Manila Residential Market Q3 2018 Report

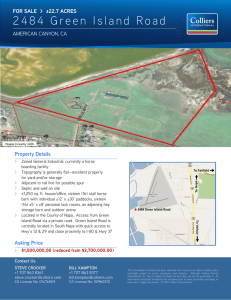

advertisement

COLLIERS QUARTERLY Joey Roi Bondoc Manager | Research | Philippines +(632) 858 9057 Joey.Bondoc@colliers.com RESIDENTIAL | MANILA | Q3 2018 | 19 NOVEMBER 2018 STABLE OCCUPANCY DESPITE RAMPED UP SUPPLY Summary & Recommendations A mix of demand from offshore gaming employees and local professionals is helping sustain the Metro Manila residential market. Vacancy in the secondary market continues to drop despite an aggressive completion of new units in 3Q2018. To seize opportunities in the sector, Colliers recommends that developers > Local professionals and Chinese offshore gaming employees continue to drive demand in the secondary market. In the pre-sales Demand market, about 42,000 units were taken up in the first nine months of the year. > Colliers sees the delivery of at least 9,600 new units in 2018. This will likely drop to about 8,300 new units annually from 2019 to Supply 2021. > tie up with the government for the skills upgrading of construction workers and push for the entry of 100% foreignowned contractors > be more flexible to the residential demand of offshore gaming operators Full Year 2018 2018–21E Annual Average 4,800 units 9,900 unit 8,200 units 4,900 units 9,600 units 8,700 units End Q3/QOQ > pursue more projects in the peripheries of established business districts > tap the rising demand for worker housing Q3 2018 Rent > By end 2018 we see average lease rates growing by only between 0.6% to 1%. From 2019 to 2021, we project lease rates to grow by only 0.3% to 0.4% per annum as we see the delivery of more units into the secondary market. > Colliers estimates 2018 year-end vacancy of about 11%. From 2019 to 2021, we expect Vacancy vacancy to stay stable at around this level. Source: Colliers International Note: USD1 to PHP54 as of end-Q3 End 2018/YOY End 2021/ Annual Average Growth 2018–21 0.9% 1% 0.5% PHP716 PHP717 PHP724 -0.5 pp 1.3 pp -0.1pp 10.8% 11.3% 11% COLLIERS QUARTERLY RESIDENTIAL | MANILA| Q3 2018 | 19 NOVEMBER 2018 RECOMMENDATIONS Residential demand in Metro Manila remain stable. To seize opportunities in the sector, Colliers encourages developers to implement the following measures: Tap demand for dormitories We believe that the demand for worker dormitories remains underserved. Thus, we encourage developers to scout for properties in the peripheries of CBDs where worker dormitories could be established. Colliers believes that the fringes of Fort Bonifacio, Makati and Ortigas are viable locations for these projects. Aside from easing the foreign ownership restriction in the entry of 100% foreign owned contractors, private developers should consider partnering with government-run training centres to support training for their construction workers. Colliers believes that this option is particularly important for firms that do not have the capacity to put up their own training centres or establish their own manpower units. UNIT COMPLETION ACCELERATES Flexibility in developments The completion of new condominium projects picked up in 3Q2018, following the delivery of more than 4,900 units. This is more than double the 1,700 units completed in the first six months of the year. Year-to-date (YTD) completion now stands at 6,600. Colliers is optimistic that the projected 9,600 new units for 2018 is likely to be met given the status of residential towers due to be completed in 4Q2018. The expansion of offshore gaming operators in Metro Manila is resulting in greater residential demand. Colliers recommends that developers be quick in tweaking development plans to capture immediately the needs of offshore gaming companies that continue to influence Manila’s property developments. Projects initially intended for hotels or malls, for instance, could be redeveloped into residential projects that could support offshore gaming operations in adjacent office towers. Fort Bonifacio accounted for 65% of office space completion in 3Q18, leading other submarkets. This was complemented by the pace of condominium unit completion in 3Q2018 as it accounted for 34% of all new units completed this quarter. Among the residential towers completed were Avida Towers BGC 34th Street Towers 1 and 2 and Viceroy McKinley Hill East Tower. These residential buildings added a combined 1,700 units to Fort Bonifacio’s condominium stock. Push for the entry of 100% foreign owned contractors Unit completion in the Bay Area remains high with the thriving business hub accounting for 26% of total delivery during the period. Monarch Parksuites and Palm Beach Villas added more than 1,200 units to the Bay Area’s residential stock. Colliers notes that a number of developers are hard-pressed in completing their projects as scheduled due to manpower constraints. To bridge the labour supply gap, we recommend that stakeholders aggressively push for the government to open up the sector to 100%-owned foreign contractors. Currently, this sector has restricted access for foreigners. According to the National Economic and Development Authority, 100% foreign-owned contractors are planned to be allowed to take part in the construction of public projects under the government’s Build, Build, Build programme so this should help ease pressure on local developers facing construction delays. 2 Public-Private Partnership Makati CBD has long been overtaken by Fort Bonifacio as the largest condominium submarket in Metro Manila, but the business district’s stock has recently been buoyed by the completion of The Stratosphere and Kroma Tower by Primex and Alveo, respectively, adding 1,151 units to Makati CBD stock. COLLIERS QUARTERLY RESIDENTIAL | MANILA| Q3 2018 | 15 NOVEMBER 2018 As of 3Q2018, Colliers recorded a total of 113,700 completed condominium units across Metro Manila’s secondary residential market, which covers major business districts. At present, Fort Bonifacio accounts for the largest number of units at 27% of residential stock followed by Makati CBD (23%), Bay Area (16%), and Ortigas Center (15%). The Bay Area has overtaken Ortigas Center starting 3Q2018 and we expect this reclaimed CBD to overtake other established business hubs such as Makati CBD by 2021. By then, Colliers sees the Bay Area having a total of 29,500 units, higher than Makati CBD’s 28,700. From 2019 to 2021, we see the completion of 8,300 new condominium units per year. By 2021, Colliers projects Metro Manila’s secondary residential stock to reach 142,000 units, about 33% higher compared to 2017. Colliers believes that ramped-up completion of new condominium units is partly attributable to the relentless demand from Chinese offshore gaming firms. Since 4Q2016, offshore gaming firms have been expanding their offices in three major submarkets, Fort Bonifacio, the Bay Area, and Makati CBD. This strong demand is spilling over to the residential sector as aside from expanding their offices, a major requirement of these offshore gaming companies is a residential complement. VACANCY DECLINES FURTHER The strong demand is translating into improved occupancy in the secondary residential market. This means that completed units in major business districts that are either for lease or sale are recording better absorption. Overall, Metro Manila vacancy further declined to 10.8% from 11.3% in 2Q2018. This is the fourth consecutive quarter in which Colliers recorded lower vacancy metro-wide with Makati CBD, Fort Bonifacio, and the Bay Area recording the fastest declines. For the end of 2018, Colliers predicts vacancy of about 11% given the strong demand from both Chinese offshore gaming employees and local professionals. This is a downward adjustment from our initial projection of 12% to 13% at the start of of 2018. Besides sustained demand, we attribute the lower vacancy rate to slower delivery of units. Our updated projection of 9,600 units for 2018 is about 30% lower than our initial estimate of 12,400. 3 Aside from the demand from offshore gaming employees, Colliers has observed more local professionals working in CBDs who pool their monthly rent and lease out condominium units located in the peripheries of major business districts such as Makati, Ortigas, and Fort Bonifacio. This is contributing to lower vacancy especially among Grade B condominium towers in the fringe areas. We see more developers investing in worker accommodation projects that cater to young urban professionals who cannot afford to own their own apartment yet or rent a condominium unit within the established business districts. These worker dormitories, are for professionals who want to live near their offices. In the past, the demand for worker dormitories has primarily been served by smaller, mom-and-pop developers. But national developers such as Ayala Land and SM Investments have started to tap into this sector. RENTS AT FLATTISH GROWTH Location Fort Bonifacio Q2 2018 617-1,005 Q3 2018 620-1,012 % Change (QoQ) 0.6% Q3 2019F 622-1,016 % Change (YoY)F 0.4% Makati CBD 540-1,080 548-1,090 1.1% 550-1,094 0.3% Rockwell Center 728-1,020 738-1,035 1.4% 741-1,039 0.4% Source: Colliers International Philippines Research Average rents in prime three-bedroom units in Makati CBD recorded a 1.1% QoQ increase while rents in Fort Bonifacio and Rockwell also rose by 0.6% and 1.4%, respectively. We do not see a significant rise in rents over the next 12 to 36 months as we still expect a substantial number of new condominium units being completed across Metro Manila during the period. From 2019 to 2021, Colliers is retaining its projection of flat to marginal rise in rents for the three business districts – Makati CBD, Fort Bonifacio, and Rockwell. We project rents to increase by only 0.3% to 0.4% per annum during the threeyear period. COLLIERS QUARTERLY RESIDENTIAL | MANILA| Q3 2018 | 15 NOVEMBER 2018 PRICES STILL RISING Capital values continue to increase with average prices of prime threebedroom units in the secondary market ranging between PHP124,000 and PHP313,000 (USD2,296 and USD5,796) per sq metre as of 3Q2018. Fort Bonifacio units recorded the fastest increase in 3Q2018 of 5% followed by Makati CBD at 3.8% and Rockwell Center at about 3%. Colliers believes that the increase in policy rates is not immediately felt in the market as the 150-basis point hike is still within the threshold that the domestic market can absorb. Banks also maintain low rates to remain competitive. Hence, developers are not wary about consumers’ capacity to pay their monthly mortgage. Metro Manila Residential Launches and Take-up (in ‘000 units) From 2019 to 2021, Colliers sees condominium prices in the three major business districts rising between 2.8% to 3.2% per year. 60 50 Location Fort Bonifacio Makati CBD Rockwell Center Q2 2018 118,000252,000 121,000301,000 199,000246,000 Q3 2018 124,000264,000 125,000313,000 208,000250,000 % Change (QoQ) 5.0% 3.8% 2.9% Q3 2019F 127,000272,000 129,000322,000 215,000258,000 % Change (YoY)F 3.0% 2.8% 53 43 37 40 43 40 35 33 35 42 36 31 30 20 10 3.2% Source: Colliers International Philippines Research PRE-SELLING TAKE-UP SUSTAINS SPACE In the first three quarters of 2018 pre-sales reached about 42,000 units, higher than the 38,000 units recorded in the same period in 2017. Given the current trend, the 2018 take up for pre-sales condominium units might even surpass the 53,000 units sold in Metro Manila in 2017. For the first nine months of 2018 some 31,000 units were launched compared to 22,600 units in the same period of 2017. The central bank’s decision to raise benchmark yields in 2018 by 150 basis points so far has not deterred developers from launching new projects. 4 Units (in '000s) Comparative Luxury 3BR Residential Capital Values (PHP / sq m) 54 2013 2014 2015 Launch Source: Colliers International Philippines Research 2016 Take-up 2017 As of 3Q18 Primary Authors: For further information, please contact: Joey Roi Bondoc Manger | Research | Philippines +(632) 858 9057 joey.bondoc@colliers.com David A. Young Chief Operating Officer | Philippines +(632) 858 9009 David.A.Young@colliers.com Richard Raymundo Managing Director | Philippines +(632) 858 9028 Richard.Raymundo@colliers.com Arren Faronilo Senior Research Analyst | Research | Philippines +(632) 863 4116 arren.faronilo@colliers.com Donica Cuenca Research Analyst | Research | Philippines +(632) 858 9068 donica.cuenca@colliers.com About Colliers International Group Inc. Colliers International Group Inc. (NASDAQ: CIGI) (TSX: CIGI) is a top tier global real estate services and investment management company operating in 69 countries with a workforce of more than 13,000 professionals. Colliers is the fastest-growing publicly listed global real estate services and investment management company, with 2017 corporate revenues of $2.3 billion ($2.7 billion including affiliates). With an enterprising culture and significant employee ownership and control, Colliers professionals provide a full range of services to real estate occupiers, owners and investors worldwide, and through its investment management services platform, has more than $25 billion of assets under management from the world’s most respected institutional real estate investors. Colliers professionals think differently, share great ideas and offer thoughtful and innovative advice to accelerate the success of its clients. Colliers has been ranked among the top 100 global outsourcing firms by the International Association of Outsourcing Professionals for 13 consecutive years, more than any other real estate services firm. Colliers is ranked the number one property manager in the world by Commercial Property Executive for two years in a row. Colliers is led by an experienced leadership team with significant equity ownership and a proven record of delivering more than 20% annualized returns for shareholders, over more than 20 years. For the latest news from Colliers, visit our website or follow us on Copyright © 2018 Colliers International The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report.