world - Upstream

advertisement

McClendon boosts

Utica investment

Pieter Schelte set for

Yme topsides job

Page 39

Page 16

THE INTERNATIONAL OIL & GAS NEWSPAPER

upstreamonline.com

VOL 19 • WEEK 05 • 31 JANUARY 2014

Wuchuan set for Swiber vessel prize

Singapore-based Swiber Offshore is set to commission China’s Wuchang Shipbuilding Industry (Wuchuan) to

build a pipelay vessel with the aim of taking on bigger players in deep-water operations.

Page 3

Total steps

up drive at

Kaombo

Project: Total

chief executive

Christophe de

Margerie

Photo:

REUTRTS/

SCANPIX

FRENCH giant Total is taking

forward its challenging deepwater Kaombo project off Angola

by submitting to state oil

company Sonangol a list of its

recommended bidders to provide

two subsea production systems

and a pair of floating production,

storage and offloading vessels.

Pages 2&3

Field narrows in race for

Nasr oilfield tender

NEWS

2

COMMENT

10

POLITICS

12

14

SHALE

36

LNG

3

The number of

bidders in Cairn

India’s Ravva

re-tender.

Page 20

Chevron push

Re-tender on offer for

Gendalo-Gehem

production units off

Indonesia.

Page 6

Gas fix for US

Obama sees natural

gas as ‘bridge fuel’

for country’s

economy. Pages 12&13

EOG sets sights on

Goodland Lime play in

East Texas.

Pages 28&29

WORLD

Repsol Sinopec eyes

BM-C-33 acreage

development off

Brazil.

Page 4

Assets swoop

Devon confident in

Mississippian Woodford

Page 5

Campos plan

Pages 36&37

40

CLASSIFIED 45

FINANCIAL

Meeting challenges

you haven’t even thought of yet.

New offshore LNG loading technology:

made to handle the toughest conditions.

Copyright © FMC Technologies, Inc. All Rights Reserved.

www.fmctechnologies.com

50

2

31 January 2014

NEWS

BRIEFS

SBM Offshore was also competing for the

job but Total’s recommendation is said

“not to be in its favour”.

Source on Total’s Kaombo project

ANGOLA

BRAZIL

Parque das

Conchas sale

ANGLO-Dutch supermajor

Shell has reached an

agreement with Qatar

Petroleum International to

sell it a 23% working

interest in the Parque das

Conchas heavy oil

development in Brazil for

$1 billion.

The sale takes place a few

months after Shell and

Indian partner Oil &

Natural Gas Corporation

exercised their preemption rights to prevent

Chinese group Sinochem

from acquiring a 35% stake

in Parque das Conchas

from Petrobras.

Shell payed about $1

billion to Petrobras to

increase its stake in the

field from 50% to 73%, but it

is now selling the 23%

interest to Qatar Petroleum

for the same price.

Parque das Conchas is

producing 50,000 barrels

per day of oil equivalent.

CANADA

Enbridge

Expansion

ENBRIDGE will spend

C$200 million (US$179

million) to expand its

Sunday Creek Terminal in

northern Alberta to

support growing

production from Cenovus

Energy’s Christina Lake oil

sands project.

The Canadian pipeline

operator will build

additional facilities

including a new site

adjacent to the terminal, a

new 350,000-barrel tank,

and carry out civil work for

a future tank.

“We are pleased to move

forward in supporting the

planned production

growth from the Christina

Lake project,” said

Enbridge.

MEXICO

PMI awarded

Pemex flotels

MEXICO’S state-run Pemex

has awarded its PMI

commercial subsidiary the

contract to build and

supply two flotels in a deal

that marks the company’s

first attempt to hand out a

major contract following

energy reform.

Pemex made the award

after PMI bid $314 million.

The 10-year lease on the

flotel begins in 2016. Pemex

described the process as

being “totally transparent”.

Challenge: Total chief executive Christophe de Margerie

Total and Sonangol review

French major advances its deepwater project off Angola with

Aker and Modec said to be in the running for subsea production

systems and pair of FPSOs

IAIN ESAU and

TAN HWEE HWEE

London and Singapore

FRENCH giant Total is taking forward its challenging deep-water

Kaombo project off Angola by submitting to state oil company

Sonangol a list of its recommended bidders to provide two subsea

production systems and a pair of

floating production, storage and

offloading vessels.

Industry sources, while cau-

tious about second guessing Sonangol’s final decisions, tipped

Aker to be Total’s preferred bidder

to win a $1 billion contract to provide Kaombo’s subsea production

systems, involving more than 60

trees and about 20 manifolds.

Tokyo-based Modec is thought

by observers to be Total’s recommended supplier of the FPSOs,

S

14

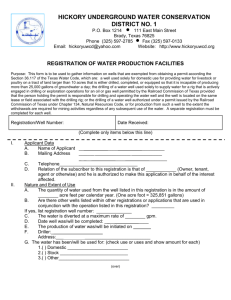

KAOMBO

IS LOCATED IN PROLIFIC BLOCK 32

Soyo

Manjercao Alho Cominhos

Colorau

Cola

Gindungo

Caril

Canela

Block

32

Gengibre

Main

map

Kaombo

Mostarda

Louro

Salsa

Atlantic Ocean

Luanda

ANGOLA

Luanda

Graphic: Total

each with the ability to handle

100,000 barrels per day of oil, 100

million cubic feet per day of gas

and store 2 million barrels of

crude.

“Modec stands a pretty good

chance of winning it,” said one

source.

Other sources said Italian player Saipem — despite its apparent

dissatisfaction about investment

returns in the FPSO business — is

not out of the running, having

submitted a strong local content

bid.

However, Saipem’s bid is understood to be more costly than Modec’s offer, which could perhaps

find favour with Sonangol, currently paying closer attention to

spiraling supply chain costs.

SBM Offshore was also competing for the job but Total’s recommendation is said “not to be in its

favour”.

The recommended bidder for

Kaombo’s umbilical, riser and

flowline packages is unclear, with

Subsea 7, Saipem and a TechnipHeerema Marine Contractors alliance all thought to be have been

chasing the order.

This package calls for some 80

kilometres of insulated flowlines

and risers plus the same amount

of umbilicals.

Sonangol could make decisions

on Total’s recommendations within three months, although it could

take longer than six months, suggested one Angola watcher, pointing out there is certainly no guarantee that the state player will

agree with Total’s recommendations.

Kaombo comprises two different clusters of widely dispersed,

marginal oil discoveries, which

on their own could not be developed.

By bringing these finds together under two separate developments, project economics have

improved, although Total was still

31 January 2014

3

$1 billion

THE VALUE of the

contract to provide subsea

production systems for

Total’s Kaombo project.

Swiber at Wuchuan

for pipelay vessel

INTERNATIONAL

AMBITIONS

TAN HWEE HWEE

and XU YIHE

Singapore and Houston

Photo: AFP/SCANPIX

wing Kaombo bidders

surprised by the high price commercial bids it received in late

2012 from the subsea and FPSO

players.

As a result, the operator spent

more than a year looking at various ways of bringing costs down

and, largely based on these efforts, made its preferences known

to Sonangol.

Some sources suggested that

Sonangol, which is undergoing a

change in key personnel, is now

looking more favourably on lower

costs bids compared to higher cost

local content offers in an effort to

get new projects moving.

The two FPSOs will be installed

in water depths of 1400 metres to

1900 metres, each tapping recoverable resources of about 300 million barrels of crude held in Oligocene and Miocene reservoirs.

The Kaombo North FPSO will

produce from about 35 subsea

wells on the Gengibre, Gindungo

and Caril discoveries, while the

Kaombo South floater will exploit

the Mostarda, Louro and Canela

finds through about 29 wells. The

Offshore Crane Technology

facebook.com/LiebherrMaritime

offshore.crane@liebherr.com

www.liebherr.com

nearby Salsa accumulation could

become a future satellite producer.

Start-up of Kaombo’s first FPSO

was originally targeted for mid2016 but, given ongoing delays,

production may only now start in

the second half of 2017 or early

2018.

The second FPSO will come on

stream about nine months later.

Oil will be offloaded into shuttle

tankers for export, while gas will

be piped to the Angola liquefied

natural gas plant at Soyo.

SINGAPORE-based Swiber Offshore is set to commission China’s Wuchang Shipbuilding Industry (Wuchuan) to build a

pipelay vessel with the intention

of taking on bigger players in

deepwater operations.

Wuchuan is set to be pronounced the victor in a newbuild tender against up to seven

yards in China alone. The five

finalists are said to have included Cosco Shipyard, Shanghai

Zhenhua Heavy Industry, CMHI

Yiulian and Rongsheng Heavy

Industries.

Wuchuan was helped in the

race by the pledge of financial

backing from parent China Shipbuilding Industry Corporation

(CSIC), sources said.

Swiber and Wuchuan are running through “some procedures”

and finalising the paperwork before signing a commercial contract, another source said.

The contract will involve the

turnkey delivery of a newbuild

construction vessel with S-Lay,

reel lay and flex-lay systems.

Swiber is understood to be in

talks with National Oilwell

Varco and Huisman for the sup-

ply of a crane with at least 4000

tonnes lift capacity to be fitted

on board the vessel. It will be

equipped with DP3 as well as a

10-point mooring system. Delivery from Wuchuan is targeted

for the end of 2016.

Swiber and Wuchuan have yet

to finalise the value of the newbuild contract, but industry

sources earlier valued the deal at

between $400 million and $500

million.

One source said the newbuild

is in the same class as Heerema

Marine Contractor’s deep-water

construction vessel Aegir.

Swiber wants to become an

international player capable of

performing offshore installation

in any waters worldwide, including harsh environments such as

the North Sea, the source said.

The Singapore-listed offshore

installation contractor is likely

to be eyeing more contracts in

the subsea umbilicals, risers and

flowlines sector currently dominated by European giants Technip and Subsea 7, following the

delivery of its newbuild.

Swiber has eight offshore installation vessels in its fleet, including the 3800-tonne heavylift

derrick barge Kaizen 4000.

These vessels are primarily active in the benign shallower waters off South-East Asia and Latin America.

Established in 1934, Wuchuan

specialises in support vessel fabrication. Its facilities in Qingdao

have built buoys for Brazilian

state oil company Petrobras.

BG gains Honduras permits

THE UK’s BG Group has obtained

an environmental permit to begin aerial gravity gradiometry

and other geophysical studies off

Honduras, according to a source,

writes Gareth Chetwynd.

“There are still one or two secondary permits to be issued, but

the survey should be starting in

the next few weeks,” the source

said.

Outstanding permits relate to

activities such as aerial photography.

BG has signed up for exploration and production rights on an

offshore block covering 35,000

square kilometres. BG managers

said the first phase of exploration, running from 2014 to 2015,

would require investments of

about $20 million.

The exploration will take place

off La Mosquitia, a remote jungle

region. BG has joined Honduran

government officials in consulting isolated fishing communities and has been defining social

projects in a region that is sometimes afflicted by crime related

to drug-running.

The main consultation workshops took place in October 2013.

With such a huge area to cover

with geological, geophysical and

seabed sampling studies, BG is

expected to home in on a chosen

area to shoot 3D seismic by late

2015 or early 2016. A second seismic campaign is likely in the

2015-2016 window.

Exploration rights run for four

years, extendable by two more,

with production rights for 20

years, renewable for five more.

The exploration contract was

the first of its kind in the Central

American nation.

NEWS

4

31 January 2014

Busy time

for player

in region

BRAZIL

Open: Repsol Sinopec

chief executive Jose

Maria Moreno

Photo: FABIO PALMIGIANI

Repsol Sinopec eye is on

Campos plan FEED work

Brazilian joint venture looking at a handful of options to develop

the entire BM-C-33 licence, focusing initially on Pao de Acucar

FABIO PALMIGIANI

Rio de Janeiro

CAMPOS RICHES

BRAZIL

B

R

A

Z

I

L

Rio de Janeiro

PA

R

AG

U

AY

Main map

Atlantic Ocean

Pampo

URUGUAY

Rio Grande

BM-C-33

Seat

Campos Basin

Gavea

nt

os

Ba

Pao de

Acucar

si

n

how to develop the trio of pre-salt

discoveries.

Repsol Sinopec chief executive

Jose Maria Moreno told Upstream

in July that the company was

considering the use of a large

FPSO with capacity to produce

between 100,000 and 150,000 barrels per day of oil and from 500

million to 700 million cubic feet

per day of gas.

However, the company is said

to be open to other development

scenarios, including the use of

more than one unit to produce

from Pao de Acucar and adjacent

discoveries.

Repsol Sinopec has discovered

more than 700 million barrels of

light 43 degrees API crude and 3

trillion cubic feet of natural gas in

the block, with the vast majority

concentrated in Pao de Acucar.

The company has already contracted Brazilian engineering

group Promon to carry out a feasibility study to determine the best

way to export natural gas from

BM-C-33.

The study will identify the best

location for the installation of a

gas treatment facility. It is understood that the options on the table

include the cities of Macae, Mage

and Sao Joao da Barra.

Nevertheless, Repsol Sinopec

is only expected to have a clearer

picture of which type and how

many production units it may

contract once an appraisal

programme in BM-C-33, which

Sa

REPSOL Sinopec is on the market

for front-end engineering and

design studies, as it searches for

the best solution to produce from

ultra-deepwater pre-salt reservoirs in the Campos basin off

Brazil.

Sources told Upstream that Repsol Sinopec issued a tender late

last year, and invited contractors

such as Technip, Doris Engineering, Fluor, Genesis, Mustang Engineering and WorleyParsons to

submit proposals for several types

of production units to be deployed

in Block BM-C-33.

The Brazilian joint venture, comprising Spanish company Repsol

and Chinese player Sinopec, is said

to be looking at a handful of options to develop the entire BM-C-33

licence, focusing initially on the

giant Pao de Acucar discovery, but

also looking at satellite structures

such as Gavea and Seat.

It is understood that contractors have the option to present

FEED solutions for floating production, storage and offloading

vessels, tension-leg platforms or

even spars.

If Repsol Sinopec chooses to

develop BM-C-33 with a spar, it

would be the first use of that type

of production unit in Brazilian

waters.

WorleyParsons and KBR carried

out independent conceptual

screening studies in late 2012, and

presented Repsol Sinopec with a

wide range of possibilities on

started in November, comes to an

end.

The company is presently drilling the Seat-2 appraisal well in

2665 metres of water using the

newbuild drillship Ocean Rig Mylos.

Despite only hitting marginal

quantities of hydrocarbons at the

original Seat well in 2009, followup 3D seismic studies shed more

light on the area, and Repsol Si-

SPANISH oil company Repsol

has prepared a busy programme

for the Western Caribbean in

2014 and 2015, with plans to

spud at least two offshore wells

and acquire plenty of seismic

data in Colombia and Aruba,

writes Fabio Palmigiani.

Repsol will participate first in

the drilling the Orca-1 wildcat

in the Tayrona block in

Colombia.

Jose Angel Murillas, Repsol

exploration director for

Northern Latin America, said

the well will be drilled by

operator Petrobras in the second

half of 2014.

Petrobras drilled one well in

Tayrona in September 2007,

Araza-1, but results were

inconclusive.

According to Murillas,

Petrobras will likely move a rig

from Brazil to Colombia in the

second quarter to spud Orca-1.

Orca-1 will be drilled in water

depths of 674 metres to a final

depth of 4775 metres.

The campaign will target

hydrocarbons in Lower Miocene

and Oligocene carbonate

reservoirs, which may hold

resources of 4 trillion cubic feet

of gas.

Repsol also has plans to spud

the Siluro-1 shallow-water

wildcat in Block RC-11 in

Colombia in 2015.

“Siluro-1 is very attractive

because of its proximity to the

coastline and existing

infrastructure, but it is much

smaller than Orca-1,” said

Murillas.

In parallel to drilling

activities, Repsol plans more

than 5000 square kilometres of

new 3D seismic in Colombia,

covering part of the Guajira

Offshore-1 block, and in Aruba.

Murillas said: “A single tender

is ongoing to contract all

planned seismic surveys. We

expect to map at least three to

five valid prospects to be drilled

between 2015 and 2018.”

Graphic: Repsol

nopec is now aiming toward the

centre of the carbonate reservoir

with the drilling of Seat-2.

If Seat-2 proves is a success, it

may reinforce the company’s

effort to look for different types of

production units to exploit BM-C33, according to one source.

Two more wells will be drilled

this year, with both likely to

appraise Pao de Acucar. A drillstem test is also planned.

Major steps up

drill activity

SPANISH player Repsol’s drilling

plans in the Caribbean are just

part of a step-up in activity that

will see the Spanish major

spend about $1.3 billion on

exploration this year.

The state-run outfit will focus

heavily on African acreage,

while spudding wells off Alaska,

and tapping a potentially vast

frontier play off the Canary

Islands as it sets aside some $910

million for drilling in 2014.

About 65% of the $1.3 billion

exploration budget is to go on

oil-led plays, with the

remaining 35% on pure gas

plays, exploration managing

director Marcos Mozetic said.

In Mauritania, the company

is two-thirds to its target zone

at a wildcat on the high-risk

Ouguiya prospect on Block Ta10

in the Taoudeni basin. In Libya,

Repsol is spudding the fourth

well in 16-well commitment

programme.

NEWS

31 January 2014

5

ABU DHABI

Contenders

in race for

Nasr field

packages

Samsung and GS said to have

dropped out of the running

VAHE PETROSSIAN

and TAN HWEE HWEE

London and Singapore

VIETNAM’S PTSC has roped in Brunei conglomerate Masshor Group

to carry out engineering, procurement and construction work on a

wellhead platform destined for

France’s Total-operated Maharaja

Lela Jamalulalam South (MLJS) gas

development off Brunei.

Masshor will deliver the jacket

of the MLJS-3 wellhead platform

from a new yard to be developed

in Muara, Brunei. The platform top-

sides will be fabricated at PTSC’s

yard in Vietnam.

Detailed design support will be

provided by France’s Technip.

The contracted work on the

MLJS-3 is scheduled to be completed by mid-2015.

The transportation and installation contract for the platform

and associated pipeline is said to

have gone to Malaysia’s SapuraAcergy.

Photo: NTB/SCANPIX

CE

MLJS platform work

Race: the field is narrowing for contracts for the Nasr development off Abu Dhabi

EE

is considered “similar in scope to

what they secured earlier”. The

delayed submission deadline for

technical bids for EPC2 is April.

Planning bids are Hyundai and

NPCC, Fluor and Technip.

The original list of potential

bidders for all Nasr packages last

year was nearly a dozen companies, including J Ray McDermott

and Australia’s Leighton Offshore, both of which indicated

early on that they were limiting

their role to working as subcontractors to the eventual main EPC

contractors.

There was talk last year that

Daewoo might prefer being a subcontractor for EPC-1, but it did in

the end submit its own bid.

The early phase of Nasr is being

developed by Larsen & Toubro under a $500 million contract

awarded in early 2011, which also

covers the early production facilities for the nearby Umm al

Lulu field.

The full field developments of

Nasr and Lulu are being carried

out separately. Nasr will eventually contribute 65,000 barrels per

day to Abu Dhabi’s capacity.

Adma-Opco is owned 60% by

Abu Dhabi National Oil Company,

with BP, Total and Jodco holding

the balance of shares.

Fluor carried out the front-end

engineering and design study for

both the Lulu and Nasr full-field

developments.

Technip carried out the FEED

for the joint development of the

early phases of Nasr and Lulu.

Nasr is about 30 kilometres northeast of the Umm Shaif complex.

Adma-Opco is trying to raise

its production capacity to nearly

1 million bpd from about 550,000

bpd.

GR

THE field of competitors for the

two main packages for Abu

Dhabi’s full field Nasr oilfield development has narrowed with

the departure of two South

Korean companies from the January submission of technical bids.

Three South Korean giants

remain in the race, with the local

National Petroleum Construction

Company (NPCC) also considered

a strong contender despite a

heavy workload.

The two engineering procurement and construction packages

issued by Abu Dhabi Marine Operating Company (Adma-Opco)

are EPC1 for seven new wellhead

towers, risers and infield pipelines, a 16-inch export line to Das

Island and another 10-inch line to

export excess gas, and EPC2 for

central processing facilities, platforms, flares, bridges, disposal

wells and infield composite cables.

EPC1 is estimated to be worth

$800 million, with EPC2 valued at

$1.4 billion.

A third package, EPC3, covers

brownfield modifications at Das

Island and hook-up of various

facilities on the island.

Sources said that Samsung Engineering and GS Engineering &

Construction dropped out of the

technical round for EPC1 in midJanuary. Price bids are due before

the end of the first quarter.

The main bidders were Hyundai Heavy Industries, Samsung Heavy Industries, Daewoo

Shipbuilding & Marine Engineering and NPCC.

Also submitting technical proposals were Petrofac, Technip

and Fluor, sources said.

One source said NPCC “seems

confident” of getting EPC1, which

Visit us at NAPE in the Greece

Booth 934 in the International

Exhibition Hall and the PGS booth

3015 in the main exhibition.

Peloponnesus

Ionian Sea

Crete

MultiClient

The diverse geology of Greece offers

a variety of petroleum potential:

In the North Ionian Sea there are

analogues to Italian and Albanian

oil and gas fields

The Katakolon oil discovery is proof

of an existing hydrocarbon system

in the Western Peloponnesus zone

South of Crete remains an

unexplored frontier with

unrevealed potential

Contact us to find tomorrow’s assets

in Greece today.

Data is now available for review.

NEW MC2D DATA

OFFSHORE GREECE

Available for the 2014 License Round

The PGS MC2D GRE2012 data provides an understanding of the regional geology

and tectonic setting of offshore western Greece. The data resolution and frequency

content obtained by the GeoStreamer GS™ acquisition technology enables advanced

prospectivity analysis and interpretation, necessary for assessing the hydrocarbon

potential before the license round opening in 2014.

Supporting your exploration success

ØYSTEIN LIE

+47 93 08 56 61 oystein.lie@pgs.com

NICOLAI BENJAMIN DAHL +47 92 49 39 31 nicolai.dahl@pgs.com

NEWS

6

31 January 2014

INDONESIA

Chevron gets going on

Gendalo-Gehem FPUs

US supermajor aims to make up for lost time by offering

compressed re-tender for delivery of two planned units

TAN HWEE HWEE

Singapore

CHEVRON aims to recover lost

time on the Gendalo-Gehem gas

condensate development off Indonesia by lining up a compressed

re-tender for the turnkey delivery

of two planned floating production units.

The US supermajor is aiming to

conclude the re-tender for a contract on the two FPUs, estimated

to make up about half the project

budget for Gendalo-Gehem development, by the end of March.

Its intent is to formalise an

award to the successful contender

in the second quarter, according

to sources.

The bid schedule is considered

ambitious in the Indonesian context, given the full tender cycle

usually takes at least six months

to complete.

Chevron is understood to have

conceded to a request from Indonesia’s upstream regulatory body,

SKK Migas, to start the re-tender

from scratch, meaning a prequalification exercise should normally

be carried out before the process

moves into full swing.

However, contractors already

pre-qualified either as lone bidders or within the same consortium in the previous tender held

in 2013, will be exempted from the

pre-qualification requirements.

The condition laid out for the

prequalification exercise effectively allows Chevron to cut the

administrative process should the

same contractors return.

The 2013 tender for the two

Gendalo-Gehem FPUs attracted

three bids.

After bids were opened, McDermott of the US was leading by

$600 million over the next contender with an offer of $2.7 billion.

Two other consortia — Hyundai

Heavy Industries with Italy’s

Saipem and Indonesia’s Tripatra

Engineering & Construction, Daewoo Shipbuilding & Marine Engineering with UK-listed Petrofac,

Malaysia’s RNZ and Indonesia’s Inti

Karya Persada Tehnik — responded

to Chevron’s 2013 bid call.

Chevron is racing against time

to conclude the re-tender for the

FPU contract, not least because it

hopes to avoid the need to call a

re-bid for a second key contract

covering subsea umbilicals, risers

and flowlines.

Aberdeen-based Subsea 7, in a

joint bid with Indonesia’s Timas

Suplindo, was declared the winner following a competitive tender for the contract involving the

procurement and installation of

the SURF package.

About 630 kilometres of pipelines, 80 kilometres of umbilicals

and up to 120 subsea flowline connections will be installed in up to

6000 feet of water.

In absence of any certainty over

the FPU delivery schedule follow-

Bid circuit

roaring

back to life

INDONESIA’S bid circuit is

roaring back to life, not only

with Chevron returning to the

market for the two floating

production units it wants for its

Gendalo-Gehem gas and

condensate development but

Pertamina Hulu Energi following

suit with a fresh tender for three

platforms panned out under the

phased expansion for the West

Madura Offshore (WMO) block.

Pertamina has issued a

prequalification call for three out

of seven new platforms planned

for WMO.

Contractors were invited to

register their interest as

Upstream went to press to

prequalify for the tender of an

engineering, procurement,

construction and installation

contract tied to a small

processing platform and two

wellhead structures in the

PHE-12 and PHE-24 fields.

The two new wellhead

platforms will be tied to the

existing processing platform in

the PHE-38 field.

The tender is expected to be

concluded in the second quarter

Chevron is

racing against

time... not

least because

it hopes to

avoid the need

to call a re-bid

for a second

contract

covering

subsea

umbilicals,

risers and

flowlines.

Ambitious bid schedule: Chevron chief executive John Watson

ing the re-tender, Chevron is said

to have secured a bid validity extension from Subsea 7-Timas Suplindo.

The pair quoted $1.9 billion for

the SURF contract, beating Chevron’s owner estimate by 16%.

McDermott’s low bid for the

FPU contract, by contrast, was

20% above the owner’s estimate.

Chevron declared the 2013 tender for the FPU contract a failed

bid on the basis of “a change to the

plan of development”.

The failed bid was called following challenges to the validity of

McDermott’s bid with respect to

its compliance with local content

regulations.

Questions were raised over the

bid qualification of the US contractor as a “domestic” rather than

“national” company.

The re-tender will mean that

the Gendalo-Gehem development

could be set back by at least a year.

Chevron initially planned to begin offshore installation work late

last year, but this is likely to slip

to late this year.

The Gendalo-Gehem gas condensate project involves the development of the Gendalo, Gehem,

Maha and Gandang discoveries.

The larger of the two newbuild

FPUs destined for the Gehem field

has a designed processing capacity of 700 million cubic feet per

day of gas and 25,000 barrels per

day of condensate.

The second floater earmarked

for the three other fields will process up to 420 MMcfd of gas and

30,000 bpd of condensate.

SKK Migas estimates a combined $7 billion will be required to

Photo: AFP/SCANPIX

develop some 4 trillion cubic feet

of gas reserves under Chevron’s

Indonesia Deepwater Development, comprising the GendaloGehem project and the planned

Bangka field development.

Chevron is expected to finalise

the award of two contracts worth

$250 million to France’s Technip

and Indonesia’s Meindo Elang Indah for the Bangka development.

France’s Technip was tipped to

land a contract valued at about

$180 million for the Bangka SURF

package, and Meindo another $70

million contract for the topsides

modification for the planned tiein to the West Seno FPU.

The Bangka tenders were concluded in July 2013 but the contract awards were held back following the exit of former SKK

Migas chief, Rudi Rubiandini.

of 2014, leading to the contract

award around mid-year.

The successful bidder will be

called on to supply a derrick

pipelay vessel with 3000-tonne

lifting capacity to carry out the

offshore installation scheduled

from June through to the end of

August 2015.

The current tender for the

three platforms is considered the

first phase of the WMO

expansion plan.

Pertamina is likely to follow up

with a separate tender in 2015 for

three to four wellhead platforms

scheduled to be installed one year

apart from the first platform trio,

sources said.

The additional platforms lined

up under the WMO phased

expansion will be instrumental

in lifting output in the offshore

block to 75,000 barrels of oil

equivalent per day by 2016.

Average production at WMO

stood at 50,000 boepd, including

some 22,500 barrels per day of

crude from the West Madura

field in late 2013.

A leaking hose on the

supporting floating storage

offloading vessel in the field has

reportedly resulted in a halt in

crude production at WMO.

PHOTO: TILLMANN FRANZEN

FOR JAMES,

SAFETY DOESN’T

HAPPEN BY

ACCIDENT.

We play our part in the bigger picture.

Safety matters. Especially when you’re developing the regulatory framework

for a country’s entire oil and gas industry. James Brown and his team at

DNV GL are working closely with the authorities in Brunei to establish

robust regulations that meet complex challenges. Our expertise covers

the entire oil and gas value chain, drawing upon deep international

experience and local expertise to provide technical advice that makes a

real difference. We take a broader view on the sector and work relentlessly

SAFER, SMARTER, GREENER

to ensure that every part we play impacts upon the bigger picture.

Following the recent merger between DNV and GL, we are 16,000

employees worldwide, dedicated to enabling businesses to meet their

challenges in a safer, smarter and greener way: in the oil and gas, energy,

maritime and other industries.

Discover the broader view at dnvgl.com

NEWS

8

31 January 2014

CHINA

Newfield targeting date

for first oil from Lufeng

US independent aiming for end of the year — 12 months late

— after opting for jacket repair rather than replacement

XU YIHE

Singapore

US INDEPENDENT Newfield is

aiming to produce first oil at its

Lufeng 7-2 field in the South China

Sea one year late at the end of 2014,

after having decided to repair

rather than replace the project’s

jacket that was damaged during a

floatover operation last August.

Partner CNOOC Ltd is also trying to get the delayed field back on

track this year, chief executive Li

Fanrong said.

Although more inspections are

needed to review options, the

company decided in a meeting in

Shenzhen, southern China, last

week that it would try to repair

the jacket, which was badly damaged above the waterline and has

a two-metre-long crack 10 metres

below it.

However, there is still uncertainty about whether there are

more cracks in the jacket further

down in the water beyond the

10-metre depth.

More inspection is needed,

especially of the section in depths

down to 29 metres, sources said.

However, the sources said that

the initial plan is to replace the

damaged part above water and

weld the crack underwater.

They added that China’s Offshore Oil Engineering Company

(COOEC) is contracted to carry out

more investigations, which are

expected to finish in April, while

French engineering giant Technip

and CNOOC’s deep-water task

force in Shenzhen have been

shortlisted as the contractors for

the repair work.

Newfield has scheduled to reinstall the topsides at the end of July

or early August, depending on

weather conditions.

It would be very difficult to find

a weather window after August,

sources said.

The first installation was originally set for 31 July last year, but

the COOEC derrick barge was

forced to escape tropical storms to

safe anchorage and returned for

operation in early August.

Sources said the operational

window including anchoring

requires up to nine days.

Newfield — headed by chief

executive Lee Boothby — is con-

Back on track: Newfield chief executive Lee Boothby

sidering a few vessel options for

the next operation, including

COOEC’s HYSY 221, and candidate

vessels from COSCO and Swiber.

Sources said Newfield is yet to

decide on its choice of the frontend engineering and design contractor for the next operation.

A consensus has been reached

by the project partners after consultation that the leg-lowering

system of the platform’s topsides

needs to be changed from a low

centre of gravity floatover using a

strand jack lowering system to a

system using middle-to-high

floatover.

“The lowering of the legs is to be

put higher,” said one source, adding that winches are now being

recommended to lower legs rather

than strand jacks, since winches

can lower faster and put legs back

when necessary.

Newfield has also recommendeded using a CCTV system as part

Photo: BLOOMBERG

of the central control during the

whole operation, and that a locking system should be provided to

prevent the leg from rotating.

Sources said that it is also being

recommended that a rapid ballasting system should be provided to

ballast a barge down quickly and

get legs engaged.

Improvements to fenders were

also suggested, to restrain barge

movement and ensuring the legs

are in capture radius.

CNOOC keen to take over Newfield’s stake in Lufeng 7-2

CHINA National Offshore Oil Corporation (CNOOC) is understood to

have grown increasingly keen to

take over the stake owned by

Newfield in the Lufeng 7-2 oil asset

in the South China Sea, a logical

move given that it has pre-emption rights over the asset.

Newfield has been marketing

the equity it holds in both the

Lufeng field and Caofeidian field

complex in Bohai Bay off northern

China since last year as part of its

plan to divest its Asian upstream

assets.

CNOOC has declined to comment on market speculation about

any possible purchase. Newfield

currently has a 12% stake in Caofeidian.

According to the model for

CNOOC’s production sharing contracts, a foreign company will

hold 100% working interest in an

offshore field during the exploration period but CNOOC is entitled

to a 51% stake during the development phaset period.

Last October, Newfield sold its

assets in Malaysia to local player

SapuraKencana Petroleum in a

deal worth $898 million, with the

proceeds to be used to pay down

some existing debt as well as for

general corporate purposes, Newfield said.

Lufeng 7-2 lies in 107 metres of

water in the Pearl River Mouth

basin of the South China Sea and

will produce 30,000 barrels per

day of crude at peak. The development involves a central processing platform with a subsea production system tied back to

existing production facilities at

the nearby Lufeng 13-1 field, operated by CNOOC.

Oil will be further processed at

the Nanhai Shengkai floating production, storage and offloading

vessel, which operates at Lufeng

13-1, about 15 kilometres away.

Drama of

floatover

operation

NEWFIELD decided to abort the

floatover operation for the

Lufeng 7-2 topsides to its jacket

in early August last year after

the strand jack failed, causing

substantial damage to the

topsides and the jacket.

The operation started on 7

August using derrick barge

Haitianlong and floatover barge

HYSY221 carrying the topsides

fabricated by China’s Offshore

Oil Engineering Company

(COOEC), which had arrived at

the location on 27 July.

The initial delay was caused

by two separate tropical storms,

Chebi and Mangkhut.

During the floatover, which

was operated by UK-based

offshore installation contractor

Abnormal Load Engineering

(ALE), the outer legs were

striking the jacket legs and

finally the strand wires broke

and one of the legs fell and

stabbed into the jacket,

according to an investigation

carried out by Singapore’s

Aqualis Offshore.

As a result, the barge was

locked by the leg.

The continuous impact

between barge, jacket and

topsides resulted in extensive

damage to the topsides and

jacket, the latter of which was

fabricated by Shenzhen Chiwan

Sembawang Engineering.

To avoid injuries, Newfield

evacuated all the installation

crew to the Haitianlong.

After three recovery

attempts, HYSY221 withdrew

from the jacket slot and was

towed to Dayawan anchorage on

11 August and then back to

Shenzhen Chiwan Sembawang

Engineering on 12 August.

The Aqualis Offshore report

was said to have attributed the

accident to a number of factors

including weather conditions,

barge motions, mooring

patterns, fendering systems and

stabbing cone.

Newfield awarded Lufeng 7-2’s

engineering, procurement,

construction, installation and

commissioning contract to

COOEC, with ALE as the supplier

and operator of the strand jack

system for the floatover

installation.

The LF7-2 jacket, fabricated by

SCSE, was originally preinstalled in a water depth of

about 106 metres. The topsides

are being repaired at SCSE in

Shenzhen.

The outer

legs were

striking the

jacket legs

and finally the

strand wires

broke and one

of the legs fell

and stabbed

into the

jacket.

NEWS

31 January 2014

9

Frontier

confident

of sample

SOUTH AFRICA

Protected: the ocean

at Table Mountain

National Park

Photo: AFP/SCANPIX

Rhino applies for TCPs

in sensitive acreage

Area of interest to little-known player is adjacent

to marine protected regions and tourist spots

IAIN ESAU

London

BRAZIL-based junior Cowan

Oil & Gas is planning a 3D seismic survey in blocks 2613A and

2613B off Namibia.

The survey would be either a

proprietary project or a multiclient project in partnership

with TGS. Cowan said it is in

talks with the US-based player.

The planned survey would

cover about 4000 square kilometres, in water depths of between 500 and 2000 metres,

and could start in March.

Cowan Oil & Gas is part of the

Cowan Group conglomerate.

vi

s

u

t

a

2

0

l#

a

n

o

ti

9

a

7

4

9

Multi-Client 2D seismic

sample taken from

offshore Croatia

Zagreb

"

Croatiaa

Osijek

Osijek

"

Rijeka

"

Pula

"

Bosnia & Herzegovina

"

taly

Split

"

Legend

Spectrum’s 2D Multi-Client

Seismic Offshore Croatia.

Existing Italian Adriatic

Multi-Client Seismic

Dubrovnik

Monte

Spectrum has acquired a truly unique Multi-Client

seismic survey offshore Croatia. This is the only

seismic data available to license in this hugely

underexplored region which expects to see its first

offshore licensing round this year.

The survey, acquired under contract to the Ministry

of the Economy in Croatia, covers approximately

15,000 kilometres of long offset seismic data

with a 5 km x 5 km grid. It extends across most

of the Croatian Adriatic Sea and connects with

Spectrum’s reprocessed seismic data covering the

Italian Adriatic Sea.

Final PSTM data will be delivered at the beginning of

February with all processed data available in early

April. The Government of Croatia plans to hold

a licensing round over the country’s offshore

continental shelf in Q2 2014.

+44 (0)1483 730201

mc-uk@spectrumasa.com

www.spectrumasa.com

H

E

4

2

rn

1

0

2

#

te

In

A New Oil Province at the Heart of Europe

e

it

s

E

P

E

P

th

o

o

A

N

Offshore Croatia

A

N

d

B

n

Kinetiko and local player Badimo

Gas, has also applied for three onshore exploration rights.

One covers the former Volksrust

TCP 47 in Free State, KwaZuluNatal and Mpumulanga, while the

remaining two, Amersfoort and

Secunda, are sited in Mpumulanga.

A significant exploration right

application was filed offshore with

the agency by ExxonMobil taking

in five deep-water blocks covering

more than 50,000 square kilometres off the east coast.

Singapore-based Silver Wave

Energy, a privately-owned player

with Burmese connections, has

applied for three exploration

rights.

The first covers 71,000 square

kilometres immediately south of

the unratified median line between South Africa and Mozambique, while the largest extends

more than 192,000 square kilometres off the west and south coast.

Silver Wave has also applied for

a much smaller exploration right

— 6700 square kilometres — off

the south coast.

Off the west coast, Oklahomabased minnow OK Energy has

submitted an exploration right

application for the Northern Cape

Ultradeep licence, immediately

south of the maritime border with

Namibia.

The company has already filed

tentative plans to carry out

seismic surveys on the licence,

assuming it is granted an exploration right.

A proposed 2D seismic survey

would run about 500 kilometres,

covering the entire 6903-square

kilometre licence.

This operation could take place

before May or between December

2014 and May 2015, and would be

followed — at an unspecified time

— by a 1000 square kilometre 3D

survey.

Cowan survey

a

A LITTLE-KNOWN company based

in East Africa has applied for two

technical co-operation permits

(TCPs) offshore and onshore South

Africa.

Rhino Oil & Gas, which

Upstream was told is controlled by

two South African businessmen,

has applied for a 12,000-square

kilometre TCP that hugs the

coastline of the Western Cape,

adjacent to sensitive marine

protected areas and major tourist

regions.

The proposed TCP would run

from Saldanha in the north,

around Cape Town and the Cape

of Good Hope, and on to Cape

Agulhas, the most southerly point

in Africa.

The area is adjacent to marine

protected regions including West

Coast National Park, Sixteen Mile

Beach, Tale Bay, Table Mountain

National Park, Helderberg and

Betty’s Bay.

Rhino has also applied to South

Africa’s Petroleum Agency for a

sizeable onshore TCP.

This permit is in the Eastern

Cape adjacent to the southern

border of Lesotho.

It is not clear whether Rhino is

looking for conventional hydrocarbons here, or if this is an

extension of the potentially shale

gas-rich Karoo basin.

TCPs, when granted, allow a

company to carry out desk-top

studies for one year, after which

they can choose to apply for an

exploration right.

Other TCP applications were

submitted recently by local player

Afro Energy for two separate

tracts of land — one straddling

Free State and Mpumulanga

provinces, and the other straddling Mpumulanga and KwaZuluNatal provinces.

Afro Energy, a joint venture

established by Australian junior

LONDON-listed junior Frontier

Resources International is confident that analysis of soil gas

samples from its Ovambo basin

licences onshore Namibia indicates the presence of a hydrocarbon generating source rock.

A soil gas survey covered 903

sites, and aimed to determine

whether a hydrocarbon generating source rock is present

and, if so, whether it has generated oil or gas.

Samples were analysed by USbased Exploration Technologies,

and showed the presence of

“anomalous, above background

levels of methane, ethane, propane and butane gases”.

10

31 January 2014

COMMENT

Ukrainian ambitions

difficult to achieve

T

HE resignation of

Ukrianian prime

minister Mykola

Azarov and his

Cabinet was a victory for

anti-government protestors.

However, the two-month

street stand-off, which has

plunged Ukraine into a state

of deep uncertainty,

continues.

In tendering his

resignation, Azarov talked of

the conflict threatening “the

economic and social

development” of the country.

There is no sign yet that

the upheaval is undermining

investment plans by foreign

oil majors, but severe

political turbulence will be

factored into the negative

side of the balance sheet for

all those as yet uncommitted

to drill there.

There were hopes that

ExxonMobil would sign a

production sharing

agreement with Ukraine at

the World Economic Forum

in Davos last week.

It did not happen,

although it looks more like

last-minute hitches on the

government’s side rather

than the US supermajor

getting cold feet.

Eduard Stavytsky, the Fuel

& Energy Minister, who has

warned of dangers to power

supply from the current

conflict, insisted a deal with

ExxonMobil would be cut

next month.

He had already delayed

one signing of the deal — to

explore conventional gas

deposits in the Black Sea —

because of unrest in

December.

Ironically, a cut-price gas

deal with Russia could be

seen as a central part of this

crisis.

Just before the Gazprom

deal was signed, Ukrainian

President Viktor Yanukovich

walked away from a wider

free trade agreement with

the European Union.

Many protesters saw this

episode as an example of

Yanukovich surrendering

Ukraine’s sovereignty to its

old colonial masters in

Moscow.

Stavytsky insists Ukraine

still wants to develop its

own oil and gas reserves and

reduce its 60% dependency

on Russian gas.

Late November, Eni of

Italy and EDF of France

signed a deal that could

bring $4 billion of new

investment if they are

successful with an oil and

gas search in the western

part of the Black Sea.

Earlier that month

Chevron signed what could

be worth $10 billion of new

spending over 50 years

under a shale gas production

sharing agreement in

Ukraine.

The move follows a first

shale deal with Shell penned

at the Davos summit last

year. That is worth anything

from $10 billion to $50

billion, according to

Ukrainian ministers.

Government officials in

Kiev have talked about these

two shale deals alone

Even if it has

attracted

some big oil

company

investment,

Ukraine

remains a long

way off selfsufficiency.

providing Ukraine with 16

billion cubic metres of gas

per annum by 2020.

These agreements may

have already paid dividends

in that Moscow has cut the

Gazprom price on the

controversial 10-year supply

arrangement it signed in

2009. That had an original

price tag of $400 per

thousand cubic metres, well

above the $370 average price

being charged to much

wealthier European nations.

Even if it has attracted

some big oil company

investment, Ukraine

remains a long way off

self-sufficiency.

First production from the

Yuzivska field, where Shell

will be working, will be 2018

at the earliest.

Ukraine is said to have

Europe’s third largest shale

gas reserves at 1.2 trillion

cubic metres, according to

the US Energy Information

Administration.

But can it be extracted

easily, safely and cheaply?

Every country wants to

emulate the shale gas

revolution seen in the US,

but many want to copy its

relatively benign political

system too. Ukraine wants

both. It will not be easy, as

shown by the smoke bombs

raining down in Kiev.

It is clear that the President recognises

the role natural gas is playing in meeting

our nation’s economic and environmental

needs.

American Natural Gas Alliance chief executive Marty Durbin

Natural gas future

is burning bright

Commodity is

now firmly in

the spotlight in

the US after

endorsement

from President

Barack Obama

I

T WAS a good week for

natural gas in the US. A

second brush with the

vaunted Polar Vortex

blanketed the Northeast,

Midwest and parts of the Deep

South with a fresh layer of ice

and snow.

The Arctic blast drove

temperatures into the sub-zero

Fahrenheit category for a good

swathe of the eastern part of the

country, which in turn drove

spot natural gas prices in some

regions, such as New York, to

astronomical heights — as high

as $90 per million British

thermal units.

Even Henry Hub gas spiked

over $5 per million Btu, a

four-year high, fueled by the

bitter cold and regional supply

fears.

When temperatures start to

rise, it’s expected gas prices will

settle back down near $4 to

$4.50.

Then, on 28 January,

President Barack Obama lauded

natural gas as “the bridge fuel”

that, if safely extracted, could

power the country’s economy

with less carbon pollution

impact on the environment.

Obama promised to cut red

tape to get more gas-fired

factories built and urged

Congress to put people to work

building fueling stations that

shift more cars and trucks from

foreign oil to American natural

gas.

Of course, Obama also took a

shot at fossil fuels with his

next breath — again chiding

Congress to employ a smarter

tax policy that would roll back

about $4 billion in tax breaks

for oil and gas companies.

Overall, the US gas lobby was

giddy over Obama’s comments,

as one would imagine.

Marty Durbin, chief

executive of the American

Natural Gas Alliance, said

Obama’s comments on natural

gas were welcomed.

“It is clear from tonight’s

speech that the president

Pledges: US President Barack Obama talks to the press

after giving his State of the Union address in Washington

on 28 January

Photo: AP/SCANPIX

recognises the role natural gas

is playing in meeting our

nation’s economic and

environmental needs,” said

Durbin.

“There is great promise for

natural gas in our transport

sector as trucks, trains and

cargo vessels transition to this

clean and abundant fuel. The

1.4 million well-paying jobs

that natural gas development

will support in 2015 can help

narrow America’s income

inequality.”

However, not everyone was

thrilled that Obama has taken a

liking to natural gas, especially

the environmental concerns

lobbying against hydraulic

fracturing — the extraction

method that is chiefly

responsible for the shale gas

resources that currently fill the

nation’s storage facilities.

Green group Earthworks said

Obama’s words and actions are

at odds when it comes to

fighting climate change yet

promoting gas drilling and

fracking. “The president’s ‘all of

the above’ energy policy is

simply ‘drill baby drill’ by

another name,” said Jennifer

Krill, executive director of

Earthworks.

“There is yet hope for

President Obama’s vision of a

clean energy future, if he turns

away from the oil and gas

industry and towards truly

renewable energy.”

Natural gas has come a long

way — from annoying

byproduct to fuel of the future

— and all in the space of just a

few short decades.

The shale surge in the US has

driven the commodity into the

spotlight, and while it will take

new infrastructure to get more

natural gas vehicles on the

road, more gas-fuelled power

generation and a true domestic

market for exportation, it is

clear that the future of

domestic natural gas has never

burned brighter.

31 January 2014

11

$6 billion

THE AMOUNT that

foreign oil companies are

owed by the Egyptian

government.

Turmoil

in store

for Egypt

SIDETRACK

B

High voltage: Statoil has been caught in the middle of a politically-charged debate about a costly plan to reduce

emissions on Norwegian fields

UPSTREAM/RYTIS DAUKANTAS

Brazil’s pragmatic approach likely to pay

off, but Argentina is facing a major crisis

I

N THE 1990s, when

Argentina’s dollaranchored economy was de

rigueur, Brazilians used to

get irritated by a market

tendency to lump the two

countries together.

The wry joke about

geographically challenged

Americans naming Buenos

Aires as the Brazilian capital

seemed less amusing in 2001 to

2003, when Argentina’s

financial crisis spilled over the

border.

Today, some critics accuse

Brazilian President Dilma

Rousseff of emulating her

Argentine counterpart Cristina

Fernandez de Kirchner’s heavily

interventionist policies and

penchant for doctoring

unfavourable data.

Rousseff’s administration has

sometimes been accused of

manipulating its own data and

undermining central bank

independence.

However, the pragmatic

streak that has run through

successive Brazilian

governments remains strong.

Brazil held three licensing

rounds for the oil sector in the

space of six months and

suddenly moved forward with

big privatisations in the sorely

neglected infrastructure sector.

Most Brazilian shipyards are

taking an increasingly practical

view on local content under the

watchful eyes of authorities

that seem more interested in

ramping up production quickly,

even if this means more foreign

help.

Argentina, on the other hand,

started the year with crippling

power cuts explained by 12

years of tough price controls

and low investment in the

energy sector.

Worse was to come, and the

country was this week

teetering on the brink of a

full-blown currency crisis.

The oil sector seemed at one

point to be leading the way

toward a more orthodox

scenario, because Kirchner’s

administration has begun to

give ground over price controls.

This change of heart came

after the expropriation of YPF,

which made the government

the country’s biggest producer.

A handful of oil companies,

such as Chevron, Total and

Wintershall, are investing in

Argentina again, but the

rumblings of a major economic

crisis could overshadow such

signs of progress, undermining

YPF’s ability to raise capital.

LETTERS TO THE EDITOR

THE INTERNATIONAL OIL & GAS NEWSPAPER

Editor-in-chief: ERIK MEANS

News editor: MARK HILLIER

Chief sub-editor: ANDREW KEMP

Upstream wants to hear from its readers, and all comments are welcome.

Send to: letters@upstreamonline.com

Address: PO Box 1182, Sentrum, N-0107 Oslo, Norway.

Phone: (+47) 2200-1300

E-mail: editorial@upstreamonline.com

Marketing director: Sidsel Norvik

EDITORIAL OFFICES

• LONDON: 11th Floor, 25 Farringdon Street, London EC4A 4AB, UK. Phone: (+44) 207-029-4150

Fax: (+44) 207-029-4197. • HOUSTON: 5151 San Felipe, Suite 1440, HoustonTX, 77056, USA. Phone: (+1) 713-626-3117

Fax: (+1) 713-626-8134. • SINGAPORE: The Riverwalk #04-04, 20 Upper Circular Road, Singapore 058416.

Phone: (+65) 6557-0653 Fax: (+65) 6557-0900. • ACCRA: Phone: (+233) 224-310-103.

• BEIRUT: Phone: (+961) 1360-091. • CALGARY: Phone: (+1) 403-455-0405.• MOSCOW: Phone: (+7) 926-203-2233.

• NEW DELHI: Phone: (+91) 981-085-9920. • PERTH: Phone: (+61) 412-577-266.

• RIO DE JANEIRO: Tel: (+55) 21-2285-9217. • WELLINGTON: Phone: (+64) 4-976-9572.

(Email to our reporters: firstname.lastname@upstreamonline.com)

SUBSCRIPTIONS & ADVERTISEMENTS:

• OSLO: PO Box 1182, Sentrum, N-0107 Oslo, Norway.

Phone: (+47) 2200-1300 Fax: (+47) 2200-1310.

• STAVANGER: Phone: (+47) 5185-9150

Fax: (+47) 5185-9160.

• HOUSTON: 5151 San Felipe, Suite 1440, Houston, TX77056,

USA. Phone: (+1) 713-626-3113 Fax: (+1) 713-626-8125.

• SINGAPORE: Phone: (+65) 6557-0600

Fax:(+65) 6557-0900

Upstream is published by NHST Media Group, Christian Krohgs gate 16, PO Box 1182, Sentrum, N-0107 Oslo and printed by Mortons Print Ltd, Horncastle, Lincs UK. Stock Information produced the day before printing.

G GROUP’S decision

to declare force

majeure on its

liquefied natural

gas exports from Egypt is

evidence of a worsening gas

supply crunch exacerbated

by unsustainable domestic

energy subsidies, writes

Nassir Shirkhani.

The move effectively ends

Egypt’s status as a gas

exporter, as total production

is hardly enough to meet

local demand.

Falling government

revenues coupled with the

reluctance of foreign

companies to invest in costly

offshore exploration are a

precursor to a worsening

energy shortage.

Increasing political

turmoil and violence are

putting more pressure on the

government’s ability to pay

international oil companies,

which are owed more than

$6 billion.

The government recently

paid $1 billion in arrears to

international oil companies,

but the funds came from

handouts from sympathetic

Persian Gulf countries such

as Saudi Arabia and the

United Arab Emirates, which

cannot be expected to

remain generous forever.

Tourism, a main pillar of

the Egyptian economy, is in

serious decline, further

squeezing revenues.

International oil

companies see little

incentive to invest while

they are not being paid and

their share of gas production

is diverted to domestic users.

The loss of gas exports

seriously undermines

confidence in Egypt as a

reliable partner.

BG said it is negotiating

with Egypt to find a solution

to the loss of exports, but the

military-backed authorities

are unlikely to listen in an

election year.

The company’s LNG

facilities at the port of Idku

therefore face the real

prospect of becoming idle.

© All articles, pictures and graphics

appearing in Upstream are

protected by copyright.

Any unauthorised reproduction is

strictly prohibited.

ID statement: Upstream (ISSN# 0807-6472)

(USPS# 016-132) is published weekly by

NHST Media Group, PO Box 1182 Sentrum,

0107 Oslo, Norway.

Annual subscription rate is US$995.

Periodicals postage paid at Summit, NJ 07901

and at additional mailing offices. USA agent is

SNI, PO Box 1409, Summit NJ 07902.

POSTMASTER: Send USA address changes to

Upstream Houston, 5151 San Felipe, Suite 1440,

Houston TX 77056

This edition was printed on 29 January 2014

12

31 January 2014

POLITICS

Ukraine

pause for

Russia

RUSSIAN President Vladimir

Putin and Prime Minister

Dmitry Medvedev have agreed

to take a pause before continuing financial and energy assistance to Ukraine, writes Vladimir

Afanasiev.

Speaking at a televised meeting with Putin, Medvedev said

the Russian government will

be able to resume help once it is

familiar with Ukraine’s new

ministers and government

policy.

Putin said that Russia should

await the appointment of new

government in Ukraine before

taking any further steps. However, he has urged Medvedev to

keep up communication with

Kiev.

Earlier this week, Ukraine’s

President Viktor Yanukovich

accepted the resignation of

Prime Minister Nikolay Azarov

and the Cabinet.

Yanukovich has also offered

controlling posts in the government to leaders of Ukraine’s

opposition in an apparent bid

to calm tensions.

In December, Russia’s statecontrolled gas monopoly

Gazprom reduced the gas price

for Ukraine’s Naftohaz Ukrainy

by 34% to $269 per thousand

cubic metres from 1 January.

In exchange, Ukraine’s government committed to increase gas imports from Russia

this year.

However, according to recent

pronouncements in Kiev, the

country is planning to keep its

gas imports this year unchanged from 2013.

Technically, Russian gas

prices may rebound to more

than $400 per thousand cubic

metres as soon as 1 April, because of a Russian requirement

that Ukraine’s state-run importer Naftohaz Ukrainy and

Gazprom have to sign a special

reduced pricing addendum to

their long-term gas supply contract each quarter.

Lebedev gets

his freedom

RUSSIA’S Supreme Court has

ordered that Platon Lebedev, a

close associate of recently freed

former Yukos chief executive

Mikhail Khodorkovsky, should

be freed from a labour camp.

According to the court,

Lebedev’s sentence has been

reduced to reflect the recent

softening of punishment for so

called “economic crimes” and

this means he has now fully

served his second sentence.

Lebedev is expected to leave

Russia as the Supreme Court

has refused to cancel an earlier

court ruling for both men to

pay $500 million in back taxes.

It’s not just oil and natural gas

production that’s booming.

We’re becoming a global

leader in solar, too.

US President Barack Obama

US

Policy: US President Barack Obama delivers his State of the Union address in Washington

Obama sees gas as crucial t

US President still seeking to cut tax breaks

for Big Oil, but sees natural gas as ‘bridge fuel’

BLAKE WRIGHT

Houston

US PRESIDENT Barack Obama

touted natural gas as “the bridge

fuel that can power our economy”

while remaining vigilant about

slamming the door on Big Oil tax

breaks during his fifth State of the

Union address on 28 January.

While energy was not the spotlight issue it had been in previous

years, Obama did take a few minutes in the one-hour-plus speech

to address what he believes is the

good and bad of the nation’s current energy policy.

“The all-of-the-above energy

strategy I announced a few years

ago is working,” he told the joint

gathering of Congress. “And today,

America is closer to energy independence than we’ve been in decades.”

Obama said he would “cut red

tape” to get estimated investments totaling $100 billion for

the construction of new factories

that use natural gas, and urged

Congress to help by putting people

to work building fueling stations

that “shift more cars and trucks

from foreign oil to American natu-

ral gas”. Shying away from topics

such as hydraulic fracturing and

the Keystone XL pipeline project,

Obama did take yet another shot

at Big Oil and the tax breaks that

he has been trying to roll back for

years.

“It’s not just oil and natural gas

production that’s booming,” he

said. “We’re becoming a global

leader in solar, too. Every four

minutes, another American home

or business goes solar, every panel

pounded into place by a worker

whose job can’t be outsourced.

Let’s continue that progress

with a smarter tax policy that

stops giving $4 billion a year to

fossil fuel industries that don’t

need it, so that we can invest

more in fuels of the future that

do.”

American Petroleum Institute

chief executive Jack Gerard said

that Obama has called for increased taxes on the oil and natural gas industry to close the income gap and create jobs.

“Punishing energy companies

by raising taxes is not sound en-

Exploration and production is ‘business as usual’ in Thailand

THE increasingly violent protests

that have taken the life of an antigovernment protest leader and

injured others in Thailand have

not yet taken their toll on exploration and production operations

in the country, writes Amanda

Battersby.

National upstream company

PTTEP said all of its production

operations were continuing without disruption, while another independent with onshore assets in

Thailand said it was “business as

usual”. However, PTTEP has

moved out of its main Bangkok

headquarters that it shares the

complex with state-owned PTT

and the Ministry of Energy.

PTTEP staff are working remotely but say that they are maintaining communications via

phone and email.

Meanwhile, Prime Minister

Yingluck Shinawatra — who the

protesters want to step down —

announced that Thailand will still

go to the polls on Sunday 2 Febru-

ary. The main opposition party

has already said it will boycott

these elections, while antigovernment protesters have managed to block voters from casting

early ballots in polling stations in

the capital and further beyond.

“We have to go forward with the

election. The election commission

will organise the election under

the framework of the constitution

and try to avoid any violence,”

Deputy Prime Minister Pongthep

Thepkanchana said. Although

exploration and production operations have yet to be directly affected by the latest wave of protests that have lasted for three

months, the political uncertainty

and the fact that many government agencies are unable to access their buildings will likely at

some point hit approvals needed

from the Energy Ministry.

There had been talk of a new

licensing round but this is now on

hold because of the ongoing

political crisis.

31 January 2014

13

34%

THE REDUCTION in the

price of gas sold by Russia’s

Gazprom to Ukraine’s Naftohaz

Ukrainy in effect until 1 April.

Libyan autonomist leader hopeful

of country resuming oil exports

THERE are renewed hopes of

Libya being able to resume oil exports in the near future following

optimistic comments by a senior

leader of the autonomy movement

which has seized ports in the east,

but oil markets cautioned against

being over-optimistic.

“I see progress with the state,

the government, the General

National Congress assembly,”

Reuters quoted Abb-Rabbo alBarassi, prime minister of the

self-declared eastern region government, as saying.

“I think it won’t take longer

than two weeks to reach a deal,

God willing. Maybe even less than

that,” he said.

Libyan Prime Minister Ali

Zeidan and the autonomy movement led by federalists such as AlBarassi and former oil security

guard Al-Ibrahim Jathran have

been involved in a war of words

DEAL IN

THE WORKS

Government keen to

settle disputes

VAHE PETROSSIAN

London

since the federalists seized three

main ports late last summer accounting for 600,000 barrels per

day of exports.

Libyan production of about

1.5 million bpd early last year is

believed to have plummeted to

about 500,000 bpd, with the government warning that it may

soon run out of funds.

Zeidani has made frequent

threats of tough action against

the militia groups, including

sending in the navy to prevent

foreign tankers from loading at

rebel-controlled ports, but the

confrontation has so far been limited to a war of words.

Al-Barassi said that the government side was now using softer

language and both sides were

keen to settle the dispute.

The government has agreed to

demands for investigating corruption and jointly supervising oil

sales, but a third demand for sharing oil revenues among the three

pre-Gaddafi regions of Cyrenaica

in the east, Tripolitania in the

west and southern Fezzan was

problematic for the government

because of fears of secession.

Al-Barassi’s group is now trying

to address Zeidan’s concern over

the third demand, Reuters quoted

him as saying.

Fragile South Sudan ceasefire still holding

Photo: AFP/SCANPIX

to US economy

ergy policy, and could lead to less

energy, less government revenue,

and fewer jobs,” said Gerard. “The

oil and natural gas industry already contributes $85 million a

day to the federal government — a

larger contributor of government

revenue than any other industry

in the US.”

Obama also promised new

standards on the amount of carbon pollution that power plants

can release into the air, but offered

that more urgency is needed to

achieve and maintain a cleaner,

safer planet.

“The debate is settled,” he said.

“Climate change is a fact. And

when our children’s children look

us in the eye and ask if we did all

we could to leave them a safer,

more stable world, with new

sources of energy, I want us to be

able to say yes, we did.”

A TENTATIVE peace is holding in

South Sudan despite accusations

from the country’s army of multiple breaches by rebels of a ceasefire agreement brokered late last

week.

The administration of President

Salva Kiir and representatives of