notes to the consolidated financial statements

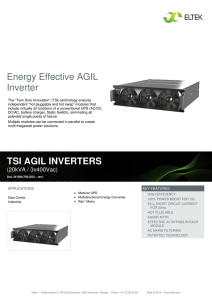

advertisement