CHEVRON CORPORATION

201 5 ANNUAL REPORT

Chevron Corporation

6001 Bollinger Canyon Road, San Ramon, CA 94583-2324 USA

www.chevron.com

© 2016 Chevron Corporation. All Rights Reserved.

10% Recycled 100% Recyclable

912-0975

2015

annual report

2015

annual report

2015 Annual Report

Publications and

other news sources

The Annual Report, distributed in

April, summarizes the company’s

financial performance in the

preceding year and provides an

overview of the company’s major

activities.

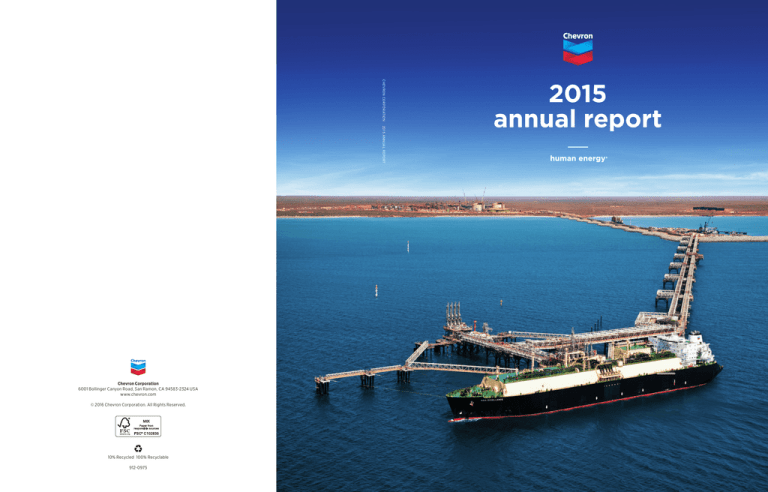

On the cover: The Chevron-operated

Asia Excellence liquefied natural gas

tanker docks at the Gorgon LNG plant

on Barrow Island, Western Australia.

The vessel delivered commissioning

cargo to cool down LNG storage and

loading facilities. This was a key piece

of the cooling process prior to the start

of LNG production. First deliveries of

Gorgon LNG will begin in early 2016.

This page: One of the largest

land-based mobile crawler cranes

in the world is used to replace the

reactor and regenerator heads in

our Richmond Refinery’s fluidized

catalytic cracker. The Richmond

Refinery produces a special clean

blend of gasoline only available in

California and fuels approximately

20 percent of the vehicles on

Northern California roads.

Chevron’s Annual Report on Form

10-K filed with the U.S. Securities

and Exchange Commission and the

Supplement to the Annual Report,

containing additional financial and

operating data, are available on the

company’s website, Chevron.com,

or copies may be requested by

writing to:

Comptroller’s Department

Chevron Corporation

6001 Bollinger Canyon Road, A3140

San Ramon, CA 94583-2324

2015

supplement to the

annual report

2015

corporate responsibility

report highlights

2015 Supplement to the Annual Report

2015 Corporate Responsibility Report

The 2015 Corporate Responsibility

Report is available in May on the

company’s website, Chevron.com/CR, or

a copy may be requested by writing to:

Policy, Government and Public Affairs

Corporate Responsibility Communications

Chevron Corporation

6001 Bollinger Canyon Road

Building G

San Ramon, CA 94583-2324

Details of the company’s political

contributions for 2015 are available

on the company’s website, Chevron.com,

or by writing to:

Policy, Government and Public Affairs

Chevron Corporation

6001 Bollinger Canyon Road

Building G

San Ramon, CA 94583-2324

Additional information about the

company’s corporate responsibility

efforts can be found on Chevron’s

website at Chevron.com/CR and

Chevron.com/CreatingProsperity.

This Annual Report contains forward-looking statements — identified by words such as “expects,” “intends,”

“projects,” etc. — that reflect management’s current estimates and beliefs, but are not guarantees of future results.

Please see “Cautionary Statement Relevant to Forward-Looking Information for the Purpose of ‘Safe Harbor’ Provisions

of the Private Securities Litigation Reform Act of 1995” on Page 9 for a discussion of some of the factors that could cause

actual results to differ materially.

PHOTOGRAPHY

Cover: Darrell Brown; Page 2: Eric Myer

PRODUCED BY Policy, Government and Public Affairs and Comptroller’s Departments, Chevron Corporation

DESIGN Design One — San Francisco, California

PRINTING ColorGraphics — Los Angeles, California

For additional information about

the company and the energy industry,

visit Chevron’s website, Chevron.com.

It includes articles, news releases,

speeches, quarterly earnings

information, the Proxy Statement and

the complete text of this Annual Report.

Hold this QR code

to your smartphone

and learn more

about Chevron.

If you do not have

a QR code reader

on your phone,

go to your app

store and search

“QR Reader.”

Chevron.com/AnnualReport/2015

2015 brought a steep and dramatic drop in the price of crude oil, one of the largest

declines our industry has experienced in years. Chevron’s response was to reduce

capital spending and aggressively cut costs while moving forward on developments

that will grow production and cash flow for the future. We are focused on improving

project execution and delivering results safely, reliably, on time and within budget.

We are optimizing our portfolio by divesting assets that no longer have a strategic

fit or cannot compete for capital with other investment alternatives. And we are

capturing the benefits of being a fully integrated energy company with Downstream

and Chemicals delivering strong results. We are optimistic about the future and

committed to being a top competitor in any economic environment.

The online version of this report contains additional information about our company,

as well as videos of our various projects. We invite you to visit our website at

Chevron.com/AnnualReport2015.

to our stockholders

Low commodity prices made 2015 a challenging year for Chevron and the entire

oil and natural gas industry, reducing earnings across the sector.

Our full-year 2015 net income was $4.6 billion,

down from $19.2 billion in 2014. Our sales

and other operating revenue were

$129.9 billion, down from $200.5 billion

in 2014. We achieved a 2.5 percent return

on capital employed versus the 10.9 percent

achieved in 2014.

In light of difficult market conditions, we

took significant actions to reduce costs and

improve net cash flow. We reduced capital

and operating expenses by $9 billion through

renegotiating contracts with vendors and

suppliers, streamlining organizations to

reduce our employee and contractor workforce, deferring and canceling projects not

economic at low prices, and selling $6 billion

in nonstrategic and other assets.

We had a number of notable accomplishments during 2015. Our Upstream business,

which is responsible for exploration and

production, increased worldwide net

oil-equivalent production by 2 percent, to

2.6 million barrels per day. We started up the

Lianzi Field, located in a unitized offshore

zone between the Republic of Congo and

Angola; Moho Nord, our deepwater development offshore the Republic of Congo;

Agbami 3, off the coast of the central

Niger Delta region; and Chuandongbei,

our natural gas field in southwest China,

which initiated production in early 2016.

In addition we ramped up Jack/St. Malo

and Tubular Bells in the U.S. Gulf of Mexico.

Also significant progress was achieved on

our major capital projects, including Gorgon,

our largest Australian liquefied natural gas

(LNG) project, and Wheatstone LNG as they

move toward start-up in 2016 and mid-2017,

respectively.

We added approximately 1 billion

investments. We focused these invest-

starting up projects under construction

barrels of net oil-equivalent proved

ments in three core areas — health,

and realizing the cash flow from them,

reserves in 2015. These additions equate

education and economic development —

lowering capital spending, reducing

to approximately 107 percent of net

to improve access to health care, develop

operating expenses, completing our

oil-equivalent production for the year.

skilled workers, and boost local and

divestment program for assets that

Significant reserves were added from

regional economies. These social invest-

have greater value to others than to

the Permian Basin in the United States

ments complement our investments in

us, and doing all this while continuing

and the Wheatstone Project in Australia.

projects and local goods and services,

to operate safely and reliably.

In our exploration program, we success-

creating jobs and generating revenues

fully drilled an appraisal well of our

for the communities where we operate.

Our company’s products provide the

Anchor discovery in the deepwater

More details are available in the 2015

energy that is critical for economic

Gulf of Mexico.

Corporate Responsibility Report.

progress. We are well positioned to

Our Downstream and Chemicals business,

I am proud to note that 2015 marked the

which is responsible for our refining,

28th consecutive year that we increased

marketing and chemical manufacturing,

the annual per-share dividend payout.

In all we do, we are guided by The

had an outstanding year. This business

Our top financial priority remains

Chevron Way. This roadmap underpins

meet growing demand in a safe and

responsible manner.

the character of our company and

“Our company’s products provide the energy

establishes the values by which we

that is critical for economic progress. We are well

deliver our results. I am confident that

positioned to meet growing demand in a safe and

responsible manner.”

our company and our employees have

what it takes to meet the challenges of

the current business environment and

achieve our vision of being the global

maintained reliable operations, benefited

maintaining and growing the dividend

energy company most admired for its

from lower feedstock costs and realized

as the pattern of earnings, cash flow

people, partnership and performance.

efficiencies gained by the reshaping of

and balance sheet strength permits.

our portfolio in recent years.

Our year-end debt ratio was a comfort-

Thank you for your confidence and

able 20.2 percent.

your investment in Chevron.

2015 was one of our best years in

overall health, environment and safety

Looking ahead, we announced a 2016

performance and our best year ever in

capital and exploratory budget of

preventing significant incidents. Our

$26.6 billion, which is 22 percent lower

Days Away From Work Rate and Motor

than our expenditures for 2015 and

Vehicle Crash Rate set new record lows,

34 percent lower than 2014. This capital

and our Total Recordable Incident Rate

budget will enable us to complete and

John S. Watson

and petroleum spill volume matched last

ramp up projects under construction,

Chairman of the Board and

year’s record lows.

fund high-return, short-cycle invest-

Chief Executive Officer

ments, preserve options for viable

February 25, 2016

We also continued our support of the

long-cycle projects, and ensure safe,

communities in which we work. This

reliable operations.

past year we advanced our strategic

programs and partnerships, with more

The focus of the enterprise in 2016 will

than $233 million in global social

remain on our five key priorities — safely

Chevron Corporation 2015 Annual Report 3

chevron financial highlights

2015

Millions of dollars, except per-share amounts

Net income attributable to Chevron Corporation

Sales and other operating revenues

Noncontrolling interests income

Interest expense (after tax)

Capital and exploratory expenditures*

Total assets at year-end

Total debt and capital lease obligations at year-end

Noncontrolling interests

Chevron Corporation stockholders’ equity at year-end

Cash provided by operating activities

Common shares outstanding at year-end (Thousands)

Per-share data

Net income attributable to Chevron Corporation — diluted

Cash dividends

Chevron Corporation stockholders’ equity

Common stock price at year-end

Total debt to total debt-plus-equity ratio

Return on average Chevron Corporation stockholders’ equity

Return on capital employed (ROCE)

$

$

$

$

$

$

$

$

$

$

4,587

129,925

123

—

33,979

266,103

38,592

1,170

152,716

19,456

1,868,646

$

$

$

$

$

$

$

$

$

$

$

$

$

$

2.45

4.28

81.73

89.96

20.2%

3.0%

2.5%

$

$

$

$

2014

% Change

19,241

200,494

69

—

40,316

266,026

27,818

1,163

155,028

31,475

1,865,481

(76.2)%

(35.2)%

78.3 %

0.0 %

(15.7)%

0.0 %

38.7 %

0.6 %

(1.5)%

(38.2)%

0.2 %

10.14

4.21

83.10

112.18

15.2%

12.7%

10.9%

(75.8)%

1.7 %

(1.7)%

(19.8)%

* Includes equity in affiliates

Net income attributable

to Chevron Corporation

Annual cash dividends

Billions of dollars

Dollars per share

30.0

5.00

Chevron year-end

common stock price

Return on capital employed

Percent

Dollars per share

150

25

4.00

120

20

3.00

90

2.00

60

10

1.00

30

5

$4.28

25.0

20.0

$89.96

15

15.0

10.0

$4.6

5.0

0.0

0.00

11

12

13

14

15

The decrease in 2015 was due to

lower earnings in upstream as a result

of lower crude oil margins and higher

depreciation expense, partially offset

by higher earnings in downstream.

4

2.5%

0

0

11

12

13

14

15

The company’s annual dividend

increased for the 28th

consecutive year.

11

12

13

14

15

The company’s stock price declined

19.8 percent in 2015.

Chevron Corporation 2015 Annual Report

Chevron Corporation 2015 Annual Report

4

11

12

13

14

15

Chevron’s return on capital

employed declined to 2.5 percent

on lower earnings and higher

capital employed.

chevron operating highlights

1

Net production of crude oil, condensate and natural gas liquids (Thousands of barrels per day)

Net production of natural gas (Millions of cubic feet per day)

Total net oil-equivalent production (Thousands of oil-equivalent barrels per day)

Refinery input (Thousands of barrels per day)

Sales of refined products (Thousands of barrels per day)

Net proved reserves of crude oil, condensate and natural gas liquids2 (Millions of barrels)

Consolidated companies

Affiliated companies

Net proved reserves of natural gas2 (Billions of cubic feet)

Consolidated companies

Affiliated companies

Net proved oil-equivalent reserves2 (Millions of barrels)

Consolidated companies

Affiliated companies

Number of employees at year-end3

1

2

3

2015

2014

1,744

5,269

2,622

1,702

2,735

1,709

5,167

2,571

1,690

2,711

2.0

2.0

2.0

0.7

0.9

4,262

2,000

4,285

1,964

(0.5)%

1.8 %

25,946

3,491

25,707

3,409

0.9 %

2.4 %

8,586

2,582

58,178

8,570

2,532

61,456

0.2 %

2.0 %

(5.3)%

% Change

%

%

%

%

%

Includes equity in affiliates, except number of employees

At the end of the year

Excludes service station personnel

Five-year cumulative total returns

(Calendar years ended December 31)

Performance graph

200

180

160

Dollars

The stock performance graph at right shows how

an initial investment of $100 in Chevron stock

would have compared with an equal investment in

the S&P 500 Index or the Competitor Peer Group.

The comparison covers a five-year period beginning

December 31, 2010, and ending December 31, 2015,

and for the peer group is weighted by market

capitalization as of the beginning of each year. It

includes the reinvestment of all dividends that an

investor would be entitled to receive and is adjusted

for stock splits. The interim measurement points show

the value of $100 invested on December 31, 2010, as

of the end of each year between 2011 and 2015.

140

120

100

80

2010

2011

2012

2013

2014

2015

Chevron

S&P 500

Peer group*

2010

2011

2012

2013

2014

2015

Chevron

100.00

120.27

126.28

150.58

140.17

117.78

S&P 500

100.00

102.12

118.44

156.83

178.30

180.81

Peer group*

100.00

112.01

116.15

137.36

127.21

108.23

*Peer Group: BP p.l.c.-ADS, ExxonMobil, Royal Dutch Shell p.l.c.-ADS, Total S.A.-ADS

Five-Year Cum. Total Returns – v1

Chevron Corporation 2015 Annual Report Chevron Corporation 2015 Annual Report

5

5

chevron at a glance

Chevron is one of the world’s leading integrated energy companies. Our success is

driven by our people and their commitment to getting results the right way — by

operating responsibly, executing with excellence, applying innovative technologies

and capturing new opportunities for profitable growth. We are involved in virtually

every facet of the energy industry. We explore for, produce and transport crude oil

and natural gas; refine, market and distribute transportation fuels and lubricants;

manufacture and sell petrochemicals and additives; generate power and produce

geothermal energy; and develop and deploy technologies that enhance business

value in every aspect of the company’s operations.

Photo: With the Jack/St. Malo development, Chevron

continues to advance the boundaries of deepwater

exploration and production. The Jack and St. Malo fields

are among the largest in the U.S. Gulf of Mexico and are

expected to have a producing life of more than 30 years.

In 2015 Chevron ramped up production from Jack/St. Malo

and announced two other important discoveries in the

region: Anchor and Sicily.

6

Chevron Corporation 2015 Annual Report

Upstream

Strategy:

Grow profitably in core

areas and build new legacy

positions.

Upstream explores for and produces crude oil and natural gas. At the end of 2015 worldwide

net oil-equivalent proved reserves for consolidated and affiliated companies were 11.2 billion

barrels. During 2015 net oil-equivalent production averaged 2.6 million barrels per day.

Top producing areas include the United States, Kazakhstan, Nigeria, Thailand, Indonesia,

Bangladesh, Angola, Australia, Canada and Venezuela. Major conventional exploration

areas include the deepwater U.S. Gulf of Mexico, offshore northwestern Australia and the

deepwater regions of western Africa. Key exploration areas for unconventional shale and

tight resources are the United States, Canada and Argentina.

Downstream

and Chemicals

Strategy:

Deliver competitive returns

and grow earnings across

the value chain.

Downstream and Chemicals includes refining, fuels and lubricants marketing, and petrochemicals and additives manufacturing and marketing. In 2015 we processed 1.7 million barrels

of crude oil per day and averaged 2.7 million barrels per day of refined product sales worldwide. Our most significant areas of refinery operations are the west coast of North America,

the U.S. Gulf Coast, Singapore, Thailand, South Korea and South Africa. We hold interests in

11 refineries, are a leader in the manufacturing and sale of premium base oils, and market

transportation fuels and lubricants under the Chevron, Texaco and Caltex brands. Products

are sold through a network of 13,946 retail stations, including those of affiliated companies.

Our chemicals business includes Chevron Phillips Chemical Company LLC, a 50 percent-owned

affiliate that is one of the world’s leading manufacturers of commodity petrochemicals, and

Chevron Oronite Company LLC, which develops, manufactures and markets quality additives

that improve the performance of fuels and lubricants.

Midstream and

Development

Strategy:

Apply commercial and

functional excellence to enable

the success of Upstream and

Downstream and Chemicals.

Midstream and Development provides services that link Upstream and Downstream and

Chemicals to the market. This includes commercializing our equity gas resource base; maximizing the value of the company’s equity natural gas, crude oil, natural gas liquids and refined

products; and transporting products worldwide. Midstream and Development has global

operations with major centers in Houston; London; Singapore; and San Ramon, California.

Technology

Strategy:

Differentiate performance

through technology.

Our three technology companies — Chevron Energy Technology, Chevron Technology

Ventures and Chevron Information Technology — are focused on enhancing business value

in all aspects of our operations. We have established technology centers in Australia, the

United Kingdom and the United States. Together they provide strategic research, technology

development, technical and computing infrastructure services, and data protection to our

global businesses.

Renewable

Energy and

Energy

Efficiency

Strategy:

Invest in profitable

renewable energy and

energy efficiency solutions.

We are one of the world’s leading producers of geothermal energy, supplying abundant,

reliable energy to millions of people in Indonesia and the Philippines. We also are investing

in energy efficiency technologies to improve the performance of our operations worldwide.

Operational

Excellence

We define operational excellence as the systematic management of process safety, personal

safety and health, the environment, operational reliability, and energy efficiency. We are

committed to attaining superior performance in operational excellence and believe our

safety goal of zero incidents is attainable.

Chevron Corporation 2015 Annual Report 7

glossary of energy and financial terms

energy terms

Additives Specialty chemicals incorporated into fuels

and lubricants that enhance the performance of the

finished products.

Barrels of oil-equivalent (BOE) A unit of measure to

quantify crude oil, natural gas liquids and natural gas

amounts using the same basis. Natural gas volumes

are converted to barrels on the basis of energy content.

See oil-equivalent gas and production.

Condensate Hydrocarbons that are in a gaseous state

at reservoir conditions but condense into liquid as they

travel up the wellbore and reach surface conditions.

Development Drilling, construction and related

activities following discovery that are necessary to

begin production and transportation of crude oil and

natural gas.

Enhanced recovery Techniques used to increase or

prolong production from crude oil and natural gas

reservoirs.

Entitlement effects The impact on Chevron’s share of

net production and net proved reserves due to changes

in crude oil and natural gas prices, and spending levels,

between periods. Under production-sharing contracts

(PSCs) and variable-royalty provisions of certain

agreements, price and spend variability can increase or

decrease royalty burdens and/or volumes attributable

to the company. For example, at higher prices, fewer

volumes are required for Chevron to recover its costs

under certain PSCs. Also under certain PSCs, Chevron’s

share of future profit oil and/or gas is reduced once

specified contractual thresholds are met, such as a

cumulative return on investment.

Exploration Searching for crude oil and/or natural

gas by utilizing geologic and topographical studies,

geophysical and seismic surveys, and drilling of wells.

Gas-to-liquids (GTL) A process that converts natural

gas into high-quality liquid transportation fuels and

other products.

Greenhouse gases Gases that trap heat in Earth’s

atmosphere (e.g., water vapor, ozone, carbon dioxide,

methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons and sulfur hexafluoride).

Integrated energy company A company engaged in

all aspects of the energy industry, including exploring

for and producing crude oil and natural gas; refining,

marketing and transporting crude oil, natural gas and

refined products; manufacturing and distributing

petrochemicals; and generating power.

Liquefied natural gas (LNG) Natural gas that is liquefied

under extremely cold temperatures to facilitate storage

or transportation in specially designed vessels.

Natural gas liquids (NGLs) Separated from natural

gas, these include ethane, propane, butane and natural

gasoline.

Oil-equivalent gas (OEG) The volume of natural gas

needed to generate the equivalent amount of heat as a

barrel of crude oil. Approximately 6,000 cubic feet of

natural gas is equivalent to one barrel of crude oil.

Oil sands Naturally occurring mixture of bitumen

(a heavy, viscous form of crude oil), water, sand and

clay. Using hydroprocessing technology, bitumen can

be refined to yield synthetic oil.

8

Chevron Corporation 2015 Annual Report

Petrochemicals Compounds derived from petroleum.

These include aromatics, which are used to make

plastics, adhesives, synthetic fibers and household

detergents; and olefins, which are used to make

packaging, plastic pipes, tires, batteries, household

detergents and synthetic motor oils.

Production Total production refers to all the crude oil

(including synthetic oil), NGLs and natural gas produced

from a property. Net production is the company’s share

of total production after deducting both royalties paid

to landowners and a government’s agreed-upon share

of production under a PSC. Liquids production refers to

crude oil, condensate, NGLs and synthetic oil volumes.

Oil-equivalent production is the sum of the barrels of

liquids and the oil-equivalent barrels of natural gas

produced. See barrels of oil-equivalent and

oil-equivalent gas.

Production-sharing contract (PSC) An agreement

between a government and a contractor (generally

an oil and gas company) whereby production is shared

between the parties in a prearranged manner. The

contractor typically incurs all exploration, development

and production costs, which are subsequently recoverable out of an agreed-upon share of any future PSC

production, referred to as cost recovery oil and/or gas.

Any remaining production, referred to as profit oil and/

or gas, is shared between the parties on an agreed-upon

basis as stipulated in the PSC. The government also may

retain a share of PSC production as a royalty payment,

and the contractor typically owes income tax on its

portion of the profit oil and/or gas. The contractor’s

share of PSC oil and/or gas production and reserves

varies over time as it is dependent on prices, costs and

specific PSC terms.

Renewables Energy resources that are not depleted

when consumed or converted into other forms of

energy (e.g., solar, geothermal, ocean and tide, wind,

hydroelectric power, biofuels and hydrogen).

Reserves Crude oil and natural gas contained in

underground rock formations called reservoirs and

saleable hydrocarbons extracted from oil sands, shale,

coalbeds and other nonrenewable natural resources

that are intended to be upgraded into synthetic oil or

gas. Net proved reserves are the estimated quantities

that geoscience and engineering data demonstrate with

reasonable certainty to be economically producible in

the future from known reservoirs under existing economic conditions, operating methods and government

regulations, and exclude royalties and interests owned

by others. Estimates change as additional information

becomes available. Oil-equivalent reserves are the

sum of the liquids reserves and the oil-equivalent gas

reserves. See barrels of oil-equivalent and oil-equivalent

gas. The company discloses only net proved reserves

in its filings with the U.S. Securities and Exchange

Commission. Investors should refer to proved reserves

disclosures in Chevron’s Annual Report on Form 10-K

for the year ended December 31, 2015.

Resources Estimated quantities of oil and gas resources

are recorded under Chevron’s 6P system, which is modeled after the Society of Petroleum Engineers’ Petroleum

Resource Management System, and include quantities

classified as proved, probable and possible reserves,

plus those that remain contingent on commerciality.

Unrisked resources, unrisked resource base and similar

terms represent the arithmetic sum of the amounts

recorded under each of these classifications. Recoverable

resources, potentially recoverable volumes and other

similar terms represent estimated remaining quantities that are expected to be ultimately recoverable and

produced in the future, adjusted to reflect the relative

uncertainty represented by the various classifications.

These estimates may change significantly as development work provides additional information. At times,

original oil in place and similar terms are used to describe

total hydrocarbons contained in a reservoir without

regard to the likelihood of their being produced. All of

these measures are considered by management in

making capital investment and operating decisions

and may provide some indication to stockholders of the

resource potential of oil and gas properties in which the

company has an interest.

Shale gas Natural gas produced from shale rock

formations where the gas was sourced from within the

shale itself. Shale is very fine-grained rock, characterized

by low porosity and extremely low permeability.

Production of shale gas normally requires formation

stimulation such as the use of hydraulic fracturing

(pumping a fluid-sand mixture into the formation under

high pressure) to help produce the gas.

Synthetic oil A marketable and transportable hydrocarbon liquid, resembling crude oil, that is produced by

upgrading highly viscous or solid hydrocarbons, such as

extra-heavy crude oil or oil sands.

Tight oil Liquid hydrocarbons produced from shale (also

referred to as shale oil) and other rock formations with

extremely low permeability. As with shale gas, production from tight oil reservoirs normally requires formation

stimulation such as hydraulic fracturing.

financial terms

Cash flow from operating activities Cash generated

from the company’s businesses; an indicator of a

company’s ability to fund capital programs and stockholder distributions. Excludes cash flows related to the

company’s financing and investing activities.

Debt ratio Total debt, including capital lease obligations,

divided by total debt plus Chevron Corporation stockholders’ equity.

Earnings Net income attributable to Chevron

Corporation as presented on the Consolidated

Statement of Income.

Margin The difference between the cost of purchasing,

producing and/or marketing a product and its sales

price.

Return on capital employed (ROCE) Ratio calculated

by dividing earnings (adjusted for after-tax interest

expense and noncontrolling interests) by the average

of total debt, noncontrolling interests and Chevron

Corporation stockholders’ equity for the year.

Return on stockholders’ equity Ratio calculated

by dividing earnings by average Chevron Corporation

stockholders’ equity. Average Chevron Corporation

stockholders’ equity is computed by averaging the sum

of the beginning-of-year and end-of-year balances.

Total stockholder return (TSR) The return to stockholders as measured by stock price appreciation and

reinvested dividends for a period of time.

Financial Table of Contents

10

36

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Notes to the Consolidated Financial Statements

Key Financial Results 10

Earnings by Major Operating Area 10

Business Environment and Outlook 10

Operating Developments 13

Results of Operations 14

Consolidated Statement of Income 17

Selected Operating Data 19

Liquidity and Capital Resources 20

Financial Ratios 22

Off-Balance-Sheet Arrangements, Contractual Obligations,

Guarantees and Other Contingencies 22

Financial and Derivative Instrument Market Risk 23

Transactions With Related Parties 23

Litigation and Other Contingencies 24

Environmental Matters 24

Critical Accounting Estimates and Assumptions 25

New Accounting Standards 28

Quarterly Results and Stock Market Data 28

29

Consolidated Financial Statements

Reports of Management 29

Report of Independent Registered Public Accounting Firm 30

Consolidated Statement of Income 31

Consolidated Statement of Comprehensive Income 32

Note 1

Note 2

Note 3

Note 4

Note 5

Note 6

Note 7

Note 8

Note 9

Note 10

Note 11

Note 12

Note 13

Note 14

Note 15

Note 16

Summary of Significant Accounting Policies 36

Changes in Accumulated Other Comprehensive Losses 38

Noncontrolling Interests 38

Information Relating to the Consolidated

Statement of Cash Flows 39

New Accounting Standards 40

Lease Commitments 40

Summarized Financial Data – Chevron U.S.A. Inc. 41

Summarized Financial Data – Tengizchevroil LLP 42

Fair Value Measurements 42

Financial and Derivative Instruments 43

Assets Held for Sale 44

Equity 45

Earnings Per Share 45

Operating Segments and Geographic Data 45

Investments and Advances 48

Properties, Plant and Equipment 49

Note 17

Note 18

Note 19

Note 20

Note 21

Note 22

Note 23

Note 24

Note 25

Note 26

Note 27

Litigation 50

Taxes 53

Short-Term Debt 56

Long-Term Debt 57

Accounting for Suspended Exploratory Wells 57

Stock Options and Other Share-Based Compensation 58

Employee Benefit Plans 59

Other Contingencies and Commitments 65

Asset Retirement Obligations 67

Restructuring and Reorganization Costs 67

Other Financial Information 67

Consolidated Balance Sheet 33

Five-Year Financial Summary 68

Consolidated Statement of Cash Flows 34

Five-Year Operating Summary 69

Consolidated Statement of Equity 35

Supplemental Information on Oil and Gas Producing Activities 70

CAUTIONARY STATEMENT RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE

HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This Annual Report of Chevron Corporation contains forward-looking statements relating to Chevron’s operations that are based on management’s current

expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,”

“expects,” “intends,” “plans,” “targets,” “forecasts,” “projects,” “believes,” “seeks,” “schedules,” “estimates,” “may,” “could,” “should,” “budgets,”

“outlook,” “on schedule,” “on track” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees

of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to

predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader

should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Unless legally required, Chevron

undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and

natural gas prices; changing refining, marketing and chemicals margins; the company’s ability to realize anticipated cost savings and expenditure

reductions; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy

sources or product substitutes; technological developments; the results of operations and financial condition of the company’s suppliers, vendors, partners

and equity affiliates, particularly during extended periods of low prices for crude oil and natural gas; the inability or failure of the company’s joint-venture

partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future

crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption

or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats and terrorist acts, crude oil

production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries, or other natural or human causes beyond

its control; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and

international economic and political conditions; the potential liability for remedial actions or assessments under existing or future environmental

regulations and litigation; significant operational, investment or product changes required by existing or future environmental statutes and regulations,

including international agreements and national or regional legislation and regulatory measures to limit or reduce greenhouse gas emissions; the potential

liability resulting from other pending or future litigation; the company’s future acquisition or disposition of assets and gains and losses from asset

dispositions or impairments; government-mandated sales, divestitures, recapitalizations, industry-specific taxes, changes in fiscal terms or restrictions on

scope of company operations; foreign currency movements compared with the U.S. dollar; material reductions in corporate liquidity and access to debt

markets; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company’s ability

to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors”

on pages 21 through 23 of the company’s Annual Report on Form 10-K. Other unpredictable or unknown factors not discussed in this report could also

have material adverse effects on forward-looking statements.

Chevron Corporation 2015 Annual Report

9

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Key Financial Results

Millions of dollars, except per-share amounts

Net Income Attributable to Chevron Corporation

Per Share Amounts:

Net Income Attributable to Chevron Corporation

– Basic

– Diluted

Dividends

Sales and Other Operating Revenues

Return on:

Capital Employed

Stockholders’ Equity

2014

2015

4,587

$

19,241

$

2.46

$

2.45

$

4.28

$ 129,925

$

$

$

$

10.21

10.14

4.21

200,494

$

2.5%

3.0%

2013

$

21,423

$

11.18

$

11.09

$

3.90

$ 220,156

10.9%

12.7%

13.5%

15.0%

2014

2013

Earnings by Major Operating Area

Millions of dollars

Upstream

United States

International

2015

$

(4,055)

2,094

$

3,327

13,566

$

4,044

16,765

Total Upstream

(1,961)

16,893

20,809

Downstream

United States

International

3,182

4,419

2,637

1,699

787

1,450

Total Downstream

$

1

$

2

Includes foreign currency effects:

Income net of tax, also referred to as “earnings” in the discussions that follow.

4,336

7,601

All Other

Net Income Attributable to Chevron Corporation1,2

(1,053)

4,587

769

2,237

$

(1,988)

19,241 $

$

487

$

(1,623)

21,423

474

Refer to the “Results of Operations” section beginning on page 14 for a discussion of financial results by major operating

area for the three years ended December 31, 2015.

Business Environment and Outlook

Chevron is a global energy company with substantial business activities in the following countries: Angola, Argentina,

Australia, Azerbaijan, Bangladesh, Brazil, Canada, China, Colombia, Democratic Republic of the Congo, Denmark, Indonesia,

Kazakhstan, Myanmar, Nigeria, the Partitioned Zone between Saudi Arabia and Kuwait, the Philippines, Republic of Congo,

Singapore, South Africa, South Korea, Thailand, Trinidad and Tobago, the United Kingdom, the United States, and Venezuela.

Earnings of the company depend mostly on the profitability of its upstream business segment. The biggest factor affecting

the results of operations for the upstream segment is the price of crude oil. The price of crude oil has fallen significantly

since mid-year 2014, reflecting persistently high global crude oil inventories and production. The downturn in the price of

crude oil has impacted, and, depending upon its duration, will continue to significantly impact the company’s results of

operations, cash flows, leverage, capital and exploratory investment program and production outlook. The company is

responding with reductions in operating expenses, including employee reductions, reductions in capital and exploratory

expenditures in 2016 and future periods, and increased asset sales. The company anticipates that crude oil prices will increase

in the future, as continued growth in demand and a slowing in supply growth should bring global markets into balance;

however, the timing of any such increase is unknown. In the company’s downstream business, crude oil is the largest cost

component of refined products.

Refer to the “Cautionary Statement Relevant to Forward-Looking Information” on page 9 and to “Risk Factors” in Part I,

Item 1A, on pages 21 through 23 of the company’s Annual Report on Form 10-K for a discussion of some of the inherent

risks that could materially impact the company’s results of operations or financial condition.

The company continually evaluates opportunities to dispose of assets that are not expected to provide sufficient long-term value

or to acquire assets or operations complementary to its asset base to help augment the company’s financial performance and

growth. Refer to the “Results of Operations” section beginning on page 14 for discussions of net gains on asset sales during

2015. Asset dispositions and restructurings may also occur in future periods and could result in significant gains or losses.

The company closely monitors developments in the financial and credit markets, the level of worldwide economic activity,

and the implications for the company of movements in prices for crude oil and natural gas. Management takes these

developments into account in the conduct of daily operations and for business planning.

10

Chevron Corporation 2015 Annual Report

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Comments related to earnings trends for the company’s major business areas are as follows:

Upstream Earnings for the upstream segment are closely aligned with industry prices for crude oil and natural gas. Crude oil

and natural gas prices are subject to external factors over which the company has no control, including product demand

connected with global economic conditions, industry inventory levels, technology advancements, production quotas or other

actions imposed by the Organization of Petroleum Exporting Countries (OPEC), actions of regulators, weather-related

damage and disruptions, competing fuel prices, and regional supply interruptions or fears thereof that may be caused by

military conflicts, civil unrest or political uncertainty. Any of these factors could also inhibit the company’s production

capacity in an affected region. The company closely monitors developments in the countries in which it operates and holds

investments, and seeks to manage risks in operating its facilities and businesses. The longer-term trend in earnings for the

upstream segment is also a function of other factors, including the company’s ability to find or acquire and efficiently

produce crude oil and natural gas, changes in fiscal terms of contracts, and changes in tax laws and regulations.

The company continues to actively manage its schedule of work, contracting, procurement and supply-chain activities to

effectively manage costs. However, price levels for capital and exploratory costs and operating expenses associated with the

production of crude oil and natural gas can be subject to external factors beyond the company’s control including, among

other things, the general level of inflation, commodity prices and prices charged by the industry’s material and service

providers, which can be affected by the volatility of the industry’s own supply-and-demand conditions for such materials and

services. In recent years, Chevron and the oil and gas industry generally experienced an increase in certain costs that

exceeded the general trend of inflation in many areas of the world. As a result of the decline in prices of crude oil and other

commodities since mid-2014, these cost pressures have softened. Capital and exploratory expenditures and operating

expenses can also be affected by damage to production facilities caused by severe weather or civil unrest, delays in

construction, or other factors.

WTI Crude Oil, Brent Crude Oil and Henry Hub Natural Gas Spot Prices - Quarterly Average

Brent

WTI

HH

WTI/Brent

$/bbl

120

HH

$/mcf

20

90

15

60

10

30

5

0

0

1Q

2Q

3Q

2013

4Q

1Q

2Q

3Q

2014

4Q

1Q

2Q

3Q

4Q

2015

The chart above shows the trend in benchmark prices for Brent crude oil, West Texas Intermediate (WTI) crude oil and U.S.

Henry Hub natural gas. The Brent price averaged $52 per barrel for the full-year 2015, compared to $99 in 2014. As of midFebruary 2016, the Brent price was $31 per barrel. The majority of the company’s equity crude production is priced based on

the Brent benchmark. Prices firmed in the first half of 2015, but declined in the remainder of the year amid persistently high

global crude oil inventories and production.

The WTI price averaged $49 per barrel for the full-year 2015, compared to $93 in 2014. As of mid-February 2016, the WTI

price was $29 per barrel. WTI traded at a discount to Brent throughout 2015 due to high inventories and excess crude supply

in the U.S. market. With the lifting of the U.S. crude oil export ban in December 2015, the spread between WTI and Brent

narrowed substantially and WTI traded around parity into February 2016.

A differential in crude oil prices exists between high-quality (high-gravity, low-sulfur) crudes and those of lower quality (lowgravity, high-sulfur). The amount of the differential in any period is associated with the relative supply/demand balances for each

crude type, which are functions of the capacity of refineries that are able to process each as feedstock into high-value light products

(motor gasoline, jet fuel, aviation gasoline and diesel fuel). In second-half 2015, the differential expanded in North America as

Canadian heavy crude production recovered from earlier planned and unplanned outages, while light sweet crude prices

in the U.S. were supported by reductions in the rig count and slowing domestic production growth. Outside of North

Chevron Corporation 2015 Annual Report

11

Management’s Discussion and Analysis of Financial Condition and Results of Operations

America, high refinery runs in Europe and Asia supported pricing for light sweet crude from the Atlantic Basin, while

increased output from Iraq and other Middle East producers pressured values of heavier, more sour crudes.

Chevron produces or shares in the production of heavy crude oil in California, Indonesia, the Partitioned Zone between Saudi

Arabia and Kuwait, Venezuela and in certain fields in Angola, China and the United Kingdom sector of the North Sea. (See

page 19 for the company’s average U.S. and international crude oil realizations.)

In contrast to price movements in the global market for crude oil, price changes for natural gas in many regional markets are

more closely aligned with supply-and-demand conditions in those markets. Fluctuations in the price of natural gas in the

United States are closely associated with customer demand relative to the volumes produced and stored in North America. In

the United States, prices at Henry Hub averaged $2.62 per thousand cubic feet (MCF) during 2015, compared with $4.28

during 2014. As of mid-February 2016, the Henry Hub spot price was $1.92 per MCF.

Outside the United States, price changes for natural gas depend on a wide range of supply, demand and regulatory

circumstances. Chevron sells natural gas into the domestic pipeline market in most locations. In some locations, Chevron is

investing in long-term projects to install infrastructure to produce and liquefy natural gas for transport by tanker to other

markets. The company’s long-term contract prices for liquefied natural gas (LNG) are typically linked to crude oil prices.

Approximately 85 percent of the equity LNG offtake from the operated Australian LNG projects is targeted to be sold into

binding long-term contracts, with the remainder to be sold in the Asian spot LNG market. The Asian spot market reflects the

supply and demand for LNG in the Pacific Basin and is not directly linked to crude oil prices. International natural gas

realizations averaged $4.53 per MCF during 2015, compared with $5.78 per MCF during 2014. (See page 19 for the

company’s average natural gas realizations for the U.S. and international regions.)

Net Liquids Production*

Net Natural Gas Production*

Net Proved Reserves

Thousands of barrels per day

Millions of cubic feet per day

Billions of BOE

2000

5500

12.5

5,269

Net Proved Reserves

Liquids vs. Natural Gas

Billions of BOE

12.5

11.2

11.2

1,744

1600

4400

10.0

10.0

1200

3300

7.5

7.5

800

2200

5.0

5.0

400

1100

2.5

2.5

11

12

13

14

11

15

United States

International

* Includes equity in affiliates.

0.0

0.0

0

0

12

13

14

15

United States

International

* Includes equity in affiliates.

11

12

13

United States

Other Americas

Africa

Asia

Australia

Europe

Affiliates

14

15

11

12

13

14

15

Natural Gas

Liquids

The company’s worldwide net oil-equivalent production in 2015 averaged 2.622 million barrels per day. About one-fifth of

the company’s net oil-equivalent production in 2015 occurred in the OPEC-member countries of Angola, Nigeria, Venezuela

and the Partitioned Zone between Saudi Arabia and Kuwait. OPEC quotas had no effect on the company’s net crude oil

production in 2015 or 2014. At their December 2015 meeting, members of OPEC did not agree on a target production level,

and in January 2016 western sanctions on Iran were lifted. As such, OPEC output is now considered likely to increase from

recent levels of approximately 31.5 million barrels per day as Iranian production and exports recover.

The company estimates that net oil-equivalent production in 2016 will be flat to 4 percent growth compared to 2015. This

estimate is subject to many factors and uncertainties, including the duration of the low price environment that began in secondhalf 2014; quotas or other actions that may be imposed by OPEC; price effects on entitlement volumes; changes in fiscal terms or

restrictions on the scope of company operations; delays in construction, start-up or ramp-up of projects; fluctuations in demand

for natural gas in various markets; weather conditions that may shut in production; civil unrest; changing geopolitics; delays in

completion of maintenance turnarounds; greater-than-expected declines in production from mature fields; or other disruptions

12

Chevron Corporation 2015 Annual Report

Management’s Discussion and Analysis of Financial Condition and Results of Operations

to operations. The outlook for future production levels is also affected by the size and number of economic investment

opportunities and, for new, large-scale projects, the time lag between initial exploration and the beginning of production.

Investments in upstream projects generally begin well in advance of the start of the associated crude oil and natural gas

production. A significant majority of Chevron’s upstream investment is made outside the United States.

In the Partitioned Zone between Saudi Arabia and Kuwait, production was shut-in beginning in May 2015 as a result of

difficulties in securing work and equipment permits. Net oil-equivalent production in the Partitioned Zone in 2014 was

81,000 barrels per day. During 2015, net oil-equivalent production averaged 28,000 barrels per day. As of early 2016,

production remains shut-in and the exact timing of a production restart is uncertain and dependent on dispute resolution

between Saudi Arabia and Kuwait. The financial effects from the loss of production in 2015 were not significant and are not

expected to be significant in 2016.

Net proved reserves for consolidated companies and affiliated companies totaled 11.2 billion barrels of oil-equivalent at

year-end 2015, an increase of 1 percent from year-end 2014. The reserve replacement ratio in 2015 was 107 percent. Refer to

Table V beginning on page 74 for a tabulation of the company’s proved net oil and gas reserves by geographic area, at the

beginning of 2013 and each year-end from 2013 through 2015, and an accompanying discussion of major changes to proved

reserves by geographic area for the three-year period ending December 31, 2015.

Refer to the “Results of Operations” section on pages 14 through 16 for additional discussion of the company’s upstream

business.

Downstream Earnings for the downstream segment are closely tied to margins on the refining, manufacturing and marketing

of products that include gasoline, diesel, jet fuel, lubricants, fuel oil, fuel and lubricant additives, and petrochemicals.

Industry margins are sometimes volatile and can be affected by the global and regional supply-and-demand balance for

refined products and petrochemicals, and by changes in the price of crude oil, other refinery and petrochemical feedstocks,

and natural gas. Industry margins can also be influenced by inventory levels, geopolitical events, costs of materials and

services, refinery or chemical plant capacity utilization, maintenance programs, and disruptions at refineries or chemical

plants resulting from unplanned outages due to severe weather, fires or other operational events.

Other factors affecting profitability for downstream operations include the reliability and efficiency of the company’s

refining, marketing and petrochemical assets, the effectiveness of its crude oil and product supply functions, and the

volatility of tanker-charter rates for the company’s shipping operations, which are driven by the industry’s demand for crude

oil and product tankers. Other factors beyond the company’s control include the general level of inflation and energy costs to

operate the company’s refining, marketing and petrochemical assets.

The company’s most significant marketing areas are the West Coast of North America, the U.S. Gulf Coast, Asia and

southern Africa. Chevron operates or has significant ownership interests in refineries in each of these areas.

Refer to the “Results of Operations” section on pages 14 through 16 for additional discussion of the company’s downstream

operations.

All Other consists of worldwide cash management and debt financing activities, corporate administrative functions,

insurance operations, real estate activities and technology companies.

Operating Developments

Key operating developments and other events during 2015 and early 2016 included the following:

Upstream

Angola-Republic of Congo Joint Development Area Achieved first production from the Lianzi Project.

Australia Progressed LNG Train 1 commissioning and start-up activities for the Gorgon Project, with first cargo lifting expected

in March 2016. All Train 2 modules are installed, and all remaining Train 3 modules were delivered as of January 2016.

Progressed construction of the Wheatstone Project. Major milestones reached include the installation of the offshore platform

and topsides, and all of the subsea pipelines and structures, along with the delivery of all LNG Train 1 and common modules.

Announced a natural gas discovery, Isosceles, in the Carnarvon Basin in 50 percent-owned Block WA-392-P.

Bangladesh Achieved first liquids from the Bibiyana Expansion Liquid Recovery Unit.

China Achieved first production from the Chuandongbei Project in early 2016.

Chevron Corporation 2015 Annual Report

13

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Republic of Congo Announced start of production from the first phase of the Moho Nord Project.

United States Announced a successful appraisal well at the Anchor prospect in the deepwater Gulf of Mexico.

Downstream

Australia Completed the sale of the company’s 50 percent interest in Caltex Australia Limited.

New Zealand Completed the sale of the company’s interest in The New Zealand Refining Company Limited and reached

agreement to sell the company’s marketing operations.

Other

Common Stock Dividends The 2015 annual dividend was $4.28 per share, making 2015 the 28th consecutive year that the

company increased its annual dividend payout.

Results of Operations

The following section presents the results of operations and variances on an after-tax basis for the company’s business

segments – Upstream and Downstream – as well as for “All Other.” Earnings are also presented for the U.S. and international

geographic areas of the Upstream and Downstream business segments. Refer to Note 14, beginning on page 45, for a

discussion of the company’s “reportable segments.” This section should also be read in conjunction with the discussion in

“Business Environment and Outlook” on pages 10 through 13.

Worldwide Upstream Earnings

Exploration Expenses

Worldwide Downstream

Earnings*

Worldwide Gasoline & Other

Refined Product Sales

Billions of dollars

Millions of dollars (before-tax)

Billions of dollars

Thousands of barrels per day

28.0

4000

8.0

3600

$7.6

$3,340

21.0

3000

6.0

2700

4.0

1800

2.0

900

2,735

14.0

2000

7.0

$(2.0)

0.0

1000

-7.0

0.0

0

11

12

13

United States

International

14

11

15

12

United States

International

13

14

15

0

11

12

13

14

11

15

United States

International

12

13

14

15

Gasoline

Jet Fuel

Gas Oils

Residual Fuel Oil

Other

*Includes equity in affiliates.

U.S. Upstream

Millions of dollars

Earnings

2014

2015

$

(4,055)

$

3,327

2013

$

4,044

U.S. upstream operations incurred a loss of $4.06 billion in 2015 compared to earnings of $3.33 billion from 2014. The

decrease was primarily due to lower crude oil and natural gas realizations of $4.86 billion and $570 million, respectively,

higher depreciation expenses of $2.19 billion and higher exploration expenses of $650 million. The increase in depreciation

and exploration expenses was primarily due to impairments and project cancellations. Lower gains on asset sales also

contributed to the decrease with current year gains of $110 million compared with $700 million in 2014. Partially offsetting

these effects were higher crude oil production of $900 million and lower operating expenses of $450 million.

U.S. upstream earnings of $3.33 billion in 2014 decreased $717 million from 2013, primarily due to lower crude oil prices of

$950 million. Higher depreciation expenses of $440 million and higher operating expenses of $210 million also contributed

to the decline. Partially offsetting the decrease were gains on asset sales of $700 million in 2014 compared with $60 million

in 2013, higher natural gas realizations of $150 million and higher crude oil production of $100 million.

14

Chevron Corporation 2015 Annual Report

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The company’s average realization for U.S. crude oil and natural gas liquids in 2015 was $42.70 per barrel, compared with

$84.13 in 2014 and $93.46 in 2013. The average natural gas realization was $1.92 per thousand cubic feet in 2015, compared

with $3.90 in 2014 and $3.37 in 2013.

Net oil-equivalent production in 2015 averaged 720,000 barrels per day, up 8 percent from 2014 and 10 percent from 2013.

Between 2015 and 2014, production increases due to project ramp-ups in the Gulf of Mexico and the Permian Basin in Texas

and New Mexico were partially offset by the effect of asset sales and normal field declines. Between 2014 and 2013,

production increases in the Permian Basin in Texas and New Mexico and the Marcellus Shale in western Pennsylvania were

partially offset by normal field declines.

The net liquids component of oil-equivalent production for 2015 averaged 501,000 barrels per day, up 10 percent from 2014

and 12 percent from 2013. Net natural gas production averaged about 1.3 billion cubic feet per day in 2015, up 5 percent

from 2014 and 2013. Refer to the “Selected Operating Data” table on page 19 for a three-year comparison of production

volumes in the United States.

International Upstream

Millions of dollars

2014

2015

2013

Earnings*

$

2,094

$

13,566

$

16,765

*Includes

$

725

$

597

$

559

foreign currency effects:

International upstream earnings were $2.09 billion in 2015 compared with $13.57 billion in 2014. The decrease between

periods was primarily due to lower crude oil and natural gas realizations of $10.57 billion and $880 million, respectively, and

higher depreciation expenses of $1.11 billion, primarily reflecting impairments. Lower gains on asset sales also contributed

to the decrease with current year gains of $370 million compared with $1.10 billion in 2014. Partially offsetting the decrease

were higher crude oil sales volumes of $590 million and lower operating expenses of $510 million. Foreign currency effects

increased earnings by $725 million in 2015, compared with an increase of $597 million a year earlier.

International upstream earnings were $13.57 billion in 2014 compared with $16.77 billion in 2013. The decrease between

periods was primarily due to lower crude oil prices and sales volumes of $1.97 billion and $400 million, respectively. Also

contributing to the decrease were higher depreciation expenses of $1.02 billion, mainly related to impairments and other asset

write-offs, and higher operating and tax expenses of $340 million and $310 million, respectively. Partially offsetting these

items were gains on asset sales of $1.10 billion in 2014, compared with $140 million in 2013. Foreign currency effects

increased earnings by $597 million in 2014, compared with a decrease of $559 million a year earlier.

The company’s average realization for international crude oil and natural gas liquids in 2015 was $46.52 per barrel,

compared with $90.42 in 2014 and $100.26 in 2013. The average natural gas realization was $4.53 per thousand cubic feet in

2015, compared with $5.78 and $5.91 in 2014 and 2013, respectively.

International net oil-equivalent production was 1.90 million barrels per day in 2015, essentially unchanged from 2014 and

down 2 percent from 2013. Between 2015 and 2014, production increases from entitlement effects in several locations and

project ramp-ups in Bangladesh and other areas were offset by the Partitioned Zone shut-in, normal field declines and the

effect of asset sales. Between 2014 and 2013, production increases due to project ramp-ups in Nigeria, Argentina and Brazil

were more than offset by normal field declines, production entitlement effects in several locations and the effect of asset sales.

The net liquids component of international oil-equivalent production was 1.24 million barrels per day in 2015, a decrease of

approximately 1 percent from 2014 and a decrease of approximately 3 percent from 2013. International net natural gas

production of 4.0 billion cubic feet per day in 2015 was up 1 percent from 2014 and unchanged from 2013.

Refer to the “Selected Operating Data” table, on page 19, for a three-year comparison of international production volumes.

Chevron Corporation 2015 Annual Report

15

Management’s Discussion and Analysis of Financial Condition and Results of Operations

U.S. Downstream

Millions of dollars

Earnings

2014

2015

$

3,182

$

2,637

2013

$

787

U.S. downstream operations earned $3.18 billion in 2015, compared with $2.64 billion in 2014. The increase was due to

higher margins on refined product sales of $1.51 billion, partially offset by the absence of 2014 asset sale gains of

$960 million.

U.S. downstream operations earned $2.64 billion in 2014, compared with $787 million in 2013. The increase in earnings was

mainly due to higher margins on refined product sales of $830 million. Gains from asset sales were $960 million in 2014,

compared with $250 million in 2013. Higher earnings from 50 percent-owned Chevron Phillips Chemical Company, LLC

(CPChem) of $160 million and lower operating expenses of $80 million also contributed to the earnings increase.

Refined product sales of 1.23 million barrels per day in 2015 increased 1 percent, mainly reflecting higher sales of jet fuel.

Sales volumes of refined products were 1.21 million barrels per day in 2014, an increase of 2 percent from 2013, mainly

reflecting higher gas oil sales. U.S. branded gasoline sales of 522,000 barrels per day in 2015 increased 1 percent from 2014

and 2013.

Refer to the “Selected Operating Data” table on page 19 for a three-year comparison of sales volumes of gasoline and other

refined products and refinery input volumes.

International Downstream

Millions of dollars

2014

2015

Earnings*

$

4,419

$

*Includes

$

47

$

foreign currency effects:

1,699

(112)

2013

$

$

1,450

(76)

International downstream earned $4.42 billion in 2015, compared with $1.70 billion in 2014. The increase was primarily due

to a $1.6 billion gain from the sale of the company’s interest in Caltex Australia Limited in second quarter 2015 and higher

margins on refined product sales of $690 million. Foreign currency effects increased earnings by $47 million in 2015,

compared to a decrease of $112 million a year earlier.

International downstream earned $1.70 billion in 2014, compared with $1.45 billion in 2013. The increase was mainly due to

a favorable change in the effects on derivative instruments of $640 million. The increase was partially offset by the economic

buyout of a legacy pension obligation of $160 million in the 2014 period, lower margins on refined product sales of $130

million and higher tax expenses of $110 million. Foreign currency effects decreased earnings by $112 million in 2014,

compared with a decrease of $76 million a year earlier.

Total refined product sales of 1.51 million barrels per day in 2015 were essentially unchanged from 2014. Excluding the

effects of the Caltex Australia Limited divestment, refined product sales were up 107,000 barrels per day, primarily

reflecting higher sales of jet fuel, gasoline and gas oil. Sales of 1.50 million barrels per day in 2014 declined 2 percent from

2013, mainly reflecting lower gas oil sales.

Refer to the “Selected Operating Data” table, on page 19, for a three-year comparison of sales volumes of gasoline and other

refined products and refinery input volumes.

All Other

Millions of dollars

Net

charges*

*Includes

foreign currency effects:

2014

2015

2013

$

(1,053)

$

(1,988) $

$

(3)

$

2

$

(1,623)

(9)

All Other consists of worldwide cash management and debt financing activities, corporate administrative functions,

insurance operations, real estate activities, and technology companies.

Net charges in 2015 decreased $935 million from 2014, mainly due to lower corporate tax items and the absence of 2014

charges related to mining assets, partially offset by higher charges related to reductions in corporate staffs. Net charges in

2014 increased $365 million from 2013, mainly due to higher environmental reserve additions, asset impairments and

additional asset retirement obligations for mining assets, as well as higher corporate tax items. These increases were partially

offset by the absence of 2013 impairments of power-related affiliates and lower other corporate charges.

16

Chevron Corporation 2015 Annual Report

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Consolidated Statement of Income

Comparative amounts for certain income statement categories are shown below:

Millions of dollars

Sales and other operating revenues

2014

2015

$

129,925

$

200,494

2013

$

220,156

Sales and other operating revenues decreased in 2015 primarily due to lower refined product and crude oil prices, partially

offset by an increase in refined product and crude oil volumes. The decrease between 2014 and 2013 was mainly due to

lower crude oil volumes, and lower refined product and crude oil prices.

Millions of dollars

Income from equity affiliates

2014

2015

$

4,684

$

7,098

2013

$

7,527

Income from equity affiliates decreased in 2015 from 2014 mainly due to lower earnings from Tengizchevroil in Kazakhstan,

CPChem, Angola LNG and the effect of the sale of Caltex Australia Limited in second quarter 2015. Partially offsetting

these effects were higher earnings from GS Caltex in South Korea and Petropiar in Venezuela.

Income from equity affiliates decreased in 2014 from 2013 mainly due to lower upstream-related earnings from

Tengizchevroil in Kazakhstan, Petropiar and Petroboscan in Venezuela, and Angola LNG. Partially offsetting these effects

were higher downstream-related earnings from GS Caltex in South Korea, higher earnings from CPChem and the absence of

2013 impairments of power-related affiliates.

Refer to Note 15, beginning on page 48, for a discussion of Chevron’s investments in affiliated companies.

Millions of dollars

Other income

2014

2015

$

3,868

$

4,378

2013

$

1,165

Other income of $3.9 billion in 2015 included net gains from asset sales of $3.2 billion before-tax. Other income in 2014 and

2013 included net gains from asset sales of $3.6 billion and $710 million before-tax, respectively. Interest income was

approximately $119 million in 2015, $145 million in 2014 and $136 million in 2013. Foreign currency effects increased

other income by $82 million in 2015, $277 million in 2014 and $103 million in 2013.

Millions of dollars

Purchased crude oil and products

2014

2015

$

69,751

$

119,671

2013

$

134,696

Crude oil and product purchases of $69.8 billion were down in 2015 mainly due to lower crude oil and refined product

prices, partially offset by an increase in crude oil volumes. Crude oil and product purchases in 2014 decreased by

$15.0 billion from the prior year, mainly due to lower crude oil and refined product prices, along with lower crude oil

volumes.

Millions of dollars

Operating, selling, general and administrative expenses

2014

2015

$

27,477

$

29,779

2013

$

29,137

Operating, selling, general and administrative expenses decreased $2.3 billion between 2015 and 2014. The decrease

included lower fuel costs of $920 million. Also contributing to the decrease were lower expenses for construction, repair and

maintenance of $300 million, contract labor of $270 million, and research, technical and professional services of $200 million.

Operating, selling, general and administrative expenses increased $642 million between 2014 and 2013. The increase

included higher employee compensation and benefit costs of $360 million, primarily related to a buyout of a legacy pension

obligation. Also contributing to the increase was higher transportation costs of $350 million, primarily reflecting the

economic buyout of a long-term contractual obligation, and higher environmental expenses related to a mining asset of $300

million. Partially offsetting the increase were lower fuel expenses of $360 million.

Millions of dollars

Exploration expense

2014

2015

$

3,340

$

1,985

2013

$

1,861

Exploration expenses in 2015 increased from 2014 mainly due to higher charges for well write-offs largely related to project

cancellations. Exploration expenses in 2014 increased from 2013 mainly due to higher charges for well write-offs, partially

offset by lower geological and geophysical expenses.

Chevron Corporation 2015 Annual Report

17

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Millions of dollars

Depreciation, depletion and amortization

2014

2015

$