Batavia Stock Focus

6 December 2012

London Sumatra

Yasmin Soulisa

yasmin@bps.co.id

62-21 5207374

Price Pressure

• Decline in revenue pressured by lower ASP

London Sumatra in 9M 2012, posted sales of Rp3.37 trillion, a 4% decline

compared to same period last year, which was Rp3.52 trillion. The pressure

came from sharp decline in commodity prices, mainly palm products and

rubber. Lonsum selling price for its palm products; CPO and Palm Kernel

(PK), had decreased 1% and 27%, respectively. While the company's rubber

price down 26% compared to 9M 2011. The seeds price was relatively

better, went up 20% yoy. Net income shrank 9% to Rp949,86 million from

Rp1,31 billion last year.

• Production relatively flat

The company faced early wintering this year. Fresh Fruit Bunch (FFB)

processed reached 1.43 million tons, rose 4% from 1,38 million tons during

the first 9 month of 2011. CPO and PK production in 9M12 increased 1.3%

and 2.4% from the same period last year, reached 322,270 tons and 77,919

tons, respectively. Nucleus FFB yield for the period declined from 13.4

tons/ha to 12.8 tons/ha. Oil extraction rate (OER) and Kernel extraction rate

(KER) stood at 22.5% and 5.4%. Meanwhile, planting activity up to 9M12

was 1,665 ha, of which 1,586 ha for oil palm new planting and the remaining

for rubber and oil palm replanting. New planting were expected around

3,500 ha to 4,000 ha this year.

Stock Data

Price (Rp)

Target (Rp)

Recommendation

52-weeks range (Rp)

Market Capitalization (Rp bn)

Outstanding shares (mn shares)

Daily average volume ('000 shares)

Daily average value (Rp mn)

1,890

2,550

BUY

1,830 - 3,150

12,895

6,823

16,230

37,718

Major Shareholder

PT Salim Ivomas Pratama

Public

59.5%

40.5%

• Maintain BUY with lower TP 2,550

We believe the current bearish trend for Lonsum is short lived, as demand

for CPO in 2012 and 2013 are estimated to rise 5% and 7% each year

(Source : Oil World). However, the current high level inventory in Indonesia

and Malaysia will add pressure to the price of CPO and rubber in short term.

Our DCF valuation with WACC 13.8% and terminal growth of 3.0% resulted

in target price of Rp2,550 implying 12.3x FY13F PE. We recommend BUY

with potential upside of 35% from current price.

Financial Highlights

(Rp billion)

Net Sales

Gross Profit

Operating Profit

Net Profit

EPS (Rp/share)

2009A

3,200

1,390

1,019

707

518

2010A

3,593

1,771

1,361

1,033

757

2011A

4,686

2,362

2,006

1,702

249

2012F

4,485

1,844

1,503

1,265

185

2013F

4,820

2,046

1,680

1,414

207

Key Ratios

P/E (x)

P/BV (x)

ROA

ROE

2009A

3.6

0.7

14.6%

18.6%

2010A

2.5

0.6

18.6%

22.7%

2011A

7.6

2.2

25.1%

29.1%

2012F

10.2

2.0

17.1%

19.7%

2013F

9.1

1.8

16.9%

19.3%

Key Assumptions

Avg. Intl. CPO Price CIF (US$/MT)

LSIP Avg. Selling Price

(Rp/kg)

LSIP Avg. Rubber Selling

Price (Rp/kg)

FFB Processed (tons)

CPO Production (tons)

CPO Sales (tons)

CPO Extraction Rate

Kernel Extraction Rate

Rubber Yield

2009A

2010A

2011A

2012F

2013F

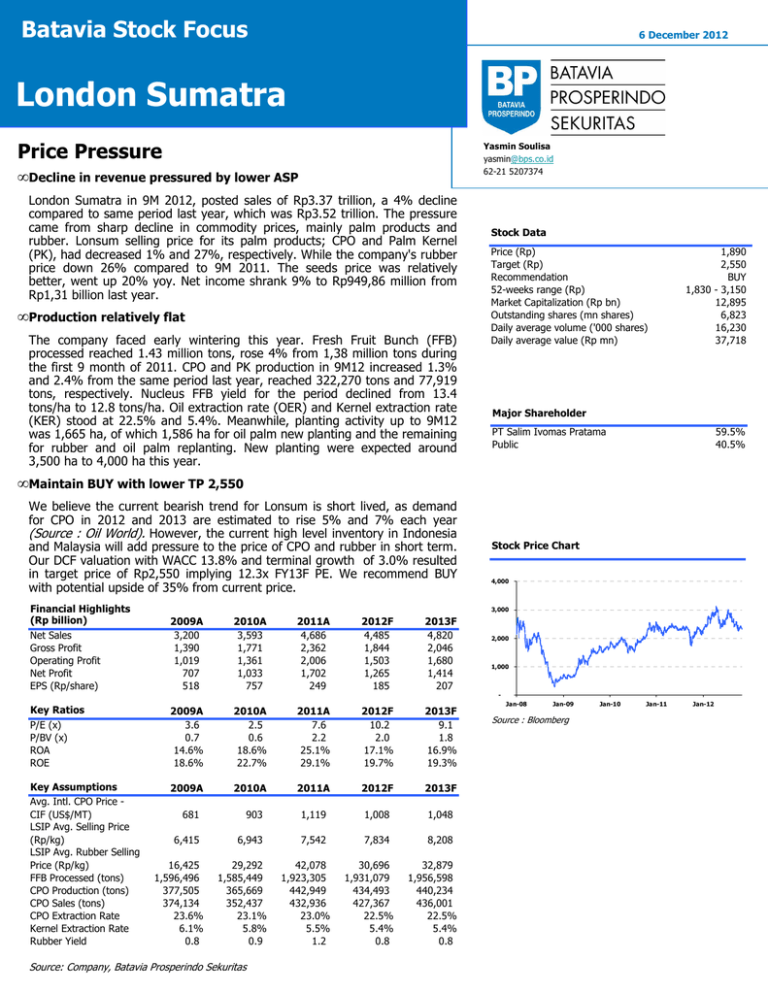

Stock Price Chart

4,000

3,000

2,000

1,000

-

681

903

1,119

1,008

1,048

6,415

6,943

7,542

7,834

8,208

16,425

1,596,496

377,505

374,134

23.6%

6.1%

0.8

29,292

1,585,449

365,669

352,437

23.1%

5.8%

0.9

Source: Company, Batavia Prosperindo Sekuritas

42,078

1,923,305

442,949

432,936

23.0%

5.5%

1.2

30,696

1,931,079

434,493

427,367

22.5%

5.4%

0.8

32,879

1,956,598

440,234

436,001

22.5%

5.4%

0.8

Jan-08

Jan-09

Source : Bloomberg

Jan-10

Jan-11

Jan-12

Batavia Stock Focus

6 December 2012

LSIP 9M 2012 Financial Highlights

(Rp billion)

3Q12

Net sales

1,142

Cost of good sold

(675)

Gross profit

467

Operating expense

(95)

Operating income

372

Pretax income

379

Net profit

311

2Q12

Change QoQ

1,230

-7%

(731)

-8%

498

-6%

(92)

4%

407

-8%

419

-10%

340

-9%

9M12

3,372

(1,985)

1,387

(270)

1,117

1,164

950

9M11

Change YoY

3,523

-4%

(1,686)

18%

1,837

-25%

(283)

-4%

1,554

-28%

1,614

-28%

1,312

-28%

FY12F

4,485

(2,641)

1,844

(341)

1,503

1,554

1,265

Achv.

75%

75%

75%

79%

74%

75%

75%

FY12F

1,931,079

434,493

427,367

14,584

14,585

21,726

Achv.

74%

74%

75%

70%

68%

82%

Source: Company, Batavia Prosperindo Sekuritas

LSIP 9M 2012 Operational Highlights

(tons)

3Q12

2Q12

FFB processed

549,521

461,475

CPO production

121,637

104,423

CPO sales

111,403

117,721

Rubber production

3,389

3,333

Rubber sales

3,670

2,520

Seeds "SumBio"

5,582

5,790

Change QoQ

19%

16%

-5%

2%

46%

-4%

9M12

1,433,320

322,270

320,455

10,159

9,899

17,796

9M11

Change YoY

1,378,238

4%

318,197

1%

309,801

3%

10,931

-7%

10,962

-10%

17,580

1%

Source: Company, Batavia Prosperindo Sekuritas

9M 2012 Sales Breakdown

Planted Area

(ha)

Nucleus

Mature

Immature

Plasma

Nucleus

Plasma

2008

2009

2010

2011

9M2012

72,985

23,656

35,781

132,422

77,664

22,632

36,102

136,398

84,929

16,776

35,976

137,681

86,723

15,498

36,513

138,734

91,049

11,737

36,347

139,133

73%

27%

74%

26%

74%

26%

74%

26%

7.1%

1.0%

9.4%

82.5%

74%

26%

Palm Product

Rubber

Seeds

Others

Source: Company, Batavia Prosperindo Sekuritas

Historical CPO Price (CIF Rotterdam)

Average Selling Price

US$/MT

1,600

Rp/kg

12,000

1,200

10,000

8,000

800

6,000

4,000

400

Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12

2007

2008

2009

2010

LSIP Avg Selling Price

Source: Bloomberg, Batavia Prosperindo Sekuritas

Source: Company, Batavia Prosperindo Sekuritas

2011

Palm Rott

2012F

2013F

Batavia Stock Focus

Income Statement

(Rp billion)

Net sales

COGS

Gross profit

Operating expenses

Operating income

Other incomes/(expenses)

Profit before income tax

Income tax expense

Net income

Balance Sheet

(Rp billion)

Total assets

Current assets

Cash and cash equivalents

Short term investment

Trade receivables

Inventories

Others

Noncurrent assets

Plantation assets

Mature plantations - net

Immature plantations

Fixed assets - net

Plasma receivables

Others

Total liabilities

Current liabilities

Short term bank loans & current

dues

Trade payables

Taxes payable

Other payables

Sales advances

Accrued expenses

Non current liabilities

Long term loans, net current

maturities

Others

Equity

Common share capital

Additional paid-in capital, net

Retained earnings

Cash Flow

(Rp billion)

CFO Total

Net income

Depreciation

Change in WC

Change in others

CFI Total

Change in ST investment

Capex

Change in others

CFF Total

Change in ST debt

Change in LT debt

Equity financing

Dividend payment

Others

Net Cash Flow

6 December 2012

2009A

3,200

(1,809)

1,390

(372)

1,019

(11)

1,008

(301)

707

2010A

3,593

(1,821)

1,771

(411)

1,361

21

1,382

(348)

1,033

2011A

4,686

(2,324)

2,362

(357)

2,006

85

2,091

(389)

1,702

2012F

4,485

(2,641)

1,844

(341)

1,503

51

1,554

(289)

1,265

2013F

4,820

(2,773)

2,046

(366)

1,680

58

1,738

(323)

1,414

2009A

4,845

964

682

77

192

13

3,881

2010A

5,561

1,487

1,161

26

264

36

4,074

2011A

6,792

2,568

2,064

101

368

34

4,224

2012F

7,400

2,649

2,199

76

342

33

4,750

2013F

8,379

3,132

2,672

75

350

35

5,246

1,126

829

1,603

55

267

1,032

679

1,388

631

1,729

57

270

1,007

622

1,505

572

1,825

57

266

952

531

1,786

493

2,162

55

255

973

569

2,059

406

2,448

59

274

1,014

601

60

82

33

64

243

352

83

76

35

157

270

386

112

23

32

65

300

421

114

17

36

62

341

403

120

19

38

67

358

412

30

322

3,813

682

1,030

2,101

386

4,554

682

1,030

2,842

421

5,839

682

1,030

4,127

403

6,424

682

1,030

4,711

412

7,332

682

1,030

5,620

-

2009A

881

707

143

12

(58)

(531)

(386)

36

(702)

(44)

(586)

142

(279)

66

(352)

Source : Company, Batavia Prosperindo Sekuritas

3

2010A

1,415

1,033

197

2

(105)

(402)

(188)

(5)

(497)

(30)

(285)

(181)

516

2011A

1,736

1,702

221

(150)

(118)

(421)

(153)

3

(409)

(416)

7

907

2012F

1,617

1,265

260

54

38

(526)

(540)

14

(955)

(681)

(275)

135

2013F

1,764

1,414

327

(1)

23

(496)

(473)

(23)

(795)

(506)

(289)

473

Head Office

Chase Plaza, 12th Floor

Jl. Jend. Sudirman Kav. 21, Jakarta 12920

Tel : +62-21 520 7374

Fax : +62-21 2598 9821

www.bps.co.id

Research Team

Andy Ferdinand

Head of Research

Banking, Consumer, Gas Infrastructure & Strategy

andy@bps.co.id

Parningotan Julio

Analyst

Technical, Cement & Toll Road

julio@bps.co.id

Yasmin Soulisa

Analyst

Agriculture & Coal

yasmin@bps.co.id

Wisnu Karto

Analyst

Automotive, Heavy Equipment & Poultry

wisnu@bps.co.id

Steven Gunawan

Research Associate

steven@bps.co.id

Jl. BKR No. 28 C

Medan

Branches

Bandung

Bandung 40265

Medan 20151

Tel : +62-22 730 7111, 731 8691

Surabaya

Malang

Fax : +62-22 730 7020

Darmo Square Blok B No. 8

Tel : +62-61 453 1150

Palembang

Palembang 30113

Tel : +62-31 562 3445

Tel : +62-711 375 600

Fax : +62-31 568 9568

Jl. Kahuripan No. 5

Makassar

Tel : +62-341 358 889

Fax : +62-61 414 9884

Jl. Rajawali No. 1174 D

Jl. Raya Darmo No. 54-56 , Surabaya 60264

Malang 65119

Semarang

Jl. Brigjend. Katamso No. 56 A

Fax : +62-711 376 855

Ruko Ruby 1 No. 9

Jl. Raya Boulevard Panakukang Mas, Makassar 90222

Fax : +62-341 353 797

Tel : +62-411 430 959 (hunting) , 455 038 (sales) Fax : +62-411 432 376

Thamrin Square Blok C 12

Jl. Thamrin No. 5, Semarang 50244

Tel : +62-24 351 6161 Fax : +62-24 351 8546

Batavia Prosperindo Sekuritas Investment Ratings: BUY – expected total return of 10% or more; HOLD – expected total return of -10% to 10%;

SELL – expected total return of -10% or less. Expected total return is defined as 12-month total return (including dividends).

DISCLAIMER

The information contained in this report has been taken from sources we deem reliable, however, PT. Batavia Prosperindo Sekuritas or its affiliates, cannot

guarantee its accuracy and completeness.

The views expressed in this report accurately reflect personal views of the analyst(s) about the subject securities or issuers and no part of the compensation of

the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations and/or views in this report. Nothing in this report

constitutes a representation that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances.

This report is published solely for information purposes and should not be considered as a solicitation or an offer to buy or sell any securities.

Neither PT. Batavia Prosperindo Sekuritas nor any of its affiliates and/or employees accepts any liability for any direct or consequential losses arising from any use

of this publication. Copyright and database rights protection exists in this publication and it may not be reproduced, distributed and/or published by any person

for any purpose without prior consent of PT. Batavia Prosperindo Sekuritas. All rights are reserved.

Our report is also available at

Bloomberg, BPSJ <GO>

ISI Emerging Market, www.securities.com