Main ideas of Macroeconomics

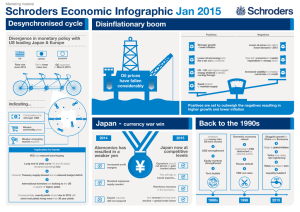

advertisement

Main ideas of Macroeconomics Introduction • 3 main ideas, output, money and expectations. They have relationships between them. • Macroeconomic theory provides us with a baseline against which to compare and assess reality and, more broadly, with a framework for understanding economic events. Introduction • The basic principles and relationships help to shed light on a surprisingly broad range of things, many of which shape the business environment and affect the relative risks and rewards of decisions that all of us make every day. Output • The goods and services produced in an economy. • Determines a countries level of prosperity • Gross domestic product. • GDP = the total value of all final goods and services produced in a country in a given year Money • Money is critical for facilitating the exchange of goods and services within an economy. • influences interest rates, exchange rates, and inflation • An increase in money supply decreases interest rates, causes the exchange rate to depreciate, and increases inflation Money – Nominal and Real • Nominal values are measured in terms of current market prices, whereas real values are measured in terms of constant prices and thus reflect underlying quantities, after controlling for inflation. • A 5 percent increase in real GDP, for example, means that output—the factor that macroeconomists most care about— has increased by 5 percent, regardless of the inflation rate. Money Supply • A central bank's primary tools for influencing the money supply are the discount rate, the reserve requirement, and open market operations e.g. buying and selling government bonds on the open market. • Inflation targeting Tools of Central Banks • Open market operations are the principal tool used by the Federal Reserve to implement monetary policy. They are a powerful and flexible means of fostering conditions in the federal funds market that are consistent with policy objectives. • http://www.federalreserve.gov/monetarypolicy/b st_openmarketops.htm • https://www.ecb.europa.eu/ecb/educational/eco nomia/html/index.en.html Expectations • Expectations can literally drive reality— particularly in the short run. • If individuals and firms expect inflation, they may actually create it by preemptively demanding wage and price increases. • Negative expectations can prove particularly brutal when they relate to the economy as a whole. Expectations • If business managers suddenly become pessimistic about future demand, they might prepare for "bad times" by canceling investment projects and laying off workers. • Many productive resources are thrown out of work • Real GDP falls, unemployment rises, and prices tend to decline. Managing expectations • Great Depression, real GDP had fallen sharply and unemployment increased rapidly • Keynes recommended aggressive deficit spending (expansionary fiscal policy) • Large deficits would create new demand for goods and services and, as a result, would lead people to revise their expectations upward. As consumers and business managers became more confident, they would increase their own expenditures, helping the economy. Expectations • Another idea is that by cutting expenditures the government can create confidence in their economy and increase investment. • By credibly committing to fight whenever it appears, central banks can help kill off inflationary expectations. Conclusion • Economic relationships that seem perfectly compelling in theory do not always hold in practice. To give just two examples: interest rates do not always fall when money supply rises, and stagnant economies don't always improve in response to deficit spending. • When interpreted well the basic principles of macroeconomics—which draw connections between output, money, and expectations—can prove enormously helpful