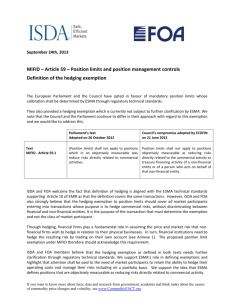

Reply form for the Consultation Paper on MiFID II / MiFIR

advertisement