2013 Annual Report - United Technologies

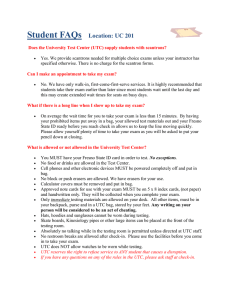

advertisement