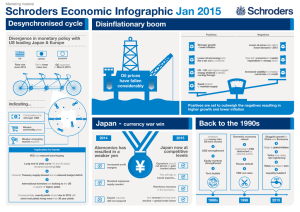

macroeconomics summary

advertisement

lOMoARcPSD|222311 Macroeconomics summary chapters 1 to 8 Macroeconomics for E&BE (Rijksuniversiteit Groningen) Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 Macroeconomics summary 2 - Aggregate output is measured as the gross domestic product GDP; The value added by all domestic firms, disregarding domestic firms operating abroad. All value added in an economy consists of the value of the final good - the value of inputs (intermediate goods). It can also be computed as the sum of all incomes: Labour income and capital income or profit income. Aggregate income and production are always equal. Nominal GDP is the sum of quantities of final goods produced times their current price. This increases over time not only due to increased production, but also because of price increases due to inflation. If we want to measure the change in production we need the real GDP: The sum of the quantities of final goods times constant (instead of current) prices. We use a reference / base year to construct prices. On the right, we see that the 2 intersect in 2010. This is thus the base year, because real and nominal GDP are then equal. Nominal GDP is also known as GDP in current prices/euros. Real GDP is also known as GDP in terms of goods, GDP in constant euros, GDP adjusted for inflation, or GDP in ‘year’ prices. Real GDP per person is the ratio of real GDP to the population of a country. GDP growth is computed in the growth of real GDP, with expansions and recessions. Hedonic pricing takes into account the changed quality of goods and thus the changed value, because a computer in 2000 is not the same as one in 2017, leading to different values. Employment is the number of people who have a job, unemployment is the number of people who don’t and are looking for one. Together they form the labour force. L = N + U. Unemployment rate is the unemployment / labour force. u = U / L Those who aren’t looking for a job are not counted as in the labour force, so when some stop looking for jobs due to high unemployment, the number of unemployed people officially falls: These are discouraged workers. This decreases the participation rate, defined as the labour force divided by the total population of working age. Inflation is a sustained rise in the price level: The general level of prices. The inflation rate is the rate at which price level increases. Deflation is the opposite. If we see the nominal GDP increase faster then the real GDP, it must be because prices increase. The GDP deflator is the nominal GDP / Real GDP. The GDP deflator is an index number and gives the rate at which the general level of prices increases over time - It gives the rate of inflation. Rearrange the equation and we see nominal GDP = GDP deflator * real GDP The GDP deflator gives the average price of output (production). The consumer price index gives the average price of consumption, so the cost of living. These 2 are often different because some of the goods produces are sold abroad, or to governments/firms. The consumer price index also consists of goods made abroad and imported, influencing cost of living as well. In Europe, the CPI is the HICP. Real wage is measured in goods rather than euros, and if it would equal price increase there’s pure inflation. But this doesn’t exist, because not all wages rise proportionally, influencing income distribution. Also, people might automatically move up in their tax brackets when they’re not adjusted for inflation: The bracket creep. So aggregate economic activity has 3 dimensions: Output growth (GDP), unemployment and inflation. Okun’s law suggests that when output growth is high, unemployment will decrease. It takes about 1,5% of GDP growth to keep unemployment constant. This is because population grows, and the Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 output per worker also grows. To keep unemployment constant, with a 0,5% population growth and 1% productivity growth, we need 1,5% output growth. The Philips curve explores the relation between unemployment and inflation, stating that when unemployment becomes too low, the economy will overheat and put an upwards pressure on inflation. It has been defined as a relation between the change in the rate of inflation, and the unemployment rate. We see that higher unemployment leads to a decrease in inflation on average. Aggregate output is determined by 3 main factors. In the short run, a few years, changes in demand determine output growth. In the medium run, a decade, supply determines the output. This consists of the capital stock, the level of technology and labor force size. In the long run, a few decades or more, the savings rate, education and government determine output. Short - demand, as a result of consumer confidence for example. Medium - supply, as a result of capital stock and the labor force. Long - education, government, saving. 3 - GDP is composed of: -Consumption, C. (55%) -Investment, I, sometimes fixed investment, is the sum of non-residential investment (firms purchasing new plants) and residential investment (people buying houses). (19%) -Government spending, G, purchases by all levels of government. This excludes government transfers such as benefits, and interest, making G smaller than government spending. (21%) -Net exports, X - IM, is exports minus imports. The result is the trade balance, either a trade surplus or deficit. -Inventory investment, the production exceeding sales, leading to a positive or negative amount. Some goods are sold a year later than produced, thus the difference between production and sales. Z = total demand for goods. We make some assumptions: All firms make 1 good, which can be used by consumers for consumption, firms for investment and by governments. This means we only look at the supply and demand of this market. We also assume firms will supply any amount at a given price P, meaning we can focus on demand when determining output. Lastly we assume the economy is closed, so X = IM = 0 The equation than becomes the following: Consumption depends mainly on disposable income, Yd, which is after tax and transfers. Thus the consumption function is C = C(Yd) meaning consumption is a function of disposable income. This is a behavioural equation because it captures some aspect of behaviour, namely consumers’. More specific is the function on the right, a linear equation determined by the propensity to consume, which gives the effect an additional euro has on consumption 0 < C1 < 1, and by C0, which is the consumption people make when income is 0. They still need to eat, so they’ll use savings or borrow. C0 may change because borrowing becomes easier or they become more optimistic. Seen on the right, the equation has a vertical intercept at C0 and the slope of C1. Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 Disposable income Yd = Y - T where T is the paid taxes - received transfers. Replacing Yd in the equation for consumption gives: Investment will be treated as an exogenous variable, meaning contrary to endogenous variables, it’s independent of other variables and given. Government spending describes fiscal policy together with T, and we take both as exogenous. Taking these 3, we now know Z = C + I + G becomes The demand for goods Z depends on income Y, taxes T, investment I and government spending G. Assuming firms don’t hold inventories and inventory investment = 0, equilibrium in the goods market requires that production equals the demand for goods: Y = Z This is an equilibrium condition, and together with the identities (3 stripes), and behavioural equations (consumption function) form all 3 equations. In equilibrium, production Y equals demand. Demand depends on income Y, which equals production. Y denotes both income and production, because GDP equals the total income earned in an economy. Production value = income. We can rewrite the equilibrium equation We can C1Y to the left side and reorganise the right We divide both by (1 - C1) The term (C0 + I + G - C1T) is the given consumption, investment, government spending and taxes (tax - transfers). These are all the parts of demand that don’t depend on output: the autonomous spending, independent of output. If the government is running a balanced budget taxes equal government spending, and if T = G. Because the propensity to consume C1 is smaller than 1, G - C1T is positive and thus autonomous spending is positive. 1/(1 - C1) is always greater than 1, because C1 is smaller than 1. This is the multiplier, the number that multiplies autonomous spending. The larger the propensity to consume C1, the larger the multiplier. Both changes in consumption and autonomous spending change output by more than its direct effect. This is because an increase in C0 increases demand, leading to an increased production, and because production equals income Y, and income increases consumption. When we plot production as a function of income, we get a 45 degree line: They are always equal. Then plot demand as a function of income. Demand depends on income and autonomous spending. Autonomous spending is the intercept with the Yaxis, where Y = 0. The slope of the line ZZ, denoting the relation between income and demand, is equal to the propensity to consume C1. In equilibrium production equals demand, Y = Z, so at the intersect of ZZ and the 45 degree line depicting income Y / demand Z / production Y. Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 When demand increases by 1 billion, production also increases by 1 billion, from A to B. Because income equals production, income grows with BC, which is just as long as AB. Then comes the 2nd round: The increase in demand CD, which equals AB times the propensity to consume. So 1 billion * C1. This second round increase in demand Z increases production Y, which equals income Y, so income increases with DE. These rounds keep going, until they approach a limit. This limit is the multiplier: 1 / (1-C1) The initial increase in demand triggers successive increases of production and income, leading to more demand etc. All these circles together equals the multiplier. The dynamics of adjustments formally describes the adjustment of output to demand over time, as it takes a while for firms to adjust production. Saving is the sum of private saving and public saving. Private saving S = Yd - C so the disposable income minus consumption. This can be rewritten as S = Y - T - C so savings equals income minus taxes (disposable income) - consumption. Public saving (T - G) equals taxes (tax - transfers) minus government spending, which can either result in a budget surplus or deficit, respectively a positive or negative public saving. We know production Y equals demand, which is C + I + G. We can rearrange to find the equation for private saving. Subtract T from both sides and move C to the left, get Y - T - C = I + G - T. The left side is private saving: So S = I + G - T. Thus investment = saving + the government surplus. I = S + (T - G). Saving equals investment: Saving S and public saving T -G. The IS-relation stands for investment equals saving, because what firms invest must be equal what government and people save. So besides production = demand we also have saving = investment in equilibrium. So we know saving S = Y - T - C Income - tax - consumption. We know C is more complex so S = Y - T - C0 - C1*(Y - T) We can rearrange this: S = -C0 + (1 - C1)*(Y - T) The propensity to save is 1 minus the propensity to consume, so (1 - C1), and propensity to save + propensity to consume = 1. In equilibrium the sum of private and public saving must thus equal investment. Thus when we take the saving from above and add T G we get private and public saving. Together, they equal investment. private public When we solve for Y, output, we get the following Which is again the equilibrium When people save more, they consume less, decreasing output. Because saving S = -C0 + (1 - C1)*(Y - T) is a function of income, which again equals on output, saving more will cause consumers to save less: The paradox of saving. In equilibrium, investment equals public + private saving: I = S + (T - G) because I, G and T are exogenous our saving cannot change in equilibrium condition. In the long run however, saving is possible of course. Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 4 - Financial markets Money is used for transactions and pays no interest: Either currency or deposit accounts. Bonds pay a positive interest i, but can’t be used for transactions. The proportion you should choose between holding money and bonds depends on 2 things: -Your level of transactions: Enough money to live, not having to sell bonds for groceries. -Interest rates on bonds: More interest means holding more bonds. Money market (mutual) funds pool funds of many people and buy (government) bonds. The demand for money in an economy, M’d, depends on the overall level of transactions and interest rate. The overall level of transactions is roughly equal to the nominal income. So we can write M’d = $Y (which is the nominal income) * L(i) which is a decreasing function of the interest rate. The - sign means L(i) has a negative effect on the demand for money: Higher interest means lower demand for money. This is shown on the right: For a given level of nominal income, the demand for money is downward sloping: With higher interest, demand is lower. When looking at the supply of money, first we assume there’s only currency, supplied by central banks. In the real world there’s also deposit accounts supplied by banks, but we disregard this for now. Supply is M’s, and in equilibrium supply equals demand: For a given supply M’s, a income Y and interest rate i, equilibrium occurs at point A. Let’s say nominal income increases to Y’, which increases the level of transactions thus increasing the demand for money at any interest rate. The demand curve shifts out right, increasing equilibrium to A’ and interest rate to i’. An increase in nominal income leads to an increase in interest because the demand for money exceeds supply at the initial interest rate. The increased i decreases the money people want to hold, re-establishing the equilibrium demand so it again equals supply. An increase in supply on the other hand leads to a decrease in the interest rate; this increases demand for money, so it equals supply. A central bank changes money supply by buying or selling bonds. If it buys bonds and pays for them by creating money, it increases M’s. If it sells bonds and removes the money it receives from circulation, it decreases supply. These are open market transactions because the central bank influences money supply in the open market for bonds. Let’s take the balance sheet of a central bank. Its assets are the bonds it holds in its portfolio, its liabilities are the stocks of money in the economy. Open market operations lead to equal changes in assets and liabilities. An expansionary open market operation increases money supply: It buys 1 million worth of bonds and thus increases its assets, while also increasing the amount of money in the economy, its liabilities. A contractionary open market operation decreases the money supply, by selling 1 million worth of bonds and thus decreasing its assets. This contracts 1 million worth of money from the economy, which it will then destroy, decreasing its liabilities and money supply. Let’s take a one-year bond of $100, meaning a promised payment of $100 one year from now. If you buy the bond for a price $pB today and hold it for a year, the rate of return is (100 - $pB) / $pB The rate of return is the interest rate, thus the interest rate: If the price is $90, the interest rate is 100 - 90 = 10 / 90 = 11,1% So the interest rate is what you get one year from now minus what you pay for the bond today, divided by the price of the bond today. Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 Thus for a one year bond paying $100 with a given interest rate we can figure out the price: The price equals the final payment divided by 1 + the interest rate. The higher the interest rate, the lower the price today. If bond markets go up, the price of bonds goes up, meaning interest goes down. With an expansionary open market operation, the central bank thus buys bonds increasing money supply and increasing bonds prices. This in turn decreases bonds’ interest rate. A contractionary open market operation will decrease money supply, decreasing bonds’ price and increasing bonds’ interest rate. In practice, central banks choose an interest rate, deciding to increase it by decreasing money. Besides currency, money is also supplied by private banks: Deposit accounts. Financial intermediaries are institutions that receive funds and use these to buy financial assets or make loans. Their assets are the financial assets they own + loans they made, their liabilities are what they owe to those they received funds from. People and firms can at any time withdraw funds or use a debit card to pay with what’s in their account, meaning a banks’ liabilities equals the value of their deposit accounts. Banks hold reserves: To make sure there’s enough cash for people to withdraw, and regulations require them to hold a certain proportion of their deposit accounts in reserve. Of the banks’ assets that aren’t reserves, roughly 70% are loans and 30% are bonds. Central bank money is the money it has issued, and these are a central banks liabilities. Not all this central bank money is held by the public as currency: Some is used as reserves by banks. The demand for central bank money = demand for currency by the public + demand for reserves by banks. Supply of central bank money is under the central banks’ control, and the equilibrium interest rate is such that supply of central bank money and demand are equal. The demand for central bank money consists of currency demand by the people and reserves by banks. For simplicity, we assume people only hold deposit accounts, so the demand for deposit accounts is given by M’d = $YL(i), meaning demand for deposit accounts will go down when interest goes up, and goes up when transactions goes up. The larger the amount of deposit accounts, the more reserves banks must hold. If we let the greek letter theta denote the reserve ratio, the demand for reserves by banks H’d = So the demand for reserves is proportional for the demand to deposit accounts, and the amount for deposit accounts in turn depends in interest and nominal income. Demand for central bank money, equivalently demand for reserves by banks, is equal to the the reserve ratio times the demand for money by people. H is the supply of central bank money, H’d demand. In equilibrium the 2 are equal so: The demand for central bank money is given, for a given level of nominal income. As interest is higher, demand is lower as people hold less deposit accounts and more bonds, thus banks need less reserves. Again, decreases in money supply will increase interest, while increased money supply decreases interest rates. By controlling the supply of central bank money, central banks determine bonds’ interest rates. In the US, the Federal Reserve determines interest by adjusting central banks money supply. In Europe, the ECB sets a refinancing rate (refi) at which banks borrow from the ECB when short on funds: They thus directly set a interest rate which influences the rates banks charge their own costumers. In the US the Fed intervenes in the Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 federal funds market, the ECB sets the rate at which banks borrow directly. Decreasing the interest rate hits a zero lower bound; a central bank can’t decrease interest below 0%, the liquidity trap. While people want to hold more money as interest rate decreases, when it hits zero people become indifferent between holding money and bonds. They want to hold at least the amount they need for transactions, and from there the demand for money becomes horizontal: Because bonds and money pay the same interest they’re indifferent. When interest rates are 0, increasing the money supply won’t have any effect: The rates remain 0. When interest rates are 0, banks too are indifferent between holding reserves and bonds: Both pay 0, so when interest rates are 0 and the central bank increases money supply, banks will hold more reserves and people more deposit accounts. 5 - The IS-LM model Remember that production Y equals demand Z, and Y = C(Y-T) + I + G We assumed that interest doesn’t affect demand and mainly investment I. Investment primarily depends on the level of sales of a firm (low sales means little investment) and the interest rate. These two effects are captured in the equation: Here, investment depends positively on production and negatively on interest. Because we assumed there’s no inventory investment, production equals sales. The new equilibrium becomes this. This is our expanded ISrelation, we can now look what happens to output when interest rate changes. An increase in output leads to an increase in demand both through its effect on income and investment. The demand relation ZZ equals output at point A, where the equilibrium level of output Y is given. When interest rates change, increasing to i’. This leads to lower demand and lower investment, making ZZ intersect at point A’ where equilibrium output is Y’. We can find equilibrium output for any value of interest rate, corresponding higher i with lower Y. This relation is the IS curve: The relation between interest and output, represented by a downward sloping curve. The IS curve can be shifted by taxes: When T increases, Y decreases, shifting the IS curve inwards. The same is true for G or consumer confidence. Returning to financial markets, where nominal income and interest rates determine the demand for money. Income positively, interest negatively. Supply M we’ll take as determined by the CB. Now lets rewrite it as a relation between real money (in terms of goods), real income (in terms of goods) and interest rate. Remember: nominal GDP = real GDP * GDP deflator $Y = YP Real GDP = nominal GDP / GDP deflator Y = $Y/P So nominal income divided by the price levels equals real income Y. Dividing both sides of the money supply equation gives: So real money supply (in goods) depends on real income, and interest. This is the LM- Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 relation: A relation between the liquidity preference (the amount of currency people want to hold) and the money supply. In deriving the LM curve, we can either take monetary policy as a choice of M, money stock, or i, interest rate. Lets say we think of monetary policy of choosing nominal money supply and thus through M/P, the real money stock. If real incomes then increase, interest rates must also increase in such proportion that money demand remains equal to supply: The increases interest rates must offset increased income so that the money stock remains equal to demand. For a given money supply, increased income leads to increased interest. This is the traditional thought: The central bank chooses the money stock and lets interest rates adjust. In reality, central banks choose an interest rate they want to achieve and adjust money supply to achieve this. This makes the LM curve simple, namely horizontal at a chosen level of interest by the central bank. The IS-relation follows interest rates and output, determining the goods-market equilibrium. The LM-relation follows interest rate and output, determining the financial market equilibrium. Equilibrium in financial markets is along the LM curve, equilibrium in goods market along the IS curve. Both markets are in equilibrium at point A. When governments engage in fiscal contraction or consolidation they reduce budget deficit, contrary to a fiscal expansion. They increase taxed but keep G constant. This has no effect on the financial markets, but does decrease disposable income, either by reducing G or increasing T. The decreased Y shifts the IS curve inwards, because it decreases both consumption and investment. Now, suppose the central bank decreases i by increasing money supply M: A monetary expansion, contrary to contraction or tightening. This won’t shift the IS curve, but it will change the LM curve: This will decrease. When i is lower, both investment and output/demand increase, increasing both consumption and investment without the IS line itself shifting. Fiscal policy, taxes, and monetary policy, interest rates and money supply can be used together in a monetary-fiscal policy mix, or simply policy mix. E.g. in a recession, both can be used in the same direction: Expansionary fiscal policy (decreasing T) shifts the IS curve outwards. Expansionary monetary policy (interest rate decrease) shifts the LM curve down. These both lead to higher output. Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 6 - Financial markets II Nominal interest rates are expressed in currency: E.g. one year government bonds 4,2% means every euro now is worth 1,042 euro’s a year from now. If the nominal interest rate for year t is i’t, borrowing one unit this year requires paying 1 + i next year. Real interest rates are expressed in terms of goods. Real interest for year t is r’t, so borrowing one basket of goods now requires you to pay 1 + r’t baskets next year. The one-year real interest rate R’t = Where 1 + r’t is the real interest rate. This thus equals (1 +i’t), which is the nominal interest rate. P’e t + 1 denotes the expected price of goods next year. P’t is the current price. So basically the real interest rate is the nominal interest rate * (current prices / expected future prices). We denote the expected inflation between t and t+1 by Pi’e t+1. The expected rate of inflation equals the expected change in euro price / euro price of this year. We can place this formula in the formula for the real interest rate: Real interest rate = Nominal interest rate / expected rate of inflation So 4% nominal interest rate and 3% inflation means real interest rate is 1,04 / 1,03 = 0,97% A less exact measure is the following: This would give 4 - 3 = 1% When expected inflation equals 0, nominal and real interest rates are equal. In the IS relation, what matters for consumption and investment is the real interest rate, whereas the CB sets the nominal interest rate. To set the real interest rate that it wants, it must account for expected inflation. Real interest = interest - inflation Again comes the liquidity trap: Real interest rate can not be lower than the negative of inflation, because nominal interest rate can’t be lower than 0. Thus r = i - inflation implies that when i = 0, the zero lower bound the CB can set, real interest R = -inflation. Bond holders require a risk premium to compensate for the risk of default. The higher this probability for default, p, the higher the premium and thus the higher the interest rate. i is the nominal interest rate on a risk-less bond, i + x on a risky bond. To get the same expected return the following equation must hold: The left hand side is the return on a risk-less bond. With the probability 1 - p of no default, and the interest of the bond (1 + i + x). So the decrease because of p should equal the increase because of x, offsetting the risk p with a premium x, making the return equal for both types of bonds. Rearranging gives: So the risk premium = the interest rate times the change for default / the change of payment. If the interest rate on a risk-less bond is 4% and probability of default p = 2%, the risk premium x = 1,04*2 / 0,98 = 2,1% is the risk premium. Apart from direct finance, borrowing directly to the ultimate lenders, much takes place through financial intermediaries who receive their funds from investors and lend these to others: E.g. Banks, mortgage companies, and hedge funds. Consider a bank with 100 assets, 80 liabilities and capital 20. The liabilities may be demand deposits and interest-paying deposits. The assets may be reserves (central bank money), loans, and government bonds. The capital ratio is capital / assets so 20%. The leverage ratio is assets to capital, so 5. This is the most important relationship. A higher leverage ratio means higher profit but also higher risk of bankruptcy. If the expected rate of return on assets is 5% and return on liabilities 4%, it has a expected profit of 100*0,05 - 80 *0,04 = 1,8. This is 1,8/20 = 9% profit per unit of capital. If the capital ratio wouldn’t be 20 but 10, the expected profit per unit of capital would be 14%: Higher leverage is higher profit per unit. The downside is that higher leverage implies a higher risk that assets become less valuable than liabilities, making a bank insolvent. Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 If investors doubt banks’ assets, they will take their funds out of the bank. The bank needs funds to repay investors, but asking money back from borrowers is hard, and selling loans to other banks means selling them at fire sale prices, far below their value because of difficulties to assess it’s quality. For demand deposits, against which cheques can be given out, is vulnerable to bank runs forcing them to close. The shortage in cash is liquidity, and the lower the liquidity of assets, the higher the risk of fire sales and insolvency leading to bankruptcy. Narrow banking restricts banks to holding liquid and safe government bonds. This means not banks but financial intermediaries now make loans, shifting the problem but not solving it. The federal deposit insurance guarantees demand deposits to a certain ceiling meaning people don’t have to redraw their cash when fearing default. This risks moral hazard as banks leverage more. Another solution is liquidity provision where central banks lend to a bank against the value of its assets, avoiding fire sales so the may weather a bank run. The IS-LM model had one interest rate, determined by the central bank. We now know there’s nominal and real interest rates, and the policy rate set by the CB differs from those faced by borrowers. This makes the new IS equation: LM stays the same, controlling nominal interest rate. In IS, the presence of expected inflation Pi’e, and risk premium x are now present. Spending decisions depend on the real interest rate r = i - Pi’e, nominal minus inflation, rather than the nominal rate. And x captures worries about liquidity and solvency. So the interest rate in the LM equation, i, no longer equals that of the IS relation, r + x. The policy rate is the nominal rate of the LM equation, the borrowing rate is the IS rate. Because CB can choose the nominal i to achieve the desired real interest r, we rewrite it: So the CB chooses the real policy rate r, but the real interest rate relevant for spending decisions is the borrowing rate: R + x: nominal interest + inflation + risk premium. Again, the CB faces the zero lower bound and a liquidity trap. In the case on the right, it decreases policy rate enough to offset the decrease in spending because of the IS shift. It sets the nominal rate at a low enough level that the real policy rate actually becomes negative, stimulating spending. Because the real policy rate can never be larger than the negative of inflation, it faces problems when inflation is low. If inflation is 0,5%, it can’t decrease the real interest rate below -0,5% and may be unable to stimulate the economy. The Case-Shiller index maps the US housing prices. The low interest rates of the 2000s pushed up demand for houses. Mortgage lenders engaged in subprime mortgages, lending to risky borrowers. When house prices started going down in 2006 their mortgage often became underwater (mortgage value exceeding house value). As borrowers defaulted, lenders made losses. Banks were highly levered because they underestimated the risk. Their managers were enticed to go for high returns, and financial regulation was avoided through structured investment vehicles. These SIVs didn’t appear on banks balance sheet and didn’t require banks to hold capital. When these SIVs dropped in value like housing prices, banks guarantee to provide funds for SIVs meant questions arose about the solvency of banks themselves. In the 90s and 00s securitisation grew: The creation of securities based on a bundle of assets, to diversify portfolio of mortgages away from one particular part of the country for example. Mortgage-based security MBS is a title to the returns from a bundle of mortgages, increasing supply of funds and again decreasing the cost of borrowing. Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 Senior securities have first claim on the returns from the bundle, junior securities get what’s left. Collateralised debt obligations CDOs are very risky junior securities. Securitisation meant that banks sold mortgages instead of keeping them on their balance sheet. This meant they no longer had incentives to make sure the borrower could repay. Rating agencies missed this risk, because MBSs were hard to asses. These became known as toxic assets, and only sellable at fire sale prices. In the 90s and 00s banks more and more depended on borrowing from other banks and investors than demand deposits. Wholesale funding is financing the purchase of assets through short termdebt from other banks/investors. Structured Investment Vehicles were entirely funded through this. Although holders of demand deposits were protected by deposit insurance, investors weren’t. When they worried about the value of assets held by the banks or SIVs, the redrew their funds. High leverage, illiquid assets and liquid liabilities resulted in a major financial crisis. Banks stopped lending to each other or to anyone else, transforming it into a macroeconomic crisis. This increased interest rates at which people and firms could borrow (decreasing investment), and decreased confidence leading to decreased consumption. Some European banks were exposed to the US housing market through Mortgage Backed Securities and Collateralised Debt Obligations they owned: Securities whose underlying assets were US housing mortgages. Trade decreased because of less trade credit provided by banks and less consumption. The US interest rates spilled over to the European market as well. In the IS-LM model, the IS curve shifted inwards. Policy responses included increasing federal deposit insurance, and the Fed put in place liquidity facilities to borrow from the Fed. It increased the set of assets institutions could use as collateral, the assets a borrower pledges when borrowing from a lender. The government introduced the Troubled Asset Relief Program to increase banks’ capital: The government acquired shares and thus provided funds for large US banks. From 2007 the Fed decreased the policy interest rate, until it hit 0 in 2008. It then turned to unconventional monetary policy, buying other assets to directly affect the rate faced by borrowers. Fiscal policy included the American Recovery and Reinvestment act with tax reductions and spending increases. The budget deficit skyrocketed to 9% of GDP in 2010. Europe started cleaning up banks’ balance sheets much later, and the ECB didn’t start unconventional monetary policy until 2015. It’s buying government bonds. Fiscal policy depended on each country’s room for expansionary policy: The higher the debt at the start of the crisis, the less room a country has for increasing government spending to offset the shift of the IS-curve. This meant countries like Italy were unable to stimulate their economies. 7.1-The labour market The population of working age are potentially available for employment, the labour force is those working or looking for work, while the rest is out of the working force. The participation rate is the ratio of labour force to the population in working age. The unemployment rate is the ratio unemployment to the labour force. For a given unemployment, a labour market can either be very active or sclerotic. Flows between 3 groups are recorded: Out of the labour force / unemployment / employment. There are 3,7 million separations, 3 million of which are job changes, the other people moving out of the labour force or becoming unemployed. 80% are quits, leaving a job for an alternative, and 20% are layoffs. Because we’re looking at monthly figures, we can calculate the duration of unemployment. There’s 1,7 million unemployed, if we divide this by the amount of people Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 leaving unemployment each month through either dropping out of the labour force or employment, we find the average amount of months people spend unemployed. Many out of the labour force are discouraged workers who will take a job if they can find one, which is why economists sometimes focus on the employment rate: The ratio of employment to the population available for work. When unemployment is high, workers face 2 problems: Employed workers have a higher change to lose their jobs & unemployed have a lower change at finding a job, expecting to remain unemployed for longer. Wages can be set through collective bargaining, between firms and unions, but usually through individual bargaining. 2 facts stand out across institutionally different countries: -Workers are typically paid higher than their reservation wage, the wage that would make them indifferent between work and unemployment. -Wages are higher when unemployment is lower. Bargaining power depends on how costly it is for the firm to replace a worker, and how hard it is for the worker to find another job. So it depends first on the nature of the job; how much skills are required. Second, it thus depends on the labour market conditions; low unemployment means stronger bargaining power for employees. When workers are indifferent (reservation wage) their productivity won’t increase. Efficiency wage theories are theories linking productivity/efficiency of workers to their wage. A low unemployment makes it more attractive for workers to quit, thus meaning firms have to increase wages to kook them. The aggregate nominal wage W depends on the expected price level P’e, the unemployment rate u, and a variable Z. Higher unemployment decreases wages, while the other variables have a positive effect. Workers don’t care about their nominal wage, but about the goods they can buy with it. Not W, but nominal wage / price of goods is important: W / P. Firms too care about the wage they pay relative to the price they receive for their goods: They’ll receive more money and are thus willing to pay more. The variable Z is a catch-all variable, e.g. unemployment insurance: The payment of unemployment benefits to workers losing their job. Workers are willing to accept any wage, no matter how low, if there’s no alternative income. Thus unemployment insurance has a positive effect on W: Wages increase with higher benefits. Minimum wage increases too increases wages, as does employment protection which makes it harder to lay-off workers. This increases their bargaining power. The prices set by firms depend on their costs, depending on production function. If we assume the only factor of production is labour, we can write the production function Y = AN Y is output, N is employment and A is labour productivity (output per worker). If we assume labour productivity to be constant, Y = N, thus only depending on the employment. P = (1+m)W takes into account the mark-up m. If markets are perfectly competitive there’s no markup and prices equal costs W. If we divide both sides of the wage determination by price level we get: The higher the unemployment rate, the lower the real wage chosen by firms. This wage-setting relation is drawn on the right. The price determination was P = (1 + m)W, so the cost of labour + the markup firms charge. If we divide both sides by the wage level W, we get: The ratio of the price level to the wage implied by the price-setting behaviour of firms equals one plus mark-up. Reversing this, we get the following: Thus, the real wage (W / P) is related to Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 the prices set by firms. An increase in mark-up leads firms to increase their prices, this is the price setting relation drawn in the figure above. Both the price setting relation, the real wage equals the prices set by firms, and the wage-setting relation, real wages are dependent on unemployment and other factors, are drawn in this figure. The equilibrium between both is given by: The equilibrium unemployment rate U’n, is such that the real wage chosen in wage setting is equal to the real wage implied by price setting. This is the natural rate of unemployment: The unemployment at which the real wage of price setting is equal to the real wage at wage setting. There’s nothing natural about it though: If we increase unemployment benefits, we increase wage, shifting op the WS curve as seen on the right. This will change the natural rate of unemployment, increasing it to U’n. If we decrease antitrust regulation, the markup m will increase thus increasing prices and decreasing real wage. This will shift down the PS curve to PS’, increasing the natural rate of unemployment to U’n. Because it turns out to not be natural but rather a result of the structures of the economy, the structural rate of unemployment would be a better name. For a given production function and labour force, the employment rate determines the level of output. So associated with a natural rate of unemployment is a natural level of output. In the short run however, the price level is often different from what the wages were set at. Thus in the short run output is still determined by monetary and fiscal policy mostly. In the medium run, the factors determining unemployment and output are indeed the wage level and the markup. 8 - The Phillips curve A.W. Philips found a clear negative reaction between inflation and unemployment: When unemployment was low, inflation was high. It was later labelled the Phillips curve, and implied a country could choose between high inflation and high unemployment. In the 70’s however, both high inflation and high unemployment appeared in most OECD countries, and a new relation appeared: Between the unemployment and the change in inflation rate. The nominal wage W depends on the expected price level P’e (positively), the unemployment rate (negatively) and the variable Z (e.g. benefits and bargaining). The price set by firms P is equal to the nominal wage W + the markup. Replacing the nominal wage W by its expression we get: We see that the real price level is a function of the expected price level. If the expected price increases, the wage increases. Because the costs for a firm depend on the wage level, this in turn increases prices. We can give F the following equation: A function of unemployment and other factors. Then we can put it all together to show a function: Price level is a relation between the expected price level and unemployment. Plotting it all as inflation is year t, we get the equation on the left. Inflation is a function of expected inflation, the markup, z, and unemployment. The original Phillips curve made sense in the 60’s, finding a clear relation between low unemployment and inflation. In the 60’s, wage setters calculated expected inflation as given on the left: The expected inflation in a year t is independent of the inflation rate the year before. In 70’s the relation broke down. Wage setters changed the way their expectations about inflation were formed, because it Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com) lOMoARcPSD|222311 became more persistent. Wage setters began taking into account the inflation in the previous year, thus now using the formula on the right. Expected inflation for a year was equal to the first part, again independent off the current inflation, and Pi’t-1, which is the inflation in the current year. Current inflation thus became a variable in calculating expected inflation. The higher Ø, the more important current inflation became. By 1975, people roughly assumed inflation in next year would be equal to current inflation. Thus Ø is equal to 1. Let’s substitute the function of expected inflation Pi’e into the determination of inflation. When Ø is equal to 0, we get the original curve: The relation between merely inflation and unemployment remains. When Ø is positive, last year’s inflation becomes a factor in next year’s inflation. As Ø becomes really large and eventually equal to 1, we get the following equation (after moving last year’s inflation to the left): The change in inflation (Pi’t - Pi’t-1) is a result of the markup, z, and unemployment. High unemployment doesn’t determine the inflation, but the change in inflation. Low unemployment doesn’t immediately mean high inflation; it just means an increase in inflation. This is what happened in the 70’s: As Ø increased to 1, people started taking into account last years inflation and the relation between unemployment and inflation disappeared. It was replaced by a relation between the unemployment rate and the change in inflation rate. This is shown on the right: The red line is the equation on the left. The change in inflation is roughly 3% - 0,5* unemployment. Thus when unemployment is higher than 6%, inflation will decrease. This is also known as the modified Phillips curve, the expectations-augmented Phillips curve, or the accelerationist Phillips curve (Because low U accelerates inflation). Because it is simply right, we call it the Phillips curve, and the original Phillips curve is the one with inflation being a result of U. The natural rate of unemployment u’n is the rate at which expected inflation is equal to inflation, thus the left side of the equation becoming 0. Solving this for u’n gives the next equation. Thus, the higher the markup or other factors affecting wages Z, the higher the natural rate of unemployment. Rearranging a bit gives the equation on the left. The change in inflation depends on the difference between the actual and natural unemployment rate. When the actual unemployment rate is higher than the natural unemployment rate, inflation will decrease. When unemployment is lower than natural, inflation increases. Thus the natural rate of unemployment is also the unemployment rate needed to keep inflation constant; the non-accelerating inflation rate of unemployment NAIRU. So we know the natural rate of unemployment depends on the markup and Z. The European average of 10% in the past 25 years, whereas inflation hasn’t decreased consistently. So this appears to be the natural rate. Europe’s labour market rigidities are often blamed for this. The generous system of unemployment insurance, employment protection, minimum wages and extension agreements: A agreement by a subset of firms and unions can be extended to the entire sector. This means even non-unionised firms are included in collective bargaining, increasing unions’ bargaining power because they don’t have to compete with non-union firms. Distributing prohibited | Downloaded by David Seidell (davidseidell@hotmail.com)