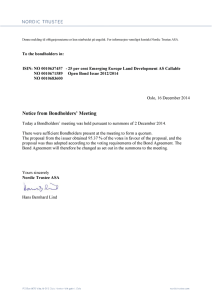

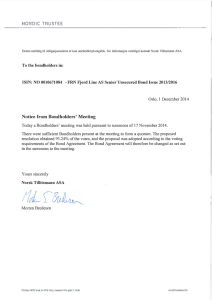

Subsequently amended NOK Bond Terms and

advertisement