Bi-Weekly Update

advertisement

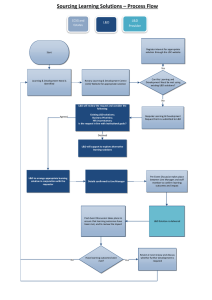

Bi-Weekly Update Rouselle Gratela – Training Specialist Kyle O’Hearn – Manager, Business Development Christine Olubick – Business Development Specialist Bob Collins – Manager, Market Strategy December 14, 2011 Meet the Presenters Rouselle Gratela Training Specialist Christine Olubick Business Development Specialist Kyle O’Hearn Manager, Business Development Bob Collins Manager, Market Strategy Today’s Agenda 1. saveONenergy Update • • Upcoming Webinars Schedule Upcoming Workshops 2. RETROFIT Small Projects Submission 3. Settlements Updates 4. Market Research Update • • LDC-level Commercial and Institutional and Industrial profiles LDC and regional-level awareness of and attitudes towards consumer programs and advertising 5. Questions Upcoming Webinars Schedule Date Webinar Topics Duration Time Wed Jan 11 saveONenergy Update 90 mins 10-11:30 o Marketing and Market Research Webinar Upcoming EM&V Workshop Save the date! • To be held January 25th at Toronto airport location • • • Will feature: • EM&V fundamentals • Overview of OPA’s EM&V Protocols and Requirements • OPA Tier 1 Evaluation Plans • Introduction to the Evaluation Advisory Committee • Discussion panel and interactive forum Intended for LDC management, staff and contractors staff directly involved with the design, delivery, and regulatory reporting of Conservation and Demand Management (CDM) Programs Venue, itinerary and registration link to be announced shortly Upcoming C&I Workshop Save the date! • To be held January 26th at Toronto airport location • Will feature: • saveONenergy business programs update • An all day opportunity to learn about the many issues relating to programs management • Understanding the application process • Updates from the C&I Working Group • Venue, itinerary and registration link to be announced shortly December 2011 Outline • RETROFIT PROGRAM - Payment update • 2010 ERIP • Waivers • Payment update • SMALL BUSINESS LIGHTING– Payment update • AUDIT FUNDING • Payment process recap • Payment update • HPNC & EXISTING BUILDING COMMISSIONING- Payment Process Update 8 RETROFIT PROGRAM- Payment Update • 2 Pre-Billing Reports (PBRs) sent out to date • OPA has received some Final Bulling Reports and invoices from some LDC’s but we are still waiting for responses from many more LDC’s. • Next PBRs to be sent before December 31, 2011 • Ensure applications ready for payment have status of ‘PostProject Submission – Payment Approve by LDC’ • Once automated process implemented for PBRs in 2012 to be disbursed on bi-weekly basis 9 2010 Electricity Retrofit Incentive Program - Waivers ERIP and RETROFIT Waivers sent out in E-blast (December 12, 2011) 1. Extension of project completion date from December 1,2011 December 31, 2011. Financial Incentives shall be paid by April 1, 2012 in place of the required 90 day period. ERIP waivers will be sent to all Conservation Officers. 10 2010 Electricity Retrofit Incentive Program - Waivers 2. For approved ERIP projects not yet started, or only partially completed, the OPA is waiving the eligibility criteria under 20112014 ERII schedule that a project must not have started prior to application. Participant must withdraw from ERIP by a letter from the Participant to the LDC and submit an application for RETROFIT PROGRAM prior to January 1, 2012. LDCs must email list of customers making use of this waiver to OPA to conservationcontracts@powerauthority.on.ca Upon receipt of list, OPA will append it to a signed ERII waiver, to be formally issued to Conservation Officer 11 2010 Electricity Retrofit Incentive Program – Payment Update $14,000,000 2010 Unprocessed ERIP Applications $12,000,000 $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 $0 08-Aug-11 12 12-Dec-11 Please submit ERIP applications ASAP in early January SMALL BUSINESS LIGHTING– Payment update • Current status of settlements: • Direct Install Eligible Cost Payments and Standard Incentive Payments (electrical contractor payments) settled up to November 1st, 2011 • Participant Based Funding (PBF) amounts: • Email sent to Conservation Officers December 2, 2011 requesting information to enable settlements of PBF amounts: • FIXED: The PBF amount actually incurred by the LDC and payment to a third party service provider for conducting an Assessment that resulted in the installation of Eligible Measures has not and will not change in 2011. • VARIABLE: The PBF amount for such Assessments has or will change in 2011 • Email response to conservationcontracts@powerauthority.on.ca 13 AUDIT FUNDING– Payment Process Recap • • LDC carries out obligations as per schedule C-1 LDC submits completed applications (including Appendix A and B) and required supporting documentation in electronic format to OPA for 2011 projects • • • • Supporting documentation includes: • • • • Do not include invoice to the OPA at this stage Submit electronically through conservationcontracts@powerauthority.on.ca with the following subject line: Energy Audit Applications-LDC Name OPA to notify LDCs in advance of streamlined process in future Energy Audit Report which may include Electricity Survey and Analysis and/or Detailed Analysis of Capital Intensive Modifications Info to support the calculation of Participant Incentives, including supporting evidence for all costs (e.g., copy of energy auditor invoices and travel expense invoices) OPA to generate Pre-Billing Reports, which will align generally with procedure developed for RETROFIT PROGRAM. First round to be sent out before Dec 31, 2011 14 HPNC & Existing Building Commissioning Payment Process Update: • Payment process Webinar in 2012 to provide details • Same general payment process as AUDIT FUNDING • LDCs continue to maintain well kept records to help facilitate payment process 15 Submitting Retroactive Small Project Under the RETROFIT Program Process for Submitting Retroactive Small Projects As per Exhibit A, Section 1.3: Ineligible Projects & Measures (c) projects where prior to submitting an Application, the applicant has entered into a binding commitment to acquire the Measures or services required to install the Measures, subject to the following exceptions: (i) the LDC is not required to reject an Application for a proposed Small Project solely on the grounds of this Section 1.3(c) where the Application was submitted for approval after February 1, 2011 but prior to January 1, 2012 and no more than 30 days following the completion of such Small Project, in which case Section 3.2(a)(i) of this Schedule will not apply to such Small Project; 17 Process for Submitting Retroactive Small Projects “Small Project” means a Project which is comprised of: (i) (ii) Prescriptive Measures and/or Engineered Measures with estimated Participant Incentives of less than or equal to $20,000; or Custom Measures with estimated Participant Incentives of less than or equal to $10,000 18 Process for Submitting Retroactive Small Projects Step 1: Applicant submits Pre-Project Submission no more than 30 days following project completion & before January 1, 2012. Step 2: LDC reviews Application according to Section 3.1 and conducts necessary post-project QA/QC requirements and Project M&V Processes according to Section 6.3 Step 3: LDC changes status to ‘Pre-Project Review – Approved to Proceed by LDC’ 19 Process for Submitting Retroactive Small Projects Step 3: Applicant completes Post-Project Submission. ***IMPORTANT*** Pre-Project submission = Post-Project submission Step 4: LDC changes status to ‘Post-Project Submission – Payment Approved by LDC’ 20 Process for submitting retroactive Small Projects Live Demonstration 21 Process for correcting Applications • Send an email to LDC.Support@powerauthority.on.ca 22 December Market Research Updates MPAC CI&I Segmentation Reports and Triple-A Results for Q2 and Q3 MPAC CI&I Segmentation Reports Available • Ready for download on SharePoint beginning Dec. 2nd • SharePoint: accessible within each LDC’s folder (in the For Review Library) • Reports show property counts for key sectors and sub-sectors in your service territory for commercial, institutional, industrial, agricultural and multi-unit res properties • Building age and size detail is also included • Information resource to enable each LDC to quantify the potential for business and industrial programs MPAC CI&I Segmentation Report Example-Ontario Link to Full Ontario Report MPAC Data Analysis: An Ontario Example Major Sectors: # of properties Major Sectors: Total Square Footage 76% Commercial (92863) 34% 11% 7% Industrial (43841) 16% 4% 3% Agricultural (99956) 37% Institutional (19355) 7% Commercial (11 million sqft) Industrial (1.6 million sqft) Multi-Unit Residential (1 million sqft) Institutional (500,000 sqft) Multi-Unit Residential (16867) 6% Agriculture (400,000 sqft) Triple-A Market Research Reports • Awareness, Attitudes and Action • The purpose is to report awareness, claimed participation and opinions of the saveONenergy campaign and the initiatives within the Consumer program. • Conducted to serve as a mid-campaign progress report • Weekly survey • Representative sample of 150 Ontarians since April 2011 • Online survey methodology: allows the display of marketing materials • People were asked about the initiatives for which they were eligible (For example, only homeowners with a forced air furnace and/or Central Air Conditioning were asked about the saveONenergy Heating & Cooling rebate.) • The CLD group will receive individual reports and all other reports will be based on the following groupings LDC Groupings: Composition CHEC CLD Eastern Central NEPA Northern Mid & SW Centre Wellington Hydro Ltd., COLLUS Power Corporation, Innisfil Hydro Distribution Systems Limited, Lakefront Utilities Inc., Lakeland Power Distribution Ltd., Midland Power Utility Corporation, Orangeville Hydro Limited, Parry Sound Power Corporation, Rideau St. Lawrence Distribution Inc., Wasaga Distribution Inc., Wellington North Power Inc., Westario Power Inc. Enersource Hydro Mississauga Inc., Horizon Utilities Corporation, Hydro Ottawa Limited, PowerStream Inc., Toronto Hydro-Electric System Limited, Veridian Connections Inc. Cooperative Hydro Embrun Inc., Eastern Ontario Power Inc., Hydro 2000 Inc., Hydro Hawkesbury Inc., Kingston Hydro Corporation, Oshawa PUC Networks Inc., Ottawa River Power Corporation, Peterborough Distribution Incorporated, Renfrew Hydro Inc., West Coast Huron Energy Inc. ,West Perth Power Inc., Burlington Hydro Inc., Halton Hills Hydro Inc., Hydro One Brampton Networks Inc., Milton Hydro Distribution Inc., Newmarket - Tay Power Distribution Ltd., Oakville Hydro Electricity Distribution Inc., Algoma Power Inc., Brant County Power Inc., Brantford Power Inc., Canadian Niagara Power Inc., Greater Sudbury Hydro Inc., Grimsby Power Incorporated, Haldimand County Hydro Inc., Niagara Peninsula Energy Inc., Niagara-on-the-Lake Hydro Inc., Norfolk Power Distribution Inc., Welland Hydro-Electric System Corp., Whitby Hydro Electric Corporation Atikokan Hydro Inc., Chapleau Public Utilities Corporation, Espanola Regional Hydro Distribution Corporation, Fort Frances Power Corporation, Hearst Power Distribution Company Limited, Kenora Hydro Electric Corporation Ltd., North Bay Hydro Distribution Limited, Northern Ontario Wires Inc., Orillia Power Distribution Corporation, PUC Distribution Inc., Sioux Lookout Hydro Inc., Thunder Bay Hydro Electricity Distribution Inc. Bluewater Power Distribution Corporation, Cambridge and North Dumfries Hydro Inc., Chatham-Kent Hydro Inc., Clinton Power Corporation, E.L.K. Energy Inc., EnWin Utilities Ltd., Erie Thames Powerlines Corporation, Essex Powerlines Corporation, Festival Hydro Inc., Guelph Hydro Electric Systems Inc., Kitchener-Wilmot Hydro Inc., London Hydro Inc., Middlesex Power Distribution Corporation, Port Colborne Hydro Inc., St. Thomas Energy Inc., Tillsonburg Hydro Inc., Waterloo North Hydro Inc., Woodstock Hydro Services Inc. Triple-A Q2 and Q3 Results: Deliverables • You will receive… • A PowerPoint report that includes analysis for key awareness, attitudes and actions questions. The report is based on results for all of Ontario • A tool to help interpret the individual spreadsheets you will receive • An Excel report for your LDC (CLD+Hydro One) or your region or LDC grouping • This report will include graphs that track awareness, ad recall and consumer program individual initiative results Link to Full Ontario PowerPoint Report Link to LDC Triple-A Spreadsheets Q2 and Q3