2012 DNB Corporate Social Responsibility

advertisement

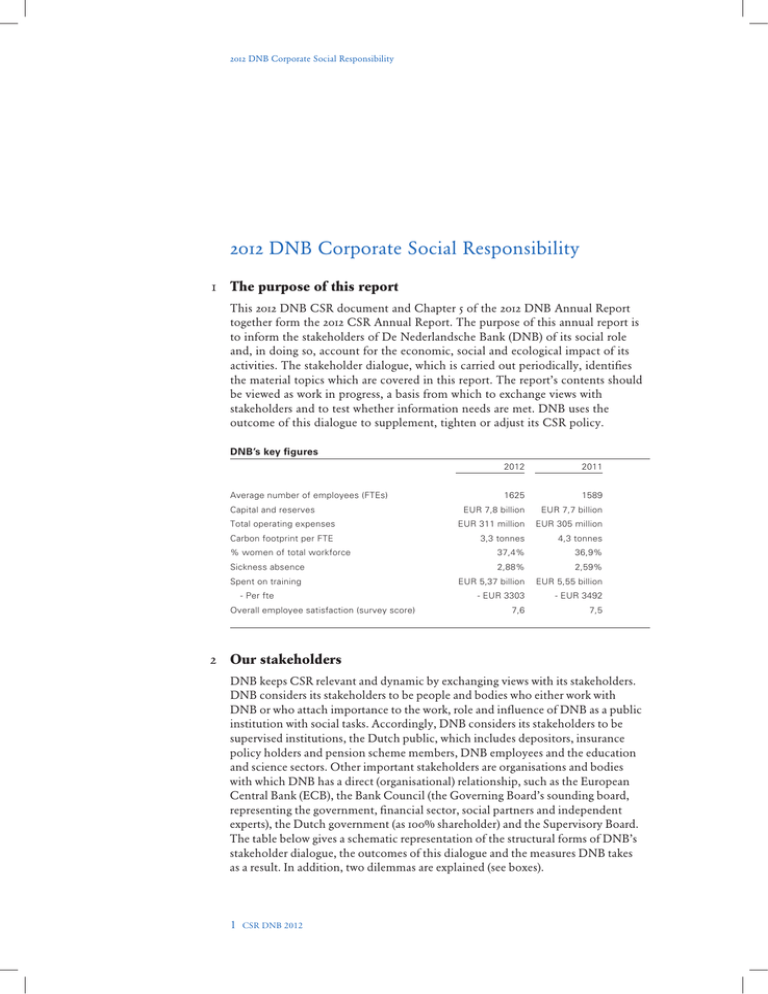

2012 DNB Corporate Social Responsibility 2012 DNB Corporate Social Responsibility 1 The purpose of this report This 2012 DNB CSR document and Chapter 5 of the 2012 DNB Annual Report together form the 2012 CSR Annual Report. The purpose of this annual report is to inform the stakeholders of De Nederlandsche Bank (DNB) of its social role and, in doing so, account for the economic, social and ecological impact of its activities. The stakeholder dialogue, which is carried out periodically, identifies the material topics which are covered in this report. The report’s contents should be viewed as work in progress, a basis from which to exchange views with stakeholders and to test whether information needs are met. DNB uses the outcome of this dialogue to supplement, tighten or adjust its CSR policy. DNB’s key figures Average number of employees (FTEs) Capital and reserves 2011 1625 1589 EUR 7,8 billion EUR 7,7 billion Total operating expenses EUR 311 million EUR 305 million Carbon footprint per FTE 3,3 tonnes 4,3 tonnes % women of total workforce 37,4% 36,9% Sickness absence 2,88% 2,59% EUR 5,37 billion EUR 5,55 billion - EUR 3303 - EUR 3492 7,6 7,5 Spent on training - Per fte Overall employee satisfaction (survey score) 2012 2 Our stakeholders DNB keeps CSR relevant and dynamic by exchanging views with its stakeholders. DNB considers its stakeholders to be people and bodies who either work with DNB or who attach importance to the work, role and influence of DNB as a public institution with social tasks. Accordingly, DNB considers its stakeholders to be supervised institutions, the Dutch public, which includes depositors, insurance policy holders and pension scheme members, DNB employees and the education and science sectors. Other important stakeholders are organisations and bodies with which DNB has a direct (organisational) relationship, such as the European Central Bank (ECB), the Bank Council (the Governing Board’s sounding board, representing the government, financial sector, social partners and independent experts), the Dutch government (as 100% shareholder) and the Supervisory Board. The table below gives a schematic representation of the structural forms of DNB’s stakeholder dialogue, the outcomes of this dialogue and the measures DNB takes as a result. In addition, two dilemmas are explained (see boxes). 1 CSR DNB 2012 2012 DNB Corporate Social Responsibility Stakeholders Form of dialogue Outcomes, issues Follow up DNB Employees Satisfaction survey (annual) General satisfaction above Working group started for benchmark; efficiency could be further research and even better improvement proposals Reputation measurement Improving score (4th quarter To continue putting our under financial citizens (1 x per 2012: 66.3); DNB front runner strategy/ambitions into practice quarter) among financial institutions and be transparent in this Public such as MinFin, AFM and ECB, but still room for improvement Providers and users of National Forum on the Payment Future of telephone banking Mediate as Chair of MOB so payments systems System (MOB) with arrival of SEPA that payment systems remain (2 x per year) accessible for people with visual impairment; banks have already committed to this Industry associations of Executive consultation with Announcement and explanation Interpretation and application supervised institutions individual industry associations of new regulations; of regulations; (3-4 x per year); Acceptable supervision costs Effective and efficient format Panel meetings on budget and of supervisory approach accountability (2 x per year) Dilemma 1: Proper supervision versus its cost A significant dilemma in supervision is the trade-off between effort and cost. On the one hand, there is the question ‘How much supervision is necessary?’ to achieve the objectives of DNB as a supervisory authority and to monitor financial stability. After all, the public and the government demand sufficient and good – i.e. effective and efficient – supervision. On the other hand, there is the pressure to keep the costs of monitoring – which are primarily borne by the supervised institutions – as low as possible; supervision should not cost too much. During the panel meetings, in which the industry associations of supervised institutions are represented, DNB consults with interested parties on the budget and justification of supervisory costs. 2 CSR DNB 2012 2012 DNB Corporate Social Responsibility Dilemma 2: Accessibility versus European standardisation and efficiency On the one hand, DNB attempts to ensure the accessibility of payment systems for all, including vulnerable groups. On the other hand, DNB supports the pursuit of a common payments market (SEPA). That makes maintaining telephone banking - a channel particularly suitable for people with a visual impairment - difficult. Entering the account number is more awkward due to the letters in the International Bank Account Number (IBAN), and telephone authorisation does not conform to SEPA standards. In addition, the need for this channel is generally declining due to the popularity of Internet banking and mobile banking. A balancing of interests was achieved in consultation with interested parties through the National Forum on the Payment System, of which DNB is chair, and banks are committed to enabling the independent organisation of fund transfers for this select group of customers, by phone or by an appropriate alternative method, even after the introduction of SEPA. Materiality analysis The material topics reported in this chapter are those identified during periodic stakeholder dialogues. In order to gauge the importance that DNB stakeholders attach to these topics, a number of questions were submitted at the end of 2011/ beginning of 2012 to representatives of umbrella associations in the financial sectors supervised by DNB. These same questions were also submitted to members of DNB’s Governing Board (see also the 2011 Annual Report). The materiality analysis (see Diagram 1) reflects the outcome of this dialogue. This was fine-tuned recently after consulting a number of key internal individuals. In addition, a media analysis was done for the reporting year to see how much attention the media gave these different topics. On this basis, the materiality analysis has remained essentially unchanged since last year. Diagram 1 - Importance for DNB and perception of stakeholders High DNB Culture. Importance experienced by stakeholders Medium Effectiveness and efficiency of DNB. Integrity and compliance. Confidence in management. FEC. Restore trust in and reputation of financial sector. Supervision of institutions’ governance, business models, behaviour and Cybercrime. culture, remuneration policy. Satisfaction survey. Communication on important topics. Pensions Employee health, staff (long-term sustainability). development and employability. Sovereign debt crisis. Financial education. The New World of Work. Collective Labour Agreement for DNB staff. Technical assistance. Sustainable procurement. Energy consumption, carbon footprint. Efficient, environmentally friendly and accessible payments system. Socially Responsible Investments (SRI). Mobility/lease policy Use of materials. Low Volunteer work. Sponsorship. Diversity. Low Medium Importance to DNB 3 CSR DNB 2012 High 2012 DNB Corporate Social Responsibility 3 Our approach Mission and strategy At the start of 2012, DNB’s Governing Board formulated a renewed mission (see box), making sustainability an important focal point. Sustainability in this context means durable and stable in the long term. (Restoring) confidence in the financial sector, in the euro and in DNB as a central bank and supervisory authority has the highest priority. DNB’s social relevance is reflected in the way it carries out its key duties, for which is has a statutory mandate. DNB aims to carry out these duties as effectively and efficiently as possible, and integrate and embed where possible sustainability in the performance of its business processes and duties. In doing so, DNB will use all available resources as responsibly as possible, paying due regard to transparency and accessibility (see the 2012 DNB Annual Report, Section 4.5). Mission DNB seeks to safeguard financial stability and thus contributes to sustainable prosperity in the Netherlands. To this end, DNB operates as an independent central bank and supervisor to ensure: - price stability and balanced macroeconomic development in Europe, together with the other central banks of the Eurosystem; - a shock-resilient financial system and a secure, reliable and efficient payment system; - strong and sound financial institutions that meet their obligations. By issuing independent economic advice, DNB strengthens policies aimed at its primary targets. These objectives form the basis of a new strategy (see the 2012 DNB Annual Report, section 4.2.6). The framework for this strategy is illustrated in Diagram 2, showing the process of value creation by DNB. CSR policy DNB used the output of the stakeholder dialogue (see Section 2) as input for any further tightening of its policy and determining its priorities. DNB’s CSR policy consists of five themed areas: CSR in key duties, environment and sustainable procurement, social policy and social commitment. Each of these themed areas includes a number of topics or spearheads, for which annual and medium-term objectives are formulated. The extent to which these objectives have been achieved is reported annually. Annex 1 provides a summary overview. Management approach DNB’s CSR policy and report are adopted annually by the Governing Board. The policy enjoys broad commitment across the organisation and is supported by experts in specific areas. These specific areas are incorporated into regular business processes and decision making is embedded in the line. The CSR 4 CSR DNB 2012 2012DNBCorporateSocialResponsibility Diagram 2 - Framework for determining strategy Impact topicality Mission Why do we exist? Statutory mandate Social impact Ambitions What kind of organisation do we want to be? “Passionate concern” Strategy How are we going to achieve our ambitions? Strategic choices Contribution of DNB organisation Resources What are going to use to achieve our ambitions? Organisation, processes, methods, instruments coordinator,inconsultationwiththeCSRsteeringgroup,providessupportand guidanceintermsofcontentandprocess. Theannualplanningandcontrolcycleenablestheprogressofeconomic, ecologicalandsocialactivitiestobemonitored.Thereportontheprogressand managementapproachregardingtheseactivitiescanbefoundintherelevant chaptersofthe2012DNBAnnualReport 4 About this report ThematerialtopicsreportedinthisSectionarethoseidentifiedinthe stakeholderdialogue(seematerialityanalysisinSection2).Thisdialoguereveals thatCSRtopicsrelatedtokeydutiesareseenasmostmaterial.Therefore,itis logicaltoreporttheseinChapter4(Accountability)oftheAnnual Report,whichcoversDNB’skeyduties.Thisreflectsourreportingpolicy: wehavetakenanothersteptowardsintegratedreportingwithour2012Annual Report.The2010CSRreportwaspublishedasaseparatereport,andthe2011 CSRreportwasincludedinthe2011AnnualReportasaseparatechapter. The2012CSRreporthasbeenincorporatedintothe2012AnnualReportby includingCSRtopicsrelatingtokeydutiesinSection4,whichcoversDNB’s keyduties. Asinthepreviousyear,thereportonenvironmentalpolicy,socialpolicy, sustainableprocurementandsocialcommitmentcanbefoundinSection5. NotestotheapproachofourCSRpolicyandreportcanbefoundinthisCSR report.Annex1providesasummaryoverviewofthereportedtopics,including objectivesandresults,andreferencestosectionsintheAnnualReport,which providefurtherinformationonthesetopics.Annex2providestheGRI(Global ReportingInitiative)Table,whichincludesreferencestosectionsinthis documentandintheAnnualReport,whichreportontherelevanttopics. 5 CSR DNB 2012 2012 DNB Corporate Social Responsibility Scope and data The information presented in the CSR report relates to the reporting year 2012 (1 January to 31 December), with the exception of the environmental data. The reporting period for DNB’s carbon footprint runs from the fourth quarter of 2011 to the third quarter of 2012 inclusive, owing to the availability of data for this period in association with the publication date of the 2012 DNB Annual Report. The quantitative data of personnel details and financial results for 2012 that are included in DNB’s 2012 Annual Report have been collected using our financial data management system and personnel data management system. The reliability of this report, including the data, was reviewed by DNB’s internal audit department before submitting it to the external auditor. DNB has no subsidiaries; all DNB locations are wholly owned by DNB. Data related to our suppliers fall outside the scope of this annual report, unless otherwise stated. The calculation of CO2 emissions includes the energy consumption (gas, electricity and diesel for heating) of all DNB locations. CO2 emissions caused by commuters, business travel and goods transport were also reported across the organisation. All data are based on calculations (no estimates), unless otherwise stated. Reporting and verification The 2012 CSR report is compliant with the reporting guidelines of the Global Reporting Initiative (GRI), version G 3.0, application level A + (see GRI Table, section 8). If GRI indicators are not reported because they are considered not material, this is stated in the GRI Table. DNB also applies the GRI Sector Supplement for Public Agencies, supplemented by (social) indicators from the Supplement for the Financial Sector. DNB is not actually a financial undertaking, but we have extracted several indicators from the FS supplement which are relevant to the organisation. Other indicators in the FS supplement do not apply. In 2013, DNB will consider how far its CSR report can be tailored to the new version of the GRI guidelines (G4) and the framework of the International Integrated Reporting Committee (IIRC). To ensure an objective and independent review, DNB asked Deloitte Accountants B.V. to assess the 2012 CSR Annual Report as presented in this document and in Chapter 5 of the 2012 DNB Annual Report. The purpose of this engagement was to provide limited assurance that the 2012 CSR report is free from material misstatement and that it has been prepared in accordance with GRI guidelines, G 3.0 application level A +. Deloitte Accountants B.V. has issued an unqualified report, which is included on page 8 of this document. Every year, DNB contributes to the Transparency Benchmark of the Ministry of Economic Affairs. DNB’s ambition is to be able to measure itself against leading government agencies in the Netherlands. In doing so, it also looks at best practices in the private sector (banks, insurance companies, pension funds). DNB is ranked 56 in the Transparency Benchmark for the reporting year 2011. Comments on this report should be sent to mvo@DNB.nl. 6 CSR DNB 2012 2012 DNB Corporate Social Responsibility INDEPENDENT ASSURANCE REPORT WITH A LIMITED DEGREE OF ASSURANCE, PREPARED BY THE AUDITOR OF THE 2012 CSR ANNUAL REPORT OF DE NEDERLANDSCHE BANK N.V. To: the General Meeting of Shareholders, Supervisory Board, Governing Board and other stakeholders We have examined the 2012 CSR Annual Report, comprising the web document ‘2012 DNB CSR’ and Chapter 5 of the 2012 DNB Annual Report (hereafter: the 2012 CSR Annual Report) of De Nederlandsche Bank N.V. in Amsterdam with the aim of providing a limited degree of assurance that the 2012 CSR Annual Report is free from material misstatement. Responsibility of the Governing Board The Governing Board of De Nederlandsche Bank N.V. is responsible for preparing the 2012 CSR Annual Report and the information contained herein in accordance with the Sustainability Reporting Guidelines (GRI G 3.0) of the Global Reporting Initiative. This responsibility includes designing, implementing and maintaining an internal control system relevant to the preparation of the 2012 CSR Annual Report, so that it is free from material misstatement, whether due to fraud or error, selecting and applying acceptable reporting criteria for social reporting and making estimates that are reasonable in the circumstances. The scope of the 2012 CSR Annual Report and the information contained therein is dependent on the reporting policy chosen by the Governing Board, which is set out in Chapter 5 ‘Corporate Social Responsibility (CSR)’ of the 2012 DNB Annual Report and section 4 of the web document 2012 DNB CSR. Responsibility of the auditor Our responsibility is drawing a conclusion about the 2012 CSR Annual Report based on our examination. We have conducted our examination in accordance with Dutch law, including standard 3410N ‘Assurance Engagements relating to Sustainability Reports’. This requires us to comply with ethical requirements and to plan and perform our engagement so that we obtain a limited degree of assurance that the information presented in this report is correct in all material respects. The 2012 CSR Annual Report includes forward-looking information in the form of views, objectives, expectations and challenges. Inherent to this information is that realisation is uncertain. For these reasons, we do not provide assurance with respect to forward-looking information. An assurance engagement for obtaining a limited degree of assurance involves performing activities to obtain a limited level of assurance with regard to the information contained in the 2012 CSR Annual Report. The selected activities are subject to the judgment of the auditor, but the nature and extent of our activities are more limited than an instruction to obtain a reasonable degree of certainty and can only result in a conclusion that gives a limited degree of assurance that the 2012 CSR Annual Report is free from material misstatement. 7 CSR DNB 2012 2012 DNB Corporate Social Responsibility The activities performed within this framework comprised for the most part the following procedures: • D etermining the existence of the relevant information systems and internal controls; • Gathering information; • Performing analytical procedures; • Aligning information with documentation and assessing the extent to which this documentation supports the information presented in the report; • Assessing the application level (A) in accordance with the Sustainability Reporting Guidelines, version G 3.0 of the Global Reporting Initiative. The engagement was carried out by a multidisciplinary assurance team with expertise in assurance and CSR. We believe that the information we obtained is sufficient and appropriate as a basis for our conclusion. Conclusion On the basis of our examination, we have no reason to conclude that: • The information contained in the 2012 CSR Annual Report has been incorrectly presented in any material aspects, based on the Sustainability Reporting Guidelines (G3.0) of the Global Reporting Initiative; • The information contained in the 2012 CSR Annual Report has been incorrectly presented, based on application level A of the Sustainability Reporting Guidelines (G3.0) of the Global Reporting Initiative as used by De Nederlandsche Bank N.V. Amsterdam, 13 March 2013 Deloitte Accountants B.V. H.H.H. Wieleman RA 8 CSR DNB 2012 2012 DNB Corporate Social Responsibility Annex 1 - Overview of CSR topics in the 2012 DNB Annual Report CSR topics Medium-term ­objective Objectives for 2012 Actions and results in 2012 Objectives for 2013 Source/ chapter/ section Socially Responsible Investment (SRI) in shares To have entire equity portfolio comply with DNB’s SRI policy. Continue following developments in SRI products to assess if a larger share of the equity portfolio could fulfil them. • First full year with 1/3 of equity investment in fund with SRI policy. • Still no index SRI fund of sufficient size and appropriate SRI policy available for expansion. Follow developments in SRI products to assess if a larger share of the equity portfolio could fulfil them. AR, § 4.7 Circulation of banknotes more efficient and environmentally friendly Extend life of banknotes. • Further reduction of 4% (compared to 2011) of banknote receipts and issues by further cooperation between interested parties. • Reduction of CO2 emissions by further reduction of transport movements. • 10% more banknotes received (compared to 2011). • 13% more transports to DNB and 15% fewer shipments from DNB (compared to 2011). Continue efforts to get market participants to re-circulate fit banknotes themselves as much as possible. AR, § 4.2 Accessible and available payments system Highlight bottlenecks in • Ensure accessibility of the participation of payment systems. vulnerable groups in • Identify bottlenecks and the payment systems suggest solutions. and propose solutions. • Continued following up on accessible telephone banking in future (thanks to MOB lobbying). • Paid extra attention to SEPA transfer form. • Assessed and monitored accessibility aspects in the context of migration to SEPA. • Publish 2013 AR, § 4.2 accessibility monitor. • Draw up and publish fact sheet ‘Accessible websites for Internet banking’ (in collaboration with stakeholders). Supervision of governance, sustainable business models, behaviour & culture incl. remuneration policies at supervised institutions Sound and solid financial undertakings that fulfil their obligations and commitments. • Fitness assessment of members of Board of Governors; also of members of Supervisory Board since 1 July. • Assessment of the Expert Centre on Culture, Organisation and Integrity (COI). • Continued research into the implementation of a controlled remuneration policy. • Examined effectiveness of the Board. • Tested funding of banks; tested profitable insurers. Same as 2012 objective, paying explicit attention to the combination of structure, actions and behaviour. CSR in key duties Institutions that, in terms of governance, are organised and function in such a way that prudential risks are controlled. 9 CSR DNB 2012 • AR, § 4.2 • Independent Public Body (ZBO) report, § 2.2 • ZBO report, § 2.3.2 and2.4.2 2012 DNB Corporate Social Responsibility CSR topics Medium-term ­objective Objectives for 2012 Actions and results in 2012 Objectives for 2013 Source/ chapter/ section Knowledge transfer Financial education • Revitalise Visitor’s • Update films in Visitor’s Centre by relocating Centre on monetary to another DNB policy. property, still to be • Participation in third renovated. national Money Week. • Offer attractive, freeof-charge educational material (lesson plans, folders, films, online games). Technical cooperation Strengthen financial and institutional development at fellow central banks and supervisory authorities of the twelve constituency countries that the Netherlands represents at the IMF and the World Bank. Constituency countries satisfied with support given by DNB with the result that all constituency countries remain members of the Dutch constituency group, despite group enlargement with Belgium and Luxembourg. Produce design for 2012 objectives achieved. layout of new Visitor’s In addition: • ‘Getting started with the euro’ Centre. (Aan de slag met de euro) educational package developed for groups 5/6 in elementary school. • Money Case (Geldkoffer) developed for practical education. AR, § 4.8.1 • Manpower made available to Same as objective for support and train central banks 2012. and supervisory authorities from our constituency countries in particular (5.6 FTE). • ‘Academic courses’ organised (Duisenberg School of Finance). • All constituency countries remained members of the group, which was expanded to include Belgium and Luxembourg. AR, § 4.8.2 Social policy Diversity of staff Focus on diversity • Revise diversity policy across the organisation and extend to include and balance in the several target groups. workforce, where: • Pay specific attention to • all employees feel at social safety. home at DNB; • differences are recognised and appreciated; • equality is the starting point, regardless of age, gender, nationality, job or nature of employment; • working conditions are customised within Collective Labour Agreement frameworks; • 32% of management positions occupied by women in 2014. Employee • Rotate employees development and for career deployment development. • Continue developing DNB Supervisory Academy. • Develop vision of internal labour market. • Crystallise aspirations for recording knowledge, skills and competences. • Develop ICT support where necessary. • Select strategic personnel planning (SPP) instrument applicable for entire organisation and implement in part of the organisation. 10 CSR DNB 2012 • Started to develop new vision of diversity policy. • 28% of women in management positions. • Partnership with LOF magazine: 350 employees received a free annual subscription. • More than 30 managers took part in meeting on social safety; social safety indicators were inventoried with those concerned. • Update diversity AR, § 5.2.1 policy and start implementation measures. • Implement improvement points regarding social safety. • Implement additional measures for getting more women into management positions. • Provide the outlines of ‘future-proof terms of employment’ document. • Vision of internal labour market not developed (no longer applicable). • Aspirations for recording knowledge, skills and competences not fulfilled. • SPP pilot started. • The ‘Best People’ plan fleshed out. • Supervision Academy grown considerably and more employees have been trained. • New course started (Basic Course for Central Bankers). • Digital career test now part of regular development tools. • Implement SPP. AR, § 5.2.2 • Set up DNB Super­ visory Academy, start in 2013. • Research into continuing education. • Start implementation vision on ‘Best People’. • Start second traineeship incl. exchange with AFM. • Finalise planning activities for Management Development. • Develop modules for results-oriented management, diversity in teams, organisation and control; new managers to follow these ­modules. 2012 DNB Corporate Social Responsibility CSR topics Medium-term ­objective Objectives for 2012 Actions and results in 2012 Objectives for 2013 Source/ chapter/ section Working at DNB • Implement ‘Best People’ plan. • Provide support for networks. • No bank-wide policy for the New World of Work. • Determine employer’s role in vitality of employees. • Set long-term strategy for Employee Satisfaction Survey. • Develop new work concept as part of renovated DNB building (ACS). • Formulate starting points for working methods at DNB; involve various disciplines. • Take next step in using technological capabilities more extensively. • Continue using new DNB profile in labour market campaign and recruitment activities. • Developed new work concept as part of ACS. • Staff works independent of time and location in many places in the bank. • Overall employee satisfaction risen (survey score). • Active networks within DNB, with activities well supported by people from across the bank. • New labour market campaign prepared and launched. • New profile permanent feature of labour market campaign. • Start implementation AR, of ‘Best People’ plan. § 5.2.3 • Conduct Employee Satisfaction Survey. • Maintain overall staff satisfaction at the very least. • Ensure Top Employers score at least equals 2012. • Recruit 50 extra employees in Supervision Occupational Health & Safety • Comply with law and • Implement an regulations. occupational health and • Ensure continuous safety management improvement of system (OHSAS 18001) in working conditions. the Cash Operations Department. External audit in December 2012 with positive outcome • Draft a new AR, occupational health § 5.2.3 & safety policy. • Formulate safety policy for working with third parties. • Develop policy for physical duties and employability of employees for different duties. • Exchange knowledge about work safety in the cash chain. Change behaviour and culture • Full introduction of Performance Management (PM) system. • Develop strategic training interventions based on the three culture themes: - aiming for results; - making explicit choices; - boosting/improving mutual cooperation • Look into possible • Decision made to introduce • Manager and AR, improvements to (PM) new PM system. employees are aware § 5.2.4 system. • Series of themes with master of change in the PM • Encourage activities that classes in change management system and the support behaviour and set up. system is used. cultural changes. • Activities aimed at specified • Establish DNB • Develop further the DNB cultural themes. Academy in 2013. Supervisory Academy See also ‘Employee (see ‘Employee development and development and deployment’. deployment’). • Continue using new profile in labour market campaign and recruitment activities (see CSR topic ‘Working at DNB’. 11 CSR DNB 2012 2012 DNB Corporate Social Responsibility CSR topics Medium-term ­objective Objectives for 2012 Actions and results in 2012 Objectives for 2013 Source/ chapter/ section • Manage adequately integrity risks at DNB. • Promote awareness among employees to ‘act with integrity’. • Limit damage from acting contrary to laws and regulations, values, standards and rules of conduct of DNB or the prevention thereof. • Further control of main integrity risks within DNB. • Continue to develop awareness of an honest culture and social safety within DNB. • Continue to perform basic operational Compliance and Integrity (C&I) tasks effectively and efficiently. • Follow up baseline development model for qualification of DNB as an honest organisation. • Key risks within DNB identified. • Manage outsourcing risk: not met, included in bank-wide research into insourcing risks in 2013. • Activities on awareness of honest culture and social safety carried out. • Continuous improvement of effectiveness and efficiency, execution of basic tasks, following internal and external developments. • Implementing DNB-wide management plan: assessment completed, plan to be updated. • Development model: feedback Next measurement of and follow up on results of development model. evaluation of this instrument. • Contribution made to risk management of loss, theft and leaks of confidential information. • Communication and workshops for (new) employees and managers about integrity policy and regulations; survey of DNB employees to test their familiarity of these. AR § 5.3 Reduction in Review the environCO2 emissions, mental policy in 2013. environmental protection and energy consumption 50% smaller carbon footprint in 2012 compared to 2007 as a base year (reduction includes via green purchase of gas and electricity consumption; green ICT programme (see green ICT) and green mobility programme (see green mobility). • Approx. 84% of CO2 emissions of total energy consumption (electricity and fuel purchased) offset by purchase of carbon credits; of the total reported CO2 emissions in 2012, approximately 58% was compensated. • Decrease in CO2 emissions compared to base year 2007 is approximately 62%. Various actions for reducing energy consumption, managing environmental risks and continuously improving environmental performances. AR, § 5.4.1 Green mobility Reduction of CO2 emissions • Contract awarded to Athlon by choosing cars based on Car Lease (April 2012) and serCO2 emissions and vice implemented. awareness in the use of the • Existing DNB lease policy evalcar and alternative modes of uated and follow-up on outtransport. comes decided as regards awarding lease cars and measures aimed to strengthen sustainability in the lease policy. Strategic Personnel Planning (see also ‘Employee development and deployment’). Integrity Sustainable operations An effective and transparent leasing policy with focus on sustainability. 12 CSR DNB 2012 • Implement policy to limit car choice to maximum CO2 emissions. • Investigate new lease policy (based on a reward benchmark), which departs from mobility criterion. AR, § 5.4.2 2012 DNB Corporate Social Responsibility CSR topics Medium-term ­objective Objectives for 2012 Actions and results in 2012 Objectives for 2013 Source/ chapter/ section Green ICT • Make conscious choices at all stages of ICT resources. • Create awareness among employees. • Achieve energy savings where possible. Start at least two projects that also focus on environmental savings. • Replaced one quarter of servers with energy-efficient variant. • VMWare Enterprise Plus implemented to efficiently share resources. Start at least two AR, § 5.4.3 projects that also focus on environmental savings. Sustainable procurement • Apply minimum • Transition from sustainability criteria of sustainable NL Agency. procurement to • Pinpoint DNB’s ambition socially responsible level and per purchase purchasing. package. • Continue to follow • Establish method for government policy measuring sustainable and market procurement. developments. • Continue to measure results. • NL Agency’s sustainability • Carry out structural AR, § 5.4.4 criteria applied where possible. application and • DNB’s level of ambition monitoring of pinpointed: DNB will, in available social addition to the environmental criteria of NL criteria, also apply social Agency, if possible. criteria of NL Agency where • Continue to follow relevant. government policy • Improved clarity of the way and market sustainability is purchased by developments. DNB by upgrading DNB’s • Continue to measure Financial System. results. Social commitment Sponsorships and donations (including art) • Contribute to organisations of which DNB is co-founder. • Contribute to projects and actions with social purpose or that concern DNB duties (often multiannual commitments). Building together • Vary and renew project selection. • Organise more departmental projects. • Budget for financial contributions: EUR 1.6 million. • Contributions to organisations of which DNB is co-founder. • Contribute to projects and actions with social purpose. • Various exhibitions and 19 art purchases. Budget for financial contributions: EUR 1.6 million. AR, § 5.5.1 Provide a varied offer of 15-20 projects for 200 employees (work projects, projects with those in need of help and (more) knowledge-intensive projects). About 250 DNB employees did voluntary work for 20 projects in 2012. Same as objective for 2012. AR, § 5.5.2 13 CSR DNB 2012 2012 DNB Corporate Social Responsibility Annex 2 - GRI-G3 Table Indicator Fully or partly Source or short description reported Reference to paragraph and/or web page 1. Vision and strategy 1.1 Statement by senior management in the organisation about the relevance of sustainability to the organisation and its strategy. Fully 2012 AR (President’s introduction); 2012 DNB CSR (Mission and CSR policy, adopted by Governing Board. AR President’s introduction; § 3 1.2 1.2Description of key impacts, risks and opportunities. Partly 2012 AR (social and environmental risks in DNB’s strategy and stakeholders not identified as material risk). AR § 4.2, 4.6.3 2. Organisational profile 2.1 Organisation name Fully 2012 DNB CSR; 2012 AR. § 1; AR boiler plate 2.2 Key duties, competences Fully 2012 DNB CSR (Mission); 2012 AR (Corporate governance); www.DNB.nl. § 3; AR § 4.4 http://www.dnb.nl/en/ about-dnb/duties 2.3 Operational structure of the organisation, including divisions, subsidiaries and partnerships Fully 2012 AR (Corporate governance); organogram on website. AR § 4.4 http://www.dnb.nl/en/ about-dnb/organisation 2.4 Location of headquarters Fully Amsterdam AR > boiler plate 2.5 Jurisdiction Fully Dutch, 2012 AR. AR, § 4.4 2.6 Ownership structure and legal form Fully N.V. (public limited company), 2012 AR. AR, § 4.4 2.7 Main target groups Fully 2012 DNB CSR; www.dnb.nl. http://www.dnb.nl/en/ about-dnb/duties 2.8 Scale of reporting organisation Fully 2012 DNB CSR (key figures); 2012 AR. § 1; financial statements/balance sheet total; notes to profit and loss account 2.9 Significant changes during the reporting period regarding size, structure or ownership Fully 2012 AR (changes to governance structure DNB). AR § 4.4.1 2.10 Awards received during the reporting period N/A None 3. Report parameters Report profile 3.1 Reporting period Fully 2012 DNB CSR (calendar year 2012 except environmental data). § 4 3.2 Date of most recent report Fully 2012 DNB CSR; www.dnb.nl. § 4; www.dnb.nl/en/ about-dnb/organisation/ maatschappelijkverantwoord-ondernemen 3.3 Reporting cycle Fully Annual § 4 3.4 Contact point for questions regarding the report Fully mvo@dnb.nl § 4 N/A= not applicable NM= not material a.i. = additional indicator N.B.: references in the table relate to sections of this CSR report, the 2012 DNB Annual Report incl. the financial statements (abbreviated to ‘2012 AR’) and DNB’s website. These documents can be found in pdf format at www.dnb.nl/en/publications/dnb-publications/annual-report 14 CSR DNB 2012 2012 DNB Corporate Social Responsibility Indicator Fully or partly Source or short description reported Reference to paragraph and/or web page Report scope and boundary 3.5 Process for defining report content Fully 2012 DNB CSR § 2 and 3 3.6 Boundary of the report Fully 2012 DNB CSR § 4 3.7 Limitations on the scope or boundary of the report Fully 2012 DNB CSR § 4 3.8 Reporting basis Fully 2012 DNB CSR § 4 3.9 Data measurement techniques and bases of calculations Fully 2012 DNB CSR; 2012 AR (explanation of tables with measurement data). § 4; AR § 5.4.1 3.10 Explanation of the effect of any restatements of information previously provided Fully 2012 DNB CSR; 2012 AR (explanation of tables with measurement data). § 4; AR § 5.4.1 3.11 Significant changes from previous reporting periods in the scope, boundary or measuring measurements applied in the report Fully 2012 DNB CSR (Introduction); 2012 AR (explanation of tables with measurement data). § 4; AR § 5.4.1 Fully 2012 DNB CSR (this GRI-G3 table). Annex 2 2012 DNB CSR § 4 GRI content index 3.12 Table identifying the location of the Standard Disclosures in the report Assurance 3.13 Policy and current practice for seeking Fully external assurance for the report 4. Governance, commitments and engagement Governance structure 4.1 Governance structure Fully 2012 AR AR § 4.4 4.2 Management function of the Governing Board's Chairman Fully 2012 AR AR § 4.4 4.3 Independent and/or non-executive board members Fully AR 2012; www.dnb.nl AR § 4.4.1; www.dnb.nl/en/aboutdnb/ organisation/supervisoryboard-and-bank-council 4.4 Consultation bodies for shareholders Fully and employees to provide recommendations or direction to the highest governing body. 2012 AR; www.dnb.nl (State is 100% shareholder; independent public body (ZBO) budget and accountability of DNB in agreement with the Minister of Finance and the Minister of Social Affairs and Employment (SZW). DNB has an active Employees Council that consults regularly with the Governing Board on policies and implementation). AR § 4.4.2; www.dnb.nl/en/ about-dnb /organisation/budget-and -accountability 4.5 Linkage between compensation for Fully members of the highest governing body, senior managers and executives managers and organisation’s performance. DNB is not a commercial or listed company; directors’ compensation is not linked to the performance of the organisation; remuneration of the Governing Board is reported. Financial statements / Remuneration of the Governing Board 4.6 Processes in pace for the highest governing body to ensure conflicts of interests are avoided Fully 2012 AR; www.dnb.nl (Bank Council) AR, § 4.4.1 and 5.3; www.dnb.nl/en/aboutdnb/ organisation/supervisory-board -and-bank-council 4.7 Board qualifications Fully 2012 AR (Notes to DNB Corporate Governance; ‘The best people for all positions’); www.dnb.nl AR, § 4.4 and 5.2.2; www.dnb.nl/en/aboutdnb/ organisation N/A= not applicable NM= not material a.i. = additional indicator N.B.: references in the table relate to sections of this CSR report, the 2012 DNB Annual Report incl. the financial statements (abbreviated to ‘2012 AR’) and DNB’s website. These documents can be found in pdf format at www.dnb.nl/en/publications/dnb-publications/annual-report 15 CSR DNB 2012 2012 DNB Corporate Social Responsibility Indicator Fully or partly Source or short description reported Reference to paragraph and/or web page 4.8 Fully Internally developed mission statements, codes of conduct and principles relevant to economic, environmental and social performance and the status of the implementation 2012 AR AR § 4.4.1, 4.4.2 and 5.3 4.9 Procedures of the highest governance Partly body for overseeing CSR performance, including relevant risks and oppor­tu­nities, and compliance with internationally agreed standards and principles 2012 AR AR § 4.6.2 and 5.3 4.10 Processes for evaluating the highest governing body's own performance, particularly with respect to relevant economic, environmental and social performance Partly 2012 DNB CSR (CSR policy and report adopted annually by Governing Board and not by SB). § 3, Annex 1 Commitments to external initiatives 4.11 Explanation of the application of the precautionary principle Fully 2012 AR AR § 5.1, 5.4.1 4.12 Externally developed economic, environmental and social charters, principles or other initiatives which the organisation endorses Fully 2012 AR (European standards on payment systems; (international) policy and regulations on supervision; Corporate governance code; Dutch legislation, international treaties on investments; COSO) AR § 4.2.3, 4.2.4, 4.4.2, 4.6, 4.7.1, 4.13 Membership of associations (such as industry associations) and/or national/ international interest groups Fully DNB is an independent supervisory authority AR § 4.2 and 4.4 (ZBO), is part of the ESCB, the Financial Stability Committee and the National Forum on the Payment System (MOB). Stakeholder engagement 4.14 Stakeholders engaged by the organisation Fully 2012 DNB CSR § 2 4.15 Identification and selection of stakeholders Fully 2012 DNB CSR § 2 4.16 Frequency and type of stakeholder engagement Fully 2012 DNB CSR § 2 4.17 Key topics and concerns raised through stakeholder engagement Fully 2012 DNB CSR § 2 Management DMA Economische aspects EC Fully 2012 DNB CSR; 2012 AR § 3; AR § 4.3, 4.5, 4.7.2 DMA Environmental aspects EN Fully 2012 DNB CSR; 2012 AR § 3; AR § 5.4.1 DMA Working conditions aspects LA Fully MVO DNB 2012; 2012 AR § 3; AR § 5.2.3, 5.4.4 DMA Human rights aspects HR Fully MVO DNB 2012; 2012 AR § 3; AR § 4.7.2, 5.4.4 DMA Society aspects SO Fully 2012 AR § 3; AR § 4.4.1, 4.4.2, 5.3 DMA Product responsibility aspects PR Partly 2012 AR § 3; AR § 4.2.3, 5.4.3, 5.4.4, 5.4.5 AR § 4.3, 4.7.1, 4.7.3, 5.5 Performance indicators Economic performance indicators EC1 Economic value generated for society Fully 2012 AR; ZBO explanation 2012 EC2 Financial risks and opportunities for the organisation’s activities as a result of climate change N/A DNB is and remains in one location and has no activities that entail such risks. EC3 Coverage of the benefits plan laid down by the organisation Fully 2012 AR / Financial statements (pension and other retirement schemes) Financial statements / Provisions / Provision for staff remuneration N/A= not applicable NM= not material a.i. = additional indicator N.B.: references in the table relate to sections of this CSR report, the 2012 DNB Annual Report incl. the financial statements (abbreviated to ‘2012 AR’) and DNB’s website. These documents can be found in pdf format at www.dnb.nl/en/publications/dnb-publications/annual-report 16 CSR DNB 2012 2012 DNB Corporate Social Responsibility Indicator Fully or partly Source or short description reported EC4 Financial assistance from government Fully ZBO explanation 2012; DNB is an independent public body(ZBO) EC5 Ratio between starting salary and minimum wage (a.i.) Partly According to Dutch legislation. EC6 Policy, methods and expenditure on locally-based suppliers N/A DNB has locations only in NL. EC7-8 Local staff recruitment, infrastructure investment N/A DNB office is in one location in Amsterdam; labour market is largely confined to local community. EC9 Significant indirect economic impacts (a.i.) N/A See also EC7-8 Reference to paragraph and/or web page AR § 5.4.4 Environmental performance indicators EN1 Total materials used by weight or volume Partly 2012 AR AR § 5.4.4, 5.4.5 EN2 Percentage of materials used that are recycled input materials Fully 2012 AR AR § 5.4.5 EN3 Direct energy consumption by primary Partly energy source 2012 AR (measurement data not reported in Joules). § 5.4.1 EN4 Indirect energy consumption by primary source Partly 2012 AR (measurement data not reported in Joules). § 5.4.1 EN5 Energy savings and efficiency improvements (a.i.) Fully 2012 AR § 5.4.1, 5.4.2, 5.4.3 EN7 Indirect energy reduction (a.i.) Partly 2012 AR (measurement data). § 5.4.1, 5.4.2, 5.4.3 EN8 Water consumption NM As an office-based organisation, water consumption is not material EN 11-12 Biodiversity (location, products) N/A DNB is an office-based organisation in the centre of Amsterdam EN16 Total direct and indirect greenhouse gas emissions by weight Fully 2012 AR EN 17-21 Emissions and water discharge NM/N/A As an office-based organisation, DNB emissions are not applicable/not material. DNB has a permit for discharging cooling water. EN22 Total amount of waste by type and disposal method. NM As an office-based organisation, the quantity of waste is not material EN23, 26 Significant spills, mitigation of environmental impact by products N/A As an office-based organisation, DNB makes no discharges and the mitigation of environmental impacts does not apply. EN27 Percentage of products sold and reclaimed packaging Partly 2012 AR (DNB does not make any products and reports only on specific packaging). EN28 Monetary value of significant fines and total number of non-monetary sanctions for non-compliance with environmental laws and regulations Not No environmental fines. DNB is licensed to store fuel and ammunition. EN29 Significant environmental consequences of transporting products, goods and materials, used for the organisation’s activities and transporting staff (a.i.) Partly 2012 AR (as far as relevant, such as transport AR § 4.2.3, 5.4.1, 5.4.5 banknotes, coins return, commuters, travel costs) § 5.4.1 AR § 4.2.3, 5.4.5 Labour practices and decent work performance indicators Employment LA1 Total workforce by employment type Fully 2012 AR (‘Employees figures’ graphs) AR § 5.2.2, 5.2.3 LA2 Total number and rate of employee turnover by age group, gender and region Fully 2012 AR (‘Employees figures’ graphs) AR § 5.2.2, 5.2.3 N/A= not applicable NM= not material a.i. = additional indicator N.B.: references in the table relate to sections of this CSR report, the 2012 DNB Annual Report incl. the financial statements (abbreviated to ‘2012 AR’) and DNB’s website. These documents can be found in pdf format at www.dnb.nl/en/publications/dnb-publications/annual-report 17 CSR DNB 2012 2012 DNB Corporate Social Responsibility Indicator Fully or partly Source or short description reported Reference to paragraph and/or web page AR § 5.2.3 Employer and employee relations LA4 Employees subject to a Collective Labour Agreement (CAO) Fully 2012 AR LA5 Minimum notice period(s) Not Laid down in the CAO Occupational health and safety LA7 Injuries, occupational illness, lost days Fully and absenteeism and number of work-related fatalities by region 2012 AR LA8 Education, prevention and risk management programmes for staff members, their families or local residents regarding serious diseases N/A DNB does not operate in risky areas. AR § 5.2.3 Training and education LA10 Training for employees (average hours) Partly Reported in training costs AR § 5.2.2 LA11 Programmes for continued employability of employees and assist them in managing career endings (a.i.) Fully 2012 AR (to upcoming retirees offers among others a course 'Farewell to your work' (Afscheid van uw werk); information on DNB intranet). AR § 5.2.2 LA12 Informing staff on performance and career development (a.i.) Fully 2012 AR AR § 5.2.4 AR § 5.2.1, 5.2.3 Diversity and equal opportunities LA13 Diversity of governance bodies and staff Partly 2012 AR (see tables and graphs). LA14 Ratio of salaries of men and women by category Not No difference in salaries at same job levels. Human rights performance indicators HR1 Percentage investments screened for human rights N/A DNB does not operate in areas where human rights are an issue. HR2 Percentage of suppliers and contractors screened for respecting human rights Partly 2012 AR (no quantitative data available). AR § 5.4.4 HR4 Total number of cases of discrimination and corrective actions taken Fully 2012 AR (undesired manners). AR § 5.3 HR5-7 Risk that no right to exercise freedom N/A of trade union association, risk of child labour and forced labour No risk. DNB involves only employees in the Netherlands. Society performance indicators Local community SO1 Nature, scope and effectiveness of any programmes and methods that assess and manage the effects of activities on local communities, including location, activities and departure. N/A DNB has an office only in the Netherlands (Amsterdam). SO2 Percentage of and total number of business units analysed for corruption-related risks Fully 2012 AR AR § 5.3 SO3 Percentage of staff trained in organisation’s anti-corruption policy and procedures Partly 2012 AR (no quantitative data available). AR § 5.3 SO4 Measures taken in response to cases of corruption Fully 2012 AR AR § 5.3 N/A= not applicable NM= not material a.i. = additional indicator N.B.: references in the table relate to sections of this CSR report, the 2012 DNB Annual Report incl. the financial statements (abbreviated to ‘2012 AR’) and DNB’s website. These documents can be found in pdf format at www.dnb.nl/en/publications/dnb-publications/annual-report 18 CSR DNB 2012 2012 DNB Corporate Social Responsibility Indicator Fully or partly Source or short description reported Reference to paragraph and/or web page Fully 2012 AR AR President’s introduction, § 5.3 N/A None Public policy SO5 Public policy positions and participation in its development, as well as lobbying Compliance SO8 Monetary value of significant fines and total number of non-monetary sanctions for non-compliance with environmental laws and regulations Product responsibility performance indicators PR1 Life cycle stages in which health and safety impacts of products and services are assessed for improvement, and percentage of major product and service categories subject to such procedures. N/A DNB is not a product organisation. PR2-7 Compliance codes regarding product information (incl. customer satisfaction) N/A DNB does not sell any products. PR8 Complaints regarding breaches of customer privacy and losses of customer data Fully DNB does not sell products/services; the legal obligation of professional secrecy applies regarding individual supervised institutions. PR9 Monetary value of significant fines for Not non-compliance with laws and regulations concerning the provision and use of products and services. None Public agencies sector supplement PA1 Describe the relationship with the Fully government and other public organisations 2012 DNB CSR; 2012 AR § 2; AR § 4.4 PA2 Definition of sustainable development Fully used 2012 DNB CSR § 3 PA3 Aspects for which DNB has developed Fully CSR policies 2012 DNB CSR § 3 PA4 DNB’s specific CSR goals for aspects listed in PA3 Fully 2012 DNB CSR (overview of CSR topics) Annex 1 PA5 Description of the process of implementing CSR Fully 2012 DNB CSR § 3 PA6 Description of CSR goals and results Fully 2012 DNB CSR (overview of CSR topics) Annex 1 PA7 Description of role of and engagement with stakeholders Partly 2012 DNB CSR (not all objectives and results § 2 submitted to stakeholders) PA8 Distribution of operating expenses per Fully cost type at detail level 2012 AR, Financial statements 2012 AR § 4.3; Financial statements/profit & loss account PA9 Distribution of operating expenses in line with profit and loss account Fully 2012 AR Financial statements/ profit & loss account PA10 Capital expenditure Fully 2012 AR Financial statements/ profit & loss account PA11 Describe how the purchasing policy is linked to sustainable development. Fully 2012 AR AR § 5.4.4 PA12 Describe the economic, environmental and social criteria for expenditure and financial commitments. Fully 2012 AR AR § 4.7 / 4.7.2 N/A= not applicable NM= not material a.i. = additional indicator N.B.: references in the table relate to sections of this CSR report, the 2012 DNB Annual Report incl. the financial statements (abbreviated to ‘2012 AR’) and DNB’s website. These documents can be found in pdf format at www.dnb.nl/en/publications/dnb-publications/annual-report 19 CSR DNB 2012 2012 DNB Corporate Social Responsibility Indicator Fully or partly Source or short description reported Reference to paragraph and/or web page PA13 Describe to what extent the purchasing policy is completely linked to key duties. Fully 2012 AR (as far as relevant, for example using fair trade cotton for production of banknotes). AR § 5.4.4 PA14 Purchase products with voluntary certification in environment and/or working conditions, broken down by product group. Fully 2012 AR (as far as relevant reported). AR § 5.4.4 Additional financial sector indicators DNB is not actually a financial undertaking, but we have extracted several indicators from the FS supplement which are relevant to the organisation. Other indicators in the FS Supplement do not apply. FS1 Policy with specific social and environ­ Fully mental aspects applied within the various business units. 2012 AR AR § 5.2 and 5.4 FS2 Procedures for estimating and Partly assessing social and environmental risks within the various business units. 2012 AR (applicable to specific business units) AR § 4.6.2, 5.2.3, 5.3, 5.4.1, 5.4.4 FS4 Process to improve staff competency to implement the social and environmental policies and procedures applied within the various business units. Partly 2012 AR (applicable to specific business units) AR § 5.2.2, 5.3, 5.4.1 Coverage and frequency of audits to assess the implementation of social and environmental policy and associated risk analyses. Fully 2012 AR (as part of the certified environmental and occupational health and safety management systems for the relevant business units of DNB, internal and external audits are conducted annually). AR § 4.6.2, 5.2.3, 5.3, 5.4.1, 5.4.4 Audit FS9 Active ownership FS10 Percentage and number of companies N/A from portfolio that is spoken about social and environmental issues. 2012 AR (passive management only) AR § 4.7.2 FS11 Percentage of assets subject to positive and negative social and environmental screening. Fully 2012 AR AR § 4.7.2 Community FS14 Initiatives to provide disabled people with better access to services. Fully 2012 AR AR § 4.2.3 FS15 Policy for the fair design and sales of financial products and services. Fully 2012 AR (DNB does not develop and sell any financial products; reporting relates fully to the (supervisory) duties of DNB) AR Chapter 2 and § 4.2.4 FS16 Initiatives to enhance financial literacy, Fully ranked by type of target group (beneficiary). 2012 AR § 4.8 N/A= not applicable NM= not material a.i. = additional indicator N.B.: references in the table relate to sections of this CSR report, the 2012 DNB Annual Report incl. the financial statements (abbreviated to ‘2012 AR’) and DNB’s website. These documents can be found in pdf format at www.dnb.nl/en/publications/dnb-publications/annual-report 20 CSR DNB 2012