Annual Report 2013

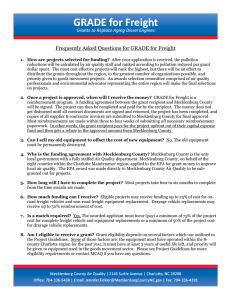

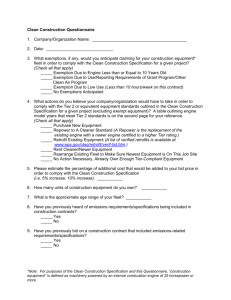

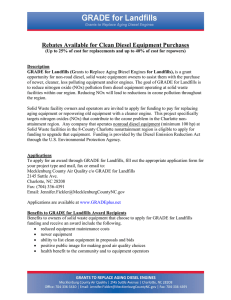

advertisement