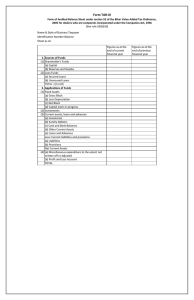

2011 - Bank ABC

advertisement