Rating Rationale for JKCL Ltd

Rating Rationale

Brickwork Ratings assigns ‘BWR BB-’ & ‘BWR A4’ ratings for the Bank Loan facilities amounting to

₹

13.00 Cr of International Book House private

Limited.

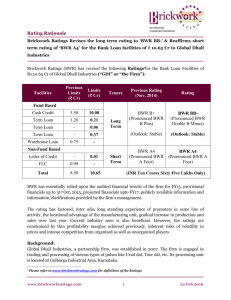

Brickwork Ratings has assigned the following Ratings 1 for Bank Loan facilities of International

Book House Private Limited (‘IBHPL’ or ‘the Company’).

Facility

(availed from

Saraswat Cooperative Bank)

Limits

( ₹ Cr)

Tenure Rating

Fund Based:

Cash credit

Term Loan

8.50

1.50

Non Fund Based:

Long

Term

BWR BB-

(Pronounced BWR Double B Minus )

(Outlook: Stable)

Bank Guarantee 2.00

BWR A4

((Pronounced BWR A Four)

(Outlook: Stable)

Letter of Credit 1.00

Short term

Total 13.00 Rupees Thirteen crores Only

BWR has principally relied upon the audited financial statements up to FY14, provisional financials for FY15 and projected financials of FY16 , publicly available information, and information/clarification provided by the Company’s management.

The rating factors in the promoter’s experience in publishing Industry, growth in revenues and improved net worth. However, the rating is constrained by competition from established players, modest scale of operations, and thin profit margins and also industry characteristics.

International Book House is an established player and is in the top 3 book distributors for higher education in the country. The company has a pan India presence with nine branches and two sales offices.

Business Overview:

International Book House Private Ltd is a Mumbai based (publisher, National distributor for all major Indian and foreign publishers and magazine subscription agent) publishing house incorporated as a private limited company in the year1941 by Mr.Bahaman Pestonji Wadia and

1 Please refer to www.brickworkratings.com

for definition of the Ratings

www.brickworkratings.com 1 22 Jul 2015

Mrs. Sophia Wadia. In 1975 it was taken over by Mr. S. Lakshminarayan, Mr. Surinder Kumar

Gupta, Mr. Santosh Kumar Rajgarhia and Mr. Jayant Shah. International Book House Private

Limited business division includes Bookpecker Direct Mail Department, Bookpecker Direct to

Home Department, Bookpecker.com, IBHbookstore.com, magazine subscription department,

Book distribution, publishing of books and periodicals and order fulfilment for international publishers.

The Company has distribution network in all major cities of india like Mumbai, Delhi,

Bangalore, Pune, Nagpur, Ahmedabad, Bhubneshwar, Chennai and Hyderabad. The company has four group companies namely Libra Intercity services Pvt ltd, I.B.D. Books and Periodicals

Pvt Ltd and Indigo Direct Marketing Pvt Ltd. The company has obtained ISO 9001:2008

Certificate .The company is also planning to open up distribution centres in Kolkata and

Coimbatore this year.

The company has tied up with Flipkart marketplace and flipkart Advantage for Mumbai,

Bangalore, Delhi, Hyderabad, Chennai, Ahmedabad and Pune and plans to do an additional business of ₹ 30 crores this financial year.Publishing majors such as S.Chand, Cengage , Arihant and Wiley have offered special terms to International Book House Private Limited for Flipkart market place.Another advantage is that payments are realized in 20-30 days.

Ownership & Management:

Mr.Sanjeev Kumar Gupta and Mr.Rohit Gupta are the two Directors of the Company.They bothe are B.com Graduates and have around 25 years of experience in the Publishing Industry. The promoters and promoters group own 100% of the company.

Financial Performance:

The net sales of the company was at ₹ 122.49 Crores as of FY 14 compared to 120.84 Crores in FY

13. Net profit has increased marginally in FY 14 at ₹ 0.52 Crores compared to ₹ 0.46 Crores in

FY13. As of 31st March 2014, the tangible Net worth of the company stood at ₹ 11.29 Crores including Quasi equity. The Company has taken Working capital facilities from Indusind Bank and working capital term loan. The gearing ratio is very high at 4.04x in FY 14. Current Ratio of the company is 1.23 x which indicates a satisfactory liquidity position of the company.

The Company has achieved for FY 15 provisional figures Net sales of ₹ 124.43 crores and net profit of ₹ 1.07 crores.

www.brickworkratings.com 2 22 Jul 2015

Rating Outlook:

The outlook is expected to remain stable over the current year. Going forward, the Company’s ability to scale up its operations by lowering Debt Equity Ratio, improve profit margins and efficiently manage working capital will remain the key rating sensitivities.

Analyst Contact Relationship Contact analyst@brickworkratings.com

425-24 bd@brickworkratings.com

Phone

1-860-425-2742

Media Contact media@brickworkratings.com

Disclaimer: Brickwork Ratings (BWR) has assigned the rating based on the information obtained from the issuer and other reliable sources, which are deemed to be accurate. BWR has taken considerable steps to avoid any data distortion; however, it does not examine the precision or completeness of the information obtained. And hence, the information in this report is presented “as is” without any express or implied warranty of any kind. BWR does not make any representation in respect to the truth or accuracy of any such information. The rating assigned by BWR should be treated as an opinion rather than a recommendation to buy, sell or hold the rated instrument and BWR shall not be liable for any losses incurred by users from any use of this report or its contents. BWR has the right to change, suspend or withdraw the ratings at any time for any reasons.

www.brickworkratings.com 3 22 Jul 2015