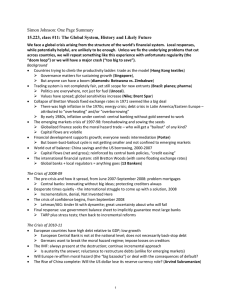

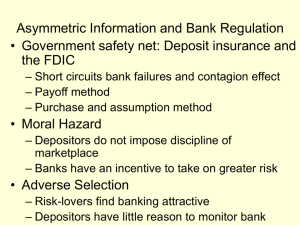

Bank bailouts, interventions, and moral hazard

advertisement