Rating Rationale for JKCL Ltd

advertisement

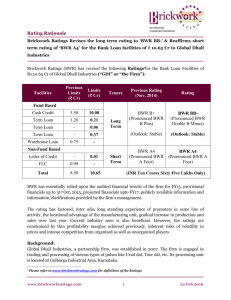

Rating Rationale Brickwork Ratings assigns ‘BWR BBB’ for the Bank Loan Facilities aggregating ₹ 195.79 Cr of Doddanavar Global Energy Private Limited. Brickwork Ratings (BWR) has assigned the following Rating1 for Bank Loan Facilities of ₹195.79 Cr (USD 31.28 Million at exchange rate of 1USD = INR 62.59) of Doddanavar Global Energy Pvt. Ltd (“DGEPL or “the company”), availed from Axis Bank Ltd., Singapore Branch: Limits (₹ Crs) Facilities Fund Based Term Loan (ECB ) 195.79 * (USD 31.28 Million) Total * Outstanding as on 195.79 31st Tenure Rating BWR BBB (Pronounced as BWR Triple B) Outlook: (Stable) INR One Ninety Five Crores and Seventy Nine Lakhs Only LongTerm March 2015. BWR has principally relied upon the audited results up to FY14, provisional financials for FY15, projections, publicly available information and information /clarifications provided by the company’s management. The Rating Inter alia factors the strength and established track record of Doddanavar group in varied business activities, successfully executing, commissioning and stabilizing the operations of 47MW capacity Wind Mills at Chikodi, Belgaum District (Karnataka), and power sales agreement with reputed private players, with good pricing and payment clauses. However, the rating is constrained by susceptibility to inherent risk in this line of business, viz., wind variability affecting the Plant Load Factor (PLF) levels. Background: Doddanavar Global Energy Private Limited(DGEPL) is a part of Doddanavar Group incorporated in 2010 at Belgaum, Karnataka. The Group companies are into various businesses like Mining, Logistics, Granite, Sugar & renewable energy. Some of the well-known entities in the group are:Doddanavar Brothers(Mine Owners), Touchstone Granites, Eco Cane Sugar Energy Limited,Shiraguppi Sugar Works Limited etc., DGEPL management also has significant shares in GEM sugars. DGEPL is engaged in the business of generation of power through wind mills, and has an installed Capacity of 47MW. The company has installed 20 machines of 1.6MW from GE India Industries Pvt. Ltd and 10 Machines of 1.5MW from Sinovel Wind Group Co. Ltd. China, which has been purchased from Doddnavar Brother Mine Owners (Wind mill Division). The Power thus generated is wheeled and banked with KPTCL (Karnataka Power Transmission Corporation) and sold to its clients like Infosys, Netapp, Welcast Seetls Limited and few others at a variable pricing model. The company has entered into for operation and maintenance with GE India Industries Pvt. Ltd. 1 Please refer to www.brickworkratings.com for definition of the Ratings www.brickworkratings.com 1 9 Oct 2015 Ownership & Management Profile: DGEPL is a closely held company, with Mr. Praveeen Doddanavar holding 40% shares, Mr. Vinod Doddanavar and Dr.Ramesh Doddanavar holding 20% each and Mr. Vrishabhanath Doddanavar and Mr. Pushpadant Doddanavar holding 10% each respectively of the total equity.DGEPL has a well-established management profile with more than 40 years of experience in grainate and sugar industries.The directors of the company are Mr.Pushpadant Doddanavar, Mr.Vrishabhanath Doddanavar and others family members.The directors are well experienced in a variety of business, including iron ore mining and exporting, granite, sugar, etc.There is a well-established second tier management with qualified and experienced professionals. Financial Performance: The company has submitted provisional financial statements for FY15. Net revenues of the company has marginally decreased from ₹ 45.75crores in FY 14 to ₹42.52crs in FY 15 because of variable wind factors. Due to accelerated depreciation, they have suffered book loss of ₹1.51Crs and ₹.5.99Crs in FY14 and 15 respectively. However, cash profit was at ₹.23.02Crs and ₹.24.40Crs in these years. DGEPL's net worth stood at ₹ 59.91crs as of March 31, 2015. The company has availed term loan facility (ECB) from Axis Bank (Singapore) in 2010, and repayment has been going on since December 2013. Its total debt : equity ratio was at 3.79x as at March 31, 2015. This ratio would come down further to 3.27x, if a part of the Unsecured Loan from promoters were to be treated as quasi-equity. The deficit in cash accruals to service debt is covered by the additional funds available by way of term of deposits.Promoters are resourceful to pump in any additional funds as and when requried.As their revenues are in INR and repayment of loan in USD, Foreign currency risk is adequately hedged. Rating-Outlook: The outlook is expected to be stable for the current year. Going forward, ability of the company to renew the PPAs with customers periodically and achieve the projected revenues, improve its profitability margins, to be able to generate adequate cash surplus would be the key rating sensitivities. Any additional capex programs or increase in borrowings will result in a rating review. Analyst Contact Relationship Contact analyst@brickworkratings.com425-24 bd@brickworkratings.com Phone Media Contact 1-860-425-2742 media@brickworkratings.com Disclaimer: Brickwork Ratings (BWR) has assigned the rating based on the information obtained from the issuer and other reliable sources, which are deemed to be accurate. BWR has taken considerable steps to avoid any data distortion; however, it does not examine the precision or completeness of the information obtained. And hence, the information in this report is presented “as is” without any express or implied warranty of any kind. BWR does not make any representation in respect to the truth or accuracy of any such information. The rating assigned by BWR should be treated as an opinion rather than a recommendation to buy, sell or hold the rated instrument and BWR shall not be liable for any losses incurred by users from any use of this report or its contents. BWR has the right to change, suspend or withdraw the ratings at any time for any reasons. www.brickworkratings.com 2 9 Oct 2015