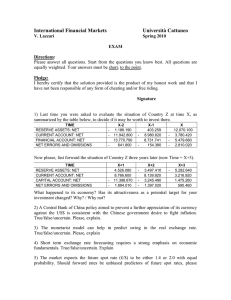

Currency Devaluation in Developing Countries.

advertisement