On-Line Extra - Marion County Property Appraiser

advertisement

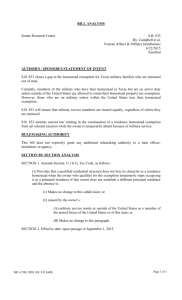

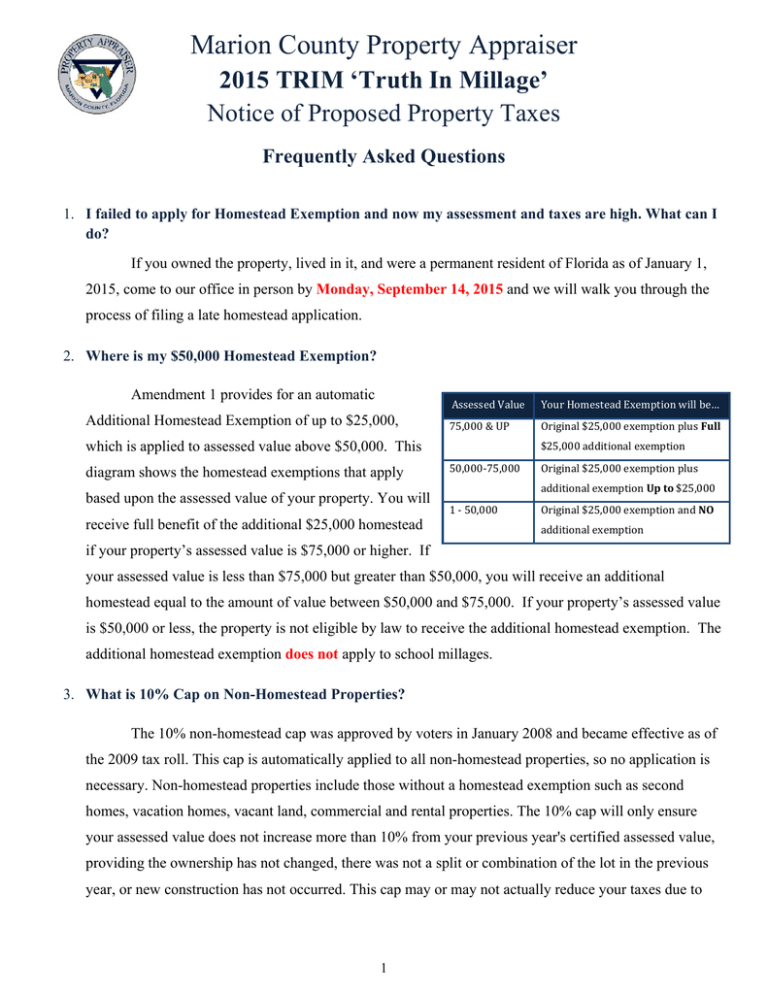

Marion County Property Appraiser 2015 TRIM ‘Truth In Millage’ Notice of Proposed Property Taxes Frequently Asked Questions 1. I failed to apply for Homestead Exemption and now my assessment and taxes are high. What can I do? If you owned the property, lived in it, and were a permanent resident of Florida as of January 1, 2015, come to our office in person by Monday, September 14, 2015 and we will walk you through the process of filing a late homestead application. 2. Where is my $50,000 Homestead Exemption? Amendment 1 provides for an automatic Additional Homestead Exemption of up to $25,000, AssessedValue YourHomesteadExemptionwillbe… 75,000&UP Original$25,000exemptionplusFull $25,000additionalexemption which is applied to assessed value above $50,000. This diagram shows the homestead exemptions that apply based upon the assessed value of your property. You will 50,000‐75,000 Original$25,000exemptionplus additionalexemptionUpto$25,000 1‐ 50,000 receive full benefit of the additional $25,000 homestead Original$25,000exemptionandNO additionalexemption if your property’s assessed value is $75,000 or higher. If your assessed value is less than $75,000 but greater than $50,000, you will receive an additional homestead equal to the amount of value between $50,000 and $75,000. If your property’s assessed value is $50,000 or less, the property is not eligible by law to receive the additional homestead exemption. The additional homestead exemption does not apply to school millages. 3. What is 10% Cap on Non-Homestead Properties? The 10% non-homestead cap was approved by voters in January 2008 and became effective as of the 2009 tax roll. This cap is automatically applied to all non-homestead properties, so no application is necessary. Non-homestead properties include those without a homestead exemption such as second homes, vacation homes, vacant land, commercial and rental properties. The 10% cap will only ensure your assessed value does not increase more than 10% from your previous year's certified assessed value, providing the ownership has not changed, there was not a split or combination of the lot in the previous year, or new construction has not occurred. This cap may or may not actually reduce your taxes due to 1 Marion County Property Appraiser 2015 TRIM ‘Truth In Millage’ Notice of Proposed Property Taxes Frequently Asked Questions other factors such as millage rates and non-ad valorem assessments, which are not determined by the Property Appraiser. The 10% cap does not apply to school millages. If you purchase a property subject to the 10% cap, the property will be reassessed at full market value in the year following a change in ownership or control, similar to the way a homestead exemption property is handled. If you change ownership or control of a property subject to a 10% cap without the recording of a deed, you must notify the Property Appraiser promptly of that change. Failure to do so subjects the property owner to a lien for back taxes plus 15% interest per annum and a penalty of 50% of the taxes avoided. 4. How is the value of my home determined? By law, the assessment date of all real and tangible personal property in Marion County is January 1 each year. The 2015 estimate of value is based on sales of comparable properties in 2014. Sales that have occurred since January 1, 2015 will be used to estimate values for 2016. 5. How can the Assessed Value of my house increase when the Just Value is decreasing? State of Florida Department of Revenue rules, which govern Save Our Homes, requires all county Property Appraisers to increase the assessed value of your homestead property annually by the lesser of either 3% or the percent change in the Consumer Price Index (CPI). In 2015, that increase was 0.80%. It is possible for your assessed value to rise even though your property is declining in Just Value; this is referred to as “recapture rule”, Recapture Rule: 12D-8.0062 Assessments; Homestead; Limitations: (1) This rule shall govern the determination of the assessed value of property subject to the homestead assessment limitation under Article VII, Section 4(c), Florida Constitution and Section 193.155, F.S., except as provided in Rules 12D-8.0061, 12D-8.0063, and 12D-8.0064, F.A.C., relating to changes, additions or improvements, changes of ownership, and corrections. (2) Just value is the standard for assessment of homestead property, subject to the provisions of Article VII, Section 4(c), Florida Constitution. Therefore, the property appraiser is required to determine the just value of each individual homestead property on January 1 of each year as provided in Section 193.011, F.S. (3) Unless subsection (5) or (6) of this rule require a lower assessment, the assessed value shall be equal to the just value as determined under subsection (2) of this rule. (4) The assessed value of each individual homestead property shall change annually, but shall not exceed just value. 2 Marion County Property Appraiser 2015 TRIM ‘Truth In Millage’ Notice of Proposed Property Taxes Frequently Asked Questions (5) Where the current year just value of an individual property exceeds the prior year assessed value, the property appraiser is required to increase the prior year’s assessed value by the lower of: (a) Three percent; or (b) The percentage change in the Consumer Price Index (CPI) for all urban consumers, U.S. City Average, all items 1967=100, or successor reports for the preceding calendar year as initially reported by the United States Department of Labor, Bureau of Labor Statistics. (6) If the percentage change in the Consumer Price Index (CPI) referenced in paragraph (5)(b) is negative, then the assessed value shall be the prior year’s assessed value decreased by that percentage. (7) The assessed value of an individual homestead property shall not exceed just value. Specific Authority 195.027(1), 213.06(1) FS. Law Implemented 193.011, 193.023, 193.155, 196.031, 213.05 FS. History–New 10-4-95. 6. What if I disagree with the January 1, 2015 Value, Exemption, or Agricultural Classification on my TRIM Notice? We strongly encourage you to contact our office should you disagree with the value, exemption, or agricultural classification on the TRIM Notice. There are over 260,000 properties that we assess annually based on a mass appraisal methodology. Although we strive to arrive at a fair and equitable value, we can miss something. We will make every effort to make sure your assessment is correct and representative of the property’s value as of January 1, 2015. 7. I received a letter from a company that describes themselves as property tax advisors who offer for a fee to challenge my property tax assessment with the County Property Appraiser. What should I do? Although we are not able to provide you with legal advice, we suggest you contact our office. If after conferring with the Property Appraiser’s Office you are not satisfied with the explanation, you may file a petition with the Value Adjustment Board or have a tax advisor or an attorney represent you. 8. Where do I go to file a VAB Petition; is there a deadline? Petitions are available at both the Property Appraiser’s Office and the Clerk Annex. However, the petition must be filed with the Clerk of VAB located at Clerk Annex (former State Attorney Building) 19 NW Pine Avenue, Room 124 (Official Records). The deadline to file a Petition is Monday, September 14, 2015 at 5:00 P.M. If you are sending via courier such as FedEx, send to: Clerk of the VAB, 110 NW 1st Avenue, Ocala, FL 34475 or you can mail petitions by regular US Mail to: Clerk of the VAB, PO Box 1030, Ocala, FL 34478-1030. Contact their office at (352) 671-5622, for additional information. 3 Marion County Property Appraiser 2015 TRIM ‘Truth In Millage’ Notice of Proposed Property Taxes Frequently Asked Questions 9. How do I prepare for the VAB Hearing? Hearings before the Special Magistrates are informal. The VAB Clerk will provide you with Rules and Guidelines for the VAB Process. In addition, once your petition is received by the Property Appraiser’s office a letter will be sent to you providing additional information. Because of our strong belief in open government, the Property Appraiser’s Office makes an ongoing effort to provide property owners access to the data needed to review assessments. You may visit our website at www.pa.marion.fl.us or come to our office to research 2014 sales. 10. What if I disagree with VAB Decision? You may file a Civil Action in the Circuit Court under section 194.171 of Florida Statutes. This can be filed whether or not you file a petition. Contact legal counsel to determine the appropriate filing deadlines and other important information before finalizing your decision. 4