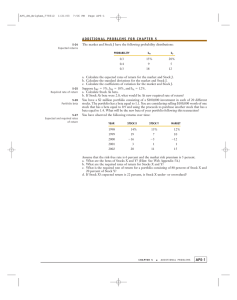

Chapter 02 Risk and Return Part I

advertisement