FirstEnergy Corp. FactBook

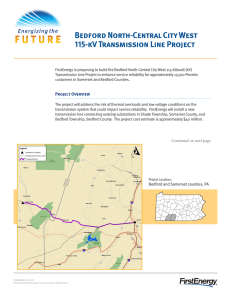

advertisement