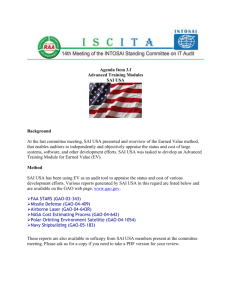

Good Practices in Supporting Supreme Audit Institutions

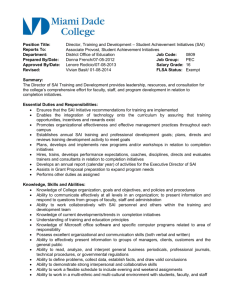

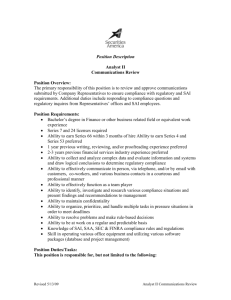

advertisement