draft decision 2013-2015 electric and natural gas conservation and

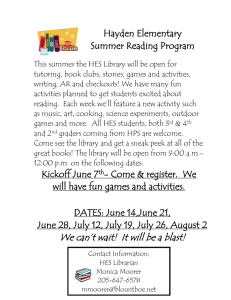

advertisement