Series 7 Addendum

October 2011

This Addendum addresses revisions to the study outline for the Series 7 Examination, effective November 7, 2011.

The number of questions (250) and time allocated (six hours) remains unchanged. However, the minimum

required passing score increases from 70% to 72% (180 questions correct). Each Series 7 Examination

includes 10 additional, unidentified pretest questions that do not contribute toward a candidate’s score.

Therefore, the examination actually consists of 260 questions, 250 of which are scored. The 10 pretest

questions are randomly distributed throughout the examination. Additionally, FINRA will be reducing the

number of questions on municipal securities.

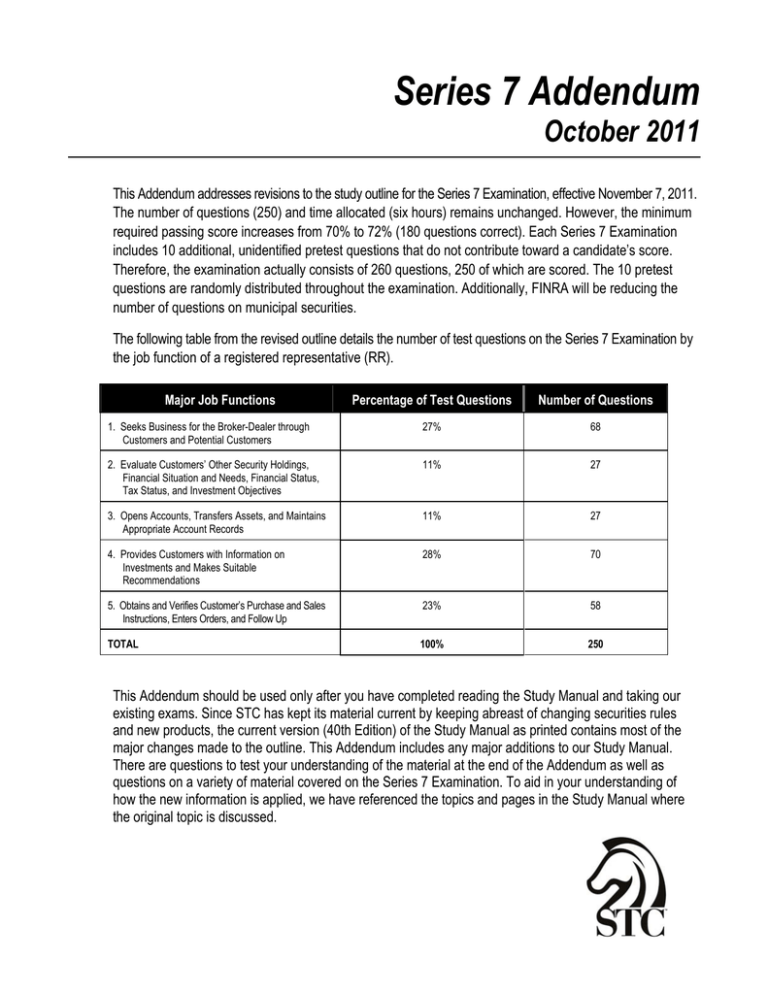

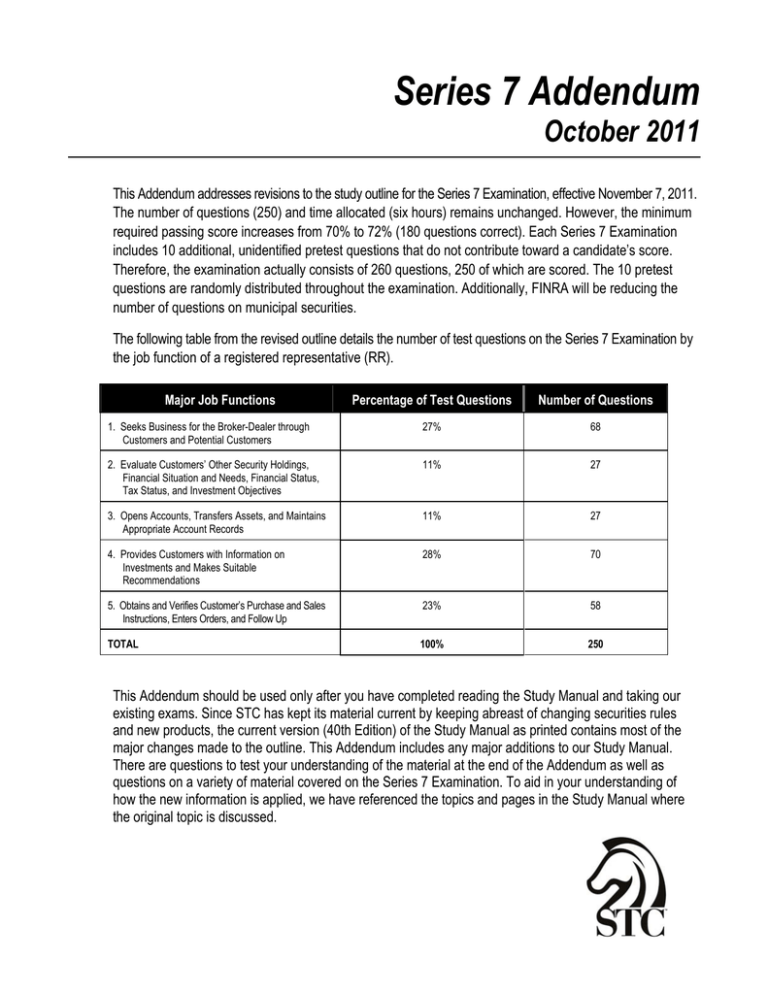

The following table from the revised outline details the number of test questions on the Series 7 Examination by

the job function of a registered representative (RR).

Major Job Functions

Percentage of Test Questions

Number of Questions

1. Seeks Business for the Broker-Dealer through

Customers and Potential Customers

27%

68

2. Evaluate Customers’ Other Security Holdings,

Financial Situation and Needs, Financial Status,

Tax Status, and Investment Objectives

11%

27

3. Opens Accounts, Transfers Assets, and Maintains

Appropriate Account Records

11%

27

4. Provides Customers with Information on

Investments and Makes Suitable

Recommendations

28%

70

5. Obtains and Verifies Customer’s Purchase and Sales

Instructions, Enters Orders, and Follow Up

23%

58

TOTAL

100%

250

This Addendum should be used only after you have completed reading the Study Manual and taking our

existing exams. Since STC has kept its material current by keeping abreast of changing securities rules

and new products, the current version (40th Edition) of the Study Manual as printed contains most of the

major changes made to the outline. This Addendum includes any major additions to our Study Manual.

There are questions to test your understanding of the material at the end of the Addendum as well as

questions on a variety of material covered on the Series 7 Examination. To aid in your understanding of

how the new information is applied, we have referenced the topics and pages in the Study Manual where

the original topic is discussed.

* Add the following to the bottom of page 2-9

A durable power of attorney gives someone else the power to manage the grantor's financial affairs if

that individual becomes incapacitated. A regular power of attorney terminates if the grantor becomes

incapacitated. An RR would need to have a durable power of attorney in order to exercise discretion if

the client becomes incapacitated.

* Add the following on page 3-2, as additional information on Account Instructions

DVP (Delivery versus Payment) and COD (Cash on delivery) are general acronyms used to describe a

relationship in which a client uses a bank to settle trades with executing firms (broker-dealers). The firm

delivers securities against the bank payment and pays against the bank delivery of securities. When

discussing a given transaction, a DVP occurs when the dealer delivers securities to the bank in return

for a cash payment from the bank. An RVP (Receive versus Payment) occurs when the dealer receives

securities from the bank and makes a cash payment to the bank. To summarize, an institutional client is

buying securities in a DVP transaction and selling securities in an RVP transaction. It is important to

remember that clients (usually institutions) set up brokerage accounts and place orders at these firms.

However, trades settle through custodian banks designated by the clients. The broker-dealer will

contact the bank, which will send payment or receive securities on behalf of the clients. The brokerdealer will not hold the client funds or securities.

* Add the following on page 3-4, as additional information on Transferring Accounts

Securities are typically transferred by the National Securities Clearing Corporation (NSCC) using the

Automated Customer Account Transfer Service (ACATS).

* Add the following on page 6-12, as additional information on Other Types of Corporate Bonds

Structured Products Structured products are derivative securities that may be linked to any of the

following underlying (reference) assets: a stock index, foreign currency, commodity, basket of securities,

change in spread between asset classes, single security, or an interest-rate and inflation-linked product.

A structured product is typically built around a fixed-income instrument (a note) and a derivative

product. The note pays a specified rate of interest to the investor at defined intervals. The derivative

component establishes the amount of payment at maturity.

These products are a type of corporate debt that is usually created by most major financial services

institutions and usually registered as securities with the SEC. Structured products are not bank deposits

and are not insured by the Federal Deposit Insurance Corporation (FDIC). This fact should be disclosed

by an RR when offering this product to clients.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

1

* Add the following on page 7-20, before Money-Market Securities

CDOs A Collateralized Debt Obligation (CDO) is a type of asset-backed security. A CDO is issued as a

bond that is backed (collateralized) by a pool of bonds, loans, and various other assets. Ownership of

this type of security is typically in the form of a tranche (slice), with any given tranche from the CDO

carrying a different maturity and risk level. The return an investor can expect from this type of investment is

based on the credit quality of the underlying assets contained in the pool. CDOs are similar in structure

to collateralized mortgage obligations (CMOs). Due to their highly complex nature, CDOs are generally

not suitable for retail investors.

* Add the following on page 8-11, as additional information on Types of Revenue Bonds

Build America Bonds (BABs) Build America Bonds (BABs) are municipal bonds issued under the

American Recovery and Reinvestment Act of 2009 (ARRA). They are designed to assist municipal issuers

in raising funds for certain infrastructure projects. They are issued for capital expenditures, not for

working capital. The interest on these bonds is taxable, but the Treasury offers a tax incentive to either

the issuer or the bondholder depending on whether the bond is a direct pay or tax credit bond. (A

municipality receives a federal tax credit.) The objective is to broaden the appeal (increase the demand)

of municipal securities to taxable fixed-income investors.

Direct pay bonds may be issued by municipalities to raise capital for all the traditional purposes except

for the issuance of private activity bonds or to facilitate refundings. The Treasury will reimburse 35% of

the interest paid on the bonds to the issuer, which helps to defray the costs of borrowing. For example,

if a municipality issues a BAB at a taxable rate of 6.25%, the issuer will receive 2.19% (6.25% × 35%)

annually from the U.S. Treasury. The net amount of interest the issuer would pay is equal to 4.06%

(6.25% - 2.19%).

While Build America Bonds are taxable, they are issued by municipal governments and subject to MSRB

rules. Broker-dealers involved in the underwriting of these bonds must provide official statements, and

all sales activities must be supervised by a municipal securities principal.

Certificates of Participation (COPs) A Certificate of Participation (COP) is a type of lease financing

agreement, typically issued in the form of a tax-exempt or municipal revenue bond. COPs have been

traditionally used as a method of monetizing existing surplus real estate. This financing technique

provides long-term funding through a lease that does not legally constitute a loan, thus eliminating the

need for a public referendum or vote.

* Add the following on page 9-21, as additional information on Exempt Offerings

Regulation S When foreign companies issue securities in their home country, they are of course

subject to any laws that country has in place. However, they would clearly not be subject to U.S.

regulations. What was not so clear for many years was whether and how U.S. laws applied to U.S.

companies issuing securities outside the country. The SEC clarified this situation by issuing Regulation

S. If a company issues securities according to Regulation S, the offering does not need to be registered

under the Securities Act of 1933.

According to Regulation S, a U.S. company may (quickly) issue an unlimited amount of securities outside

the country without filing documentation with the SEC. There are no restrictions as to the type of nonU.S. investors who may purchase the security.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

2

Only a non-U.S. person may buy an overseas offering sold under Regulation S. The investor must not be

defined as a U.S. person. A U.S. citizen who is traveling, or who resides outside the U.S. for a significant

part of the year, would still be classified as a U.S. investor. A U.S. person is defined as any individual

who is a resident of the U.S. as well as any partnership, estate, or account held for the benefit of a U.S.

resident.

An overseas investor who acquires securities pursuant to Regulation S may sell the securities overseas

immediately through a designated offshore securities market (for example, The London Stock Exchange).

There is a distribution compliance period (holding period) of 40 days for debt securities and a one-year

period before an equity security sold pursuant to Regulation S may be resold in the U.S.

* Add the following on page 10-9, as additional information on MSRB Rules

Regulation Regarding Political Contributions (G-37)

The MSRB created rules to deal with the practice known as pay-to-play. This term refers to the practice

of municipal securities dealers making political contributions in order to curry favor with politicians

who might, in return, steer municipal securities underwriting business their way. A political contribution

means any gift, subscription, loan, advance, or deposit of money, or anything of value. Any reimbursement

of debt incurred in a political campaign or payment for transition or inaugural expenses of a successful

candidate is also considered a contribution. The MSRB believes that this practice undermines not just

the integrity of the municipal securities market, but investor confidence in the market as well. Investor

confidence is essential to ensure a healthy, liquid market.

This rule applies to a municipal finance professional (MFP). An MFP is defined as any associated person

of a broker-dealer primarily engaged in municipal underwriting, trading, sales, financial advisory and

consulting services, and research or investment advice on municipal securities. Registered representatives

who recommend municipal securities to retail investors are generally excluded from the definition. An

exception is solicitation of municipal securities business from issuers. Any amount of this activity will

result in the classification of an associated person as an MFP.

Municipal securities firms are prohibited from engaging in specified municipal securities business with

issuers for two years if certain political contributions are made to officials of those issuers. MFPs may

make certain contributions without triggering the two-year ban. If (1) the representative is entitled to

vote for the official and (2) the contributions do not exceed $250 per election, there is no violation.

Interpretations

Since many questions have been raised by municipal securities dealers concerning the application of

this rule, the MSRB has provided firms with guidance by issuing an interpretative notice.

An MFP contributes more than $250 and the ban is triggered. If the MFP leaves the firm, the ban is

still in place. If that MFP is hired at a new firm and is still defined as an MFP, the new firm will also

be prohibited from engaging in negotiated municipal securities business based on the date of the

contribution. If the MFP is hired at a new firm and is not defined as an MFP, the two-year ban

would not apply to the new firm.

A person contributes $200 while employed as an MFP at Dealer A. Three months later the same

person contributes another $200 to the same candidate while now employed as an MFP at Dealer B.

The two-year ban would apply only to Dealer B.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

3

A two-year look-back period applies to municipal finance professional contributions. If an individual is

not an MFP and has made contributions to a political candidate that would have resulted in a

violation, the firm that employs the individual would be subject to the underwriting ban if the

individual is employed in the role of an MFP within two years of the contribution.

If the contribution to the political candidate is made from a joint checking account, the contribution

would be viewed as split evenly by the contributors, and the contribution limit would apply.

Therefore, if the check from the joint account exceeds $500, a violation would occur. If the check is

signed only by the MFP, the entire amount is attributable to the MFP. If the spouse of an MFP made

a contribution by writing a check from a personal (rather than joint) account, the contribution

would not be viewed as originating from the MFP. In this case, there is no limit on the amount the

spouse may contribute under this MSRB rule.

* Add the following on page 12-3, as additional information on the Inside Market

The SEC Order Handling Rules require that a customer's limit order be displayed in a market maker's

quote if it improves that quote. Improving the quote is defined as either a buy order higher than the

market maker’s bid or a sell order lower than the market maker’s offer. This is true even if the customer's

order does not improve the inside market. For example, if the market maker’s quote is 20.25 – 20.85 and

the market maker receives an order from a client who wants to buy stock at 20.35, the market maker

must display the customer’s limit order price in its quote.

* Add the following on page 12-7, as additional information on Regulation NMS

According to Regulation NMS, broker-dealers are prohibited from accepting bids, offers, or indications

of interest for NMS stocks priced at $1.00 or more, in increments smaller than $0.01 and, for NMS stock

less than $1.00, in increments smaller than $0.0001 (a hundredth of a penny). The RR is not permitted to

accept an order to buy or sell in sub-pennies (more than two decimal places) if the stock is trading at or

above $1.00.

* Add the following on page 12-8, as additional information after The Fourth Market

Dark Pool A dark pool is a source of liquidity for large institutional investors and high-frequency

traders and this system would not disseminate quotes. The system can be operated by broker-dealers or

exchanges, and allows these investors to buy and sell large blocks of stock anonymously. The objective

is to allow these investors to trade with the least amount of market impact, with low transaction costs.

Some dark pools provide matching systems and can also allow for participants to negotiate prices.

* Add the following to the bottom of page 12-9

OATS The Order Audit Trail System (OATS) enables FINRA to effectively review market activity in

regard to customer orders within a member firm, to conduct surveillance, and to enforce rules. OATS

records the life of an order from receipt, to routing, to modification if applicable, and then to either

cancellation or execution.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

4

TRACE TRACE is a reporting system that was created to provide greater transparency in the corporate

bond market. It is not a quotation or an execution system. Broker-dealers provide quotes and will

execute transactions in corporate bonds. FINRA disseminates bond transaction information for

publicly traded, TRACE-eligible securities (which include investment-grade, non-investment-grade

bonds, and debt securities issued by a government-sponsored enterprise). Although transactions for

securities issued under Rule 144A are reported to TRACE, the information is not disseminated. There is

no regulatory quote or execution system as there is for equity securities.

* Add the following on page 12-14, as additional information on Industry Rules and Regulations

Business Continuity Plan FINRA requires that members have plans in place if the unexpected occurs.

Broker-dealers must establish a written business continuity plan that will identify procedures to be

followed in the event of an emergency or significant business disruption. These procedures must

provide that all customer obligations be met, and must address the firm’s existing relationship with

other broker-dealers and counterparties. The plan must be reviewed annually in light of any changes in

the firm’s business structure, general operations, or location.

FINRA also requires each member firm to provide to the regulator by means of an electronic process, or

other means as FINRA may specify, prescribed emergency contact information, which must include the

designation of two emergency contact persons. At least one of these individuals must be a member of senior

management and a registered principal of the member firm. If the second contact person is not a registered

principal, she must be a member of senior management who has knowledge of the firm's business

operations. The rule also specifies that both emergency contact persons must be associated persons of the

member firm. In the case of a small firm with only one associated person (e.g., a sole proprietorship

without any other associated persons), the second emergency contact person may be either a registered

or nonregistered person with another firm who has knowledge of the member firm's business operations.

Possible candidates for this role include the firm's attorney, accountant, or a clearing firm contact.

* Add the following on page 12-18, as additional information on Research Reports

Under Regulation AC, a research analyst must certify that her research report accurately reflects her

personal views. The analyst must also disclose whether she received compensation for her specific

recommendation. Under this rule, broker-dealers are also required to obtain periodic certifications by

research analysts regarding public appearances (attesting that a statement was made regarding the

views she expressed being her own and a written certification documenting that she did not receive

compensation to make positive comments).

* Add the following to the bottom of page 12-19

Borrowing and Lending Practices with Customers

Registered individuals may not borrow money from, or lend money to, a customer unless certain

conditions are met. These conditions include implementing written procedures permitting such

activity and satisfying any one of the following provisions.

1. The customer and the registered person are immediate family members.

2. The customer is a financial institution regularly involved in the business of extending credit or

providing loans.

3. Both parties are registered with the same firm.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

5

4. The loan is based on a personal relationship between the customer and the registered person.

5. The loan is based on a business relationship independent of the customer-broker relationship.

If the conditions indicated in provisions 3, 4, or 5 prevail, the firm must approve the lending activity prior to

the execution of the loan.

* Add the following on page 12-27, as additional information on Secondary Market Trading of

Municipal Securities

RTRS The Real-Time Transaction Reporting System (RTRS) is operated by the MSRB and is open each

business day from 7:30 a.m. to 6:30 p.m. Unless an exception is available, all transactions in municipal

securities must be reported within 15 minutes of the time of the trade. Any transaction effected outside

the hours that RTRS is open must be reported no later than 15 minutes after the beginning of the next

business day.

EMMA The MSRB has established the Electronic Municipal Market Access (EMMA) system as the primary

market disclosure service for official statements, other related primary market documents, and

information. The EMMA Web site can receive documents from issuers and underwriters and provides

access free of charge to the public. The EMMA system also contains information related to the continuing

disclosure requirements submitted by municipal issuers and secondary market transactions submitted

by municipal securities dealers. EMMA receives transactional information from the MSRB’s Real-Time

Transaction Reporting System.

* Add the following on page 12-29, as additional information on Bond Buyer Indexes

The Bond Buyer Municipal Bond Index is based on the prices of 40 recently issued long-term general

obligation and revenue bonds. The index is calculated by taking the price estimates and adjusting them

to a 6.00% coupon. The index is published daily and serves as the basis for a futures contract (which is

no longer traded).

* Add the following to the end of Chapter 13 (Margin Chapter)

Portfolio Margin

Chapter 13 of the Series 7 Study Manual discusses strategy-based margin where the margin requirement is

based on the type of investment strategy pursued by the client. Portfolio-based margin (when compared to

strategy-based margin) is a more accurate way to evaluate risk since it is based on the total portfolio of

the client. This approach takes into consideration both long and short positions held in the client’s

account. For example, in a strategy-based margin account, a stock bought at $30 that is hedged by the

purchase of a put with a $25 strike price would be evaluated as two separate strategies. The amount at

risk (the maximum loss) is calculated for each strategy. The client’s net margin requirement would not

be based on the reduced loss potential of the hedged position. Portfolio margining takes this simple

hedging concept one step further by evaluating the net risk of all the positions held in a given account.

Margin is calculated based on the net risks of the eligible instruments in a customer’s account. This is a

more sophisticated way of gauging the client’s position, based on the overall level of risk in the account.

It permits a better alignment of margin requirements based on the net risk of the entire portfolio. For

that reason, portfolio margining is sometimes referred to as risk-based margining.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

6

Eligible Participants Portfolio margin is not available to small retail clients. The following entities are

permitted to engage in portfolio margining.

1. Any broker or dealer registered with the SEC under the Exchange Act

2. Any member of a national futures exchange to the extent that listed index options, unlisted

derivatives, ETF options, index warrants, or underlying instruments hedge the member’s index

futures

3. Any person approved to engage in uncovered option contracts. If a customer wants to trade

unlisted derivatives, the customer must maintain equity of at least $5,000,000 at all times. Prior to

offering a portfolio margining methodology, a broker-dealer must develop a profile of customers

who will be eligible to use it. The broker-dealer must put in place an approval process and

implement minimum equity requirements for customers eligible to use portfolio margining.

Risks of Portfolio Margining and Disclosure The benefit of portfolio margining is that clients

typically have lower margin requirements. Nevertheless, portfolio margining may expose them to

unexpected risks, due to the greater leverage afforded. If an account falls below the minimum

maintenance margin, all calls must be met within three business days. FINRA requires that customers

using a portfolio margin account receive a disclosure statement and sign an acknowledgement form

prior to their initial transaction.

This statement must describe the special risks associated with portfolio margin accounts that include

the following liabilities.

Portfolio margining normally allows for greater leverage in an account that may lead to larger losses

in the event of adverse market movements.

Because the maximum time for meeting a margin deficiency is shorter than in a standard margin

account, the risk is greater that a customer’s portfolio margin account will be liquidated involuntarily.

* Add the following on page 13-20, as additional information on Margin Requirements for

Other Securities

Special Maintenance Requirements on Leveraged ETFs Exchange-Traded Funds (ETFs) are securities

that resemble index mutual funds but trade throughout the day. Some of these products are constructed to

employ leverage with performance double or triple the underlying index. Due to this inherent leverage,

these products have special maintenance requirements in excess of the typical SRO thresholds of 25% on

long positions and 30% on short positions. The margin requirement on these securities can be computed

by multiplying the portfolio leverage factor by the standard SRO maintenance requirement. For example, a

double long portfolio would have a requirement of 2 × 25% (SRO long maintenance) or 50%. A triple

short portfolio would have a requirement of 3 × 30% (SRO short maintenance) or 90%.

* Add the following on page 15-39, as additional information on Index Option Strategies

VIX Options VIX is the CBOE's Volatility Market Index option. It is a broad-based index option and is

calculated using the S&P 500 Index option bid and ask quotes. The VIX or volatility index is often

referred to as a gauge of investors’ fears. The index tends to move inversely with the S&P 500 Index. The

VIX usually rises when the S&P 500 Index falls and will fall when the S&P 500 Index rises. An investor

will buy calls when she expects the market to decline and volatility to increase. An investor will buy puts

on the VIX if she expects the market to rise and volatility to decrease. Many investors will buy VIX call

options as a hedge against a possible decline in the market. The VIX option can be used by investors

that expect either an increase or a decrease in volatility.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

7

* Add the following on page 17-4, as additional information on Section 529 Plans

A 529 College Savings Plan is a type of municipal fund security. If sales loads are depicted in municipal

fund securities advertising, the maximum amount of the sales charge should be indicated. Additionally,

sales charges may be reflected in the performance data of the investment and, if they are not, a statement to

that effect should be provided.

* Add the following on page 17-13

Health Savings Account (HSA) A Health Savings Account (HSA) is a tax-advantaged account that can

be used by individuals to pay for qualified medical expenses. An HSA is not open to all individuals. It is

generally open only to persons who are not enrolled in any type of health plan other than a qualified

high deductible health plan. Contributions are made in pretax dollars (which are limited under IRS

guidelines), grow tax-free, and withdrawals are tax-free if used to pay qualified medical expenses. The

funds may be invested in mutual funds, although the types of funds may be limited by an HSA trustee (a

financial institution).

Any funds withdrawn that are used for nonqualified medical expenses are taxable and subject to a 20%

IRS tax penalty. The funds do not need to be used each year and may be carried over to be used in the

future. Once reaching age 65, funds can be withdrawn at any time and are subject only to ordinary

income tax. (You avoid the 20% IRS penalty.) However, you may avoid any tax by continuing to use the

funds for qualified medical expenses.

* Add the following on page 18-8, after Exchange-Traded Funds

HOLDRs Holding Company Depository Receipts (HOLDRs) are created by depositing securities of a

certain sector (e.g., Biotech, Internet, Retail) into a trust and selling interests in the trust to investors.

HOLDRs offer investors diversification similar to an Exchange-Traded Fund (ETF). Unlike ETFs, the

owner of a HOLDR has an ownership interest in the shares of the companies that the HOLDR is

invested in and would retain the right to vote. Once the portfolio has been created, the makeup of the

portfolio will typically not change, although if a company included in the portfolio goes bankrupt or

merges with another company, the makeup of the HOLDR may be altered.

Investors have the ability to control when they are taxed, since they determine when to hold or sell the

HOLDR. An investor in a mutual fund does not have that benefit since the portfolio manager would

determine when to hold or sell the securities in the fund. Benefits also include liquidity and pricing

throughout the day (i.e., they are exchange-traded) as compared to an index or sector mutual fund,

which has daily pricing and is purchased directly from the fund. HOLDRs have no management fees

and are considered low-cost since there are only small transaction costs and custodian fees.

Exchange-Traded Notes (ETNs) An Exchange-Traded Note (ETN) is a type of unsecured debt security.

This type of debt security differs from other types of fixed-income securities since ETN returns are

linked to the performance of a commodity, currency, or index minus applicable fees. ETNs do not

usually pay an annual coupon or specified dividend. All gains are paid at maturity. These securities are

traded on an exchange, such as the NYSE, and may be purchased on margin or sold short. Investors

may also choose to hold the debt security until maturity. ETNs carry issuer risk that is tied to the

creditworthiness of the financial institution backing the note. If the issuer's financial condition

deteriorates, it could negatively impact the value of the ETN, regardless of how its underlying index

performs.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

8

* Add the following on page 18-15, as additional information on an Investment Adviser

Soft Dollars Soft dollars are products and services that an investment adviser receives from a brokerdealer in exchange for customer order flow. Under a soft-dollar arrangement, a broker-dealer may provide

an investment adviser with services and information that assist the adviser in making investment

decisions on behalf of clients (research reports). If the service or product primarily benefits the adviser

rather than the client, it may not be purchased with soft dollars. Providing office equipment and supplies

does not meet the standards for soft-dollar compensation as determined by the SEC. Attending a

research seminar would be acceptable, but not reimbursement of the travel expenses entailed to attend

the conference.

* Add the following on page 19-10

Variable Life Insurance

The key difference between variable life insurance and the other types of permanent life insurance is

that variable life insurance gives the policyholder choices about the way premium payments are

invested. In traditional life insurance policies, the insurance company makes all the investment

decisions and bears all the risks, similar to a fixed annuity. In a variable life policy, the policyholder, not

the insurance company, assumes the investment risk. She may also lose all her cash value if

performance is substandard, although her death benefit generally may not decrease below a certain

guaranteed minimum.

A variable life insurance investment is not appropriate for everyone. The investor must be knowledgeable

and sophisticated enough to understand the consequences of the investment options available to her.

She must also be able to tolerate the fact that the policy=s cash value may fluctuate greatly. Most variable life

insurance policies are sold with a fixed death benefit. But the death benefit may increase if the money

that the policyholder has invested in the subaccounts of the separate account performs better than the

policy=s Assumed Interest Rate (AIR). Generally, the death benefit cannot fall below a certain floor⎯the

face value of the policy. The insurance company guarantees that the beneficiary will receive the

minimum death benefit as long as the policyholder makes all the required premium payments and does

not take out loans against the policy.

The cash value of a variable life policy depends on the performance of the subaccounts in which the

policyholder invests her net premiums and, therefore, could theoretically decline to zero if these

investments perform poorly. The tax implication of a variable insurance policy is that there are no tax

consequences to the beneficiaries of the policy, but the death benefit is included in the deceased’s

estate for tax purposes.

* Add the following to the bottom of page 22-37

The put/call ratio is a technical market indicator and is found by dividing the volume of all put

transactions by the volume of all call transactions on a daily basis. Technical analysts view the put/call

ratio as a contrarian indicator. The higher the ratio, the more oversold the market, and the higher the

probability that the market will reverse course and turn bullish. The opposite is true for a low put/call

ratio, which is viewed as a bearish indicator.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

9

Questions

1.

2.

Which TWO of the following statements are TRUE concerning a company that becomes delisted

from the NYSE or Nasdaq?

I.

II.

III.

IV.

It may be quoted on the OTC Bulletin Board.

It may only be quoted in the OTC Pink market.

Firm quotes would no longer be available.

Firm quotes may still be available.

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

A business that is traded on an exchange, owns properties in its portfolio, and makes mortgage

loans to developers is an example of a:

a.

b.

c.

d.

3.

Which of the following statements BEST describes Exchange-Traded Notes (ETNs)?

a.

b.

c.

d.

4.

ETNs are debt instruments linked to the performance of a commodity, currency, or index.

ETNs are equity securities that pay a large dividend.

ETNs are mutual funds that invest in debt instruments.

ETNs are equity securities that represent ownership of a securities exchange.

The IPO of Symphony Music Inc. was registered on July 1, 20XX. If the manager of the new issue

wants to publish a research report on Symphony Music, what would be the earliest date that it

could publish the report?

a.

b.

c.

d.

5.

Closed-end investment company

Exchange-traded notes

Hybrid REIT

A direct participation program

July 11, 20XX

August 1, 20XX

August 11, 20XX

September 1, 20XX

A municipal finance professional (MFP) residing in New Jersey would be permitted to make which

of the following political contributions?

a.

b.

c.

d.

A $350 contribution to a New Jersey gubernatorial candidate

A $200 contribution to a Philadelphia, PA mayoral fund raiser

A $250 contribution to the mayor's reelection committee in her hometown

None of the above

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

10

6.

7.

When an investor purchases a municipal fund security, she will pay a sales load that is stated in the

official statement. Which TWO of the following statements are TRUE regarding an advertisement

for this municipal fund security?

I.

II.

III.

IV.

The minimum sales load should be stated in the ad.

The maximum sales load should be stated in the ad.

Sales charges may not be reflected in performance data.

Sales charges may be reflected in performance data.

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

Which of the following political contributions made by a municipal finance professional would

NOT violate the provisions of MSRB Rule G-37?

a.

b.

c.

d.

8.

9.

Which TWO of the following choices would be the most suitable purchasers of municipal zerocoupon bonds?

I.

II.

III.

IV.

An investor who does not seek present additional cash flow

An investor who seeks the tax benefits of long-term capital gains

An investor who needs cash for living expenses

A custodian account where the parent of the minor child is in the highest tax bracket

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

Which of the following employees of a municipal securities firm would be considered a municipal

finance professional?

a.

b.

c.

d.

10.

$100 to a candidate for whom you may vote

$100 to a candidate for whom you may not vote

$500 to a candidate for whom you may vote

$500 to a candidate for whom you may not vote

A municipal bond trader

An investment banker specializing in corporate bonds

A retail representative who recommends municipal securities

A file clerk working in the firm's municipal finance library

A variable annuity would be MOST suitable for which of the following customers?

a.

b.

c.

d.

A client in a high tax bracket who is purchasing the annuity for his spouse's retirement needs

A client in a high tax bracket who is purchasing the annuity for short-term liquidity needs

A client who is purchasing the annuity in a 401(k) for his retirement needs

A client who is purchasing the annuity in order to have the funds available by the age of 50

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

11

11.

12.

Which TWO of the following activities would require special disclosure documents?

I.

II.

III.

IV.

Penny stock trading

Trading in high-yield bonds

Day trading

Online trading

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

Advertising for municipal fund securities investments must be approved prior to its official use by:

a.

b.

c.

d.

13.

14.

The correct order for the transfer of an account from one firm to another is:

I.

II.

III.

IV.

The carrying firm validates the transfer instructions

The customer is informed of any nontransferable securities

The carrying firm sends the customer’s securities to the receiving firm

The customer provides a written transfer request to the receiving firm

a.

b.

c.

d.

IV, I, II, III

IV, I, III, II

I, IV, II, III

I, IV, III, II

Which of the following statements is NOT TRUE regarding a firm's anti-money laundering

program?

a.

b.

c.

d.

15.

The program must comply with a blueprint or template supplied by the SEC.

The program must be designed to comply with the Bank Secrecy Act.

The program must provide for annual testing of the system.

The firm must designate a specific individual responsible for implementing the firm's antimoney laundering program and must identify the person to FINRA.

Portfolio margin permits an investor to:

a.

b.

c.

d.

16.

The Municipal Securities Rulemaking Board

The state sponsoring the municipal fund securities investment program

A principal of the firm who is selling the program

The portfolio manager of the municipal fund security investment

Avoid margin deficiencies

Assume greater leverage

Trade directly with market makers

Trade without depositing funds until the securities decline in value

In order to implement a portfolio margin program, the firm must obtain approval from:

a.

b.

c.

d.

The options exchange

FINRA

The SEC

The OCC

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

12

17.

When a margin requirement is designed to consider that the risk of one position is offset by another

position, i.e., having a long S&P 400 position offset by a short S&P 100 position, this approach to

calculating a margin requirement would be considered:

a.

b.

c.

d.

18.

The minimum equity requirement for a pattern day trader is:

a.

b.

c.

d.

19.

Through the EMMA system

Through the TRACE system

Directly from the issuer

From the OATS system

FINRA disseminates bond transaction information for all these securities, EXCEPT:

a.

b.

c.

d.

21.

$25,000, which the client has five business days to deposit

$25,000, which must be deposited before the client may continue day trading

Four times the maintenance requirement for the account

$2,000 or 100% of the short market value

Investors may receive disclosure and secondary market information concerning municipal

securities:

a.

b.

c.

d.

20.

Portfolio-based

Strategy-based

Derivative-based

Inversely correlated

Noninvestment-grade corporate bonds

Rule 144A securities

Investment-grade corporate bonds

GSE bonds

Which TWO of the following statements are TRUE concerning Trade Reporting and Compliance

Engine (TRACE) reports?

I.

II.

III.

IV.

Only the seller is required to report the transaction.

Both the buyer and the seller involved in the transactions are required to report the transaction.

The system is used for corporate debt.

The system is used for municipal debt.

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

13

22.

23.

An investor would like to trade exchange-traded funds (ETFs) in her brokerage account. Which

TWO of the following statements are TRUE concerning purchasing and selling short ETF shares?

I.

II.

III.

IV.

Purchases may be executed in a cash or margin account.

Short sales may be executed in a cash or margin account.

Short sales may only be executed in a margin account.

Leveraged ETFs can only be purchased in a margin account.

a.

b.

c.

d.

I and II

I and III

II and III

II and IV

In mutual fund advertising, it is NOT permissible to state that:

a.

b.

c.

d.

24.

The system used to report municipal securities transactions is called the:

a.

b.

c.

d.

25.

26.

Trade Reporting and Compliance System

Order Audit Trail System

Trade Reporting and Compliance Engine

Real-Time Transaction Reporting System

The term fast market is characterized by which TWO of the following descriptions?

I.

II.

III.

IV.

An imbalance of orders

A very low number of trades

Highly volatile prices

The quotes of market makers being updated very quickly

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

Which of the following lists assists a broker-dealer in making a reasonable determination that a

security is available to be borrowed from another broker-dealer in order to effect a short sale

transaction?

a.

b.

c.

d.

27.

A fund does not charge a 12b-1 fee

Dollar cost averaging assures long-term growth

Funds of competitors have higher expense ratios

The investment adviser has 20 years experience

An Easy to Borrow List

A Hard to Borrow List

A Threshold Security List

A Restricted Stock List

In a soft-dollar arrangement between an investment adviser and a broker-dealer, the broker-dealer

would be permitted to pay:

a.

b.

c.

d.

The cost of a coach flight for a portfolio manager to attend a conference

The cost of a conference concerning the future of the computer software industry

The cost of computer terminals used to deliver market data services

A percentage of the salaries of the adviser's internal research staff

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

14

28.

A registered representative wants to place an advertisement for a mutual fund in his local paper.

According to FINRA, prior approval for the advertisement must be given by:

a.

b.

c.

d.

29.

What is the acronym associated with the process of a client instructing his bank to deliver securities

against payment by the clearing firm?

a.

b.

c.

d.

30.

A registered principal

The SEC

The sponsor of the mutual fund

A compliance officer

RVP

COD

DVP

POA

Selling away takes place when a registered representative:

a. Sells his firm's client list to nonaffiliated broker-dealers without his firm's permission

b. Engages in private securities transactions outside his regular scope of employment without his

firm's permission

c. Sells securities through his firm in a financial product not created by his firm

d. Purchases speculative securities for his own account

31.

Which TWO of the following situations would require written notification to an employer?

I. A registered person is leaving the country on a business trip for more than three months.

II. A registered principal is serving on the board of directors of a private company.

III. A registered person wants to act as a consultant for a private placement of a security that is not

being offered by her broker-dealer.

IV. A registered principal intends to purchase corporate securities in a personal account

established at her employing broker-dealer.

a.

b.

c.

d.

32.

The Order Audit Trail System tracks the:

a.

b.

c.

d.

33.

I and III

I and IV

II and III

II and IV

Execution of an order only

Cancellation of an order only

Time an attempt was made to place an order

Entire life of an order that is accepted by a member firm

According to SRO rules, an e-mail message complaining about excessive commissions sent to an

RR's personal electronic device:

a.

Does not constitute an official complaint since the electronic device is not an official brokerdealer contact channel and its use for business is typically prohibited

b. Is a complaint and must be maintained by the broker-dealer

c. Is a complaint and must be forwarded to the appropriate SRO

d. Must be followed up within 10 business days by a written document from the client to be

considered an official complaint

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

15

34.

Under SRO rules, the carrying firm must complete the transfer of a customer account:

a.

b.

c.

d.

35.

A broker-dealer must include all the following components in its business continuity plan, EXCEPT:

a.

b.

c.

d.

36.

Within one business day of receipt of the transfer instructions

Within three business days of validation of the transfer instructions

Immediately upon receipt of the transfer instructions

Immediately upon validation of the transfer instructions

The impact of a disruption of the firm's counterparties

The home addresses and phone numbers of key employees

Regulatory reporting

Alternative locations for employees

Dedicated Securities has been invited to join a syndicate selling a new offering of common stock.

The head of the firm's syndicate department notices that the agreement among underwriters

mentions a penalty bid. Which of the following choices is an example of a penalty bid?

a. If Dedicated fails to sell its allotment, it will be liable for twice its normal commitment.

b. If Dedicated fails to solicit a certain number of indications of interest, it will be required to pay a

fee to the syndicate manager.

c. If Dedicated sells some of the issue to a customer, who later sells the stock back to the syndicate

at the stabilizing bid, Dedicated will forfeit the concession on those shares.

d. If Dedicated sells some of the issue to a customer, who later sells the stock back to the syndicate

at the stabilizing bid, Dedicated could be penalized for failure to maintain the public offering price.

37.

XYZ Corporation will need to borrow funds in the bond market soon. While current interest rates

are not attractive from its viewpoint, the company knows that interest rates could drop suddenly.

The company would like to be ready to sell the bonds quickly. It would also like the bonds to be as

liquid as possible in order to attract investors. Which of the following choices would be most

appropriate for its needs?

a.

b.

c.

d.

38.

An equity security that is distributed under Regulation S may be resold by:

a.

b.

c.

d.

39.

A private placement under Regulation D

An intrastate offering under Rule 147

A traditional registration statement

A shelf registration under Rule 415

Immediate sale within the U.S. market

Immediate sale in a designated offshore market

Regulatory approval from SROs

Waiting six months, then selling within the U.S. market

Pickette Financial Services is participating in the IPO of Swank Tanks, Inc., as the managing

underwriter. If a research analyst at Pickette wants to initiate coverage on Swank Tanks, she:

a.

b.

c.

d.

Must wait 10 calendar days after the offering date

Must wait 25 calendar days after the offering date

Must wait 40 calendar days after the offering date

May not issue a research report due to a conflict of interest

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

16

40.

A U.S. issuer conducts an offering of corporate bonds in China. How long is the holding period if a

broker-dealer wants to offer the securities to an investor in the U.S.?

a.

b.

c.

d.

41.

A designated market maker/specialist has an order on its book from a public customer to buy stock

at $34.70 and another order from a public customer to sell stock at $34.95. The DMM may:

a.

b.

c.

d.

42.

Buy stock for its own account at $34.71

Buy stock for its own account at $34.69

Sell stock from its own account at $34.96

Sell stock from its own account at $35.01

A customer at your firm has an online trading account. If the customer places a limit order for a

Nasdaq-listed stock and your firm is a market maker in this security, which of the following

statements is TRUE?

a.

b.

c.

d.

43.

25 days

40 days

90 days

One year

The order will be executed automatically.

The order will be sent to an ECN.

The order will be displayed only if it improves the inside market.

The order will be displayed only if it improves the market maker’s quote.

Relevant to trading equity securities, the term dark pool is BEST defined as:

a. Trading prior to an exchange’s normal market hours

b. Trading after an exchange ends its normal market hours

c. Trading between investors, allowing them to buy and sell securities anonymously without

quotes being displayed

d. Trading between investors, allowing them to buy and sell securities anonymously with quotes

being displayed

44.

Of the following factors, which would be the MOST important to consider when analyzing the

investment portfolio of a client who has retirement as her primary investment objective?

a.

b.

c.

d.

45.

Age

Net worth

Education level

Previous investment history

Which of the following choices BEST defines the Municipal Bond Index?

a.

b.

c.

d.

The average yield on 25 revenue bonds with 30-year maturities

The average yield on 20 selected municipal bonds with 20-year maturities

An estimate of the prices of 40 long-term bonds adjusted to a 6% coupon

The average yield on 11 selected municipal bonds with 20-year maturities

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

17

46.

Regarding a company’s financial statements, total assets are equal to:

a.

b.

c.

d.

47.

48.

Total Liabilities + Stockholders’ Equity

Total Liabilities - Stockholders’ Equity

Total Liabilities + Stockholders’ Equity - Depreciation

Stockholders’ Equity + Goodwill

A registered representative is reviewing a corporation’s financial statements. Which TWO of the

following statements are TRUE concerning an issuer’s bond interest expense?

I.

II.

III.

IV.

The annual interest payments are found on the balance sheet.

The annual interest payments are found on the income statement.

The interest payment is deducted from net income.

The interest payment is deducted from EBIT.

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

A client contacts an RR after reviewing the financial statements of the S-Works Carbon Company.

The client is confused since the company paid a cash dividend but had a loss for the last fiscal year.

Which of the following statements is TRUE?

a. The company is permitted to pay a cash dividend even though it had a loss.

b. The company is not permitted to pay a cash dividend if it had a loss.

c. If the company has a loss in its last fiscal year, it may pay a cash dividend only with prior

approval from shareholders.

d. If the company has a loss in its last fiscal year, it may pay a cash dividend only with prior

approval from the SEC.

49.

The Taft Food Company intends to distribute to existing stockholders’ shares of its grocery

business. The shares of this company will be traded separately from Taft. This is an example of a:

a.

b.

c.

d.

50.

Stock dividend

Reverse merger

Spinoff

Initial public offering

Which of the following statements is TRUE concerning VIX options?

a.

b.

c.

d.

An investor will buy puts if she expects the S&P 500 Index to fall.

An investor will buy calls if she expects the S&P 500 Index to rise.

An investor will buy calls as a hedge if she expects the S&P 500 Index to fall.

An investor will only buy options on the VIX if she expects an increase in the volatility on the

S&P 500 Index.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

18

51.

52.

An investor who expects an increase in volatility in the equity markets would MOST likely adopt

which TWO of the following strategies?

I.

II.

III.

IV.

Long VIX call options

Short VIX call credit spread

Short VIX put credit spread

Long VIX put options

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

An individual owns 800 shares of stock at an original cost of $55 per share. If the company

distributes a 15% stock dividend, what is the client's cost basis per share?

a.

b.

c.

d.

53.

When a client buys a bond above par, the confirmations must indicate the:

a.

b.

c.

d.

54.

Rating

Contra-party

Lower of yield to call or yield to maturity

Catastrophe call provisions

Which of the following choices best describes Certificates of Participation?

a.

b.

c.

d.

55.

$63.25

$55.00

$47.83

$47.75

They are a form of equity financing for a corporation.

They are a type of REIT.

They are a type of bond, typically created through a lease agreement.

They are a type of bond based on payments from residential mortgages.

Which TWO of the following types of municipal securities would NOT require voter approval?

I.

II.

III.

IV.

A general obligation bond backed by income taxes

A special tax bond

A bond backed by ad valorem taxes

A certificate of participation

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

19

56.

57.

Bergen County has issued Build America Bonds to improve its transportation system. Which TWO

of the following statements are TRUE concerning these bonds?

I.

II.

III.

IV.

The bonds are federally tax-free.

The bonds are federally taxable.

The issuer will receive a federal tax credit.

The issuer will receive a federal reimbursement.

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

A municipality may issue a Direct Pay Build America Bond to finance all of the following activities,

EXCEPT:

a.

b.

c.

d.

58.

The net borrowing cost to a municipal issuer of a Direct Pay Build America Bond (BAB) with a 7%

interest rate is:

a.

b.

c.

d.

59.

Refund a mass transportation bond

Raise capital to expand its school system

Make a primary offering to establish a public sewer system

Raise additional capital for a government housing project

0%

2.45%

4.55%

7.00%

Which TWO of the following choices are differences between Exchange-Traded Funds (ETFs) and

Exchange-Traded Notes (ETNs)?

I. ETFs may be traded in the secondary market and ETNs cannot.

II. ETNs carry issuer risk which is tied to the creditworthiness of the financial institution backing

the note and ETFs do not have issuer credit risk.

III. ETF returns are based on the performance of an index and ETNs pay a fixed coupon rate.

IV. ETNs have a maturity date and ETFs do not.

a.

b.

c.

d.

60.

I and III

I and IV

II and III

II and IV

A Collateralized Debt Obligation or CDO is BEST defined as a:

a.

b.

c.

d.

Type of REIT

Type of asset-backed security

Type of closed-end investment company

Type of municipal revenue bond

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

20

61.

Which of the following investors is LEAST likely to purchase a Collateralized Debt Obligation

(CDO)?

a.

b.

c.

d.

62.

Agawam Commercial Bank & Trust Company

Oakdale Pension Fund

Robert & Susan Abramowitz, JTWROS

Lincolnshire Hedge Fund

An investor places an order to buy shares of a mutual fund after that investment company has

determined its net asset value for the day. The RR instructs the fund company to purchase the

shares at that day’s NAV for the investor. Which of the following statements concerning this

potential trade is TRUE?

a. This is a sales practice violation known as late trading.

b. This is an acceptable practice known as market timing.

c. The RR would need to have prior written approval by a principal of the firm to execute this

order.

d. The investor may only purchase Class B shares in this case, since Class A shares are not

available under this arrangement.

63.

Structured products are typically comprised of two components including:

a.

b.

c.

d.

64.

A fixed-income note and common stock

A fixed-income note and a derivative product

A fixed-income note and a fixed-equity contract

Two different types of derivative products

Which of the following statements is NOT TRUE concerning a structured product offered by an RR?

a. They are usually registered with the SEC.

b. The principal that the investor would receive may be based on the value of a stock traded on an

exchange.

c. The principal the investor would receive may be based on the value of foreign currency.

d. Since this product is usually sold by a bank, the principal will be protected by the FDIC.

65.

66.

Structured products may:

I.

II.

III.

IV.

Offer returns linked to equity securities

Not offer returns linked to commodities

Not offer returns linked to interest rates

Be formulated to provide principal protection

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

Regulation AC (Analyst Certification) does NOT apply to:

a.

b.

c.

d.

Brokers

Dealers

Issuers

Research analysts

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

21

67.

Regulation FD applies to:

a.

b.

c.

d.

68.

Retail customers

Issuers of securities

Institutional investors

Broker-dealers

A registered representative is permitted to borrow from, or lend funds to, customers in all of the

following situations, EXCEPT:

a. The customer is an immediate family member of the registered representative

b. The customer is an accredited investor

c. The loan is based on a business relationship independent from the member firm customer

relationship

d. The customer has a personal relationship with the registered representative

69.

A registered representative is the owner of a marina on the North Shore of Long Island. She wants to

build an apartment complex on this property in order to increase the property's cash flow. If she

receives a loan from family members, which of the following statements is TRUE?

a.

b.

c.

d.

70.

71.

Which TWO of the following statements are TRUE concerning a Health Savings Account?

I.

II.

III.

IV.

The contribution is made in pretax dollars.

The contribution is made in after-tax dollars.

The funds grow tax-free if used to pay qualified medical expenses.

The funds grow tax-deferred if used to pay qualified medical expenses.

a.

b.

c.

d.

I and III

I and IV

II and III

II and IV

All of the following choices are characteristics of a Health Savings Account (HSA), EXCEPT:

a.

b.

c.

d.

72.

Her broker-dealer is required to approve the loan.

She is required to notify her firm of the loan.

She is required to notify FINRA.

She is not required to notify her firm about the loan.

The amount a person can contribute each year is limited

It is not open to individuals who are enrolled in their company’s health insurance plan

The funds may be invested in mutual funds

The funds must be used each year and may not be carried over

One of your clients, Kona Okemo, has a long-term objective of capital appreciation. Which of the

following investment strategies would MOST closely achieve this goal?

a. 30% corporate bond fund, 30% municipal bond fund, and 40% in a U.S. government bond fund

b. 50% in an ETF that follows the S&P 500 and 50% in a diversified bond fund

c. 30% in an ETF that follows the S&P 500, 20% in an emerging markets fund, 15% in a REIT fund,

15% in a biotechnology fund, and 20% in a U.S. government bond fund

d. 20% in an oil and gas fund, 20% in a technology fund, 20% in an emerging markets fund, 20% in

a municipal bond fund, and 20% in a U.S. government bond fund

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

22

73.

Lindsay Depaul is a client seeking a balance between income and capital growth. Which of the

following investment strategies would MOST closely achieve this goal?

a. 30% corporate bond fund, 30% municipal bond fund, and 40% in a U.S. government bond fund

b. 20% in a blue-chip fund, 20% in a technology fund, 20% in an emerging markets fund, 20% in a

municipal bond fund, and 20% in a U.S. government bond fund

c. 50% in an ETF that follows the S&P 500 and 50% in an equity foreign index fund

d. 30% in an ETF that follows the S&P 500, 20% in an emerging markets fund, 15% in a REIT fund,

15% in a biotechnology fund, and 20% in a U.S. government bond fund

74.

An investor has an equity portfolio that consists mainly of domestic companies. If an RR wants to

diversify the client’s portfolio to include foreign companies, which of the following investment

products would MOST closely achieve this goal?

a.

b.

c.

d.

75.

A mutual fund that tracks the FTSE Index

A mutual fund that tracks the EAFE Index

An ETF that tracks the S&P 500 Index

A mutual fund that tracks the Wilshire Index

Randy Cervello has a variable life insurance policy. Which of the following statements BEST

describes the tax consequences of his variable life insurance policy upon his death?

a.

There are no tax consequences to his beneficiary and the death benefit is not included in his

taxable estate.

b. There are gift taxes due from his beneficiary in the year he dies.

c. The value of the policy will be included in Randy’s estate for tax purposes.

d. The policy proceeds are federally taxable to the beneficiary.

76.

The purchaser of a variable life insurance policy bears which of the following risks?

a. The death benefit may fall to zero due to poor market performance.

b. The policy may have no cash value if the separate account performance is negative.

c. The insurance company may increase the premiums if the investment performance of the

separate account is poor.

d. The increasing cost of doing business may force the insurance company to raise expense

charges against the separate account.

77.

The MOST appropriate buyer(s) for a variable life insurance policy is/are:

a.

b.

c.

d.

78.

A person who requires the discipline of forced savings

Parents with a modest income who have young children

A person who wants the assurance of a guaranteed cash value

A person with an understanding of investments who can tolerate market risk

A durable power of attorney:

a.

Gives someone else the authority to manage the grantor's finances if that person becomes

incapacitated

b. Generally may not be revoked by the grantor

c. May take the place of a will in many states

d. Is automatically revoked if the grantor is declared incompetent

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

23

79.

A municipal finance professional (MFP) and her spouse make a political contribution of $400 from

a joint account. Only the MFP signs the check. According to the MSRB political contribution rules,

the contribution would be viewed as a:

a.

b.

c.

d.

80.

What is a client’s maximum gain if she is long XAM stock and short an XAM call?

a.

b.

c.

d.

81.

It is a reporting system for corporate bonds.

It is a reporting system for U.S government bonds.

It is a reporting system for stocks listed on Nasdaq.

It is a reporting system for municipal bonds.

An American company has sold its services to a British consulting firm and is expecting payment

from a customer in British pounds. To hedge against an increase in the U.S. dollar, the American

company should:

a.

b.

c.

d.

84.

The difference between the market price and the strike price plus the premium

The market price plus the premium

The market price minus the premium

Unlimited

Which of the following statements is TRUE regarding TRACE?

a.

b.

c.

d.

83.

The difference between the market price and the strike price plus the premium

The difference between the market price and the strike price minus the premium

The market price minus the premium

Unlimited

What is a client’s maximum loss if he is short KNP stock and short a KNP put?

a.

b.

c.

d.

82.

$200 contribution from each party

$400 contribution from the MFP

$400 contribution from the spouse

$200 contribution from each party, but it must be reported to the MSRB

Buy British pound puts

Buy British pound calls

Write British pound calls

Write British pound straddles

A retail sales person has helped his firm win the role as the lead underwriter in a local municipal

bond issue. If the underwriting was conducted on a negotiated basis, which of the following

statements is TRUE?

a. As long as the control relationship is disclosed, there are no other restrictions.

b. The retail sales person could not have made political contributions to elected officials in the

past two years.

c. The retail sales person would be required to register as a municipal securities principal.

d. The action by the retail sales person would be a violation of MSRB rules.

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

24

85.

Which of the following direct participation programs would be associated with low costs to obtain

the property and high up-front costs?

a.

b.

c.

d.

86.

An investor purchases a zero-coupon municipal bond maturing in 15 years that is callable in five

years at 102. If the bond is called, the investor would receive:

a.

b.

c.

d.

87.

An oil and gas developmental program

An equipment leasing program

An exploratory oil and gas program

An income oil and gas program

Par value

102% of the par value

102% of the original cost

102% of the compound accreted value

A client is interested in obtaining the expense ratio of a mutual fund recommended by the RR.

Which of the following actions would be BEST for the RR to take?

a. Instruct the client to obtain the information from FINRA

b. Refer the client to the fund’s sponsor since the RR may not be authorized to release this

information

c. Instruct the client to obtain that information from the SEC database of mutual fund

prospectuses

d. Inform the client that this information may be obtained by reviewing the front of the fund’s

prospectus

88.

Sipcar is a stock listed on Nasdaq and the inside market is $3.40 - $3.45. A client contacts an RR and

wants to place an order to buy the stock at $3.425. The BEST course of action for the RR is to:

a.

b.

c.

c.

89.

You discover that one of your clients is on the OFAC list. You must:

a.

b.

c.

d.

90.

Accept the order

Accept the order and have it approved in advance by a principal

Not accept the order

Accept the order and request that it be routed to an ECN

Contact federal law enforcement authorities immediately

Call the client to see if a mistake has been made

Investigate the matter further to see if there is evidence of suspicious activity

Notify FINRA

A client wants to make sure she does not pay more than $3,000 to execute a spread transaction. The

RR should:

a.

b.

c.

d.

Submit two limit orders

Submit one limit for the buy side of the transaction and a market order for the sell side

Submit one order for a net debit of $3,000

Submit one order for a net credit or $3,000

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

25

91.

Which of the following choices is NOT a characteristic of a HOLDR?

a.

b.

c.

d.

92.

What is the SRO maintenance requirement on a $1 million purchase of a 2x Long Gold Index ETF?

a.

b.

c.

d.

93.

$1,000,000, since these securities are not eligible for additional margin

$500,000

$250,000

$125,000

What is the SRO maintenance requirement on a $1 million purchase of a 3x Short Gold Index ETF?

a.

b.

c.

d.

94.

Diversification

The right to vote

The ability to control when you are taxed

Once-a-day pricing

$3,000,000

$1,000,000

$900,000

$300,000

White Shoe Securities sells a Nasdaq-listed stock at 4:15 p.m. What is the reporting requirement on

the TRF?

a.

There is no reporting requirement since Nasdaq transactions do not need to be reported to the

TRF.

b. It must be reported before the opening on the next day.

c. It must be reported within one hour to the TRF.

d. It must be reported within 30 seconds to the TRF.

95.

Which of the following statements is NOT TRUE about Exchange-Traded Notes (ETNs)?

a. ETNs generally pay a fixed coupon rate.

b. ETNs may be sold at any time in the secondary markets or held until maturity.

c. ETNs carry issuer risk that is tied to the creditworthiness of the financial institution backing the

note.

d. If the issuer's financial condition deteriorates, it could negatively impact the value of the ETN,

regardless of how its underlying index performs.

96.

A customer asks an RR for assistance in investing a $150,000 inheritance. The customer would like

to use the funds to start a new business within the next year. Which of the following choices would

be the LEAST suitable investment recommendation for this customer?

a.

b.

c.

d.

97.

Taxable money-market funds

Tax-exempt money-market funds

Short-term U.S. government funds

Balanced funds

Before accepting a DVP order from a customer, a broker-dealer must:

a.

b.

c.

d.

Notify FINRA

Obtain the name of the customer's agent from the customer

Receive approval of the trade from the contra broker

Notify the appropriate banking regulator

Copyright © Securities Training Corporation, 2011. All Rights Reserved.

26

98.

What is a client’s maximum loss if she is long XAM stock and short an XAM call?

a.

b.

c.

d.

99.

The difference between the market price and the strike price plus the premium

The market price plus the premium

The market price minus the premium

Unlimited

A high put/call ratio would MOST likely be associated with a(n):

a.

b.

c.

d.

Bullish indicator

Bearish indicator

Indicator that the market will trade within a narrow range

Indicator that the trading volume will be increasing

100. In order to be eligible for portfolio margin, a client must:

a.

b.

c.

d.

Be an accredited investor

Have at least $500,000 of investable assets at a firm

Be approved for uncovered writing