Heterogeneous Information Diffusion and Horizon Effects in Average

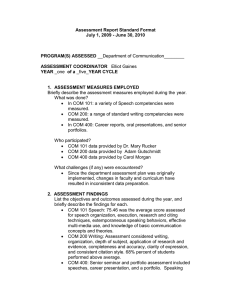

advertisement

MACROECON & INT'L FINANCE WORKSHOP

presented by Murray Carlson

FRIDAY, April 19, 2013

3:30 pm – 5:00 pm, Room: HOH-706

Heterogeneous Information Diffusion and Horizon Effects in

Average Returns

Oliver Boguth, Murray Carlson, Adlai Fisher, and Mikhail Simutin∗

April 15, 2013

ABSTRACT

We show that when stocks react to fundamentals with heterogeneous delay, the observed

short-horizon mean return of a buy-and-hold portfolio is downward biased relative to its

average fundamental return. Our theory predicts distinct patterns in portfolio mean returns calculated at different horizons, depending on the degree of information delay for

stocks within the portfolio. Consistent with our model, average daily returns of portfolios

of small, illiquid, and volatile stocks, rescaled to longer horizons by compounding, show

downward bias on the order of 6% annually. Evidence of substantial bias remains in the

average monthly returns of some U.S. style portfolios and in the majority of international

indices. The direction and magnitude of these findings cannot be explained by standard

microstructure frictions such as bid-ask bounce, iid measurement error, or asynchronous

trade. Our results contribute to growing evidence of delayed price adjustment as an important friction with broad impacts. The theory and findings also have practical implications

for benchmarking and performance evaluation.

∗

We thank Hank Bessembinder, Carole Comerton-Forde, Cam Harvey, Andrew Karolyi, and seminar participants at the University of New South Wales, University of North Carolina at Chapel Hill, the University

of Toronto, SUNY-Buffalo, Wilfred Laurier University, the Finance Down Under Conference, the Northern

Finance Association Meetings, and the Pacific Northwest Finance Conference for helpful comments. This

paper previously circulated under the title “On Horizon Effects and Microstructure Bias in Average Returns and Alphas.”

Boguth: oliver.boguth@asu.edu; W. P. Carey School of Business, Arizona State

University, PO Box 873906, Tempe, AZ 85287-3906. Carlson and Fisher: murray.carlson@sauder.ubc.ca; adlai.fisher@sauder.ubc.ca; Sauder School of Business, University of British Columbia, 2053 Main Mall, Vancouver, BC, V6T 1Z2. Simutin: mikhail.simutin@rotman.utoronto.ca; Rotman School of Management, University

of Toronto, 105 St. George Street, Toronto ON, Canada, M5S 3E6. Support for this project from the Social

Sciences and Humanities Research Council of Canada and the UBC Bureau of Asset Management is gratefully

acknowledged.

Heterogeneous Information Diffusion and Horizon Effects in

Average Returns

Abstract

We show that when stocks react to fundamentals with heterogeneous delay, the observed short-horizon mean return of a buy-and-hold portfolio is downward biased

relative to its average fundamental return. Our theory predicts distinct patterns

in portfolio mean returns calculated at different horizons, depending on the degree

of information delay for stocks within the portfolio. Consistent with our model,

average daily returns of portfolios of small, illiquid, and volatile stocks, rescaled to

longer horizons by compounding, show downward bias on the order of 6% annually. Evidence of substantial bias remains in the average monthly returns of some

U.S. style portfolios and in the majority of international indices. The direction

and magnitude of these findings cannot be explained by standard microstructure

frictions such as bid-ask bounce, iid measurement error, or asynchronous trade.

Our results contribute to growing evidence of delayed price adjustment as an important friction with broad impacts. The theory and findings also have practical

implications for benchmarking and performance evaluation.

1. Introduction

Over the last two decades, considerable evidence has accumulated that stock prices

react to new information with differential delays. In influential early work, Lo and

MacKinlay (1990) present evidence of predictability from large stocks to small stocks.

An impressive subsequent literature shows that analyst coverage, degree of firm complexity, investor attention depending on day of the week, and other factors can influence the speed with which stocks react to news.1 When stock prices relate to news at

different rates, well-known consequences include strong positive autocorrelations and

cross-autocorrelations in short-horizon portfolio returns.

We demonstrate new implications of heterogeneity in information diffusion for average portfolio returns. We first develop a theoretical environment in which stocks react

to fundamentals with different delays. We show that the observed short-horizon mean

return of a buy-and-hold portfolio is downward biased relative to its average fundamental return. This result may seem surprising. Prior literature has focused on earning

positive profits by active trading strategies that take advantage of slow information

diffusion. Our result applies to the average short-horizon returns of a buy-and-hold

strategy, and can be understood by considering the portfolio weights implied by a buyand-hold strategy.

Consider measuring portfolio returns following a positive shock to fundamentals.

Stocks that react slowly to the positive information will be underweighted at the beginning of the measurement interval relative to their fundamental values. At the same

time, their observed short-horizon returns are expected to be high. Similarly, follow1

See, for example, Brennan, Jegadeesh, and Swaminathan (1993), Badrinath, Kale, and Noe (1995),

Klibanoff, Lamont, and Wizman (1998), Chordia and Swaminathan (2000), Hong, Lim, and Stein (2000),

Huberman and Regev (2001), Hirshleifer and Teoh (2003), Hou and Moskowitz (2005), Cohen and Frazzini

(2008), Dellavigna and Pollet (2009), Hirshleifer, Lim, and Teoh (2009), Menzly and Ozbas (2010), Chordia,

Sarkar, and Subrahmanyam (2011), Hirshleifer, Lim, and Teoh (2011), Tetlock (2011), and Cohen and Lou

(2012).

1

ing a negative shock to fundamentals, slow-adjusting stocks are overweighted in the

portfolio, while their future returns will tend to be low. The negative cross-sectional

correlation between portfolio weights and future observed returns has implications for

portfolio returns. In particular, observed average portfolio returns become downward

biased relative to their fundamental return at short horizons. These effects are less

important when returns are measured over longer intervals, since the effects of slow information diffusion become smaller. Thus, theory predicts specific patterns in average

returns measured over different horizons.

The setting for our analysis differs fundamentally from prior literature, which has

considered bias in average returns arising from iid measurement error in prices. Blume

and Stambaugh (1983) and Roll (1983) explain how iid measurement errors in prices

cause upward bias in the mean returns of individual stocks and equally-weighted,

periodically-rebalanced portfolios, due to Jensen’s inequality. Conrad and Kaul (1993),

Canina, Michaely, Thaler, and Womack (1998), and Liu and Strong (2008) provide additional empirical analysis and recommendations to empirical researchers in the presence

of iid measurement error. Most recently, Asparouhova, Bessembinder, and Kalcheva

(“ABK”, 2010, 2012) show how biases arise in Fama-MacBeth regressions and average

returns of equal-weighted style portfolios under iid measurement error, and propose

empirical corrections. In contrast to this literature, we focus on delayed price adjustment as a pricing friction. Unlike the standard assumption of iid measurement error,

our setting implies price deviations that are correlated with fundamentals. ABK (2012,

p. 46) anticipate that the case we investigate, where measurement errors are correlated

with fundamentals, should be a profitable direction for research.

Our implications for biases in measured mean returns also differ fundamentally from

prior literature. Under the iid measurement errors studied previously, equal-weighted

portfolio returns are upward biased, and the mean returns of well-diversified value-

2

weighted portfolios remain unbiased. Indeed, the weighting schemes proposed by ABK

capture the beneficial aspects of allowing portfolio weights to vary with past returns.

In contrast, under the case of heterogeneous information diffusion that we focus on,

portfolio returns are downward biased rather than upward biased, and value-weighted

portfolios are more severely impacted than equal-weighted or otherwise rebalanced portfolios. We can thus sharply distinguish the empirical predictions for mean returns of

iid measurement error versus heterogeneity in information diffusion.

An existing literature analyzes differential price adjustment, but focuses on impacts to higher moments of returns, such as individual stock and portfolio variances,

autocorrelations, and cross-autocorrelations. Most notably, delayed reaction of some

securities to fundamentals causes portfolio returns to be positively autocorrelated and

observed portfolio variances to be downward biased (Scholes and Williams, 1977; Lo

and MacKinlay, 1990). These same studies conclude, in contrast to our findings, that

the implications for observed mean returns are innocuous.2 However, these studies

base their conclusions on the properties of logarithmic returns. Empirical researchers

are more often concerned with simple returns, as for example when calculating an alpha

from a time-series regression or carrying out a standard cross-sectional asset pricing test.

Unlike logarithmic returns, which are additive, simple returns involve compounding. In

the presence of asynchronous price adjustment, positive autocorrelations, generated by

heterogeneity in information diffusion rather than fundamentals, inflates the importance of compounding. The average single-period return must be downward biased to

compensate.

To provide a more complete framework for empirical analysis, we develop an approximation for the difference between average returns calculated over arbitrary different

2

Scholes and Williams write, “. . .expectations of measured returns [. . .] always equal true mean returns” (p.

113). Lo and MacKinlay state, “. . . nontrading does not affect the mean of observed returns” (p. 187).

3

time scales.3 Our formula shows that when the variance ratio of long-horizon to shorthorizon returns exceeds one, indicating persistence, the average subperiod return scaled

by multiplying or compounding is downward biased relative to the buy-and-hold return.

We verify that this approximation is empirically accurate for a variety of standard style

portfolios. Building on this result, we show that alpha differences across different horizons can be largely explained by applying our formula. Thus, alphas across horizons are

not arbitrarily different, but to a close approximation are explained by a few specific

moments of returns, most notably variance ratios across horizons.

Consistent with our theoretical predictions, we show empirically that short-horizon

portfolio return averages, alphas, and Fama-MacBeth coefficients are often not reliable,

even in the case of value-weighting or other non-rebalanced strategies. For all portfolios we consider, performance metrics based on daily return measures significantly

understate longer-horizon buy-and-hold returns. As theory predicts the biases are particularly strong for illiquid and volatile portfolios such as those containing small stocks

and momentum losers. The differences in return measures reach up to 6% annually for

U.S. style portfolios. Even monthly returns of U.S. style portfolios show meaningful

biases, and only at a quarterly horizon do average returns reliably show small horizon

effects.

The evidence in international indices is even stronger. Average monthly returns,

rescaled by compounding to an annual horizon, consistently understate longer-horizon

returns. The magnitude of the effect in emerging and frontier markets, where heterogeneity in information arrivals is most severe, exceeds 10% annually in some cases.

Exchange Traded Funds (ETFs) which track a subset of the international indices are

available, for which daily closing prices are arguably less succeptible to the microstruc3

Horizon effects in returns have been a fundamental topic in finance since Blume (1974). More recent

developments focus on the subtle effects of estimation error (Jacquier, Kane, and Marcus, 2003, 2005) and

parameter uncertainty (Pastor and Veronesi, 2003; Pastor and Stambaugh, 2012).

4

ture biases that affect the individual stocks prices used to compute index returns. Although horizon effects are somewhat smaller for ETFs than for the associated indices,

rescaled average monthly returns of ETFs remain consistently below the annual average

returns. The differences between short and long-horizon mean returns in international

markets thus remain economically significant even in data that is likely to reflect the

price impact of trading activity at the individual stock level.

Section 2 provides theoretical analysis of the link between heterogeneity in information diffusion and average portfolio returns. Section 3 demonstrates implications for

horizon effects in standard empirical methods. Section 4 provide empirical evidence

in U.S. style portfolios. Section 5 gives international evidence. All proofs are in the

Appendix.

2. A Model of Heterogeneity in Information Diffusion

In this section we develop a model in which stocks react to fundamental information with

heterogeneous delays. We provide considerable generality in the model. The delay type

of an individual firm follows a stationary Markov-switching process, permitting that the

speed at which an individual firm adjusts to systematic information may change over

time. The model also allows heterogeneous adjustment to multiple sources of systematic

news.

We first develop an analytical result showing that in the presence of heterogeneity

in information diffusion, individual stock and portfolio mean returns are downward biased relative to the mean returns of fundamentals. We then provide a parsimonious

calibration showing parameters that permit the model to quantitatively match in a

portfolio of small stocks the following empirically observed moments: 1) a slowly decaying (hyperbolic) pattern of loadings on current and lagged daily market returns,

2) a slowly decaying pattern of return autocorrelations, and 3) observed mean returns

5

at different horizons, including apparent downward bias at short-horizons. We also

show the parameters under which the model matches empirically observed moments of

a value-weighted large-stock portfolio. These parameters imply negligible amounts of

slow price adjustment.

The setting we analyze complements a set of models developed in earlier literature. First, iid measurement error (e.g., Blume and Stambaugh (1983)) produces effects in value-weighted portfolio returns that differ qualitatively from what we observe

in the data. Second, models based on asynchronous trade (e.g., Lo and MacKinlay

(1990)) produce qualitatively similar patterns in portfolio autocorrelations to the data.

However, prior literature has already shown that even aggressive calibrations of asynchronous trade models cannot match the level and persistence of observed portfolio

autocorrelations (Boudoukh, Richardson, and Whitelaw (1994)). We add to prior literature by showing theoretically the implications of asynchronous trade for downward

bias and horizon effects in average returns. We also show, complementing Boudoukh,

Richardson, and Whitelaw (1994), that even aggressive calibrations of asynchronous

trade models cannot capture quantitatively observed horizon effects in mean returns.

For the convenience of the reader, the iid measurement error and asynchronous trade

models, as well as our new theoretical results for the asynchronous trade model and

calibrations, are summarized in the Internet Appendix.

We now focus attention on our model of heterogeneity in information diffusion. This

is the only model among the broad set we have considered that is able to jointly match

empirical moments of value-weighted portfolio betas and lagged betas, autocorrelations,

and horizon effects in mean returns.

6

2.1. Model Setup

We assume fundamental asset returns over one period have a K-dimensional factor

structure, and denote the vector of factor realizations at time t by ft = (f1,t ...fK,t )0 , for

t ∈ N. For simplicity, we assume the factors are independent and identically normally

distributed with mean µf and diagonal covariance matrix Σf .4 The fundamental value

of an individual stock has instantaneous logarithmic returns given by

rt∗ = rf t + β 0 ft + εt ,

(1)

where we use an asterisk to denote the fundamental return, rf t is the riskless rate, β

is a K × 1 vector of constant factor exposures, and εt is an iid normal variable with

zero mean and standard deviation σ. To simplify notation, we suppress subscripts to

distinguish individual assets throughout our exposition.

To capture the idea of slow information diffusion, we permit that observed stock

returns may reflect innovations in lagged as well as contemporaneous fundamentals.

We stochastically assign stocks into one of Θ groups. Each group θ ∈ 1, ..., Θ differs by

the speed δθ at which fundamental information incorporates into observed asset prices.

Observed logarithmic stock returns follow

" Θ

#

X

rt = rf t + β

δθ (Dθt−1 + ρθt ft ) + εt ,

(2)

θ=1

where, for each θ, δθ is a scalar, Dθt−1 is a K × 1 vector, and ρθt is a diagonal K × K

matrix. The state variables Dθt track “information deficits” with respect to all factors

in each decay group θ, and the elements of ρθt randomly match information arriving

from the K factors to a group θ.

The random variables ρθt are required to be stationary, non-negative, and sum to

P

one: Θ

θ=1 ρθt = 1. These restrictions ensure that new information arrival cannot make

4

The analysis can easily be modified to accommodate features such as non-normal returns or stochastic

volatility.

7

prices “catch up” on old information faster, and that all information is eventually

incorporated into prices. In the implementation, we will further assume that combinations of period−factor information are be assigned to only one decay group, i.e., that

ρθt ∈ {0, 1} for all θ, t.

Information deficits Dθt accumulate underreaction to past and current factor realizations according to the state equations

D1t = (1 − δ1 )(D1t−1 + ρ1t ft )

D2t = (1 − δ2 )(D2t−1 + ρ2t ft )

..

.

DΘt = (1 − δΘ )(DΘt−1 + ρΘt ft ),

(3)

where 1 = δ1 > δ2 > ... > δΘ > 0 are non-stochastic, stock specific information delays.

Both the states Dθt and the random matrices ρθt are assumed to be unobservable.

The impact of a current factor realization on stock returns is determined by the terms

PΘ

θ=1 δθ ρθt ft in equation (2). The date−t information delay is therefore determined by

the evolution of the family of random matrices ρθt . To model these processes, we

define the associated Markov chains skt ∈ {1, 2, ..., Θ} on the “delay groups” skt . The

delay group skt = 1 is associated with the parameter δ1 = 1 and therefore produces a

price process that reacts instantaneously to factor k information, while the delay state

skt = Θ, with δΘ < δθ ∀θ, corresponds to the slowest possible reaction stock prices

to current factor−k realizations. The transition matrices for the delay states for each

factor k are assumed to be independent and are given by

p

p

· · · pkΘ

k1 k2

pk1 pk2 · · · pkΘ

Pk = e−λ∆ IΘ + (1 − e−λ∆ )

..

.

pk1 pk2 · · · pkΘ

8

(4)

where λ is the arrival intensity of a change in state and IΘ is the identity matrix

of dimension Θ. This form of the transition matrix for skt conveniently distinguishes

between changes in the state variable, which occur according to the intensity parameter

λ, and the steady-state distribution of skt as defined by the parameters pkθ . By further

defining the diagonal elements of the matrices ρθt (k, k) = 1{skt =θ} , we assume that in

delay state skt = θ a constant fraction δθ of the current factor realization immediately

impacts on returns, and that the remaining information is released into the market at

a geometrically declining rate δθ (1 − δθ )s−t .

2.2. The Impact of Slow Information Diffusion on Return Measurement

We now consider a special case of our model of slow information diffusion where returns

are driven by a single factor. We consider two classes of assets, one which we refer to as

the leader assets for which factor realizations are immediately incorporated into prices

and one which we refer to as the lagger assets for which there is a single delay state.

Logarithmic returns of the leader assets are assumed to be generated by equation (1)

with rf t = 0 and β = 1,

rt∗ = p∗t − p∗t−1 = ft ,

(5)

where p∗t is the log price of the fundemental asset. The factor realizations ft are independently normally distributed with mean µf and standard deviation σf . Lagger

logarithmic returns rt = pt − pt−1 given by the system of equations

rt = δ(Dt−1 + ft )

Dt = (1 − δ)(Dt−1 + ft ).

(6)

(7)

Straightforward manipulation of the dynamic equation for the information deficit Dt

shows that it is a stationary random variable.

9

Lemma 1 The information deficit follows an AR(1) process

Dt − Dt−1

1−δ

= −δ Dt −

µf + (1 − δ)σf ξt+1 ,

δ

(8)

where ξt are independent standard normal random variables. The unconditional distribution for Dt is normal with E(Dt ) =

1−δ

µf

δ

and Var(Dt ) =

(1−δ)2

σ2 .

1−(1−δ)2 f

If we further assume that there is a known date t = 0 when p∗0 = p0 = D0 = 0 we

can conveniently relate the leader prices to the lagger prices.

Lemma 2 Leader and lagger logarithmic prices are cointegrated:

p∗t = pt + Dt .

(9)

The fact that leader and lagger prices are cointegrated leads to the intuitive conclusion

that short-run return distributions of the two series will be different but that their

long-run return distributions will converge.

It is possible to obtain closed-form expressions for characteristics of lagger returns

within this simplified setting. The following proposition characterizes the unconditional

distribution of short-run returns.

Proposition 1 Lagger short-run log returns rt are unconditionally normal with E(rt ) =

µf and Var(rt ) =

1

δ

δ

σ2

2−δ f

1

eµf + 2 [ 2−δ ]σf < eµf + 2 σf

2

2

< σ 2 . Mean short-run simple returns are given by E (ert ) =

∗

= E ert .

This proposition makes several notable points that are relevant to applied empirical research. First, the proposition shows that the unconditional mean of logarithmic returns

of leader and lagger stocks are equal. Second, although slow diffusion of information

has no implications for mean returns, the short-run lagger log returns have lower unconditional variance than the leader log returns. This is a direct reflection of the fact

that short run lagger returns are exposed to only a fraction 0 < δ < 1 of the current

10

factor realization. Third, a consequence of these two facts is that mean simple returns

of lagger stocks are a downward biased estimate of the fundamental mean simple return

that can be measured from leader stocks. Although the first two points have been made

in prior work (e.g., Lo and MacKinlay (1990)), the downward bias in expected simple

returns has not been emphasized.

Conventional wisdom is that value-weighted portfolios produce returns that are less

susceptible to bias than reweighted portfolios such as equal-weighted portfolios. We

now show that when some stocks respond slowly to factor information, value-weighted

portfolios produce returns with an additional source of downward bias for the fundamental mean return. Assume that a fraction π of stocks are leaders and that the

remaining fraction 1 − π are laggers. The following proposition characterizes the simple

returns for a value weighted portfolio in this setting.

Proposition 2 The simple return on a value-weighted portfolio of leader and lagger

stocks is given by

Rt = wt−1 eft + (1 − wt−1 )eδ(Dt−1 +ft ) ,

(10)

where

wt−1 =

πeDt−1

.

πeDt−1 + 1 − π

(11)

The mean portfolio return is given by

E(Rt ) = E(wt−1 )e

where Cov

µf + 12 σf2

δ

µf + 21 [ 2−δ

σf ]

+(1−E(wt−1 ))e

1−π

, eδ(Dt−1 +ft )

πeDt−1 +1−π

2

+Cov

1−π

δ(Dt−1 +ft )

,e

,

πeDt −1 + 1 − π

(12)

< 0.

This proposition makes several important points. Equation (11) shows that the value

weights are a function of the lagged information deficit Dt−1 and, therefore, stationary.

This result follows from the fact that leader and lagger stock prices are cointegrated.

Equation (12) shows that there are three potential sources of bias when attempting to

11

measure fundamental mean returns using a value weighted portfolio. First, the mean

weight does not equal the proportion of leaders E(wt−1 ) 6= π. Although there is no

closed-form expression for this bias, it can be shown to be small. Second, the lagger

mean stock return is biased downwards relative to the fundamental mean return, as

was demonstrated in Proposition 1. The third source of bias arises because of the

negative correlation between lagger value weights and lagger stock returns as given

by Cov(1 − wt−1 , eδ(Dt−1 +ft ) ). This additional downward bias in the portfolio simple

return, which is caused by downweighting past high factor returns in the lagger stocks,

can be highly significant. Interestingly, the use of exogenous portfolio weights, such as

equal weights, will eliminate this source of bias and will produce higher mean portfolio

returns than does value weighting when slow information diffusion governs a subset of

the returns. The next subsection quantifies the magnitude of these biases within the

context of a calibrated version of the full model.

2.3. Parameterization and Calibration

We provide a calibrated version of our model to quantify the magnitude of heterogenous

information diffusion in small stocks. Heterogeneity across stocks can arise from differences in decay rates δθ as well as from the probabilities that any particular information

is assigned to a given decay rate. In order to parameterize our model in a parsimonious

way, we focus on only two factors, a market and non-market factor, and restrict the

set of allowable delay states and transition probabilities. Small stock returns display

long memory with significant autocorrelations that persist beyond one trading month

(21 days). To capture the slowly-decaying autocorrelations that we find in the data,

we choose the information delay parameters δθ , θ ∈ {1, 2, ...7}, to produce a geometric

progression {0, 20 , 21 , ..., 25 } of shock half lives. To limit parameters in the transition

matrix for delay states, shocks to factor k ∈ {1, 2} are assumed to be entirely incorpo-

12

rated in contemporaneous returns with an unconditional probability pk1 = ak and to

affect returns with a lag chosen from the six possible values δθ , θ ∈ {2, 3, ..., 7}, with

equal unconditional probabilities (1 − ak )/6. These restrictions on the parameter space

allow us to characterize slow reaction to market and non-market factors using only two

parameters: a1 is low when returns react slowly to market return innovations, and a2

is low when returns react slowly to non-market news.

We obtain daily returns produced by the smallest decile of US stocks during the

period 1926-2012 from the data library of Ken French. Two sets of moments are used

to calibrate the model: 1) Betas from univariate regressions of daily excess returns on

the excess market return with lags from 0 to 42 days, and 2) Autocorrelations with lags

from one to 42 days. These moments allows us to determine the slow adjustment of

small stock prices to both market news and undiversifiable non-market news.

Panel A in Figure 1 shows that positive exposure to lagged market shocks persists

for up to two trading months (dashed line). Our model can produce a similar pattern

in lagged market betas (solid line) when a1 = 0.35. Thus, our calibration implies that

market information is instantaneously incorporated into small stock returns only 35%

of the time and that 65% of the time the shock is delayed, potentially so severely that

the half-life of the news is 32 days.

Panel B in Figure 1 shows that positive autocorrelations in small stock returns

persist for up to two trading months (dashed line). To calibrate our model to this

pattern, a second, undiversifiable, non-market factor with the same variance as the

market factor is required. The small value of the parameter a2 = 0.1 indicates that,

unconditionally, small stocks respond slowly to non-market news: Small stocks react

instantaneously to non-market news only 5% of the time. In the vast majority of cases

(95% of the time) non-market factor information diffuses only very slowly into small

stock prices.

13

For comparison, Panels C and D of Figure 1 show lagged betas and autocorrelations

for the largest decile of CRSP stocks. Neither the betas nor the autocorrelations display

evidence of slow information diffusion, and a calibration of the model with a1 = a2 = 1

provides the best fit to this data.

The magnitude of information delay required to explain lagged beta and autocorrelation for small stocks is much higher than can be produced by models of microstructure

frictions. Boudoukh, Richardson, and Whitelaw (1994) consider the impact of nonsynchronous trading and show that such models produce geometrically declining autocorrelations, and that even extreme heterogeneity in daily non-trading probabilities ranging

from 0 − 85% produces autocorrelations of only 18%. Our model, calibrated to small

stock returns, shows that heterogeneity in information diffusion is necessary to explain

both the relatively low short-horizon dependencies in returns and the high long-horizon

dependencies. This pattern in returns is most plausibly generated by slow information

diffusion into observed small-stock prices.

3. Horizon Effects in Empirical Applications

We provide an analytical formula that shows how average returns scale across horizons.

We then extend our analysis to the scaling of abnormal performance as measured by

Jensen’s (1968) alpha and Fama and MacBeth (1973) coefficients, and develop a simple

diagnostic tool that shows the impact of microstructure effects at different horizons.

3.1. Horizon Effects in Average Returns

Consider the problem of an empiricist evaluating the performance of an investment

strategy. A standard return decomposition identifies abnormal return as measured by

alpha, the systematic market component, and a residual:

R̄in − R̄f n = αin + βin R̄M n − R̄f n + εin ,

14

(13)

where R̄jn , j ∈ {i, M, f } , denotes the unconditional average n-period gross return

R̄jn = E(Rj,t+1 . . . Rj,t+n )

for all t,

(14)

the index i denotes an arbitrary portfolio, M the market, f the risk-free rate, βin is the

market exposure calculated from n-period returns, and εin is the component of returns

that is uncorrelated with the market. Setting the base period to one day, R̄i1 gives the

average return using daily returns, while R̄i,21 would reflect an average return calculated

from n = 21 day periods, or approximately monthly returns.

A standard convention for reporting mean returns is to rescale linearly to a different

horizon, typically either a month or a year. We correspondingly define the rescaled

mean returns

RS

R̄in

≡ 1 + n R̄i1 − 1 ,

(15)

and the associated ratio of the linearly rescaled to buy-and-hold mean return

RS

νjn ≡ R̄jn

/R̄jn .

Rescaling a short-horizon mean to approximate a longer-horizon mean introduces a bias

whenever the average net returns of the portfolio do not rescale one-for-one with time.

For iid returns, the ratio νjn will be less than one due to compounding, but we

generally expect this effect to be small. To see this, define the short-horizon return

rescaled by compounding as

n

RSg

R̄in

≡ R̄i1

(16)

and the related ratio

g

RSg

νjn

≡ R̄jn

/R̄jn .

g

Under independence of returns, νjn

= 1. Consider the rescaling of daily alphas to

monthly, quarterly, or annual frequencies, or the rescaling of monthly alphas to quarterly

or annual frequencies. In these cases, the effects of compounding alone are small, and

15

RSg

g

RS

R̄in

≈ R̄in

or equivalently νjn

≈ νjn .5 Hence, when the returns of the portfolio i are

iid, linearly rescaling a daily to a monthly or annual alpha or a monthly to an annual

alpha is innocuous.

To identify and quantify the primary source of horizon effects in mean returns, we

consider normally distributed, single period logarithmic returns: ri1,t = ln (Ri1,t ) ∼

N (µi , σi2 ). Assume that log returns aggregated over n periods have a normal distribu2

tion with variance σin

, where n is the relevant horizon. These assumptions are exactly

satisfied if ri1,t is a stationary ARMA(p, q) process with Gaussian innovations, and

approximately hold in more general cases. We show:

Proposition 3 The ratio of rescaled to buy-and-hold mean returns satisfies

g

νin ≈ νin

≡

RSg

R̄in

2

= enσi (1−V Rin )/2 ,

R̄in

2

/ (nσi2 ) is the variance ratio. The net return ratios are

where V Rin ≡ σin

net

νin

g,net

≈ νin

RS

R̄in

−1

νin − 1

≡

= νin +

R̄in − 1

R̄in − 1

g

RSg

−1

νin

R̄in − 1

g

= νin +

.

≡

R̄in − 1

R̄in − 1

The bias in rescaled returns relative to the buy-and-hold return is thus determined by

the short-horizon variance σi2 and the variance ratio V Rin . When the variance ratio is

net

one, for example if returns are iid, then νin = νin

= 1 and rescaled short-horizon return

means approximate well longer-horizon buy-and-hold averages. Empirically, individual

asset returns are typically negatively autocorrelated, implying V Rin < 1, consistent

with the upward bias in Blume and Stambaugh (1983). For portfolios, the tendency for

net

positive spurious autocorrelations suggests νin

< νin < 1, implying a downward bias

in short-horizon average returns.

RSg

RS

For example, assuming a one percent average monthly return, R̄i12

= 1.1268 and R̄i12

= 1.12. The

magnitudes of the biases in (18) will then be tiny. Since νin = 1.12/1.1268 = 0.9939, the bias in alpha due to

the first term of (18) will be (νin − 1)R̄in = −0.0061 ∗ .01, less than a basis point per month in absolute terms.

5

16

3.2. Horizon Effects in Alphas

Horizon effects in mean returns give rise to horizon effects in performance measures.

Consider the problem of an empiricist evaluating the performance of an investment

strategy using Jensen’s (1968) alpha αin . A standard convention for reporting alphas

is to rescale linearly to a different horizon, typically either a month or a year. For

example, Ang and Kristensen (2011), Barber (2007), Lewellen and Nagel (2006), and

Li and Yang (2011), compute alphas from daily returns, and rescale linearly to longer

horizons. We correspondingly define the rescaled alpha

RS

αin

≡ nαi1 ,

(17)

and show

Proposition 4 The difference between the linearly rescaled and buy-and-hold alphas is

RS

αin

− αin ≈ (νin − 1)R̄in − β1 (νM n − 1)R̄M n − (β1 − βn ) R̄M n − R̄f n .

(18)

Rescaling a short-horizon alpha to approximate a longer-horizon alpha introduces a bias

whenever the average net returns of the portfolio or the market index do not rescale

one-for-one with time, or the betas calculated using different return frequencies are

not identical. A substantial literature investigates the measurement of betas across

different horizons (e.g., Dimson, 1979; Scholes and Williams, 1977), and our paper does

not address this issue. Rather, we focus on the scaling of mean returns across horizons.

In practice, however, horizon effects in alphas can be substantial. To preview our

empirical results, for the portfolio of small stocks, the daily alpha rescaled to a monthly

RS

frequency is αsmall,21

= 43 basis points, while the alpha obtained from using buy-

and-hold returns of 21-day “months” is almost 50% larger, αsmall,21 = 61 basis points.

Rescaling the alpha from a monthly to a quarterly frequency also substantially increases

the alpha.

17

A common view in the empirical finance literature is that alphas calculated at a daily

frequency represent the profits available to an investor with a daily investment horizon,

that monthly alphas represent performance from the perspective of an investor with a

monthly horizon, and so forth. This view implicitly assumes that investors can transact

at observed daily prices. Following arguments in ABK, even if a subset of investors is

able to implement such daily rebalancing, gains and losses from the trades sum to zero

across all investors. Consequently, rescaled alphas can provide an unbiased measure of

profitability for at best only a subset of short-horizon investors who successfully transact

at observed prices. Importantly, such performance measures will not properly capture

profitability of investors in aggregate. As is clear from (13), any bias in measured

average returns of the portfolio or the index due to microstructure effects will bias the

calculation of alpha.

3.3. Horizon Effects in Fama-MacBeth Regressions

The choice of return horizon also impacts Fama and MacBeth (1973, FM) coefficients

and their interpretation. Consider cross-sectional regressions:

Rin,t − 1 = ant + bnt Xit + int

(19)

where for simplicity Xit is a univariate characteristic for stock i at time t, Rin,t is an nperiod gross return on stock i starting at time t, and int is uncorrelated and mean zero.

Fama (1976, p. 328) shows that the time-series of FM coefficients bnt can be interpreted

as payoffs on a zero-cost investment strategy with portfolio weights proportional to the

characteristic.6

To see how the estimated FM coefficients change with time scale, consider estimating

(19) using n = 1 and n = 2 period returns. The conditional expectation of a 1-period

6

For example, suppose Xit is a small stock indicator. Then, ant measures the realized return of a large

stock portfolio, and bnt represents the realized size premium.

18

return is

E (Rin,t | Xit ) = 1 + a1 + b1 Xit .

(20)

The conditional expectation of the two-period return is

E (Rin,t Rin,t+1 | Xit ) = E (1 + a1t + a1t+1 + b1t Xit + b1t+1 Xit+1 | Xit )

+E (a1t a1t+1 | Xit )

+E (a1t b1t+1 Xit+1 + a1t+1 b1t Xit | Xit )

+E (b1t b1t+1 Xit Xit+1 ) | Xit ) .

(21)

If the time-series of FM coefficients are serially independent and uncorrelated with the

characteristic Xit , only the first term of Equation (21) is substantially different from

zero. In this case, provided the characteristic Xit is approximately constant across periods, the coefficient means scale approximately linearly, i.e., a2 ≈ 2a1 and b2 ≈ 2b1 ,

where an and bn respectively denote the time-series averages of the regression coefficients ant and bnt . Serial correlations in the time-series of FM coefficients can be driven

by microstructure noise. For example, in the case where positive autocorrelations and

cross-serial correlations are driven by asynchronous price adjustment, we expect the

short-horizon coefficients to be downward biased, 2a1 < a2 , 2b1 < b2 .7 Generally, different types of microstructure noise could lead to different patterns in the autocorrelations

of the FM coefficients.

In recent work, ABK focus on the specific case of noise in prices that is uncorrelated

with fundamentals. They show that weighting observations i by their lagged returns

can correct the bias caused by iid noise in prices. The ABK weighting scheme would

not work, however, to correct bias in FM coefficients caused by asynchronous price

adjustment, as such a weighting scheme does not address the autocorrelation terms in

(21). To account for both iid measurement error, as in ABK, and asynchronous price

7

For example, Xit inversely related to size ensures cross-serial correlations will be positive since large stocks

typically lead small stocks.

19

adjustment, one would need to use the ABK weights as well as choose a return horizon

long enough to minimize the importance of autocorrelations and cross-autocorrelations

in the FM coefficients.

3.4. Diagnosing Microstructure Frictions and Choosing the Return Horizon

We propose a simple procedure to diagnose biases in average returns and choose a horizon for empirical analysis. Modifying and extending the notation developed in Section

3.1 to accommodate greater empirical flexibility, consider geometrically rescaling an

n-period return to a horizon of m periods:

m/n

R̄inm ≡ [E(Ri,t+1 . . . Ri,t+n )]m/n ≡ R̄in .

(22)

If returns are iid,

R̄inm = R̄imm ≡ R̄im

for all n, m > 0.

(23)

This suggests using a plot of R̄inm versus the return-period length n as a diagnostic.

When this plot is approximately flat, then rescaling effects have a small impact.

Figure 2 demonstrates this diagnostic technique using data simulated from our Section 2 model using both the small and large stock calibrations. Panel A clearly shows

that for small stocks, where evidence of slow information diffusion is strong, value

weighted portfolio return means are downward biased at short horizons. This bias is

highly economically significant, with rescaled daily mean returns a full 40 basis points

per month lower than the rescaled annual mean returns. On the other hand, Panel B

shows that for the large stocks, where lagged betas and return autocorrelations provided no evidence of slow information diffusion, no horizon effects are present in average

holding period returns.

20

4. Empirical Evidence in U.S. Indices and Style Portfolios

We show the magnitudes of the rescaling biases in attribute-sorted portfolios and market

indices, and implement empirical methods to avoid these biases.

4.1. Data

Using data from CRSP and Compustat, we form portfolio returns on the basis of the

following characteristics:

Market Equity: The market value of the equity of the firm at the end of calendar

year τ − 1 is used to form portfolios beginning in July of year τ .

Book-to-Market: The ratio of the book value of equity to the market value of

equity, using the end of the previous calendar year book and market equity values.8

Similar to Fama and French (1993), the book-to-market ratio at the end of calendar

year τ − 1 is used to form portfolios starting in July of year τ .

Momentum: The cumulative return of individual stocks in the calendar months

t − 12 to t − 2 is used to form portfolios starting in month t.

Price: The price per share at the end of month t − 2 is used to construct portfolios

beginning in month t.

Short-term reversal: The return in month t − 2 is used to form portfolios starting

in month t.

Volatility: The standard deviation of daily stock returns estimated from months

t − 13 to t − 2 is used to form portfolios starting in month t.

8

Book equity used to calculate the book-to-market ratio is defined as stockholders’ book equity plus balance

sheet deferred taxes plus investment tax credit less the redemption value of preferred stock. If the redemption

value of preferred stock is not available, we use its liquidation value. If the stockholders’ equity value is not on

Compustat, we compute it as the sum of the book value of common equity and the value of preferred stock.

Finally, if these items are not available, stockholders’ equity is measured as the difference between total assets

and total liabilities.

21

Illiquidity: The Amihud (2002) price impact measure defined as average ratio of

absolute daily returns to daily dollar volume, estimated in year τ − 1 is used to

construct portfolios beginning in year τ .

Z-Score: The bankruptcy predictor introduced in Altman (1968) and measured

in fiscal year ending in calendar year τ − 1 is used to form portfolios beginning in

July of year τ .

For each attribute, we construct decile portfolios and study the returns of the top

and bottom groups. We calculate daily time series of each decile under three weighting

schemes.9 First, we compute initially equal-weighted (IEW) returns by investing $1 in

each stock at the beginning of each rebalancing period and holding the resulting portfolio until the next rebalancing period.10 Second, we calculate initially value-weighted

(IVW) returns, where, at the beginning of each rebalancing period, we invest in each

stock an amount proportional to its most recent market capitalization.11 Under the first

two weighting schemes, market equity, book-to-market, illiquidity, and Z-score portfolios are rebalanced annually, and the other portfolios are rebalanced monthly. Finally,

we compute equal-weighted (EW) returns by rebalancing stocks in a portfolio to equal

weights daily.

4.2. Horizon Effects in Average Returns and Alphas

Table 1 compares average daily, monthly (21 day), quarterly (63 day), semi-annual (126

day), and annual (252 day) returns, rescaled geometrically to different horizons. We

9

The sample periods are 1964-2009 for the book-to-market and Z-score portfolios, 1927-2009 for the momentum portfolio, and 1926-2009 for the remaining portfolios.

10

See Asparouhova, Bessembinder, and Kalcheva (2010) for discussion of initially equal-weighted portfolios.

Many empirical studies construct IEW portfolios by allocating stocks to portfolios according to some stock

characteristic, with equal portfolio weights at the initial formation (e.g., Greenwood (2005); Brennan and

Wang (2010); Sadka (2010); Kaniel, Ozoguz, and Starks (2012)). Event studies evaluating BHARs also use

this weighing scheme (e.g., Loughran and Ritter (1995)).

11

Note that IVW differs from conventional value-weighting if the market capitalization changes for reason

unrelated to stock performance, such as share issuance and repurchases.

22

consider the CRSP market index, and decile 1 and 10 portfolios of stocks sorted by

market equity, book-to-market ratio, and momentum.

Following our theoretical analysis, we expect rescaled daily returns to be smaller

than buy-and-hold returns of longer horizons, with the downward bias being largest for

portfolios of illiquid and volatile stocks. The results are consistent with this prediction.

For the initially equal-weighted small stock portfolio, the geometrically rescaled daily

means are substantially below the buy-and-hold averages for monthly returns (1.41 percent versus 1.63), quarterly returns (4.30 versus 5.73), and annual returns (18.34 versus

25.87). The biases are even larger for initially equal-weighted momentum losers, with

geometric rescaled daily versus buy-and-hold returns of 0.67 versus 1.00 at a monthly

horizon, and 8.34 versus 14.97 at an annual horizon. The differences between rescaled

and buy-and-hold returns are smaller, although still meaningful, for portfolios of large

stocks and initially value-weighted portfolios. These results confirm our prediction of

systematic biases in mean returns calculated from daily returns.

Importantly, these biases do not completely disappear at a monthly return horizon.

For example, the annualized monthly return of the initially equal-weighted momentum

loser portfolio is 12.72, while the corresponding measures of quarterly, semi-annual,

and annual returns are all relatively similar between 14.64 and 14.97. The effects of

rescaling are thus strong in daily returns and remain relevant in monthly returns.

In the Appendix we show robustness of the results of Table 1 to linear instead of

geometric rescaling. As anticipated in Section 3, the results are very similar to those

with geometric rescaling. Since linear rescaling easily accommodates statistical tests

based on means, is more common empirically, and as shown in Section 3 is implicit in

performance regressions that calculate alphas at different horizons, in the remainder of

tables we use linear rescaling.

In Table 2 we test the significance of differences in linearly rescaled (RS) versus

23

buy-and-hold (BH) returns, and demonstrate the accuracy of our analytical approxnet

net

is close to the

developed in Section 3. The statistic νin

imation of the ratio νin

estimated RS/BH ratio for all portfolios, validating the accuracy of the approximation

given in Proposition 3. The results also show that the rescaled returns are below the

buy-and-hold returns for all portfolios and horizons considered. Even apparently small

biases, for example for the large stock portfolio (−0.02 monthly, −0.15 quarterly) are

statistically significant, indicating that the return difference is stable over time. Many

of the portfolios show much larger differences between rescaled short-horizon returns

and longer-horizon returns. For example, in Panel B the rescaled monthly return average consistently understates the quarterly averages, with the largest differences for

portfolios of low-priced stocks (1.21 quarterly) and small stocks (0.82), and sizeable

differences for other portfolios (e.g., 0.24 for value stocks).

Interestingly, portfolios with the highest autocorrelation do not necessarily have the

largest differences between rescaled and buy-and-hold returns. For example, the low

liquidity portfolio has high autocorrelations (0.20 in daily returns and 0.17 in monthly

returns), but the low volatility of this portfolio keeps horizon effects contained to about

0.40 quarterly. The portfolio of liquid stocks exhibits similar horizon effects, achieved

through a higher return volatility paired with lower autocorrelation, so that the return spread (high illiquidity minus low illiquidity) is nearly unaffected by the choice of

horizon. In contrast, the high- and low-volatility portfolios have comparable daily autocorrelations (0.20 vs 0.17), but the standard deviation of the high-volatility portfolio

is about three times larger than the low-volatility portfolio. As a result, an apparently

small difference in means based on daily returns (3.03 − 2.62 = 0.42 when rescaled

to a quarterly frequency) translates to a large difference in actual quarterly returns of

4.52 − 2.79 = 1.73.

Table 3 clarifies how the rescaling bias we focus on in this paper differs from the ef-

24

fects of iid measurement error. Focusing on the small stock portfolio, the average daily

return rebalanced to equal weights (RB = 0.24) substantially exceeds the average daily

return of the buy-and-hold portfolio (BH = 0.07). This is the measurement error bias of

Blume and Stambaugh (1983), and is highly significant. At monthly and annual horizons, the difference between the returns of rebalanced portfolios and the buy-and-hold

portfolio continues to grow. For example, the annual return of the rebalanced portfolio

is 138.8, while the buy-and-hold return is 25.87. The biases caused in multi-period

returns by frequent portfolio rebalancing are discussed by Roll (1983) and subsequent

authors. The rescaling bias that we focus on can be seen in the difference between

the rescaled (RS) and buy-and-hold (BH) returns at monthly and annual horizons. In

contrast to the upward biases caused by iid measurement error and portfolio rebalancing, the rescaled returns are downward biased, as indicated by the negative signs

and statistically significant t-statistics in all entries of the row RS-BH for long-only

portfolios.

We show how horizon effects in mean returns translate into horizon effects in alphas.

Table 4 presents linearly rescaled daily alphas and monthly alphas for the attributesorted portfolios. We decompose the difference in the two alphas into return bias, factor

bias, and beta bias, using Equation (18). The largest estimates for factor and beta bias

are 0.05 and 0.06 respectively. The average return biases are larger, in the range of

0.10 to 0.40 monthly. Table 5 similarly decomposes the difference in alphas calculated

from monthly and quarterly data. The raw return biases are again the most substantial

contributor to the alpha bias. Thus, horizon effects in portfolio mean returns, which

are the focus of our paper, are the dominant component driving alpha differences across

horizons.

25

4.3. Choosing a Horizon

In Figure 3, we follow the method proposed in Section 3 of plotting the rescaled returns

R̄inm versus the return-period length n = 1, ..., 252 for fixed m = 21. All of the plots

show the characteristic shape associated with asynchronous trade and partial price

adjustment demonstrated in Section 3. For low n, the plots slope upward, and for larger

n the plots flatten out and stabilize. In a number of portfolios (small stocks, momentum

losers, high volatility, high inverse price, low reversal), the difference between R̄inm for

n = 1 (daily) and the flat part of the graph is 40-50 basis points monthly, or more. Most

of the portfolios show a horizon effect of at least 10 basis points monthly for n = 1. In

many of the plots a strong upward slope is still apparent for monthly returns (n = 21).

Only at a quarterly horizon do the plots reliably flatten out for all portfolios.

Plotting the return-measurement interval versus rescaled returns, as shown in Figure

3, provides a useful diagnostic tool for empiricists. Choosing a measurement interval

sufficiently long that it is on the flat portion of the rescaled return plot is a simple way

to alleviate concerns about the impact of microstructure frictions on average returns.

Conversely, using a return-measurement interval on the sloping portion of the rescaled

return graph should suggest consideration of the effects of measurement errors. In future

work we anticipate that the effects of microstructure frictions demonstrated here could

be directly incorporated into empirical moment conditions when using higher-frequency

data.

5. International Evidence

International portfolios exhibit considerable heterogeneity in liquidity.12 In this section,

we study horizon effects among region and country portfolios, as well as among style

12

Summarizing a large empirical literature, Bekaert, Harvey, and Lundblad (2007) note in their abstract:

“Given the cross-sectional and temporal variation in their liquidity, emerging equity markets provide an ideal

setting to examine the impact of liquidity on expected returns.”

26

portfolios constructed from international equities.

From Datastream, we identify all available country and regional US-dollar-denominated

MSCI indices. To be included in our sample, we require indices to have at least 10 years

of valid data and eliminate overly redundant regions13 to produce our international return sample of 56 country and 49 regional indices. We supplement this international

data with developed market style portfolios from Ken French’s website. We download 6 portfolios formed on size and book-to-market ratio and 6 portfolios formed on

size and momentum for five markets: Asia Pacific excluding Japan, European, Global,

Japanese, and North American. Following the methodology outlined on the website,

we compute returns on small, big, high book-to-market, low book-to-market, winner,

and loser portfolios for each market.

Tables 6, 7, and 8 compare average monthly returns rescaled to annual frequency

(RS) with average buy-and-hold annual returns (BH).14 Several observations from the

Tables are particularly noteworthy. First, rescaling biases are significant. For example,

the average difference between BH and RS returns is 4.1% per year in country portfolios

and 2.4% in regional index portfolios. These magnitudes are economically significant

and clearly call for caution in interpreting statistics calculated using average monthly

returns.

Second, rescaling biases in the international portfolios are systematic. Rescaled

returns are lower than buy-and-hold returns for every country, every region, and every

style portfolio. Figure 1 plots the histogram of the ratios of RS and BH returns and

confirms this observation graphically: The ratio is always below 1 and for several indices

approaches 0.5.

Third, consistent with our theoretical predictions, horizon effects are stronger in

13

MSCI maintains a number of regional indices (e.g., Europe Excluding Ireland) that closely overlap with

other broader indices that we study (e.g., Europe). For brevity, we exclude such regional indices.

14

Our focus on monthly returns is due to their wide use in the international finance.

27

smaller, less liquid markets where information diffusion is likely to be slow. For example,

Table 6 shows that the average difference between BH and RS returns in countries

classified as Developed by MSCI is 2% annually, whereas for the Emerging and Frontier

countries the difference is 5% on average and exceeds 10% for several countries. Regional

indices in Table 7 and international style portfolios in Table 8 exhibit similar patterns,

with stronger biases in regions with emerging markets. For example, the bias in the

small stock portfolio in Asia Pacific (ex. Japan), at 4.84% per year, is nearly six times

larger than it is in North America.

Finally, Table 8 also shows that the biases in the long and the short sides of the

factor portfolios partially offset, and the bias in the net long-short factor portfolios is

smaller. This suggests that biases in the average returns of country and regional indices will closely translate into biases in alphas. An empiricist measuring performance

of international portfolios, particularly those in smaller, less liquid markets can inadvertently introduce substantial biases in average returns and alphas, even when monthly

returns are used.

To determine whether the differences between rescaled and buy-and-hold returns

reflect an econometric bias or tradable profit opportunities, we compare horizon effects in non-investable market indices and investable exchange-traded funds. Table

9 summarizes the results for MSCI country indices from Datastream and the corresponding iShares country ETFs from CRSP. The average (median) difference between

rescaled and buy-and-hold returns amounts to −1.87% (−1.33%) per year for indices.

The magnitude is lower by more than a third for ETFs: −1.17% (−0.81%). Smaller

horizon effects in ETFs suggest that their prices reflect information more fully than do

index prices. The results presented in the table indicate that a considerable portion

of the difference between rescaled and buy-and-hold returns of the indices is due to

a non-tradable econometric bias. Importantly, the horizon effects are sizeable even in

28

ETFs, suggesting some room for profitable investment strategies as a consequence of

slow information diffusion into stock prices.

6. Conclusion

We establish theoretically, using standard models of asynchronous trading and partial price adjustment, that short-horizon average returns of value-weighted and other

non-rebalanced portfolios are biased. In contrast to the existing literature on iid measurement error, the bias under these sources of microstructure friction is downward

rather than upward, and impacts value-weighted portfolios more than equal-weighted

portfolios.

To explain these biases, we develop an analytical approximation linking the average

returns of a portfolio over arbitrary horizons. Average returns over a long horizon

are closely approximated using only a few simple moments of returns, namely, the

short-horizon average return and variance, and the variance ratio of long- to shorthorizon returns. The formula explains why bid-ask bounce, which generates a variance

ratio of long-horizon to short-horizon returns less then one, produces an upward bias

in short-run returns. On the other hand, asynchronous price adjustment produces a

variance ratio greater than one, and a downward bias in short-horizon portfolio returns.

We show that, consistent with theory, buy-and-hold portfolios of small, illiquid, and

volatile stocks have average returns that are substantially downward biased at a daily

horizon. These biases remain significant in many cases even for monthly returns.

We propose a simple solution to account for these biases. Plotting rescaled average

returns versus the return horizon permits easy diagnosis of market microstructure frictions by a sharp slope at short-horizons. Choosing a sufficiently long return horizon on

the flat portion of this graph ensures that pricing frictions should not cause a problem

in measured return means, alphas, or Fama-MacBeth coefficients. Given the increas-

29

ing importance of short-horizon returns in empirical work, awareness of these biases is

important, and we anticipate continued advances in empirical methods that explicitly

account for microstructure frictions.

30

7. Appendix: Proofs

Proof of Lemma 1

Let ft = µf + σf ξt where the random variables ξt are independent standard normals.

Substituting this expression for ft in equation (7) produces equation (8). Since 0 <

δ < 1, the process for Dt is AR(1) and the formulas for the unconditional mean and

variance can be obtained by applying the expectation and variance operators to both

sides of equation (8).

Proof of Lemma 2

By assumption, p∗0 = p0 + D0 . To apply the inductive proof of the result, assume

that p∗t−1 = pt−1 + Dt−1 . Equations (5), (6), and (7) yield

pt + Dt = pt−1 + δ(Dt−1 + ft ) + (1 − δ)(Dt−1 + ft )

= pt−1 + Dt−1 + ft

= p∗t−1 + ft

= p∗t .

Proof of Proposition 1

Formulas for the unconditional mean and variance of lagger returns follow by applying the expectation and variance operator to both sides of equation (6) and then

substituting the expressions for E(Dt ) and Var(Dt ) from Lemma 1. The upper bound

on lagger variance follows from the fact that 0 < δ < 1 < 2 − δ implies that

Proof of Proposition 2

31

δ

2−δ

< 1.

Formula (11) is derived as follows:

∗

wt−1

πept−1

=

∗

πept−1 + (1 − π)ept−1

πept−1 +Dt−1

=

πept−1 +Dt−1 + (1 − π)ept−1

πeDt−1

.

=

πeDt−1 + (1 − π)

(24)

(25)

(26)

Expression (12) follows from applying the expectation operator to equation (10) and

applying the definition of covariance.

Proof of Proposition 3

RSg

We first observe that R̄in

= en(µi +σi /2) . The RS measure depends only on the first

2

and second moments of daily returns. By contrast, buy-and-hold returns over a monthly

horizon depend on how daily returns aggregate. In particular, by assumption of joint

normality of daily log returns, the monthly log returns are also normally distributed, i.e.,

2

2

BH

ri,1 + · · · + ri,n ∼ N (nµi , σin

). As a consequence, the BH statistic is R̄in

= enµi +σin /2 .

The ratio of the two statistics is

νin ≡

RSg

R̄in

2

2

2

= e(nσi −σin )/2 = enσi (1−V Rin )/2 .

BH

R̄in

(27)

The ratio in the net returns is

net

νin

≡

RSg

R̄in

−1

νin − 1

= νin + BH

.

BH

R̄in − 1

R̄in − 1

(28)

Proof of Proposition 4

Scaling the short-horizon Jensen’s alpha, given by equation (13) in the case where

n = 1, to its n-period long-horizon value yields the expression

RS

nαi1 ≡ αin

= nR̄i1 − nR̄f 1 + β1 nR̄M 1 − nR̄f 1

= (nR̄i1 − 1) − (nR̄f 1 − 1) + β1 (nR̄M 1 − 1) − (nR̄f 1 − 1)

= (1 + (nR̄i1 − 1)) − (1 + (nR̄f 1 − 1)) + β1 (1 + (nR̄M 1 − 1)) − (1 + (nR̄f 1 − 1))

= νin R̄in − νf n R̄f n + β1 νM n R̄M n − νf n R̄f n ,

32

RS

where νjn ≡ (1 + n(R̄j1 − 1))/R̄jn = R̄jn

/R̄jn . Subtracting the long-horizon buy-and-

hold alpha αin produces

RS

− αin =

αin

νin R̄in − νf n R̄f n + β1 νM n R̄M n − νf n R̄f n

− R̄in − R̄f n + βn R̄M n − R̄f n

= (νin − 1)R̄in − (νf n − 1)R̄f n − β1 νM n R̄M n − νf n R̄f n + βn R̄M n − R̄f n .

This expression can be equivalently written

RS

αin

− αin = (νin − 1)R̄in − β1 (νM n − 1)R̄M n + (βn − β1 ) R̄M n − R̄f n

−(1 − β1 )(νf n − 1)R̄nf .

(29)

The approximation (18) follows if rescaling has an insignificant impact on the average

return of the risk-free asset, νf n ≈ 1.

33

References

Altman, E. I., 1968, “Financial Ratios, Discriminant Analysis and the Prediction of Corporate

Bankruptcy,” Journal of Finance, 23, 589–609.

Amihud, Y., 2002, “Illiquidity and Stock Returns: Cross-Section and Time-Series Effects,” Journal of

Financial Markets, 5, 31–56.

Ang, A., and D. Kristensen, 2011, “Testing Conditional Factor Models,” Journal of Financial Economics,, Forthcoming.

Asparouhova, E., H. Bessembinder, and I. Kalcheva, 2010, “Liquidity Biases in Asset Pricing Tests,”

Journal of Financial Economics, 96, 215–237.

, 2012, “Noisy Prices and Inference Regarding Returns,” Journal of Finance,, Forthcoming.

Badrinath, S. G., J. R. Kale, and T. H. Noe, 1995, “Of Shepherds, Sheep, and the Crossautocorrelations in Equity Returns,” The Review of Financial Studies, 8, 401–430.

Barber, B. M., 2007, “Monitoring the Monitor: Evaluating CalPERS’ Activism,” Journal of Investing,

pp. 66–80.

Bekaert, G., C. R. Harvey, and C. T. Lundblad, 2007, “Liquidity and expected returns: Lessons from

emerging markets,” Review of Financial Studies, 20(6), 1783–1831.

Blume, M. E., 1974, “Unbiased Estimators of Long-Run Expected Rates of Return,” Journal of the

American Statistical Association, 69, 634–638.

Blume, M. E., and R. F. Stambaugh, 1983, “Biases in Computed Returns - an Application to the Size

Effect,” Journal of Financial Economics, 12, 387–404.

Boudoukh, J., M. P. Richardson, and R. F. Whitelaw, 1994, “A Tale of Three Schools: Insights on

Autocorrelations of Short-Horizon Stock Returns,” Review of Financial Studies, 7, 539–573.

Brennan, M. J., N. Jegadeesh, and B. Swaminathan, 1993, “Investment Analysis and the Adjustment

of Stock Prices to Common Information,” Review of Financial Studies, 6, 799–824.

Brennan, M. J., and A. W. Wang, 2010, “The Mispricing Return Premium,” Review of Financial

Studies, 23, 3437–3468.

Canina, L., R. Michaely, R. H. Thaler, and K. L. Womack, 1998, “Caveat Compounder: A Warning

about Using the Daily CRSP Equal-Weighted Index to Compute Long-Run Excess Returns,” Journal

of Finance, 53, 403–416.

Chordia, T., A. Sarkar, and A. Subrahmanyam, 2011, “Liquidity Dynamics and CrossAutocorrelations,” Journal of Financial and Quantitative Analysis, 46, 709–736.

Chordia, T., and B. Swaminathan, 2000, “Trading Volume and Cross-Autocorrelations in Stock Returns,” Journal of Finance, 55, 913–935.

Cohen, L., and A. Frazzini, 2008, “Economic links and predictable returns,” Journal of Finance, 63(4),

1977–2011.

Cohen, L., and D. Lou, 2012, “Complicated firms,” Journal of Financial Economics, 104(2), 383–400.

Conrad, J. S., and G. Kaul, 1993, “Long-Term Market Overreaction or Biases in Computed Returns?,”

Journal of Finance, 48, 39–63.

34

Dellavigna, S., and J. M. Pollet, 2009, “Investor Inattention and Friday Earnings Announcements,”

Journal of Finance, 64(2), 709–749.

Dimson, E., 1979, “Risk Measurement When Shares Are Subject to Infrequent Trading,” Journal of

Financial Economics, 7, 197–226.

Fama, E. F., 1976, Foundations of finance : portfolio decisions and securities prices. Basic Books, New

York.

Fama, E. F., and K. R. French, 1993, “Common Risk-Factors in the Returns on Stocks and Bonds,”

Journal of Financial Economics, 33, 3–56.

Fama, E. F., and J. D. MacBeth, 1973, “Risk, Return, and Equilibrium - Empirical Tests,” Journal of

Political Economy, 81, 607–636.

Greenwood, R., 2005, “Short- and long-term demand curves for stocks: theory and evidence on the

dynamics of arbitrage,” Journal of Financial Economics, 75(3), 607 – 649.

Hirshleifer, D., S. S. Lim, and S. H. Teoh, 2009, “Driven to Distraction: Extraneous Events and

Underreaction to Earnings News,” Journal of Finance, 64(5), 2289–2325.

, 2011, “Limited Investor Attention and Stock Market Misreactions to Accounting Information,”

Review of Asset Pricing Studies, 1(1), 35–73.

Hirshleifer, D., and S. H. Teoh, 2003, “Limited attention, information disclosure, and financial reporting,” Journal of Accounting and Economics, 36(1-3), 337–386.

Hong, H., T. Lim, and J. C. Stein, 2000, “Bad news travels slowly: Size, analyst coverage, and the

profitability of momentum strategies,” Journal of Finance, 55, 265–295.

Hou, K., and T. J. Moskowitz, 2005, “Market frictions, price delay, and the cross-section of expected

returns,” Review of Financial Studies, 18(3), 981–1020.

Huberman, G., and T. Regev, 2001, “Contagious speculation and a cure for cancer: A nonevent that

made stock prices soar,” Journal of Finance, 56(1), 387–396.

Jacquier, r., A. Kane, and A. J. Marcus, 2003, “Geometric or Arithmetic Mean: A Reconsideration,”

Financial Analysts Journal, 59, 46–53.

, 2005, “Optimal Estimation of the Risk Premium for the Long Run and Asset Allocation: A

Case of Compounded Estimation Risk,” Journal of Financial Econometrics, 3(1), 37 – 55.

Jensen, M. C., 1968, “Performance of Mutual Funds in Period 1945-1964,” Journal of Finance, 23,

389–416.

Kaniel, R., A. Ozoguz, and L. Starks, 2012, “The high volume return premium: Cross-country evidence,” Journal of Financial Economics, 103(2), 255–279.

Klibanoff, P., O. Lamont, and T. A. Wizman, 1998, “Investor Reaction to Salient News in Closed-End

Country Funds,” Journal of Finance, 53, 673–699.

Lewellen, J., and S. Nagel, 2006, “The conditional CAPM does not explain asset-pricing anomalies,”

Journal of Financial Economics, 82, 289–314.

Li, Y., and L. Yang, 2011, “Testing Conditional Factor Models: A Nonparametric Approach,” Journal

of Empirical Finance, 18(5), 972 – 992.

35

Liu, W., and N. Strong, 2008, “Biases in Decomposing Holding-Period Portfolio Returns,” Review of

Financial Studies, 21, 2243–2274.

Lo, A. W., and A. C. MacKinlay, 1990, “An Econometric Analysis of Nonsynchronous Trading,”

Journal of Econometrics, 45, 181–211.

Loughran, T., and J. R. Ritter, 1995, “The New Issue Puzzle,” Journal of Finance, 50, 23–51.

Menzly, L., and O. Ozbas, 2010, “Market Segmentation and Cross-predictability of Returns,” Journal

of Finance, 65(4), 1555–1580.

Pastor, L., and R. F. Stambaugh, 2012, “Are Stocks Really Less Volatile in the Long Run?,” Journal

of Finance, 67, 431 – 478.

Pastor, L., and P. Veronesi, 2003, “Stock Valuation and Learning about Profitability,” Journal of

Finance, 58, 1749–1789.

Roll, R., 1983, “On Computing Mean Returns and the Small Firm Premium,” Journal of Financial

Economics, 12, 371–386.

Sadka, R., 2010, “Liquidity risk and the cross-section of hedge-fund returns,” Journal of Financial

Economics, 98(1), 54 – 71.

Scholes, M. S., and J. Williams, 1977, “Estimating Betas from Nonsynchronous Data,” Journal of

Financial Economics, 5, 309–327.

Tetlock, P. C., 2011, “All the News That’s Fit to Reprint: Do Investors React to Stale Information?,”

Review of Financial Studies, 24, 1481 – 1512.

36

Table 1. Horizon Effects in Style Portfolios

Performance

Metric

Daily

Monthly

Quarterly

Semi-Annual

Annual

Daily

Monthly

Quarterly

Semi-Annual

Annual

Daily

Monthly

Quarterly

Semi-Annual

Annual

Daily

Monthly

Quarterly

Semi-Annual

Annual

Daily

Monthly

Quarterly

Semi-Annual

Annual

Daily

Monthly

Quarterly

Semi-Annual

Annual

Daily

Monthly

Quarterly

Semi-Annual

Annual

1 day

0.04

0.04

0.04

0.05

0.06

0.07

0.08

Holding Horizon

1 mo

3 mo

6 mo

1 year

1 day

A. CRSP Value-Weighted Index

0.84

2.55

5.17

10.61

0.86

2.62

5.30

10.89

2.62

5.31

10.90

5.33

10.94

10.97

Holding Horizon

1 mo

3 mo

6 mo

B. Market Capitalization, Initially Value-Weighted

Big

0.80

2.43

4.92

10.09

0.06

1.26

0.81

2.45

4.95

10.14

1.46

2.49

5.04

10.32

5.06

10.37

10.49

C. Market Capitalization, Initially Equal-Weighted

Big

0.81

2.46

4.97

10.20

0.07

1.41

0.83

2.52

5.10

10.46

1.63

2.58

5.22

10.71

5.19

10.64

10.69

D. Book-to-Market,

Value

1.16

3.52

7.17

1.20

3.63

7.39

3.64

7.42

7.31

Initially Value-Weighted

E. Book-to-Market,

Value

1.36

4.13

8.42

1.49

4.52

9.25

4.70

9.62

9.65

Initially Equal-Weighted

1.51

1.51

1.71

1.80

14.85

15.33

15.38

15.16

15.37

17.55

19.36

20.16

20.24

19.91

0.04

0.02

0.77

0.78

0.48

0.59

F. Momentum, Initially Value-Weighted

Winners

4.60

9.41

19.71

-0.01

-0.15

4.61

9.44

19.77

0.03

4.72

9.67

20.27

9.76

20.47

20.26

G. Momentum, Initially Equal-Weighted

Winners

5.23

10.74

22.62

0.03

0.67

5.51

11.32

23.93

1.00

5.74

11.82

25.04

12.05

25.56

24.69

Small

3.83

4.44

5.12

Small

4.30

4.98

5.73

Growth

2.33

2.37

2.42

Growth

1.44

1.79

1.97

Losers

-0.46

0.09

0.37

Losers

2.02

3.04

3.47

1 year

7.80

9.07

10.49

10.43

16.22

18.97

22.09

21.95

22.65

8.78

10.21

11.78

11.78

18.34

21.46

24.94

24.94

25.87

4.72

4.79

4.90

4.96

9.65

9.80

10.04

10.16