income tax treatment of new zealand patents 1

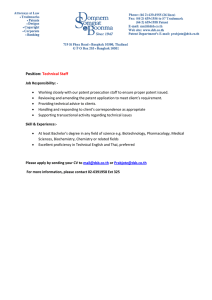

advertisement