Company Update, 17 February 2015

Sound Global (967 HK)

Buy (Maintained)

Industrial - Environment Control

Market Cap: USD1,472m

Target Price:

Price:

HKD12.00

HKD7.58

Macro

Risks

Convincing Rebuttal Of Allegations

Growth

Value

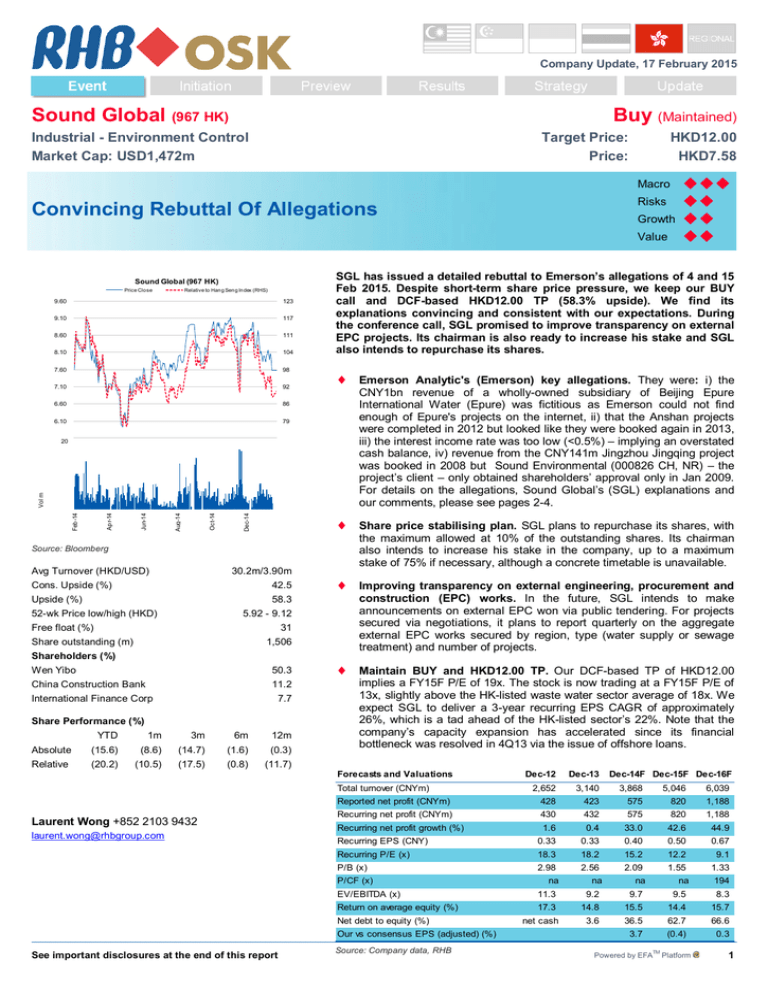

Sound Global (967 HK)

Relative to Hang Seng Index (RHS)

9.60

123

9.10

117

8.60

111

92

6.60

86

6.10

79

5.60

20

18

16

14

12

10

8

6

4

2

73

Aug-14

Dec-14

7.10

Oct-14

98

Jun-14

104

7.60

Apr-14

8.10

Feb-14

Vol m

Price Close

30.2m/3.90m

Cons. Upside (%)

42.5

Upside (%)

58.3

52-wk Price low/high (HKD)

5.92 - 9.12

Free float (%)

31

Share outstanding (m)

1,506

Shareholders (%)

Wen Yibo

50.3

China Construction Bank

11.2

International Finance Corp

7.7

Share Performance (%)

YTD

1m

3m

6m

12m

Absolute

(15.6)

(8.6)

(14.7)

(1.6)

(0.3)

Relative

(20.2)

(10.5)

(17.5)

(0.8)

(11.7)

Emerson Analytic's (Emerson) key allegations. They were: i) the

CNY1bn revenue of a wholly-owned subsidiary of Beijing Epure

International Water (Epure) was fictitious as Emerson could not find

enough of Epure's projects on the internet, ii) that the Anshan projects

were completed in 2012 but looked like they were booked again in 2013,

iii) the interest income rate was too low (<0.5%) – implying an overstated

cash balance, iv) revenue from the CNY141m Jingzhou Jingqing project

was booked in 2008 but Sound Environmental (000826 CH, NR) – the

project’s client – only obtained shareholders’ approval only in Jan 2009.

For details on the allegations, Sound Global’s (SGL) explanations and

our comments, please see pages 2-4.

Share price stabilising plan. SGL plans to repurchase its shares, with

the maximum allowed at 10% of the outstanding shares. Its chairman

also intends to increase his stake in the company, up to a maximum

stake of 75% if necessary, although a concrete timetable is unavailable.

Improving transparency on external engineering, procurement and

construction (EPC) works. In the future, SGL intends to make

announcements on external EPC won via public tendering. For projects

secured via negotiations, it plans to report quarterly on the aggregate

external EPC works secured by region, type (water supply or sewage

treatment) and number of projects.

Maintain BUY and HKD12.00 TP. Our DCF-based TP of HKD12.00

implies a FY15F P/E of 19x. The stock is now trading at a FY15F P/E of

13x, slightly above the HK-listed waste water sector average of 18x. We

expect SGL to deliver a 3-year recurring EPS CAGR of approximately

26%, which is a tad ahead of the HK-listed sector’s 22%. Note that the

company’s capacity expansion has accelerated since its financial

bottleneck was resolved in 4Q13 via the issue of offshore loans.

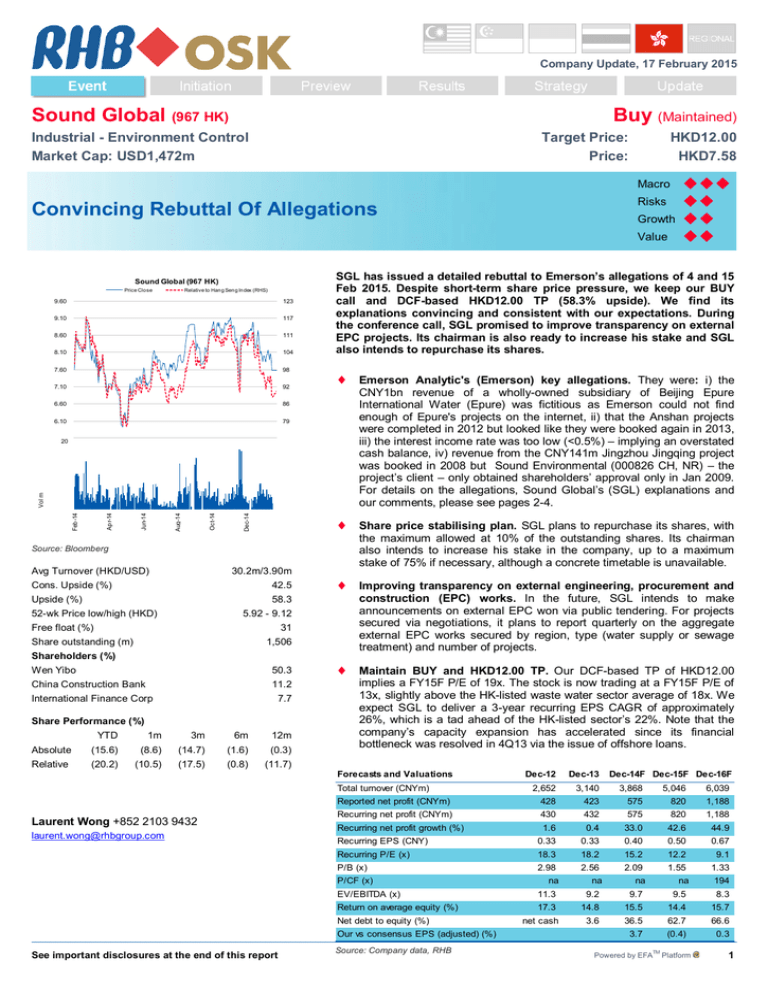

Forecasts and Valuations

Shariah compliant

Laurent Wong +852 2103 9432

laurent.wong@rhbgroup.com

Dec-12

Dec-13

2,652

3,140

3,868

5,046

6,039

Reported net profit (CNYm)

428

423

575

820

1,188

Recurring net profit (CNYm)

430

432

575

820

1,188

Recurring net profit growth (%)

1.6

0.4

33.0

42.6

44.9

Recurring EPS (CNY)

0.33

0.33

0.40

0.50

0.67

Recurring P/E (x)

18.3

18.2

15.2

12.2

9.1

P/B (x)

2.98

2.56

2.09

1.55

1.33

Total turnover (CNYm)

P/CF (x)

na

na

Dec-14F Dec-15F Dec-16F

na

na

194

EV/EBITDA (x)

11.3

9.2

9.7

9.5

8.3

Return on average equity (%)

17.3

14.8

15.5

14.4

15.7

3.6

36.5

62.7

66.6

3.7

(0.4)

0.3

Net debt to equity (%)

Our vs consensus EPS (adjusted) (%)

See important disclosures at the end of this report

3

.

2

0

.

2

0

0

.2

0

0

SGL has issued a detailed rebuttal to Emerson’s allegations of 4 and 15 .

0

Feb 2015. Despite short-term share price pressure, we keep our BUY 0

call and DCF-based HKD12.00 TP (58.3% upside). We find its 0

explanations convincing and consistent with our expectations. During

the conference call, SGL promised to improve transparency on external

EPC projects. Its chairman is also ready to increase his stake and SGL

also intends to repurchase its shares.

Source: Bloomberg

Avg Turnover (HKD/USD)

Source: Company data, RHB

net cash

Powered by EFA

TM

Platform

1

Sound Global

(967 HK)

17 February 2015

Emerson’s 4 Feb key allegations, SGL's responses and our comments

Emerson: According to the approval report by China Regal Assets Appraisal Co Ltd

(CR Appraisal), the CNY1bn technology services revenue (inside the external EPC

segment) was fictitious, generated by a wholly-owned subsidiary of Epure, which was

not commonly known by staff. "Technology services revenue” was never reported

separately in SGL’s annual report. Additionally, Epure’s 2012 revenue filed to the

State Administration of Industry and Commerce (SAIC) was 24% lower than the

number shown in CR Appraisal’s report. Lastly, Epure failed to pay the social security

payment (CNY210,000) on time in Nov 2011, suggesting that its cash balance was

overstated.

SGL:

Most of SGL’s EPC projects were secured by negotiation, not by bidding.

The company is generally not allowed to disclose the details (including the

owners) of the projects. Hence, this explains why Emerson was unable to

use an internet search (eg dowater.com) to get the full EPC projects list in

China.

CR Appraisal confirmed to have erroneously classified all of Epure’s

revenue as “technology services revenue”, but it should only be 4% in 2013

based on International Financial Reporting Standards (IFRS). The remaining

96% should be booked as “construction services revenue”. For financial

reporting, SGL normally groups the two under “turnkey projects and services

revenue”.

Epure’s revenue in 2012, which was filed with the SAIC, was 24% lower

than that in CR Appraisal report. The accounts that Epure filed with the

SAIC were based on Chinese Generally Accepted Accounting Principles

(GAAP) and audited by Beijing Zhongpingjian Huahao CPA (Zhongpingjian).

In 2012, for some of the EPC projects where Epure acted as the main EPC

contractor, the sub-contractors directly issued invoices to the project owners,

and Zhongpingjian excluded them from Epure’s revenue. However, these

sub-contracted constructions were part of the EPC contract signed with the

project owners, and so SGL booked revenue based on the percentage of

completion.

Epure’s revenue has been audited by Deloitte with an unqualified opinion.

Epure obtained environmental engineering (water pollution control) design

qualification certificate (Class B) in Feb 2009 and certificate (Class A)

licences in Dec 2010.

The late payment (Nov 2011) of social insurance by Epure was due to a

clerical error and that the company had settled this payment in Dec 2011.

Epure had CNY1,299m cash on hand in Dec 2013, as audited by Deloitte.

Our comments:

We believe the strongest evidence that suggests the authenticity of the CNY1bn

technology revenue each year in 2011-2013 lies with the filing with the SAIC. If such

a figure was faked or overstated, the sum filed would be much lower, and a company

undertaking this would have been able to pay less tax.

Although SGL did not give the full list of its external EPC projects to uphold

confidentiality, it has revealed three external EPC projects (investments totalling:

CNY550m) to the Anshan Environmental Protection Bureau (Anshan Bureau). These

projects were unknown to Emerson. This is a solid piece of evidence that proves that

the latter was not able to get the full list of water EPC projects in China via internet

research. Hence, its accusations on both Anshan projects (see point 2) and Epure’s

CNY1bn revenue is unfounded.

SGL explained most of Epure’s revenue should be “construction service revenue”

and “technology services revenue” (ie design revenue), which accounted for only 4%

of the latter’s income in 2013. Thus, SGL did not report “technology services

revenue” separately.

Epure’s 2012 revenue filed with the SAIC was 24% lower than the amount in the CR

Appraisal report. We agree that accounting revenue booking should be based on

signed EPC contracts and the percentage of completion. In contrast, for SAIC’s filing,

revenue is based on invoices, ie if SGL's subcontractors send invoices directly to the

project owners, SGL will bill the profit margins to the project owners.

At only CNY210,000, the late payment was a very small amount. Furthermore, it was

settled quickly.

See important disclosures at the end of this report

2

Sound Global

(967 HK)

17 February 2015

Emerson: The Anshan projects – three build, operate and transfer (BOT) projects

with a total capacity of 210,000 tonnes and total investments of CNY487m – were

completed and booked in 2012. However, they seem to have been booked again in

2013.

SGL: In Dec 2011, SGL secured CNY200m worth of build and transfer (BT)

pipe network and pump station construction works for the three Anshan BOT

projects. It also secured another three external EPC projects (worth CNY550m)

in Anshan via competitive negotiation, namely the: i) Anshan Lishan district

sewage collection pipe network project, ii) Anshan Qianshan district sewage

collection pipe network project, and iii) Anshan Panjialu sewage interception

project. In 2013, SGL booked construction revenue of CNY138m for pipelines

and pump stations, and CNY380m for the three external EPC works. The

remaining construction revenue was for auxiliary works, eg roads and

landscaping, for the three BOT projects.

Our comments: SGL’s clarification is convincing. The three external EPC

projects that were never disclosed before, together with the BT construction of

pipes and pump stations, can sufficiently explain the revenue from the Anshan

Bureau in 2013.

Emerson: Revenue from the CNY141m Jingzhou Jingqing EPC project – Sound

Environmental was the client – was booked in 2008, but the latter only obtained

shareholders’ approval in Jan 2009.

SGL: Sound Environmental signed the BOT agreement and pipe network

construction project contract on 18 Feb 2008 with Jingzhou Municipal

Government, which required immediate construction. Thus, the former started

construction on 23 Feb 2008. Sound Environmental announced this contract on

19 Dec 2008 and obtained its shareholders’ approval on 4 Jan 2009.

Our comments: SGL was able to explain that the Jingzhou revenue was not

fictitious. Nevertheless, the commencement of connection transaction before

obtaining shareholders’ approval was a bad practice and management should

improve its corporate governance in future. The recent restructuring

(announced in Sep 2014) to let Sound Environmental directly hold a 31.2%

stake in SGL will likely eliminate connected transactions going forward.

Emerson: According to Sound Global’s HK listing document published in Jun 2010,

the Guangxi Chongzuo project had 30,000 tonnes daily capacity and its total

investment would be CNY68.2m. SGL recognised CNY56.1m as construction

revenue as of 31 Mar 2010. In fact, Chongzuo Phase 1 (in 2009) had only 15,000

tonnes/day capacity.

SGL: The Chongzuo project had 30,000 tonnes/day short-term capacity and the

planned investment was CNY68.2m. Phase 1 had 15,000 tonnes/day capacity

with CNY59.5m worth of total investment. The building structure (including the

building complex, canteen, pump room and power distribution room) was based

on 30,000 tonnes/day, whereas the sedimentation basin, biochemical treatment

and sewage treatment facilities were constructed based on a capacity of 15,000

tonnes/day. SGL booked CNY56.3m construction revenue in 2008-2010. Phase

2 has a capacity of 15,000 tonnes/day, with an investment of CNY13m.

Our comments: The Chongzuo project had only 15,000 tonnes/day capacity.

However, Phase 1 incurred much higher investment than Phase 2, because

many building structure construction was based on 30,000 tonnes/day capacity.

Thus, the revenue recognition of CNY56.3m is valid.

See important disclosures at the end of this report

3

Sound Global

(967 HK)

17 February 2015

Emerson: The announcement of the Shaanxi Hancheng project in 2012 had misled

investors as a BOT project with a total investment of CNY98m when, in fact, it was

only an external EPC upgrade project with CNY20m worth of investments.

SGL: SGL secured the Hancheng Phase 1 BOT in 2008, which had a capacity

of 25,000 tonnes/day and an investment of CNY47.9m. It booked most of the

construction revenue in 2009-2011. Phase 2 had a capacity of 25,000

tonnes/day with an investment of CNY29.5m. The total investments of both

Phases 1 and 2 were CNY77.4m. In Oct 2012, SGL announced that it had

secured a contract to upgrade Phase 1’s water discharge standard from Class

IB to Class IA 1, and that the investment of the upgrade was CNY20.6m. Thus,

the total investment of the entire Hancheng project has been increased to

CNY97.7m. For the upgrade, CNY13.8m worth of construction revenue was

booked in 2013.

Our comments: The allegation that the Hancheng project was a misleading

announcement is invalid, since the headline of the announcement already

suggested a "wastewater treatment upgrading project". Now, a clearer

breakdown of the CNY98m investment (including investments on the upgrade)

should offer investors greater clarity. We expect better disclosures for future

projects.

Emerson: Interest income rate of less than 0.5% was too low, implying an overstated

cash balance.

SGL: The EPC business requires high liquidity. Keeping adequate cash in hand

can facilitate high quality M&A and ensures that the company does not lose out

to its competition. Additionally, when bidding for EPC projects, SGL is required

to demonstrate strong funding capabilities to win the trust of the project owners.

Thus, SGL can only keep the cash mainly in current accounts. The effective

interest income rate is 0.355%, consistent with annual interest rate, which can

be earned through current account deposits offered by banks in China.

Our comments: SGL’s explanation echoes our expectations that the low

effective interest rate was due to SGL's EPC business requiring cash during the

year. The company often borrows in 2H (eg the USD110m syndicated loan in

Taiwan was raised in 4Q13). Hence, the new cash cannot contribute to a fullyear interest income.

Emerson’s 15 Feb key allegations, SGL's responses and our comments

Emerson: SGL recognised CNY314m in revenue with respect to the three Anshan

BOT projects and CNY61.8m with respect to the pipe network/pump stations

construction in 2012 (a total of CNY376m, or 14.2% of 2012 revenue). However, in its

2012 annual report, the company said its largest customer for that year was the

Jiangyan City Housing and Urban Construction Bureau, which contributed 10.73% to

its revenue. Why not the Anshan Bureau instead?

SGL: The question was answered in the recent conference call with

management. The Anshan BOT projects booked CNY314m in construction

revenue in 2012. In fact, the construction was done for internal BOT projects.

Although the revenue from Anshan was huge, it was not the largest external

client. Hence, SGL attributed the Jiangyan project instead of Anshan as its

largest client in the 2012 Annual Report (page 116).

Our comments: We believe that SGL’s clarification is convincing.

See important disclosures at the end of this report

4

Sound Global

(967 HK)

17 February 2015

Recommendation Chart

Price Close

Recommendations & Target Price

12.0

na

10.00

9.00

8.00

7.00

6.00

5.00

4.00

3.00

Buy

2.00

Oct-10

Neutral

Sell

Trading Buy

Nov-11

Dec-12

Take Prof it

Not Rated

Jan-14

Source: RHB, Bloomberg

Date

Recommendation

Target Price

2014-12-08

Buy

2014-04-15

Not Rated

12.0

na

Price

7.5

7.0

Source: RHB, Bloomberg

See important disclosures at the end of this report

5

RHB Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated: Stock is not within regular research coverage

Disclosure & Disclaimer

All research is based on material compiled from data considered to be reliable at the time of writing, but RHB does not make any repres entation or

warranty, express or implied, as to its accuracy, completeness or correctness. No part of this report is to be construed as an offer or solicitation of an offer

to transact any securities or financial instruments whether referred to herein or otherwise. This report is general in nature and has been prepared for

information purposes only. It is intended for circulation to the clients of RHB and its related companies. Any recommendation contained in this report does

not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee . This report is for the

information of addressees only and is not to be taken in substitution for the exercise of judgment by addressees, who should obtain separ ate legal or

financial advice to independently evaluate the particular investments and strategies.

This report may further consist of, whether in whole or in part, summaries, research, compilations, extracts or analysis that has been prepared by RHB’s

strategic, joint venture and/or business partners. No representation or warranty (express or implied) is given as to the accu racy or completeness of such

information and accordingly investors should make their own informed decisions before relying on the same.

RHB, its affiliates and related companies, their respective directors, associates, connected parties and/or employees may own or have positions in

securities of the company(ies) covered in this research report or any securities related thereto, and may from time to time add to, or dispose off, or may be

materially interested in any such securities. Further, RHB, its affiliates and related companies do and seek to do business with the company(ies) covered

in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies),

may sell them or buy them from customers on a principal basis and may also perform or seek to perform significant investment banking, advisory or

underwriting services for or relating to such company(ies), as well as solicit such investment, advisory or other services fr om any entity mentioned in this

research report.

RHB and its employees and/or agents do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arise

from any reliance based on this report or further communication given in relation to this report, including where such losses, loss of profits or damages are

alleged to have arisen due to the contents of such report or communication being perceived as defamatory in nature.

The term “RHB” shall denote where applicable, the relevant entity distributing the report in the particular jurisdiction mentioned specifically herein below

and shall refer to RHB Research Institute Sdn Bhd, its holding company, affiliates, subsidiaries and related companies.

All Rights Reserved. This report is for the use of intended recipients only and may not be reproduced, distributed or published for any purpose without prior

consent of RHB and RHB accepts no liability whatsoever for the actions of third parties in this respect.

Malaysia

This report is published and distributed in Malaysia by RHB Research Institute Sdn Bhd (233327-M), Level 11, Tower One, RHB Centre, Jalan Tun Razak,

50400 Kuala Lumpur, a wholly-owned subsidiary of RHB Investment Bank Berhad (RHBIB), which in turn is a wholly-owned subsidiary of RHB Capital

Berhad.

Singapore

This report is published and distributed in Singapore by DMG & Partners Research Pte Ltd (Reg. No. 200808705N), a wholly-owned subsidiary of DMG &

Partners Securities Pte Ltd, a joint venture between Deutsche Asia Pacific Holdings Pte Ltd (a subsidiary of Deutsche Bank Group) and OSK Investment

Bank Berhad, Malaysia which have since merged into RHB Investment Bank Berhad (the merged entity is referred to as “RHBIB”, which in turn is a whollyowned subsidiary of RHB Capital Berhad). DMG & Partners Securities Pte Ltd is a Member of the Singapore Exchange Securities Trading Limited. DMG &

Partners Securities Pte Ltd may have received compensation from the company covered in this report for its corporate fin ance or its dealing activities; this

report is therefore classified as a non-independent report.

As of 15 February 2015, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd do not have proprietary

positions in the securities covered in this report, except for:

a)

As of 15 February 2015, none of the analysts who covered the securities in this report has an interest in such securities, except for:

a)

Special Distribution by RHB

Where the research report is produced by an RHB entity (excluding DMG & Partners Research Pte Ltd) and distributed in Singapore, it is only distributed

to "Institutional Investors", "Expert Investors" or "Accredited Investors" as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not

an "Institutional Investor", "Expert Investor" or "Accredited Investor", this research report is not intended for you and you should disregard this research

report in its entirety. In respect of any matters arising from, or in connection with this research report, you are to contact our Singapore Office, DMG &

Partners Securities Pte Ltd

Hong Kong

This report is published and distributed in Hong Kong by RHB OSK Securities Hong Kong Limited (“RHBSHK”) (formerly known as O SK Securities Hong

Kong Limited), a subsidiary of OSK Investment Bank Berhad, Malaysia which have since merged into RHB Investment Bank Berhad ( the merged entity is

referred to as “RHBIB”), which in turn is a wholly-owned subsidiary of RHB Capital Berhad.

6

RHBSHK, RHBIB and/or other affiliates may beneficially own a total of 1% or more of any class of common equity securities of the subject company.

RHBSHK, RHBIB and/or other affiliates may, within the past 12 months, have received compensation and/or within the next 3 months seek to obtain

compensation for investment banking services from the subject company.

Risk Disclosure Statements

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that

losses will be incurred rather than profit made as a result of buying and selling securities. Past performance is not a guide to future performance. RHBSHK

does not maintain a predetermined schedule for publication of research and will not necessarily update this report

Indonesia

This report is published and distributed in Indonesia by PT RHB OSK Securities Indonesia (formerly known as PT OSK Nusadana S ecurities Indonesia), a

subsidiary of OSK Investment Bank Berhad, Malaysia, which have since merged into RHB Investment Bank Berhad, which in turn is a wholly-owned

subsidiary of RHB Capital Berhad.

Thailand

This report is published and distributed in Thailand by RHB OSK Securities (Thailand) PCL (formerly known as OSK Securi ties (Thailand) PCL), a

subsidiary of OSK Investment Bank Berhad, Malaysia, which have since merged into RHB Investment Bank Berhad, which in turn is a wholly-owned

subsidiary of RHB Capital Berhad.

Other Jurisdictions

In any other jurisdictions, this report is intended to be distributed to qualified, accredited and professional investors, in compliance with the law and

regulations of the jurisdictions.

DMG & Partners Research Guide to Investment Ratings

Kuala Lumpur

Hong Kong

Singapore

Buy: Share price may exceed 10% over the next 12 months

Trading Buy:Malaysia

Share price

may exceed 15% over theRHB

nextOSK

3 months,

however longer-term outlook remains uncertain

Research Office

Securities Hong Kong Ltd. (formerly known

DMG & Partners

Neutral: Share

mayInstitute

fall within

months

as12

OSK

Securities

Securities Pte. Ltd.

RHB price

Research

Sdn the

Bhdrange of +/- 10% over the next

Take Profit:

Target

price One,

has been

attained. Look to accumulate at lower

Honglevels

Kong Ltd.)

Level

11, Tower

RHB Centre

10 Collyer Quay

th

Sell: Share price may

byRazak

more than 10% over the next 12 months

Jalanfall

Tun

12 Floor

#09-08 Ocean Financial Centre

Lumpur

World-Wide House

Singapore 049315

Not Rated: Stock isKuala

not within

regular research coverage

Malaysia

Tel : +(60) 3 9280 2185

Fax : +(60) 3 9284 8693

DISCLAIMERS

19 Des Voeux Road

Central, Hong Kong

Tel : +(852) 2525 1118

Fax : +(852) 2810 0908

Tel : +(65) 6533 1818

Fax : +(65) 6532 6211

Phnom

Penh

This research is issuedJakarta

by DMG & Partners Research Pte Ltd and it is forShanghai

general distribution only. It does not have any regard

to the

specific investment

objectives, financial situation and particular needs of any specific recipient of this research report. You should independen tly evaluate particular

Securities

Indonesia financial adviser

RHB

OSK (China)

Advisory

Ltd. into any

RHBtransaction

OSK Indochina

Securities

Limited

(formerly

investmentsRHB

andOSK

consult

an independent

before

makingInvestment

any investments

or Co.

entering

in relation

to any

securities

or

(formerly known as OSK (China) Investment

known as OSK Indochina Securities Limited)

Mulia Building,

20th in

Floor,

investment Wisma

instruments

mentioned

this report.

Advisory Co. Ltd.)

Jl. Jenderal Gatot Subroto No. 42,

No. 1-3, Street 271

Jakarta 12710, Indonesia

Suite 4005, CITIC Square

Sangkat Toeuk Thla, Khan Sen Sok

The informationTel

contained

herein has been obtained from sources 1168

we believed

to be reliable but we do not make any representation

or warranty nor

: +(6221) 2783 0888

Nanjing West Road

Phnom Penh

accept any responsibility

or2783

liability

as to its accuracy, completeness orShanghai

correctness.

are subject to change

Fax : +(6221)

0777

20041Opinions and views expressed in this report

Cambodia

without notice.

China

Tel: +(855) 23 969 161

Tel : +(8621) 6288 9611

Fax: +(855) 23 969 171

Faxof: +(8621)

6288

9633or sell any securities.

This report does not constitute or form part of any offer or solicitation

any offer

to buy

Bangkok

DMG & Partners Research Pte Ltd is a wholly-owned subsidiary of DMG & Partners Securities Pte Ltd, a joint venture between OSK Investment Bank

Berhad, Malaysia which have since merged into RHBRHB

Investment

Bank Berhad

(thePCL

merged

entity

is referred to as “RHBIB” which in turn is a whollyOSK Securities

(Thailand)

(formerly

known

owned subsidiary of RHB Capital Berhad) and Deutsche Asiaas

Pacific

Holdings Pte

Ltd (a PCL)

subsidiary of Deutsche Bank Group). DMG & Partners Securities

OSK Securities

(Thailand)

Pte Ltd is a Member of the Singapore Exchange Securities Trading

Limited.

10th Floor,

Sathorn Square Office Tower

98, North Sathorn Road, Silom

Bangkok 10500

DMG & Partners Securities Pte Ltd and their associates, directors, Bangrak,

and/or employees

may have positions in, and may effect transactions in the securities

Thailand

covered in the report, and may also perform or seek to perform broking and

other corporate finance related services for the corporations whose s ecurities

Tel: +(66) 2 862report.

9999

are covered in the report. This report is therefore classified as a non-independent

Fax : +(66) 2 108 0999

As of 15 February 2015, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd, do not have proprietary

positions in the subject companies, except for:

a)

As of 15 February 2015, none of the analysts who covered the stock in this report has an interest in the subject companies covered in this report, except

for:

a)

DMG & Partners Research Pte. Ltd. (Reg. No. 200808705N)

7