中国:传统半导体行业的新前沿(摘要)

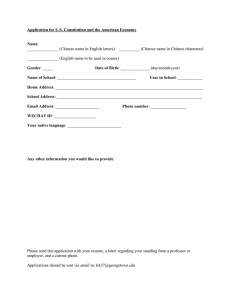

advertisement