Interest Rate Risk in Banking Book (IRRBB) - Regulations

advertisement

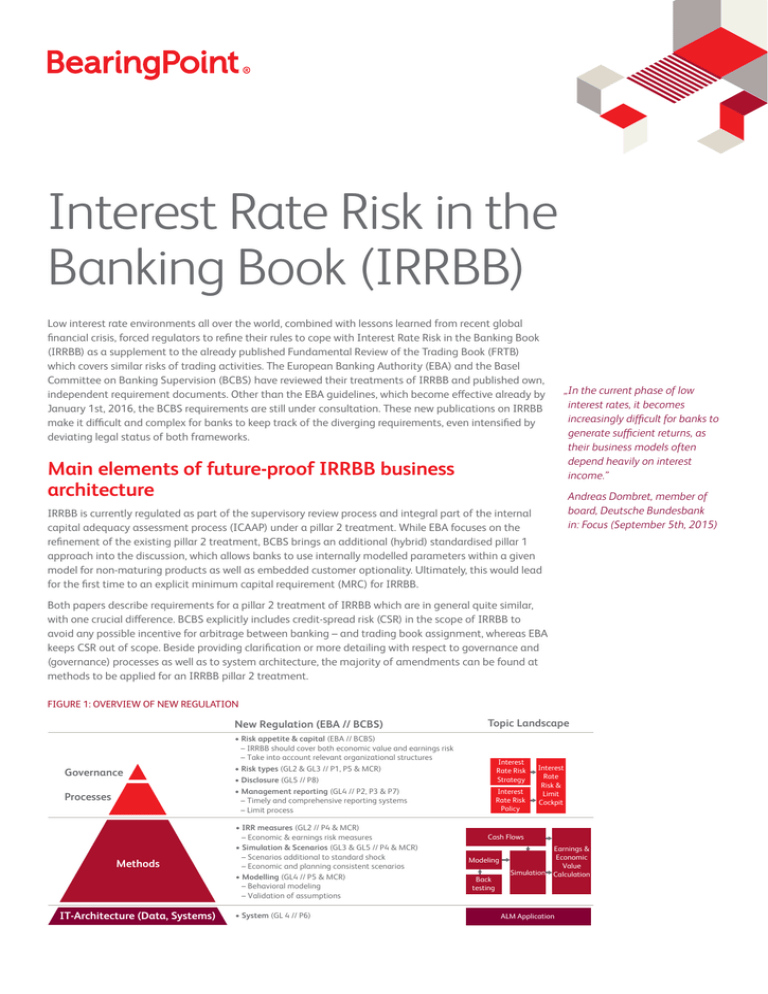

Interest Rate Risk in the Banking Book (IRRBB) Low interest rate environments all over the world, combined with lessons learned from recent global financial crisis, forced regulators to refine their rules to cope with Interest Rate Risk in the Banking Book (IRRBB) as a supplement to the already published Fundamental Review of the Trading Book (FRTB) which covers similar risks of trading activities. The European Banking Authority (EBA) and the Basel Committee on Banking Supervision (BCBS) have reviewed their treatments of IRRBB and published own, independent requirement documents. Other than the EBA guidelines, which become effective already by January 1st, 2016, the BCBS requirements are still under consultation. These new publications on IRRBB make it difficult and complex for banks to keep track of the diverging requirements, even intensified by deviating legal status of both frameworks. Main elements of future-proof IRRBB business architecture IRRBB is currently regulated as part of the supervisory review process and integral part of the internal capital adequacy assessment process (ICAAP) under a pillar 2 treatment. While EBA focuses on the refinement of the existing pillar 2 treatment, BCBS brings an additional (hybrid) standardised pillar 1 approach into the discussion, which allows banks to use internally modelled parameters within a given model for non-maturing products as well as embedded customer optionality. Ultimately, this would lead for the first time to an explicit minimum capital requirement (MRC) for IRRBB. „In the current phase of low interest rates, it becomes increasingly difficult for banks to generate sufficient returns, as their business models often depend heavily on interest income.” Andreas Dombret, member of board, Deutsche Bundesbank in: Focus (September 5th, 2015) Both papers describe requirements for a pillar 2 treatment of IRRBB which are in general quite similar, with one crucial difference. BCBS explicitly includes credit-spread risk (CSR) in the scope of IRRBB to avoid any possible incentive for arbitrage between banking – and trading book assignment, whereas EBA keeps CSR out of scope. Beside providing clarification or more detailing with respect to governance and (governance) processes as well as to system architecture, the majority of amendments can be found at methods to be applied for an IRRBB pillar 2 treatment. FIGURE 1: OVERVIEW OF NEW REGULATION New Regulation (EBA // BCBS) Governance Processes Methods IT-Architecture (Data, Systems) Topic Landscape • Risk appetite & capital (EBA // BCBS) – IRRBB should cover both economic value and earnings risk – Take into account relevant organizational structures • Risk types (GL2 & GL3 // P1, P5 & MCR) • Disclosure (GL5 // P8) • Management reporting (GL4 // P2, P3 & P7) – Timely and comprehensive reporting systems – Limit process • IRR measures (GL2 // P4 & MCR) – Economic & earnings risk measures • Simulation & Scenarios (GL3 & GL5 // P4 & MCR) – Scenarios additional to standard shock – Economic and planning consistent scenarios • Modelling (GL4 // P5 & MCR) – Behavioral modeling – Validation of assumptions • System (GL 4 // P6) Interest Rate Risk Strategy Interest Rate Risk Policy Interest Rate Risk & Limit Cockpit Cash Flows Modeling Back testing Earnings & Economic Value Simulation Calculation ALM Application Regulators acknowledge the irresolvable dilemma of not being able to stabilise economic value (EV) and earnings (NII) simultaneously in case of changes to interest rates. Therefore, they reinforce the previous requirement of having in place and continuously enhancing IRRBB measures following EV and earnings approaches, considering all relevant sub-types of IRRBB (repricing risk, yield curve risk, basis risk, option risk) and using both of them consistently for internal risk appetite statement, measurement and limit systems (Figure 2 |). In the past banks mainly focused on IRRBB methods, which measure the (long term) economic value effect of interest rate changes. Now they need to supplement existing value-based approaches by earnings-based risk measures to reveal also the (short term) effect on earnings, respectively the banks ability to generate new capital in future. Furthermore, both regulators emphasize the treatment of customer behaviour in the context of cash flow modelling. Due to the fact, that the balance sheets of typical (retail) banks show an enormous amount of non-maturing deposits/loans and further products with embedded client options, these positions represent a substantial portion of a bank´s IRRBB and need to be treated with adequate importance. Prudent behavioural modelling of such positions should be reflected to base IRRBB risk assessment on realistic profiles of future cash flows. (Figure 2 |) Earnings To allow for a more precise reflection (simulaFIGURE 2: IRRBB BUSINESS ARCHITECTURE tion) of continuously changing future economic Calculation 1 Cash Flows conditions the regulators accelerate the impleRepricing Gap mentation of dynamic simulation in addition to Net Interest Income (NII) Simulation 2 3 Modelling already widely used static risk measures. The Optionality Earnings at Risk Scenario advantage of dynamic models (especially for Generation No specific earning based measures) is their ability to show repricing dates PV01 New Business Assumptions the impact of changes in conditions for posiCorporate partial PV01 (time bucket sensitivity) planning ongoing tions and cash flows over time. In doing so, they CaR / EVE internal stress managetesting heavily rely on consistently modelled assumpVaR ment Backtesting tions and their correlations to each other. This means that corporate planning assumptions, assumptions referring to the future shape of interest rate curves and related FX-rates need to be modelled incorporating typical economic interdependencies. (Figure 2 |) Economic Value Based on the heavy reliance on models for instrument pricing, cash flow calculation and risk measurement, regulators expect banks to have prudent model validation processes in place to assure prompt corrective actions in case model parameters are proven to lack precision. EBA also claims that a bank is responsible to provide a sound technical infrastructure for IRRBB measurement and detailed risk analysis of their banking book positions in a flexible and timely manner, allowing the decomposition of IRRBB to single risk drivers. Challenge and BearingPoint Approach BCBS discusses four approaches to calculate the capital demand in a potential pillar 1 regime of IRRBB. Therefore, it aims to better understand how banks will be affected by such a regulation. Banks are now confronted with the challenge not only to develop EBA pillar II compliant IRRBB frameworks and systems, but also to participate in parallel in BCBS QIS studies to assess future capital demand and to carry out own analyses to identify levers to impact capital demand, given the hybrid characteristics of the standardised approach. BearingPoint can assist its clients with a field-tested delivery model, developed especially to identify, assess and support the resolution of required refinements of treasury related risk governance, processes, methodologies and business and system architecture. With our well-structured approach and rich pool of proven samples and prototypes, which could be easily enhanced we are able to support client activities with tangible results from the first day until go-live. About BearingPoint BearingPoint consultants understand that the world of business changes constantly and that the resulting complexities demand intelligent and adaptive solutions. Our clients, whether in commercial or financial industries or in government, experience real results when they work with us. We combine industry, operational and technology skills with relevant proprietary and other assets in order to tailor solutions for each client’s individual challenges. This adaptive approach is at the heart of our culture and has led to long-standing relationships with many of the world’s leading companies and organizations. Our 3500 people, together with our global consulting network serve clients in more than 70 countries and engage with them for measurable results and long-lasting success. www.bearingpoint.com © 2015 BearingPoint GmbH. FC 1040 EN Contact Maik Frey Partner maik.frey@ bearingpoint.com Thomas Steiner Partner thomas.steiner@ bearingpoint.com