Optimal Housing, Consumption, and Investment Decisions over the

advertisement

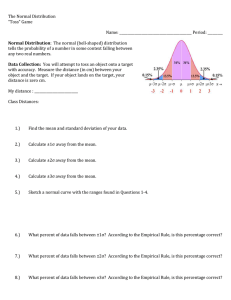

Introduction Model Solution Empirical income Robustness Summary Optimal Housing, Consumption, and Investment Decisions over the Life-Cycle Holger Kraft1 1 Goethe Claus Munk2 University Frankfurt, Germany 2 Aarhus University, Denmark Bachelier Finance Society Toronto, June 2010 1 / 27 Introduction Model Solution Empirical income Robustness Summary Outline 1 Introduction 2 Model 3 Solution 4 Empirical income 5 Robustness 6 Summary 2 / 27 Introduction Model Solution Empirical income Robustness Summary Motivation Labor income and housing decisions important for most individuals Some papers include labor income, some papers housing decisions The few papers including both aspects are restrictive [Campbell/Cocco (QJE03), Cocco (RFS05), Yao/Zhang (RFS05), Van Hemert (WP09)] Difficult optimization problem – typically solved by highly complex numerical methods 3 / 27 Introduction Model Solution Empirical income Robustness Summary This paper Rich model: stochastic labor income, house price, interest rate, stock price Disconnect housing consumption and housing investment Closed-form “Excel-ready” solution Model generates life-cycle behavior with many realistic features Non-negligible welfare gains from “perfect” house price-linked financial contracts 4 / 27 Introduction Model Solution Empirical income Robustness Summary Outline 1 Introduction 2 Model 3 Solution 4 Empirical income 5 Robustness 6 Summary 5 / 27 Introduction Model Solution Empirical income Robustness Summary Financial assets Short-term interest rate (= return on cash ): drt = κ (r̄ − rt ) dt − σr dWrt Price Bt = B(rt , t) of bond (20Y used later): dBt = (rt + λB σB (rt , t)) dt + σB (rt , t) dWrt Bt Stock price: ! q dSt dWrt = (rt + λS σS ) dt + σS ρSB , 1 − ρ2SB dWSt St 6 / 27 Introduction Model Solution Empirical income Robustness Summary Housing “Unit” house price Ht : (unit ≈ 1 “average” sq. foot) dWrt dHt = rt + λH σH − r imp dt + σH (ρHB , ρ̂HS , ρ̂H ) dWSt Ht dWHt Housing positions: owning ϕot housing units renting ϕrt units at rental rate νHt per unit investing in REITs , ϕRt units, total return dHt Ht + ν dt Housing consumption: ϕCt = ϕot + ϕrt Housing investment: ϕIt = ϕot + ϕRt 7 / 27 Introduction Model Solution Empirical income Robustness Summary Labor income and wealth Income rate Yt until retirement at T̃ : dWrt dYt = (µ̄Y (t) + brt ) dt + σY (t) (ρYB , ρ̂YS , ρ̂Y ) dWSt Yt dWHt In retirement: Yt = ΥYT̃ , t ∈ [T̃ , T ]. Human wealth/capital: Lt = EQ t Z t T e− Rs t ( Yt F (t, rt ), t < T̃ , ru du Ys ds = YT̃ F (t, rt ), t ∈ (T̃ , T ], where F is known in closed form. Financial/tangible wealth: Xt . Total wealth: Xt + Lt . 8 / 27 Introduction Model Solution Empirical income Robustness Summary The individual’s optimization problem Z J(t, X , r , H, Y ) = sup Et T e −δ(u−t) t 1 β 1−β 1−γ c ϕ ds 1 − γ u Cu Choose: ct perishable consumption rate ϕCt housing units consumed π̂It fraction of total wealth invested in house, π̂It = Ht ϕIt Xt +Lt π̂Bt fraction of total wealth invested in bond π̂St fraction of total wealth invested in stock 9 / 27 Introduction Model Solution Empirical income Robustness Summary Selected parameter values Individual Wealth Risk aversion Work life Retirement House Exp. return Volatility Imputed rent Rent Unit price 20,000 4 30 Y 20 Y 1% 12% 5% 5% 250 Excess stock return Income Initial Avg. growth Volatility Retirement Correlations income/stock,bond house/stock house/bond income/house 5% 20,000 2% 7.5% 60% 0 0.5 0.65 0.57 10 / 27 Introduction Model Solution Empirical income Robustness Summary Outline 1 Introduction 2 Model 3 Solution 4 Empirical income 5 Robustness 6 Summary 11 / 27 Introduction Model Solution Empirical income Robustness Summary Solution to the HJB-equation... J(t, X , r , H, Y ) = 1 g(t, r , H)γ (X + YF (t, r ))1−γ , 1−γ ην Hk g(t, r , H) = 1−β Z T e−d1 (u−t)−β γ−1 Bκ (u−t)r γ du, t βν X + YF Hk , 1−β g X + YF ϕC = ηH k−1 , g c=η π̂S , π̂S , π̂S : see below 12 / 27 Introduction Model Solution Empirical income Robustness Summary Investments – fractions of total wealth σ Y ζS L , σS X + L 0 ↔ 33% σY ζB σr Fr L 1 ξB − − = γ σB σB σB F X + L −63% 0 ↔ 116% 0 ↔ −42% Stocks π̂S = Bonds π̂B House π̂I = 1 ξS γ σS 4% 1 ξI γ σH 91% speculative − σY ζI L σH X + L 0 ↔ −109% − adjust for human wealth Note: σY drops to zero at retirement, but L/(X + L) > 0 − σr gr , σB g 49% HgH g 15% + hedge jump 13 / 27 Introduction Model Solution Empirical income Robustness Summary Expected wealth over the life-cycle 800 Expected wealth (in thousands) 700 600 500 Total wealth Financial wealth 400 Human wealth 300 200 100 0 0 5 10 15 20 25 30 35 40 45 50 Time, years 14 / 27 Introduction Model Solution Empirical income Robustness Summary Expected investments over the life-cycle 800 Expected investment (in thousands) 600 400 200 Bond Stock 0 House 0 5 10 15 20 25 30 35 40 45 50 -200 -400 -600 Time, years 15 / 27 Introduction Model Solution Empirical income Robustness Summary ... with age-dependent income volatility 1000 800 Expected investments (in thousands) 600 400 Stock, constant 200 House, constant Bond, constant Stock, decreasing 0 0 5 10 15 20 25 30 35 40 45 50 House, decreasing Bond, decreasing -200 -400 -600 -800 Time, years 16 / 27 Introduction Model Solution Empirical income Robustness Summary Housing consumption and investments 2500 2250 2000 Expected housing units 1750 1500 1250 Housing cons 1000 Housing inv 750 500 250 0 0 5 10 15 20 25 30 35 40 45 50 Time, years 17 / 27 Introduction Model Solution Empirical income Robustness Summary Outline 1 Introduction 2 Model 3 Solution 4 Empirical income 5 Robustness 6 Summary 18 / 27 Introduction Model Solution Empirical income Robustness Summary Empirical income profiles Expected annual income (thousands) 50 45 40 35 30 no high 25 high 20 college 15 constant 10 5 0 25 35 45 55 65 75 85 Age, in years 19 / 27 Introduction Model Solution Empirical income Robustness Summary Expected investments again 1200 1000 Expected investment (in thousands) 800 Stock, no high 600 House, no high Bond, no high 400 Stock, high House, high Bond, high 200 Stock, college House, college 0 25 35 45 55 65 75 85 Bond, college -200 -400 -600 Time (years) 20 / 27 Introduction Model Solution Empirical income Robustness Summary Housing consumption and investments again 3500 3000 Expected housing units 2500 Housing cons, no high 2000 Housing inv, no high Housing cons, high Housing inv, high 1500 Housing cons, college Housing inv, college 1000 500 0 25 35 45 55 Time (years) 65 75 85 21 / 27 Introduction Model Solution Empirical income Robustness Summary Outline 1 Introduction 2 Model 3 Solution 4 Empirical income 5 Robustness 6 Summary 22 / 27 Introduction Model Solution Empirical income Robustness Summary Unspanned labor income Our solution requires market completeness, i.e., spanned labor income Labor income is much closer to being spanned when housing assets are included – high income-house price correlation If labor income is unspanned, the implementation of our consumption/investment strategy is sub-optimal Bick, Kraft & Munk (presented Thursday): the welfare loss is relatively small (magnitude ≤ 3%) 23 / 27 Introduction Model Solution Empirical income Robustness Summary Constant housing consumption 20% 18% Wealth loss compared to full flexibility 16% 14% 12% 10% 8% 6% 4% 2% 0% 0 100 200 300 400 500 600 700 800 900 1000 Fixed level of housing units Note: minimum certainty-equivalent wealth loss is only 0.24% 24 / 27 Introduction Model Solution Empirical income Robustness Summary Infrequent rebalancing of housing positions Welfare loss Adjustment frequency 2 years 5 years Infrequent ϕC , frequent ϕI 0.03% 0.07% Infrequent ϕI , frequent ϕC 0.43% 1.85% Infrequent ϕC and ϕI 0.46% 1.96% suggests moderate welfare gains from market for REITs or CSI housing contracts suggests moderate effects of housing transactions costs 25 / 27 Introduction Model Solution Empirical income Robustness Summary Outline 1 Introduction 2 Model 3 Solution 4 Empirical income 5 Robustness 6 Summary 26 / 27 Introduction Model Solution Empirical income Robustness Summary Summary Framework for consumption, housing, and investment decisions over the life-cycle High income/house correlation life-cycle patterns in optimal decisions, in particular housing investment Calibrated model has many realistic features Lots of comparative statics in the paper Need to know more about typical life-cycle pattern in income volatility and income/house price correlation Our model is a benchmark for numerical solutions with portfolio constraints and transaction costs 27 / 27