “Sawmills have to cut production.”

That has already started to happen. In recent

weeks, two of North America’s largest lumber

producers, West Fraser Timber Co. and Canfor

Corp. , announced they are reducing production

at sawmills in British Columbia in response to low lumber prices.

Curtailments at Canadian mills along with a strong home-renovation and remodeling market

has some optimistic that lumber’s slide will be short-lived.

“At some point, people will start to build up a position for next year’s building season,” Jim

Major, finance chief for building-supply firm BMC Stock Holdings Inc., told investors recently.

“And when you see that, hopefully there is some rebound in the lumber market.”

To receive our Markets newsletter every morning in your inbox, click here.

Write to Ryan Dezember at ryan.dezember@wsj.com

Copyright © 2018 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or customers visit

https://www.djreprints.com.

https://www.wsj.com/articles/behind-lumbers-collapse-a-perfect-storm-of-housing-and-trade-11546437601?mod=hp_lead_pos6

2/2