Course Description: Prerequisites

Finance 325: Corporate Finance

Fall 2013

Professor Levine

Course Syllabus

This version: September 4, 2013

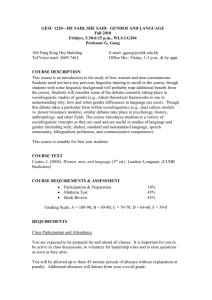

Name:

Office:

Email:

Office hours:

Professor

Prof. Oliver Levine

Grainger 5274D olevine@bus.wisc.edu

M 5:20-6:20pm,

W 8:30-9:30am, and by appointment only.

T.A.

Adam Spencer

Grainger 1290 ahspencer@wisc.edu

Tu 11am-12pm,

Th 2:30-3:30pm, and by appointment only.

For faster replies, please use the prefix “FIN 325” in the subject line of all emails.

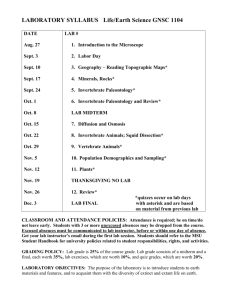

Meetings and Dates:

Lecture:

Midterm:

Final:

Course Description:

Mondays and Wednesdays

Section 1: 1:00 – 2:15pm, Grainger 1195

Section 2: 2:30 – 3:45pm, Grainger 1175

Section 3: 4:00 – 5:15pm, Grainger 1185

Wednesday, October 23, in class

Thursday, December 19, 5:05-7:05pm, Room TBA

Development of the theory, method and analytical techniques of financial management.

Techniques of capital budgeting; valuation of projects and firms; theory of capital structure; dividend policy; cost of capital; mergers and acquisitions. The emphasis will be on the theory of these financial policy decisions, rather than the institutional and practical details.

Prerequisites:

Finance/Econ 300, Math 213 or 222, Gen Bus 304 or equiv, and Acct I S 301.

1

Course Website:

I will post announcements, handouts, problem sets, discussion articles, etc. on the course website. Please check it regularly for postings. https://courses.bus.wisc.edu

Problem Sets:

There will be five problems sets throughout the semester. Problem sets are due at the beginning of class on the due date without exception. Late problem sets will automatically receive a score of zero. The grade from your lowest scoring assignment will be dropped.

Problem sets will be done in groups of four (see below for details), and each group will turn in only one set of solutions. Please submit problem sets in hard copy with the names of all group members on the front page.

Case Studies:

There will be two case studies during the semester. Case study write-ups are due at the beginning of class on the due date without exception. Late submissions will automatically receive a score of zero. Cases will be graded on a ten point scale. Just as with problem sets, case study write-ups will be done in groups of four (see below for details), and each group will turn in only one write-up per case study. Please submit case study write-ups in hard copy with the names of all group members on the front page.

A case write-up should be a concise and neatly composed document that uses text, tables, and/or figures as you judge to be appropriate to answer the case questions. The write-up should not exceed three pages of text plus three pages of tables and/or figures. This limit is to help you: the intent is for you to think about the concepts and to work through a real-world problem analytically, not to provoke an arms race among the groups. You should refer to the numbers given in the case or in your tables and figures to indicate how you arrived at your conclusions. Always state explicitly the assumptions you are making in your write-up.

Responding to case study questions is a simulation of real-world problem solving, for which making reasonable assumptions is a critical part of being able to find the best course of action.

Note that we will discuss each case during the lectures after the write-ups have been submitted, but “answers” to the cases will not be posted or distributed. Cases are learning tools for which there are many valid answers and displaying analytical reasoning is more important than the actual numbers. I am happy to answer questions and discuss previous cases during my office hours.

If you have specific questions when you are working on the cases, please start by directing them to the teaching assistant, who is an excellent resource. His role is to answer clarifying questions, prevent you from going down the wrong track, and aid generally in the learning process. Of course, you should not expect him to feed you answers. The process of working through cases is a critical aspect of learning about corporate finance.

2

The case study course pack is available for purchase from Harvard Business publishing at https://cb.hbsp.harvard.edu/cbmp/access/21336225

Group Work:

You will form two groups which remain for the entire semester: one group for problem sets, and another group for case studies. Your case study groups may not contain more than one person who was also in your problem set group. This is to force you to meet and work with a variety of people throughout the class. Groups may include students from other sections.

Please form groups the first two weeks of class and have one person from each group send an email to the TA with your four group members. Please email the TA with group assignments no later than 5pm on Friday, September 14.

If you fail to form a group by this date, you will be randomly assigned to a group. After this time, all groups are final and may not be changed.

Group work should be independent of other groups. When preparing cases, please do not speak to members of other groups about the case, and it is prohibited to get information, assistance, or materials from people who have prepared this case previously.

At the end of the semester I will ask each person to give a brief evaluation of everyone in each of their groups. Peer evaluation will be anonymous and will be a component of your problem set and case study grades. This is not just to encourage everyone in the group to contribute, but is also an opportunity for you to reward students within the group that take the time to help others.

Articles for Class Discussion:

Several times throughout the semester I will post an article, op-ed, or other piece of writing.

These will be accompanied by a couple of questions that I will pose to form the basis for a short class discussion. Please have read and thought about the posted material prior to class.

You will not be asked to hand in a write-up, however, please come prepared to contribute to the class discussion. This will be part of your class participation grade.

Exams:

There will be a midterm examination, given during class, and a final exam, at the time, date, and location set by the University. With the exception of a medical emergency, the exams must be taken during the scheduled times. If you have a final exam time conflict with another class, please email me at the beginning of the semester to discuss accommodations. There are no scheduled make-up exams.

You should bring a calculator to the midterm and final, and you may bring one sheet of paper with notes you wrote yourself (you can write on both sides). You may not photocopy or print a copy of another person’s notes, they must be your own. No additional material or

3

technology can be used during the exam. Without exception you must take the exam in the section for which you are registered.

If you believe that there has been a mistake in the grading, you should bring it to my attention within one week of receiving the grade. Requests for re-grading must be made in writing and the precise nature of the problem or mistake should be explained. Note that the complete exam will be re-graded.

Class Participation:

A component of your grade will be class participation. I will not take formal attendance, however, I encourage you to come to class and be ready to make thoughtful and relevant contributions. Contribution quality is more important than quantity. Attendance, quality of inclass contributions, and attending any scheduled special events (such as guest lectures) will all be taken into account when determining participation grade.

Discussion Sections:

There will be five Friday discussion sections during the semester, led by the TA, which will occur the Friday before each exam, one on September 14 to review basic concepts from FIN

300, and two others to review material (see schedule below). The discussions will be a forum for you to ask questions about the material covered in lecture and to prepare for the exams. If you want the TA to solve a specific question from a problem set, please send him an email at least two days prior to the session. Attending discussions is not mandatory, but please use them as a tool for learning the material and preparing for exams to the extent you find necessary.

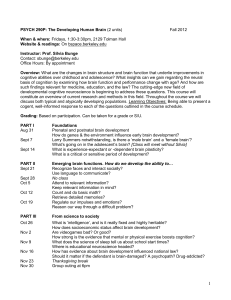

Grading:

Problem Sets

Case Write-ups

Midterm Exam

Final Exam

20%

20%

20%

35%

Class Participation 5%

4

Student Use of Electronics in the Classroom:

“The Wisconsin School of Business policy is that students are not permitted to use personal electronic technology such as computers, cell phones, mp3 players (e.g. iPods), recording devices or other hand-held devices during class periods unless specifically permitted by the course instructor. We believe that classroom use of such technology can serve as a distraction for the user, classmates, and the instructor, and can hinder instruction and learning. In establishing restrictions, instructors are expected to make reasonable accommodations for students with disabilities.”

I will follow and enforce the official policy of the Wisconsin School of Business.

Supplemental Reading:

Corporate Finance by Berk and DeMarzo, 2nd Ed. (2011)

The lectures and lecture notes are the focus of the course. Berk and DeMarzo (BD) is the recommended supplemental textbook but it is not required. Relevant chapters are noted below. It will be available on reserve.

Topics

Cash flows and PV

Investment decisions rules

Risk and return

Estimating the cost of capital

Capital structure – M&M

Debt and taxes

Trade off theory

WACC & APV

Payout policy

Agency problems

Information asymmetry

Signaling and adverse selection

Real options

Raising capital

Mergers & Acquisitions

Executive compensation

Relevant Book Chapters (Berk and DeMarzo)

4.1-4.6, 7.1-7.2

3.3, 6.1-6.5

10, 11

12

14.1-14.5

15.1-15.5

16.1-16.4

18.2-18.3

17.1-17.7

16.5-16.7

16.8-16.9

16.8, 17.6

22.1-22.4, 22.7

23, 24

28

29.1-29.4

5

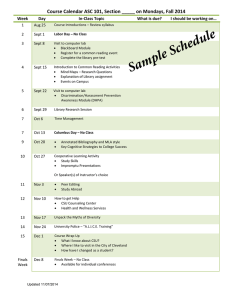

Schedule*:

Week

1

2

3

4

Sept 9

Monday

Cash flows and PV

Sept 4

Wednesday

Introduction Sept 7

Friday

Sept 11

Sept 18

Cash flows and PV (cont.) Sept 14

Risk and return Sept 21

Discussion;

Due: group assignments

Sept 16 Investment decision rules

Sept 23

Risk and return (cont.)

PS1 due

Sept 30 Estimating cost of capital

Sept 25 Risk and return (cont.) Sept 28 Discussion

5 Oct 2

Capital structure – M&M

PS2 due

Oct 5

6 Oct 7

Capital structure – M&M

Examples

First case due

Oct 9 First case discussion Oct 12

7 Oct 14 Debt and taxes Oct 16 Trade off theory Oct 19

Discussion

(Midterm prep)

8

9

10

Oct 21

Oct 28

Nov 4

Midterm Exam preparation

PS3 due

Trade off theory

Agency costs of leverage

Oct 23 Midterm Exam

Oct 30 Trade off theory

Nov 6

Agency benefits of leverage,

Information asymmetry

11 Nov 11 WACC

12 Nov 18 Mergers and Acquisitions

13 Nov 25 Executive compensation

Nov 13

Nov 20

Payout policy

PS4 due

Special Topic: TBD

Nov 27 Raising capital

14 Dec 2 Raising capital Dec 4 Real options

15

F

Dec 9

Final Exam preparation

Second case due

Dec 11

Discuss second case; course wrap-up and review

PS5 due

Dec 19 FINAL EXAM : Thursday, December 19, 5:05-7:05pm, Room TBA

Oct 26

Nov 2

Nov 9

Nov 16

Dec 14

Discussion

Nov 23 Thanksgiving

Nov 30

Dec 7

Discussion

(Final prep)

*The midterm and final dates will not be changed, nor will makeups be given. In addition, homework and case write-up due dates will not be moved up. However, on rare occasion homework and case study due dates may be pushed to later if justified by course progress. It is likely the specific topics scheduled to be discussed each day will change over the course of the semester. I will do my best to announce any significant changes on the course website and update the syllabus calendar.

6

Revision History:

None.

7