estimates - Colliers International

advertisement

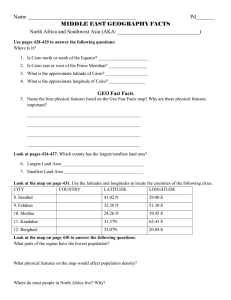

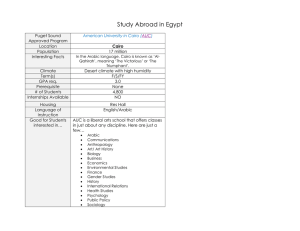

Real Estate Overview Report Greater Cairo | Real Estate 2015 Accelerating success. Greater Cairo Real Estate Market Overview September 2015 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International 1 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Colliers International Service Lines > Commercial Valuations Mixed Use Developments Retail Hospitality Healthcare & Life Sciences Education & Human Capital Infrastructure & Public Private Partnership Airport Cities & City Centres Ports and Waterfront Development Industrial &Special Economic Zones Leisure, Tourism & Culture Development Entertainment Sports Cities > Residential Valuations > Hospitality > Healthcare and Education > Development Solutions > Retail Advisory > Retail Leasing > Corporate Solutions > Property Management > Sales and Leasing 2 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International ian.albert@colliers.com 3 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Introduction Real estate has shown resilience despite political turmoil witnessed across the country over the past four years. Many investors capitalised on real estate (primarily in the residential market) as a hedge against currency risks and inflation with the concurrent rise in the values of property acting as a buffer. Identifying this growing market segment developers successfully focused on delivering housing units targeting the upper-­mid and high-­end consumer groups. Since 2014 however, Cairo witnessed increased consumer confidence and economic stability driven partially by externally supported ambitious government economic centric investments, aimed at the country’s infrastructure, and the announcement of a number of new real estate projects. This has translated into renewed investor confidence and in positive inflows into the retail and tourism markets. Ian Albert Regional Director (MENA) Valuations and Advisory Colliers International ian.albert@colliers.com The retail market which was historically dominated by traditional souks and high street retail continues to transform, reflecting the changing society and sentiment. In particular Greater Cairo has witnessed a rapid growth in international standard shopping malls and more recently a focus towards high-end retailing. Tourism has also witnessed a revival with significant increases in visitors resulting in a positive impact on Egypt’s hotel market. Although the number of inbound tourists remained constant in 2014 when compared with the previous year, total tourism spending surpassed 2008 figures. High occupancy rates and increased average length of stay across hospitality establishments have not gone unnoticed by hotel investors/ operators, with a number of high profile international brands such as the Ritz Carlton, St Regis and the Westin entering the Cairo market further supporting the positive sentiment. Investment extends beyond retail and hospitality with mega projects such as Cairo Airport City and the Suez Canal Expansion driving economic growth and the consequential demand for additional housing, retail and social infrastructure. Egypt’s large consumer base, positive investor confidence, economic climate that encourages taxation breaks and low labor costs, together with a growing middle class, underline optimistic trends benefitting Greater Cairo’s real estate market. 4 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Residential Market Overview 5 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International The Residential Market Appreciating house prices have driven investments towards Cairo’s undersupplied residential market, as the best hedge against high inflation rates and risks of currency devaluation. Upper-­mid and high income residents with sufficient disposable incomes were targeted by key developers, and Cairo witnessed a significant increase in upper-­mid and high income units. Mansoor Ahmed Director | Development Solutions Colliers International mansoor.ahmed@colliers.com Although the volume of residential transactions remain subdued due to the on-­going political instability, investor confidence has increased significantly since 2014. In contrast to other regional markets such as Dubai and Abu Dhabi where price appreciation has been driven primarily by a combination of expatriate demand and investor speculation, we see that the upward movement in Greater Cairo’s housing market is underpinned by sustained local demand and un-­met supply fundamentals. Moreover, the favourable demographics in Egypt -­the young population profile composing of 32% under the age of 15, suggests a continuously growing residential market. Overall market performance across Cairo’s residential sales and rental market have improved significantly since 2013. Sales prices across apartments and villas increased by 27% and 64% respectively during the said period. Average rental rates on the other hand increased by 14% across apartments, while villas witness a marginal drop during the same period. This marginal decline in villa prices was primarily driven by the drop seen in Zamalek, while prices increased across other areas. Based on current trends, we estimate that the residential market requires an additional 500,000 units by 2020. This constitutes to approximately 90,000 – 100,000 units every year. Based on historic trends however, average new supply released into the market annually is approximately 45,000 units, meeting only 50% of the required housing units. Given the significant income disparity, residential demand in Greater Cairo is clearly delineated by income groups, with nearly 70% of residents who can afford unit prices below US$ 58,000. The movement of wealthy and upper-­ middle income Cairenes to the new communities in order to escape congestion in central Cairo on the one hand, and the continuous housing needs of Cairo’s mid-­income segments on the other, constitutes the defining demand drivers of the local residential real estate market. 6 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International SECTOR DEFINITION CAGR 2% 25 Population (Millions) Residential Sector Overview GREATER CAIRO POPULATION ESTIMATES In a city market with over 17 million residents, and a population growing at 2% every year, the need for housing units are constant on the rise. 20 15 10 5 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Source: Colliers International Research and Analysis There is also notable a relocation of upper-middle and high income households towards the new communities such as New Cairo, 6th of October City and Al Obour City in order to escape congestion in central Greater Cairo. DEMAND FOR ACCOMMODATION BY HOUSING LEVEL IN GREATER CAIRO 77% Middle 16% Economic Housing Housing DEMAND Based on population growth rates, on average 90,000 – 100,000 units are required every year to meet the demand generated by new households alone. 5% 2% Low Cost Housing The pronounced housing need however is skewed towards more affordable housing for Greater Cairo’s middle income residents, representing 77% of Greater Cairo’s population. Luxury Housing Source: Colliers International Research and Analysis Income levels of this majority range between US$ 5,000 and US$ 65,000 per annum, and affordability is limited to units priced below US$ 151,000. RESIDENTIAL SUPPLY – ANNUAL COMPLETION 80 Low Cost Level SUPPLY In 2014, the total existing residential supply exceeded 5.2 million units. Units (Thousands) Economic Level On average, 45,000 new units enter the residential market annually, with a high concentration on economic housing projects sponsored by the government. Middle Level 60 Upper Middle Level Luxury Level 40 20 2009 2011 2010 2012 2013 Source: Colliers International Research and Analysis Close proximity to airport has effected a notable One of central Cairo’s most upmarket locations Increasingly housing upper-middle income demographic Upmarket core of 6 of October City are the gated communities such as Palm Hills and Beverley Hills th 6th of October 7 as high-income earners relocate elsewhere given chronic congestion problems business Zamalek Mohandessein Primarily residential area catering to the high income segment Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Heliopolis orientation Maadi Nasr City New Cairo Primarily targeting upper-­mid and high-­end residents 2014 Residential Sector Overview MARKET GAP MARKET GAP - 2020 20 6 Million Population Based on the current trends, the residential market requires an additional of 500,000 units by 2020. With government sponsored programs aimed at economic housing, and key developers launching projects targeting high-­income residents, the market gap for affordable housing targeting the majority of middle income residents remains unmet. MARKET PERFORMANCE Average sales prices for apartments and villas increased by 27% and 64% respectively since 2013. Average rental rates for apartments increased by 14% during the same period. The most significant increases were observed in 6th of October City and in Heliopolis. Unlike apartments, average rental for villas have witnessed a drop of 4% since 2013. This drop is driven by falling prices in Zamalek, with prices rising in the other areas. Million Units Additional Supply Required RESIDENTIAL MARKET PERFORMANCE Sales Market Rental Market 27% 64% 14% -4% Change 2013-2015 Change 2013-2015 Change 2013-2015 Change 2013-2015 Average Apartment Sales Price Average Villas Sales Price Average Apartment Rent Average Villa Rent US$ 55/m² US$ 90/m² US$ 870/m² US$ 2,000/m² Source: Colliers International Research and Analysis Per Annum Per Annum POTENTIAL OPPORTUNITIES Based on the market gap of each housing category, the following opportunities are highlighted. MARKET OPPORTUNITIES Based on households income levels, the majority of demand exists across middle income residents (77%), although there still remains unmet demand for upper-mid/ luxury housing units, given the number of high-net-worth wealthy Egyptians in the market. Low income housing units also remain undersupplied, although not as pronounced as the market gap across the middle income sector. Upper-­mid / Luxury Housing Targeting households with annual income of Middle Housing Targeting households with annual income of Low Cost Housing Targeting households with annual income of Source: Colliers International Research and Analysis 8 0.5 Million Units Housing Demand Greater Cairo | Real Estate Market Overview | 2015 | Colliers International US$65,000 – US$125,000 US$10,000 – US$25,000 US$1,750 – US$2,500 Retail Market Overview 9 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International The Retail Market Driven by significant income disparities, Cairo’s retail market is fragmented between souks, high streets and international quality shopping malls. Historically, the market’s growth has been cumbersome and cautious, due to slow economic growth and high tariffs on imported goods. However, over the past decade, the market landscape has witnessed major transformations, supported by substantial economic and tax reforms. Consequently, consumer confidence increased notably, which triggered the interest of regional and international retailers to enter the market and capitalise on the large consumer base. Stuart Gissing Regional Director Colliers International stuart.gissing@colliers.com The average rental rates across Cairo’s shopping malls range between EGP 4,500 (US$ 625) per m² per annum and EGP 8,500 (US$ 1,190) per m² per annum, with established Grade A shopping malls operating close to full occupancy. The increasing competitive landscape however, has seen Grade B malls experiencing low occupancy -­up to 40% available lettable area. Rents are expected to reflect occupancy levels, with average rents across established, well positioned shopping malls set to increase and maintain a premium over less competitive malls. Generations X and Y represent 56% of Greater Cairo’s total population. The importance of this demographic is their aspiration for lifestyle products and international brands. This increasing consumer demographic also accounts for the highest dwell time, and therefore F&B/ dinning and entertainment products are some of the key retail components to be factored into next generation shopping malls. Colliers expects Greater Cairo’s organised retail market to remain undersupplied over the short to medium term. According to existing market sentiments, the market will be in a position to absorb an additional 1.6 million m² GLA of new supply by 2020. Increasing catchment population around new residential communities will also see an offshoot demand for a number of community shopping malls to be developed. It is expected that, given Cairo’s growing population, young demographics and a growing middle class, primary grade lifestyle shopping malls with family entertainment components will attract high visitor volumes, occupancy rates and rentals compared to less competitive malls. 10 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Retail Sector Overview BREAKDOWN OF HOUSEHOLDS’ RETAIL SPENDING Retail Spending 51% Food & Non-Alcoholic Drinks SECTOR DEFINITION Tobacco & Alcoholic Drinks 67% Being one of the largest retail market in the region, the consumer base for Greater Cairo alone, exceeds 17 million, making it an attractive market for international and regional retailers. Shopping malls have successfully attracted international brands, meeting latent demand from wealthy Egyptians, and offer a shopping experience modelled on international retailing standards with compiled tenant mixes, food courts, entertainment facilities, and anchor tenants. 7% Restaurants & Hotels Furnishing & Home 8% Clothing & Footwear 8% 10% Source: BMI; Colliers International Analysis RETAIL DEMAND 2 600 000 DEMAND CAGR 3% GLA (m²) 2 400 000 Significant income disparities have resulted in consumers being highly price-­sensitive and with traditional shopping habits, on one hand, and organised shopping mall activity on the other. 2 200 000 2 000 000 1 800 000 Currently, the demand for organised retail in Greater Cairo is estimated at 2.2 million m² GLA, and is expected to reach 2.4 million m² GLA by 2020. 2014 2015 2016 2017 2018 2019 2020 Source: Colliers International Research and Analysis RETAIL SUPPLY -­ANNUAL COMPLETION SUPPLY 2018 By end of 2015, the total organized retail supply in Greater Cairo is expected to reach 1.1 million m² GLA. GLA (m²) 2017 An additional supply of 600,000 m² GLA is scheduled to come into the market over the next five years, provided construction timelines are met. 2016 2015 2014 50 000 100 000 150 000 200 000 Source: Colliers International Research and Analysis Golf City Mall Designopolis Mall Dandy Mall Hyper One Mall of Arabia Dolphin Land Mall Cityscape Mall 11 The District Nile City Towers As highlighted in the map, 6th of October City and New Cairo hold the majority of the existing retail supply across different retail formats within Greater Cairo, given the availability of land supply. Sun City Mall First Mall City Stars Emerald Mall Rehab Mall (1 & 2) Porto Cairo Cairo Festival City Downtown Mall Maadi City Centre Greater Cairo | Real Estate Market Overview | 2015 | Colliers International 250 000 Retail Sector Overview MARKET GAP 1.5 1.3 million m² GLA MARKET GAP 1 million m² GLA 2010 million m² GLA 2015 The retail market is currently undersupplied by approximately 1.3 million m² GLA. 2020 Despite an additional supply of 600,000 m² GLA expected to come online over the next five years, the market is still expected to remain undersupplied by 1 million m² GLA by 2020. AVERAGE RENTAL RATES FOR KEY SHOPPING MALLS (US$/M²/ANNUM) MARKET PERFORMANCE 100% 80% 60% 40% 20% 0% Average Galleria40 Sky Plaza Porto Cairo Mall of Arabia Centre Maadi City Dandy Mall City 500 Golf City Mall Occupancy levels for Grade A shopping malls range between 80% to full occupancy. US$/m²/Annum 1 000 Cairo Festival City Stars, Cairo Festival City and Mall of Arabia are achieving the highest rentals, while secondary malls such as Golf City Mall and Sky Plaza are witnessing some of the lowest lease rates. Occupancy Rate 1, 500 City Stars The average rental rates in key shopping malls range between US$408 per m² per annum and US$1,200 per m² per annum. Source: Colliers International Research and Analysis MARKET OPPORTUNITIES Largest demographics are between the ages of 15 – 64 12 DEVELOPMENT TIPS Target Young Consumers Young consumers (20-­39 years of age) of total population, driving represent demand for brands coming into the market Community Retail Demand for retail components within residential communities to meet everyday needs of the catchment population. Lifestyle Retail The higher proportion of generation X & Y consumers and their preferences to spend more time dining and entertaining outside, make it more likely for the F&B and the entertainment components within shopping malls to increase 47% 85-100 65-85 45-65 30-45 15-30 12-15 9-12 6-9 3-6 1-3 0-1 Given Cairo’s growing population and composition of generations X & Y, primary grade lifestyle shopping malls complete with family entertainment components will attract high visitor volumes, occupancy rates and rentals. Source: Colliers International Research and Analysis Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Hospitality Market Overview 13 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International The Hospitality Market In the first half of 2015, the number of room nights sold in Egypt’s key cities (Cairo, Alexandria, Hurghada, Sharm El Sheikh, Luxor) grew by 13% year-­on-­year. Cairo in particular saw a 39% increase in demand, while Hurghada experienced a decrease of 7% due to strong competition with Sharm El Sheikh. Filippo Sona Director | Head of Hotels Colliers International filippo.sona@colliers.com In another positive move for the tourism industry, August 2015 saw Germany lift its travel ban on all tourist destinations in Egypt. The lift is expected to lead to higher visitation figures from this key source market, which contributed approximately 800,000 tourists and EGP 2 billion (US$255 million) in revenues during 2014. Germans’ length of stay is also expected to increase from its current average of one week, slowly returning to the two week stays witnessed in 2010. In addition to the traditional source markets, the ministry of tourism is aiming to diversify its demand base, for instance by targeting 200,000 Iranian tourists by 2016, and 1 million Indian tourists by 2017. The tourism authorities are bullishly targeting a total 20 million tourists by 2020, up from 9.8 million in 2014. The improved confidence in the hotel industry is apparent through the recent signings of international hotel brands, such as the Swissotel Katameya in Cairo, the DoubleTree by Hilton in Ain Al Sokhna, and the Westin Resort in Soma Bay. With the recovery in full swing, hotel investors interested in Egypt are now reaching their highest level of confidence in the last four years. 14 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Hospitality Sector Overview HOSPITALITY LAND SCAPE OF CAIRO 70% 5 STAR 20% 4 STAR SECTOR LANDSCAPE Egypt relies heavily on its tourism sector which accounted for over 5% of the nation’s GDP in 2014. Despite benefitting from a wide tourism market, Egypt’s internationally branded hotel supply is heavily weighted towards the 5-star segment providing various hotel development opportunities across other segments. 10% 3 STAR Source: Colliers International PURPOSE OF VISIT TO CAIRO 70% CORPORATE DEMAND With the exception of the Pyramids market, all other hotel submarkets of Cairo rely on corporate travelers. 9% FIT 15% LEISURE Hotel demand has seen a notable shift towards eastern (New Cairo) and Western (6th of October City) Cairo in recent years. This shift is due to new business parks providing high quality office spaces and thus appealing to high-profile companies. 2% 4% MICE/ OTHERS Groups Source: Colliers International SUPPLY PROJECTED HOTEL SUPPLY | NO. OF KEYS Supply remained stable between Q2 2014 and Q2 2015. However six hotels are expected to enter the market by year end 2015, operated by Marriott International, Starwood Hotels, Time Hotels, Kempinski, and Hilton Worldwide. CAGR 5% Internationally branded supply currently represents 64% of Cairo’s hotel market, of which 86% are 5-star rated. Q2 2014 Q2 2015 Source: Colliers International Note: Includes 3,4 and 5-star quality supply FY 2015 (f) FY 2016 (f) Heliopolis Zamalek Nasr City Mohandessein New Cairo Maadi 6th of October 15 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International FY 2017 (f) Hospitality Sector Overview ADDITIONAL SUPPORTABLE ROOMS 10,540 2,018 14,321 MARKET GAP Colliers expects a 7.5% average annual increase in Cairo’s hospitality demand over the next five to ten year period, in-­ line with Euromonitor’s tourism projections for Egypt. Projected Keys 2020 2015 KPIs | YOY % CHANGE MARKET PERFORMANCE Cairo’s hospitality demand is mainly generated by Egyptian and GCC nationals, accounting for 78% of total guest nights. ADR MARKET OPPORTUNITIES +26% -­14% +6% +43% Occ 50% +­29% +­1% +8% US$117 OCC Growth in corporate demand has fueled Cairo’s hotel market performance increase in Q2 2015. +26% Q2 2013 Q2 2014 Q2 2015 Forecast FY 2015 RevPAR Source: STR Global, Colliers International Lack of quality serviced apartments appealing to domestic leisure tourists represents an opportunity for international operators to penetrate the market. 16 2025 Source: Colliers International Given the above mentioned demand growth, Cairo’s hotel market will need an additional 10,540 keys over and above the announced supply by 2025. Due to the large number of currently outdated, and new forthcoming 5-­star supply, opportunity lies in developing economy and midscale hotels targeting leisure tourists visiting the pyramids. Additional supportable keys Additional supportable keys Greater Cairo | Real Estate Market Overview | 2015 | Colliers International DEVELOPMENT TIPS Midscale & Economy Hotels In locations near the pyramids catering to the leisure segment Upscale Hotels In 6th of October City and 5th Settlement districts to cater to the Upscale business parks Serviced Apartments Within Ma’adi district to cater to relocating employees Commercial (Offices) Market Overview 17 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International The Commercial (Office) Market Cairo is the acknowledged financial and business centre of Egypt. However the city does not have a clearly defined Central Business District (CBD) as compared to other international and regional cities. Grade A office space currently available for lease within Greater Cairo is located on major commercial arteries that also hold a significant proportion of Cairo’s Grade B office stock. Hassan Abou Alam Senior Manager | Business Development Colliers International hassan.aboualam@colliers.com High occupancy rates across Cairo’s limited Grade A office stock has prompted the conversion of ground floor residential developments into office space as a short-term measure to counter the undersupplied market. However, this has only intensified the existing fragmentation of the office market in Greater Cairo. The existing undersupplied market is supported by rising rental levels. The average rental rates of office space in key areas within Greater Cairo range between US$300 per m² per annum and US$ 350 per m² per annum in 2015, increasing 6% since 2014. We are continuing to witness significant demand for office space in new cities from local business entities who are willing to relocate to new offices in less congested areas and into developments with better build quality. In the absence of a defined CBD within Greater Cairo, New Cairo has emerged lately as the capital’s CBD assisted by its location -­ adequate infrastructure, ease of access, proximity to the Cairo International Airport, and the availability of supporting services. The market is expected to remain undersupplied in the short to medium term, with an additional 3.1 million m² NLA of new supply required by 2020. We expect rentals to remain strong, especially across developments offering international build quality in districts away from highly dense areas of the traditional city centre. 18 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Commercial (Office) Sector Overview GRADE A OFFICE DEMAND SECTOR DEFINITION Egypt’s economy is the third largest in the Arab world, only behind KSA and the UAE. Despite a labour force of 4.5 million, the city remains fragmented in terms of a Central Business District (CBD). New Cairo and 6th of October City currently holds approximately 2 million m² NLA of Greater Cairo’s formal office supply. GRADE A OFFICE DEMAND CAGR 2% 5 100 000 DEMAND Demand for office space is driven by the volume of workers who actually require office space. Tenants are considering New Cairo and 6th of October City as favourable commercial districts, given their ease of accessibility and better building quality in comparison with older areas like Maadi and El Dokki. NLA (m²) 4 800 000 4 500 000 4 200 000 3 900 000 2014 2015 2016 2017 2018 With demand expected to increase 2% annually, by 2020 cumulative office demand is expected to reach 4.7 million m² NLA. 2020 GRADE A OFFICE SUPPLY -­ANNUAL COMPLETION 2018 SUPPLY Provided construction timelines are met, cumulative office supply is expected to reach approximately 2.3 million m² NLA over the next 5 years. 2017 NLA (m²) Based on Colliers research, more than 800,000 m² office space are expected to be completed over 2015 – 2018. There are currently no upcoming developments planned for delivery between 2019 and 2020. 2016 2015 2014 100 000 200 000 300 000 400 000 Source: Colliers International Research and Analysis Heliopolis Zamalek Moving away from traditional business centres Nasr City Mohandessein New Cairo Maadi 6 of October th 19 2019 Source: Colliers International Research and Analysis Greater Cairo | Real Estate Market Overview | 2015 | Colliers International 500 000 Commercial (Office) Sector Overview MARKET GAP 2.7 1.8 million m² NLA MARKET GAP 2020 AVERAGE RENTAL RATE FOR GRADE A OFFICES(US$/M²/ANNUM) AND OCCUPANCY LEVEL Despite nearly 800,000 m² NLA expected to come online during 2015 – 2020, the market still requires an additional 480,000 m² of formal office space to be delivered annually in order to meet market equilibrium in 2020. Rental Market MARKET PERFORMANCE Occupancy Level 70% 80% 6% Average rental rates of office space in key areas within Greater Cairo range between US$300 per m² per annum and US$350 per m² per annum. The highest rentals are achieved in New Cairo, averaging at US$ 370 per m² per annum. to % Change 2015 The overall market witnessed an average rental growth of 6% during 2014 – 2015, underpinned by the limited primary grade office stock in the market. Occupancy Level 2015 Av. Office Rent US$ 340/m² Per Annum MARKET OPPORTUNITIES Source: Colliers International Research and Analysis With demand for office space expected to outweigh supply over the next five years, there is a potential market gap that can be met by new primary grade office space. PROMISING MARKETS 90th 6 th New Cairo The demand for commercial lands in New Cairo is towards the 90th street, given the majority of commercial developments are located in the vicinity 6th of October City 6th of October City is another key location for residential and commercial land demand, based on Colliers ground research Source: Colliers International Research and Analysis 20 million m² NLA 2015 2010 Currently, formal office supply in Greater Cairo is witnessing a shortfall of approximately 2.7 million m² NLA. This undersupply is expected to narrow down to 2.4 million by 2020, provided construction timelines are met. Tenants are likely to prefer locations away from the traditional city centre in order to avoid severer traffic congestion and pollution experienced in the downtown areas of Cairo. 2.4 million m² NLA Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Mega Projects Market Insights A number of national mega projects are planned and implemented including Cairo Airport City, Suez Canal expansion, and New Capital City that are likely to drive demand for additional real estate products. Suez Canal Expansion 29,000 mi² Area of proposed logistics around canal SUEZ CANAL EXPANSION The Suez Canal expansion will increase the Canal’s annual revenues from US$5.3 billion to approximately US$13.2 billion in 2023. According to the Suez Canal Authority’s projections, daily transits will rise from their current level of 49 ships to 97 ships by 2023. 97 ships Daily transits by 2023 US$13.5bn Projected Revenues by 2023 One of the canal expansion’s positive impacts is a planned scheme of establishing an airport in Ain Sokhna. This will enhance the corporate demand for residential, commercial, retail, education and healthcare facilities along with hotel rooms, especially in the East side of the City Centre. Airports and aviation sector around the Suez Canal are also planned to compliment the major investment being made to expand the Suez Canal. More than 120,000 job Creation CAIRO AIRPORT CITY 2,8mn m² Cairo Airport City is aimed at positioning Cairo as the centre of the region through a series of logistical, retail, and recreational developments. There is a study to link the Airport City with the new Suez Canal through a new railway line with Ain Sokhna port, and Cairo International Airport. Cairo Airport is likely to be a major assembly and distribution centre of passengers and cargos. The Airport City is a complete city around the airport and will include a new trade free zone, cargo village, factories belonging to the civil aviation for packaging, and food outlets. In addition, an entertainment area, administrative offices, hotels and a hospital are planned or under construction. The project is expected to provide more than 120,000 jobs on the short and long term. This will translate to additional demand for residential units, commercial space, and hotel rooms. Aero City Commercial Entertainment District: 5mn m² 447mn m² Cairo Airport Core NEW CAPITAL CITY The New Capital City is expected to be a new administrative and financial district, extending Cairo eastwards to the Coast of Red Sea. According to the Egyptian Government and the master planners, the City will be a new urbanization area that is projected to host over 7 million residents. The new city is expected to be surrounded by local schools, religious buildings, civic amenities and shops. The project is expected to attract domestic and international investors. Therefore, a stronger demand for real estate developments is anticipated in the future. 21 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International 7 Million residents Cargo & Logistics Village Awards Wining Company 58 2012 Voted #1 Advisor MENA 2013 Voted #1 Advisors and Consultants MENA Voted #1 Project Advisory Team MENA Voted #1 Healthcare PPP Advisory MENA 2014 Voted #1 Advisors and Consultants MENA Voted #1 Advisors and Consultants UAE Voted #1 Advisors and Consultants KSA Voted #1 Advisors and Consultants Qatar 16 first place awards in total 2014/15 Best Property Consultancy Arabia 2014-2015 2015 Voted #1 Advisors and Consultants MENA Voted #1 Advisors and Consultants UAE Voted #1 Advisors and Consultants KSA Best Consultants – to the Private Sector (Shortlisted) Education Infrastructure – Best Education Property Consultants (Shortlisted) Best Financial Advisor (Shortlisted) 22 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International Colliers International Our Services at Glance SERVICES AT A GLANCE > Strategic & Business Planning > Economic Impact Studies > Market & Competitive Studies > Market & Financial Feasibility Studies > Financial Modelling > Market & Commercial Due Diligence > Land, Property & Business Valuation > Mergers & Acquisitions Assistance > Buy Side Advisory / Sell Side Advisory > “Sale & Lease Back” Advisory > Public Private Partnership (PPP) & Privatisation > Operator Search & Selection and Contract Negotiation > Site Selection & Land / Property Acquisition > Asset & Performance Management > Performance Management & Industry Benchmark Surveys Countries | Markets Algeria | Bahrain | Ecuador | Egypt | Iran | Iraq Jordan | Kenya | KSA | Kurdistan | Kuwait | Morocco Nigeria | Oman | Pakistan | Qatar | South Africa Sudan | Tanzania | Togo | Tunisia | Turkey UAE | Zanzibar 23 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International 502 offices in 67 countries on 6 continents United States: 151 Canada: 46 Latin America: 26 Asia Pacific: 190 EMEA: 89 $2.3 Billion in annual revenue Ian Albert Regional Director | MENA Region ian.albert@colliers.com Stuart Gissing Regional Director | MENA Region stuart.gissing@colliers.com Mansoor Ahmed Director | Head of Development Solutions | MENA Region Healthcare | Education | Public Private Partnership (PPP) mansoor.ahmed@colliers.com 160 Filippo Sona Director | Head of Hotels | MENA Region filippo.sona@colliers.com 16,300 Hassan Abou Alam Senior Manager | Business Development | Egypt Mobile +20 106 094 4550 hassan.aboualam@colliers.com Million square metres under management Professionals and staff Colliers International | MENA Region Dubai | United Arab Emirates +971 4 453 7400 About Colliers International Colliers International is a global leader in commercial real estate services, with over 16,300 professionals operating out of more than 502 offices in 67 countries. Colliers International delivers a full range of services to real estate users, owners and investors worldwide, including global corporate solutions, brokerage, property and asset management, hotel investment sales and consulting, valuation, consulting and appraisal services and insightful research. The latest annual survey by the LipseyCompany ranked Colliers International as the second-most recognized commercial real estate firm in the world. In MENA Colliers International has provided leading advisory services through its regional offices since 1996. Colliers International currently has four corporate offices in the region located in Dubai, Abu Dhabi, Riyadh and Jeddah. www.colliers.com/uae Disclaimer The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. 24 Greater Cairo | Real Estate Market Overview | 2015 | Colliers International