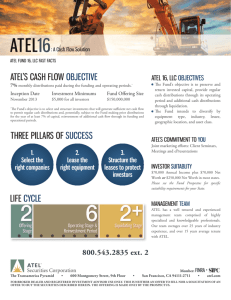

Energy is our business

advertisement